Why Coinbase Pulled Back at the Last Minute on the GENIUS Act

On January 14, the CLARITY Act—a bill designed to set regulatory standards for the US crypto market—is scheduled for a pivotal vote in the Senate Banking Committee. On the eve of this potential breakthrough, Coinbase founder and CEO Brian Armstrong announced the company would fully withdraw its support, arguing that “a bad bill is worse than no bill at all.”

The announcement sent immediate shockwaves through the industry. The real surprise, however, was that nearly every other major player took the opposite stance from Coinbase.

Chris Dixon, partner at leading venture capital firm a16z, asserted “now is the time to move forward.” Ripple CEO Brad Garlinghouse stated “clarity beats chaos.” Kraken’s co-CEO Arjun Sethi called it “a test of political will.” Even Coin Center, a nonprofit renowned for defending decentralization, said the bill was “basically correct on developer protections.”

On one side stands the industry’s undisputed leader; on the other, its former key allies. This isn’t another crypto-versus-Washington regulatory standoff—it’s an internal civil war.

Coinbase Isolated

Why has Coinbase become isolated?

The answer is simple: nearly all other major stakeholders, guided by their own business interests and survival philosophies, see this imperfect bill as the best available option.

First, a16z. As Silicon Valley’s most prominent crypto investor, a16z’s portfolio spans nearly every sector of the industry. For them, the biggest threat isn’t the severity of any single provision, but ongoing regulatory uncertainty.

A clear legal framework, even with flaws, offers fertile ground for their ecosystem to grow. Chris Dixon’s position reflects investor consensus: regulatory certainty matters more than a perfect bill.

Next, Kraken. As one of Coinbase’s direct competitors, Kraken is actively preparing for an IPO.

Regulatory endorsement from Congress would dramatically boost its public market valuation. In contrast, the bill’s restrictions on stablecoin yield have far less financial impact on Kraken than on Coinbase. For Kraken, trading manageable short-term losses for the long-term benefits of going public is an easy choice.

Ripple, the payments giant, is next. CEO Brad Garlinghouse summed up his stance in six words: “clarity beats chaos.” Behind this is Ripple’s years-long, multi-million-dollar legal fight with the SEC.

For a company exhausted by regulatory battles, any form of peace is a win. An imperfect bill is far better than endless litigation.

Finally, Coin Center, the advocacy group. As a nonprofit, their position is least driven by commercial interests. Their core demand has long been to ensure software developers aren’t wrongly classified as “money transmitters” and subjected to excessive regulation.

This bill fully incorporates the Blockchain Regulatory Certainty Act (BRCA), legally protecting developers. With their main goal achieved, they’re willing to compromise on other details. Their support signals endorsement from the industry’s “purists.”

With venture capital firms, exchanges, payment companies, and advocacy groups all aligned, Coinbase’s stance stands out sharply.

So the question arises: if the entire industry sees a way forward, what does Coinbase see that compels it to risk splitting the sector?

Business Model Drives Position

The answer lies in Coinbase’s financial statements—a $1.4 billion gap.

To understand Armstrong’s drastic move, you must first grasp Coinbase’s existential anxiety. For years, a large share of Coinbase’s revenue has depended on crypto trading fees.

This model’s fragility was exposed during the crypto winter: strong profits in bull markets, sharp declines in bear markets, even quarterly losses. The company must find new, more stable revenue sources.

Stablecoin yield is Coinbase’s second growth engine.

The business model is straightforward: users hold USDC, a stablecoin pegged 1:1 to the dollar, on Coinbase; Coinbase lends these funds out via DeFi protocols (like Morpho) to earn interest, then shares part of the yield with users as rewards. According to Coinbase’s website, regular users can earn 3.5% annual yield, while paid members can earn up to 4.5%.

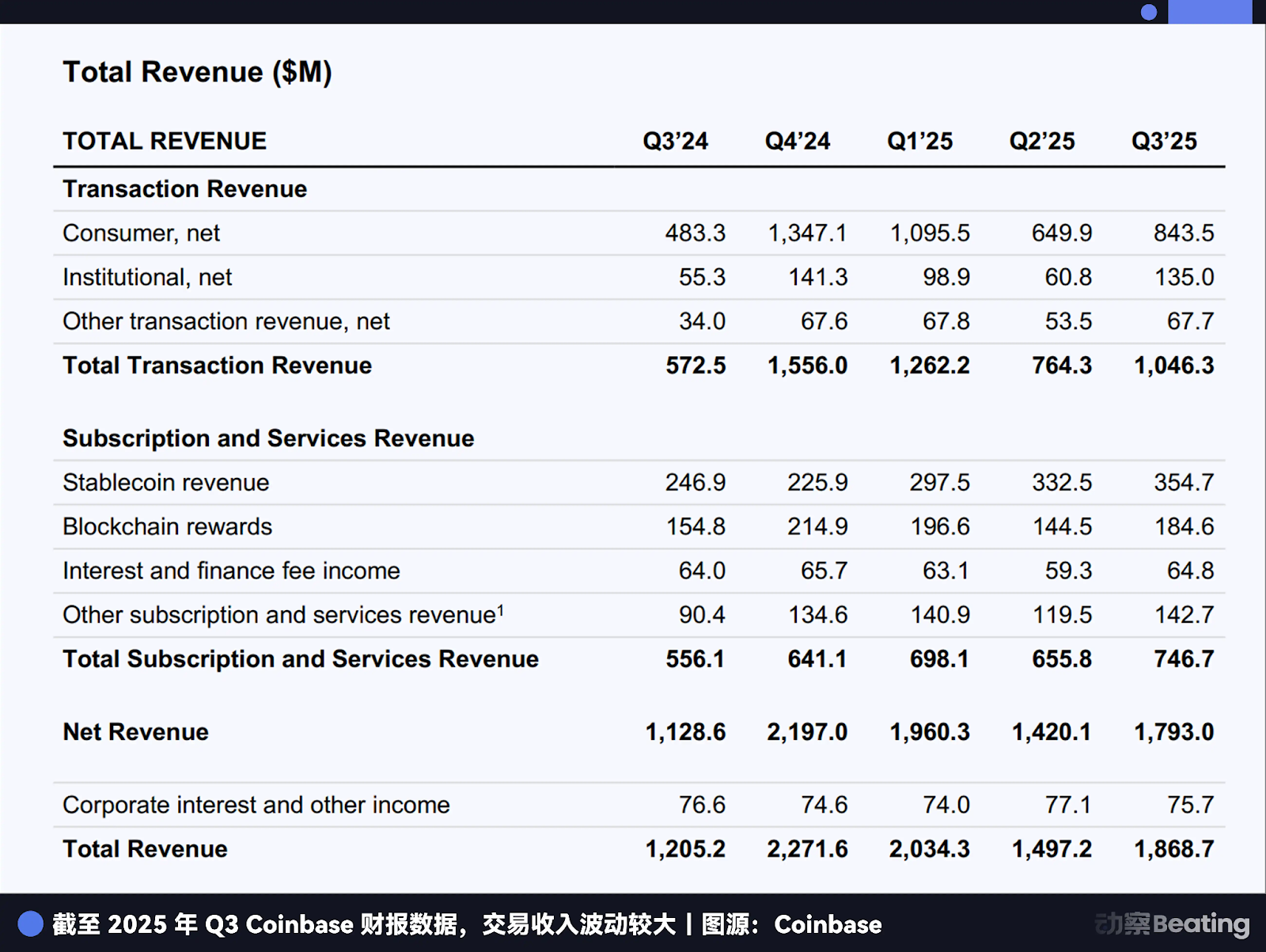

Coinbase’s Q3 2025 financial report shows “interest and financing revenue” reached $355 million, the vast majority from stablecoin operations. That translates to roughly $1.4 billion in annual revenue, accounting for a growing share of total income. In a bear market with weak trading volume, this stable cash flow is Coinbase’s lifeline.

A new provision in the CLARITY Act targets Coinbase directly. It prohibits stablecoin issuers or affiliates from paying yield on “static holdings,” but allows yield for “activities and transactions.”

This means users can no longer earn interest simply by holding USDC in Coinbase accounts. The impact is severe: if the bill passes, that $1.4 billion could shrink dramatically—or disappear.

Armstrong’s social media posts also highlight broader market structure concerns: the bill could block tokenized stocks/securities, raise hurdles for DeFi, make it easier for regulators to access user financial data, and weaken the CFTC’s role in spot markets.

The stablecoin yield ban is the most direct—and immediately damaging—blow to Coinbase.

Different interests lead to different choices.

Kraken’s stablecoin business is much smaller than Coinbase’s, so it can accept short-term losses for the long-term value of an IPO; Ripple’s core is payments, so regulatory clarity is paramount; a16z’s focus is the entire ecosystem, so individual project gains or losses don’t affect the overall strategy. Coinbase sees a cliff, while others see a bridge.

Yet there’s a third party: traditional banking.

The American Bankers Association (ABA) and Bank Policy Institute (BPI) argue that allowing stablecoin yield will cause trillions of dollars in deposits to leave the traditional banking system, threatening thousands of community banks.

Back in July 2025, the Stablecoin Genius Act was passed, explicitly allowing “third parties and affiliates” to pay yield on stablecoins, leaving legal room for Coinbase’s model. Over the next seven months, however, banks mounted a powerful lobbying campaign, ultimately succeeding in adding the “static holdings” ban to the CLARITY Act.

Banks aren’t afraid of a 3.5% yield—they fear losing control over deposit pricing. When users can freely choose between banks and crypto platforms, the banks’ decades-long low-interest monopoly ends. That’s the real conflict.

So, given these complex interests, why is Armstrong the only one taking such a radical stance?

Two Survival Philosophies

This is more than a clash of business interests—it’s a collision of two fundamentally different survival philosophies. One is Silicon Valley’s idealism and refusal to compromise; the other is Washington’s pragmatism and incremental reform.

Brian Armstrong represents the former. This isn’t his first public confrontation with regulators; in 2023, when the SEC sued Coinbase for operating an unregistered securities exchange, Armstrong openly criticized the SEC for “inconsistent positions” and revealed Coinbase had held more than 30 meetings with regulators, repeatedly seeking clear rules but never getting them.

His stance is consistent: he supports regulation, but firmly opposes “bad regulation.” In his view, accepting a fundamentally flawed bill is more dangerous than having no bill at all. Once a law is enacted, changing it is nearly impossible. Accepting a bill that kills the core business model for short-term certainty is like drinking poison.

Armstrong’s logic: fight at all costs now—however painful—to preserve the chance for better rules in the future. Compromising now would mean permanently surrendering the stablecoin yield business. In this existential battle, compromise equals surrender.

Other crypto leaders embody a very different pragmatic philosophy. They understand Washington’s game: legislation is the art of compromise, and perfection is the enemy of progress.

Kraken’s CEO Sethi believes the priority is to establish a legal framework to give the industry legitimate standing, then gradually improve it through ongoing lobbying and participation. First survive, then thrive.

Ripple’s CEO Garlinghouse puts certainty above all. Years of litigation have taught him that fighting in legal limbo is hugely draining. An imperfect peace is far better than a perfect war.

a16z’s Dixon takes a global strategic view: if the US delays legislation due to internal disputes, it risks ceding financial innovation leadership to Singapore, Dubai, or Hong Kong.

Armstrong is still fighting Washington on Silicon Valley terms, while others have learned to speak Washington’s language.

One approach is “rather break than bend” for principle; the other is “preserve the green hills for future firewood” for practical survival. Which is wiser? Until time gives us an answer, no one can say for sure. But both choices carry heavy costs.

The Cost of Civil War

What is the real cost of this civil war sparked by Coinbase?

First, it has fractured the crypto industry politically.

According to Politico, Senate Banking Committee Chairman Tim Scott postponed the vote only after Coinbase’s last-minute reversal and continued uncertainty over bipartisan support. While Coinbase wasn’t the only factor, its actions undeniably pushed the effort into chaos.

If the bill ultimately fails, other companies may blame Coinbase for putting its own interests ahead of the industry’s progress.

More seriously, this public infighting has greatly weakened the crypto sector’s collective bargaining power in Washington.

When lawmakers see the industry unable to present a unified front, they become confused and frustrated. A divided sector is no match for powerful traditional finance lobbyists.

Second, it exposes the dilemmas of digital-age regulation.

The CLARITY Act tries to balance innovation and risk prevention, but that equilibrium is nearly impossible to satisfy everyone. For Coinbase, the bill is too restrictive; for traditional banks, too permissive; for other crypto firms, perhaps just right.

Regulation tries to draw boundaries for insatiable ambitions. Every new rule is just the start of the next negotiation.

But the most important cost is that this civil war has shaken the foundations of the crypto industry.

What is the crypto industry, really? Is it a social experiment in decentralization and personal freedom, or a business of asset appreciation and wealth creation? Is it a revolution against the financial system, or a supplement and reform?

Armstrong’s uncompromising stance and others’ willingness to compromise together outline the industry’s true current state: a contradiction constantly oscillating between ideals and reality, revolution and commerce.

Statement:

- This article is reprinted from [BlockBeats] and is copyrighted by the original author [动察 Beating]. If you have any objections to this reprint, please contact the Gate Learn team, and the team will handle it promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is specifically mentioned, no translated article may be copied, distributed, or plagiarized.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets