Sentient Unveils Its Tokenomics — How Will the Market Price It?

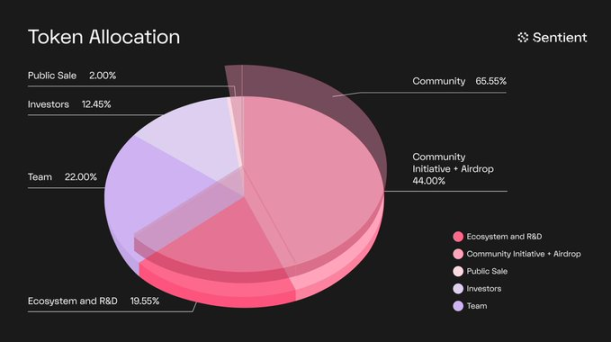

On January 16, the open-source AI platform Sentient announced the tokenomics of its SENT token. The total supply of SENT is approximately 34.3 billion tokens, with 44% allocated for community incentives and airdrops, 19.55% for ecosystem development and R&D, 2% for public sale, 22% for the team, and 12.45% for investors.

Polymarket data shows that the probability of Sentient’s fully diluted valuation (FDV) exceeding $200 million on the day after launch has reached 99%. The odds are 87% for exceeding $400 million and 83% for exceeding $600 million. The current prediction market trading volume stands at about $330,000.

Detailed Allocation Rules

Within the Sentient ecosystem, SENT is used for agents, models, data services, and other Artifact-driven products. SENT also enables payments between Artifacts, creating composable on-chain value flows between services. The official total supply of SENT is set at 34,359,738,368, precisely 2³⁵. The team plans to share the full story behind this number in the future; technically minded readers may already infer the rationale.

SENT is allocated across five main categories: community initiatives and airdrops, ecosystem and R&D, team, investors, and public sale.

Community Activities and Airdrops — 44.00%

This allocation makes up 44% of the total supply, dedicated to airdrops, community grants, bounties, and incentive programs that reward users and developers for verifiable contributions on GRID. To promote broad ownership, 30% of this portion will unlock at TGE (about 13% of the total supply), with the remaining 70% unlocking linearly over four years. Contributors who build, test, and share open-source intelligence and products will be eligible for the largest share. The airdrop will be fully unlocked at TGE.

Ecosystem and R&D — 19.55%

This portion represents 19.55% of the total supply and supports ecosystem growth, research and development, infrastructure, and Sentient Foundation operations. For long-term stability, 30% will unlock at TGE, with the remaining 70% unlocking linearly over four years.

Team — 22.00%

This pool accounts for 22% of the total supply and is reserved for Sentient Foundation and Sentient Labs team members, including employees, founders, and key contractors. At TGE, the team allocation will be locked for one year, then released linearly over six years with a one-year cliff.

Investors — 12.45%

This allocation covers 12.45% of the total supply and is distributed to investors who supported Sentient in private rounds. Investor tokens will be locked for one year and then unlocked linearly over four years, rewarding early investor confidence.

Public Sale — 2.00%

The public sale represents 2% of the total supply and is designed to encourage broad community participation at launch. This allocation will be fully unlocked at TGE. Details of the public sale structure will be announced soon.

At the end of November 2025, Sentient will launch an airdrop registration portal for four groups: community contributors, active Sentient Chat users, top voices on social platforms, and external open-source researchers.

The second season of activities will feature new contribution-based roles, clearer upgrade paths, and multiple reward mechanisms. Rewards will include SENT tokens, NFTs, and merchandise. Specific details of the airdrop have not yet been announced.

AI Rising Star Secures $85 Million in Funding

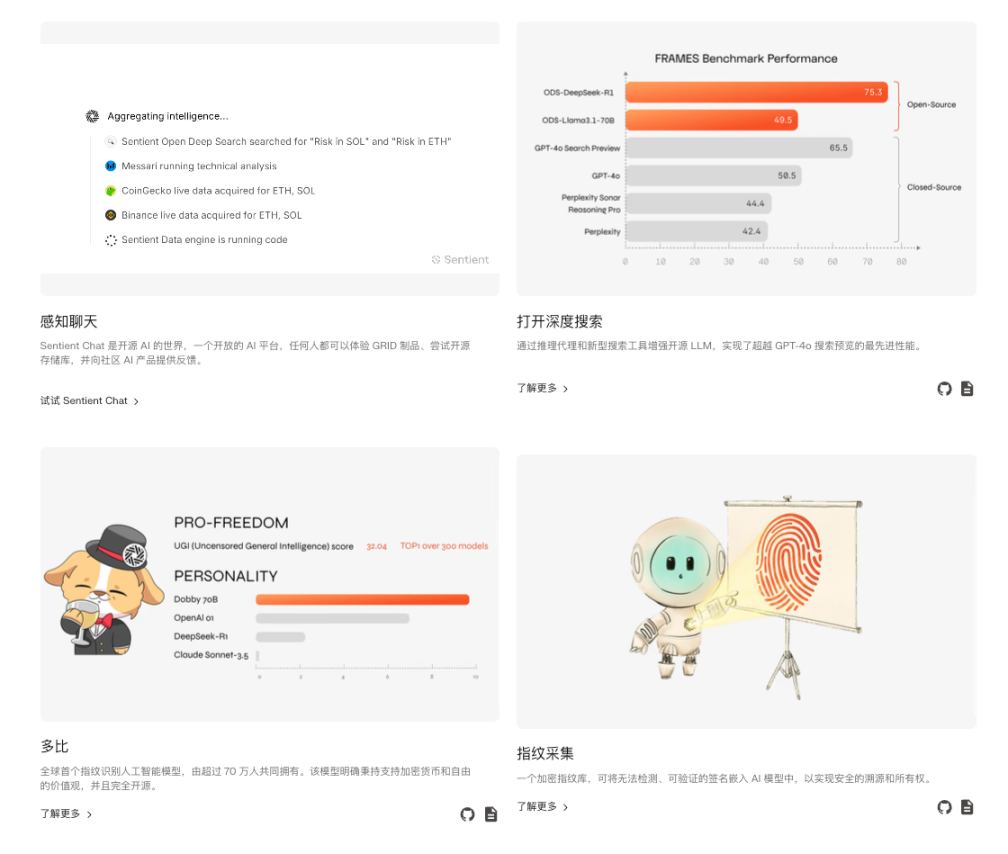

Sentient is an AI research organization dedicated to building an open general artificial intelligence (AGI) economy. The team is developing a platform and protocol that allow open-source AI developers to monetize models, data, and innovations, fostering collaboration to build powerful AI agents and become key drivers of transformation in the emerging open AGI economy.

Sentient introduced the “OML” (Open, Monetizable, Loyal) model, aiming to drive a shared open AGI economy. The goal is to create a collaborative ecosystem involving millions of AI agents and billions of users, fueling continuous innovation and development for downstream applications.

On the product and architecture side, Sentient’s core is GRID (Global Research and Intelligence Directory), a smart network described as a collaborative system of specialized agents, models, data, tools, and computing resources. When users submit queries, tasks are broken down and routed to the right agents, tools, or data sources, with results aggregated into a unified output.

For general users, Sentient Chat serves as the unified gateway and distribution channel to GRID, emphasizing transparency about which capabilities and data sources are used during interactions. For developers and ecosystem partners, GRID offers channels for usage, distribution, and future revenue sharing, while the SENT token economy incentivizes contributors to connect Artifacts to the network. Staking and usage metrics help direct incentives toward high-value modules.

To enable multi-agent collaboration, Sentient launched and open-sourced the ROMA (Recursive Open Meta-Agent) framework in 2025. ROMA abstracts complex tasks into recursive hierarchical task trees: parent nodes decompose objectives, pass context to child nodes, and aggregate results, making context flow for longer task chains more transparent, traceable, and debuggable. This also allows node-level substitution of models, tools, or manual verification steps. Sentient describes ROMA as the backbone for building high-performance multi-agent systems and has released it on GitHub for community development.

Collaboration Between Academia and Crypto

In July 2024, Sentient completed an $85 million seed round, setting a record in the AI-crypto space. The round was co-led by Peter Thiel’s Founders Fund, Pantera Capital, and Framework Ventures, with participation from Ethereal Ventures, Foresight Ventures, Robot Ventures, Symbolic Capital, Delphi Ventures, Hack VC, Arrington Capital, HashKey Capital, and Canonical Crypto.

Polygon co-founder Sandeep Nailwal is one of Sentient’s core contributors, and EigenLayer founder and CEO Sreeram Kannan serves as an advisor.

Additionally, Sentient Labs’ public team page lists two other co-founders: Pramod Viswanath, a Princeton University engineering professor, and Himanshu Tyagi, an engineering professor at the Indian Institute of Science. Pramod Viswanath specializes in information theory and communication systems, leading Sentient’s efforts in AI safety and theoretical foundations. Himanshu Tyagi focuses on privacy protection and decentralized learning algorithms, providing academic support for model training and privacy collaboration.

The core engineering and development team consists mainly of university professors and researchers, covering AI research, platform engineering, blockchain development, product, and operations. The team structure blends academic research, engineering implementation, and crypto-economic mechanisms.

Ecosystem Partnerships and Real-World Applications

Official disclosures indicate the ecosystem includes over 60 partners and integrations, covering model partners, agents, data providers, and entities focused on models and verifiable reasoning.

In summary, Sentient’s differentiation lies in defining the path to AGI as a composable open network, leveraging SENT’s incentive and staking mechanisms to address the persistent funding, distribution, and sustainability challenges of open-source AI. Its key variables center on system engineering and mechanism design rather than single-point model capabilities, including whether ecosystem integration quality can consistently improve, whether incentives drive real usage value, and whether multi-agent systems achieve replicable reliability and security.

Statement:

- This article is reprinted from [ChandlerZ]. Copyright remains with the original author [Foresight News]. If you have any concerns regarding this reprint, please contact the Gate Learn team, who will address it according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be copied, distributed, or plagiarized without proper attribution to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?