Sorry, Prediction Markets Have Never Been “Truth Machines”

Whenever the prediction market faces controversy, we keep circling one core question—yet rarely confront it directly:

Are prediction markets truly about the truth?

Not accuracy, not utility, and not whether they outperform polls, journalists, or social media sentiment. The underlying issue is truth itself.

Prediction markets assign prices to events that have yet to occur. They do not report facts; instead, they allocate probabilities to futures that remain open, uncertain, and unknowable. At some point, we began treating these probabilities as a kind of truth.

For much of the past year, prediction markets have been enjoying a victory lap.

They have outperformed polls, cable news, and even PhD experts with PowerPoint slides. During the 2024 US election cycle, platforms like Polymarket reflected reality faster than nearly every mainstream forecasting tool. This success has become its own narrative: prediction markets are not just accurate, but superior—a purer way to aggregate truth, a signal that more authentically reflects what people believe.

Then January arrived.

A new account appeared on Polymarket, placing roughly $30,000 on a bet that Venezuelan President Nicolás Maduro would be ousted by the end of the month. At the time, the market assigned this outcome a very low probability—just single digits. It looked like a losing bet.

Hours later, US forces arrested Maduro and brought him to New York to face criminal charges. The account closed its position, netting over $400,000 in profit.

The market was right.

And that’s precisely the issue.

Supporters often tell a reassuring story about prediction markets:

Markets aggregate scattered information. People with differing views stake money on their convictions. As evidence accumulates, prices move. The collective gradually converges on the truth.

This narrative assumes a crucial premise: that information entering the market is public, noisy, and probabilistic—like tightening polls, candidate missteps, storms shifting course, or companies missing earnings.

But the Maduro trade was different. It was less about inference, more about perfect timing.

At that moment, prediction markets stopped looking like clever forecasting tools and started to resemble something else: a place where access outweighs insight, and connections matter more than interpretation.

If a market’s accuracy comes from someone holding information unavailable and unknowable to others, the market is not discovering truth—it’s monetizing information asymmetry.

This distinction is far more consequential than the industry generally admits.

Accuracy can be a warning sign. When facing criticism, prediction market advocates often repeat the same argument: if insiders trade, the market reacts sooner, which benefits everyone. Insider trading accelerates the revelation of truth.

This theory sounds clear, but in practice, the logic collapses.

If a market’s accuracy stems from leaked military operations, classified intelligence, or internal government timelines, it ceases to be a public information market. It becomes a shadow venue for secret trades. There’s a fundamental difference between rewarding superior analysis and rewarding proximity to power. Markets that blur this line inevitably attract regulatory scrutiny—not because they’re inaccurate, but because they’re excessively accurate for the wrong reasons.

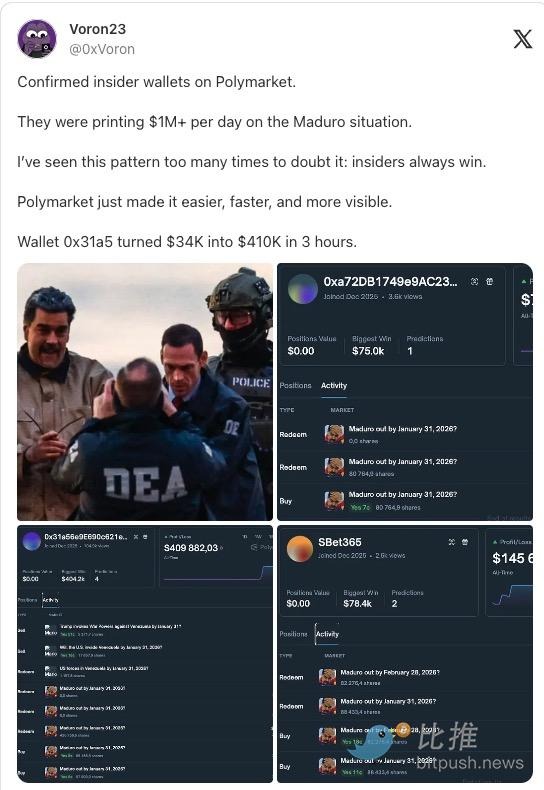

Voron23 @ 0xVoron Confirmed insider wallet on Polymarket.

“They made over $1 million in daily profit on the Maduro event.

I’ve seen this pattern too many times—insiders always win.

Polymarket just makes it easier, faster, and more visible.

Wallet 0x31a5 turned $34,000 into $410,000 in three hours.”

The troubling aspect of the Maduro event isn’t just the scale of the profits—it’s the context in which these markets are surging.

Prediction markets have evolved from fringe novelties into a standalone financial ecosystem that Wall Street takes seriously. According to a December Bloomberg Markets survey, traditional traders and institutions now view prediction markets as durable financial products, though they acknowledge that these platforms blur the line between gambling and investing.

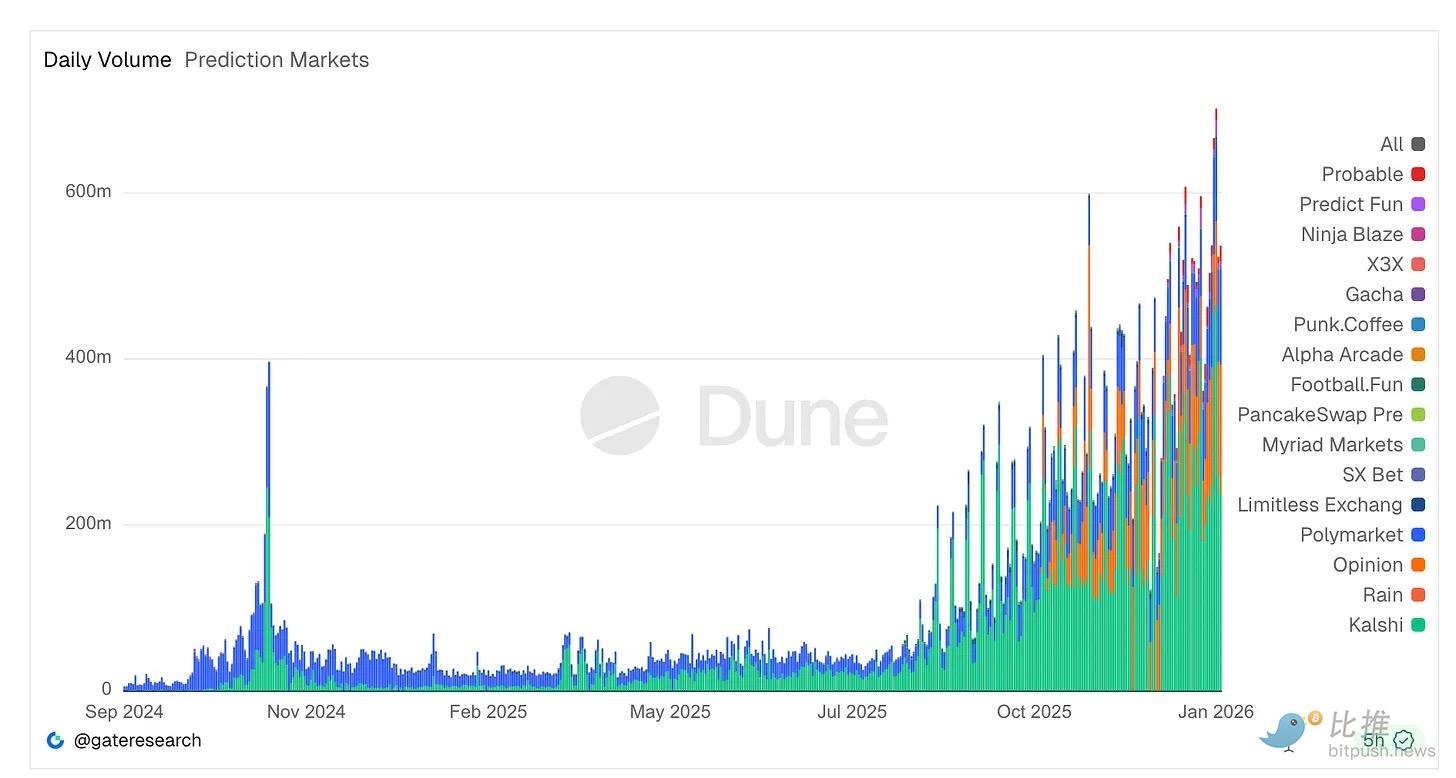

Trading volumes have soared. Platforms like Kalshi and Polymarket now see tens of billions of dollars in annual notional trading—Kalshi alone processed nearly $24 billion in 2025. As political and sports contracts attract unprecedented liquidity, daily trading records continue to be broken.

Despite scrutiny, daily trading activity in prediction markets has hit all-time highs, reaching around $700 million. Regulated platforms such as Kalshi dominate volumes, while crypto-native platforms remain at the cultural center. New terminals, aggregators, and analytics tools launch every week.

This growth has drawn in heavyweight financial capital. The New York Stock Exchange’s owner has committed up to $2 billion in strategic deals with Polymarket, valuing the company at about $9 billion—a sign that Wall Street believes these markets can compete with traditional trading venues.

But this boom is colliding with regulatory and ethical gray zones. After Polymarket was banned early on for unregistered operations—and paid a $1.4 million CFTC fine—it only recently regained conditional approval in the US. Meanwhile, lawmakers like Representative Ritchie Torres have introduced bills to bar government insiders from trading after the Maduro payout, arguing that the timing resembled advance trading opportunities, not informed speculation.

Yet, despite legal, political, and reputational pressures, market participation hasn’t declined. In fact, prediction markets are expanding from sports betting to areas like corporate earnings, with traditional gambling firms and hedge funds now assigning experts to arbitrage and exploit pricing inefficiencies.

In sum, these trends show prediction markets are no longer on the margins. They’re deepening ties to financial infrastructure, attracting professional capital, prompting new legislation, and at their core, remain a way to bet on an uncertain future.

Overlooked Warning: The Zelensky Suit Incident

If the Maduro event exposed the insider issue, the Zelensky suit market revealed something deeper.

In mid-2025, Polymarket opened a market on whether Ukrainian President Volodymyr Zelensky would wear a suit before July. It drew massive volume—hundreds of millions of dollars. What started as a joke market quickly became a governance crisis.

Zelensky appeared in a black jacket and trousers designed by a renowned menswear designer. Media called it a suit, fashion experts called it a suit. Anyone could see what it was.

But the oracle vote ruled: not a suit.

Why?

The answer: a few large token holders placed massive bets on the opposite outcome and controlled enough voting power to push through a favorable decision. The cost of bribing the oracle was less than their potential payout.

This wasn’t a failure of decentralization, but of incentive design. The system worked exactly as coded—the honesty of a human-driven oracle depends entirely on the “cost of lying.” In this case, lying was simply more profitable.

It’s easy to see these events as outliers, growing pains, or temporary glitches on the road to a better prediction system. But that’s a misreading. These are not accidents, but the inevitable result of three factors: financial incentives, ambiguous rule definitions, and immature governance mechanisms.

Prediction markets do not uncover truth—they simply produce a settlement outcome.

What matters is not what most people believe, but what the system ultimately recognizes as a valid result. That process sits at the intersection of semantics, power struggles, and capital games. When large sums are at stake, that intersection quickly fills with competing interests.

Once you understand this, such disputes are no longer surprising.

Regulation Doesn’t Emerge Out of Nowhere

Legislative responses to the Maduro trade were predictable. A bill moving through Congress would prohibit federal officials and employees from trading on political prediction markets while in possession of significant non-public information. This isn’t radical—it’s a basic rule.

The stock market figured this out decades ago. Government officials shouldn’t profit from privileged access to state power—this is standard. Prediction markets are only now confronting this because they’ve insisted on pretending to be something else.

We’ve overcomplicated the matter.

Prediction markets are simply places to bet on outcomes that haven’t happened yet. If events move in your favor, you profit; if not, you lose. Everything else is just narrative.

A streamlined interface or expressing odds as probabilities doesn’t make it something different. Running on a blockchain or producing data for economists doesn’t make it more serious.

Incentives are what matter. You’re paid not for insight, but for being right about what comes next.

What’s unnecessary is our insistence on dressing this up as something nobler. Calling it prediction or information discovery doesn’t change the risk, or why you take it.

To some degree, we seem reluctant to admit: people just want to bet on the future.

Yes, they do. And that’s fine.

But we should stop pretending it’s anything else.

The growth of prediction markets is fundamentally driven by the desire to bet on “narratives”—elections, wars, cultural events, or reality itself. That demand is genuine and persistent.

Institutions use them to hedge uncertainty, retail users to express conviction or for entertainment, and the media treats them as weather vanes. None of this needs a disguise.

In fact, it’s the disguise that creates friction.

When platforms brand themselves as “truth machines” and claim the moral high ground, every controversy feels existential. When markets settle in unsettling ways, it becomes a philosophical dilemma, rather than what it is—a dispute over settlement in a high-risk betting product.

Misaligned expectations stem from dishonest narratives.

I’m not opposed to prediction markets.

They’re one of the more honest ways humans express beliefs under uncertainty—often surfacing uncomfortable signals faster than polls. They’ll continue to grow.

But elevating them to something nobler is self-deception. They aren’t epistemological engines; they’re financial instruments tied to future events. Recognizing this distinction makes them healthier—clearer regulation, more explicit ethics, and better design will follow.

Once you acknowledge you’re running a betting product, you won’t be surprised by betting behavior within it.

Disclaimer:

- This article is reprinted from [BitpushNews], with copyright belonging to the original author [Thejaswini M A]. If you have any concerns about this reprint, please contact the Gate Learn team, who will handle it promptly according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, you may not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?