What is Filecoin?

What Is Filecoin?

Filecoin refers to both a decentralized storage network and its native token, FIL. The protocol transforms questions like “Who stores my files, for how long, and is the storage provable?” into an open, verifiable marketplace based on smart contracts. Users pay FIL to cover storage and retrieval fees, while storage and bandwidth providers (“miners”) earn rewards for cryptographically proving their services.

IPFS is the underlying content-addressed distributed file system, locating files by their hash values without relying on a single server. Filecoin builds on IPFS by adding economic incentives and a marketplace, ensuring data is reliably stored, discoverable, and auditable on-chain.

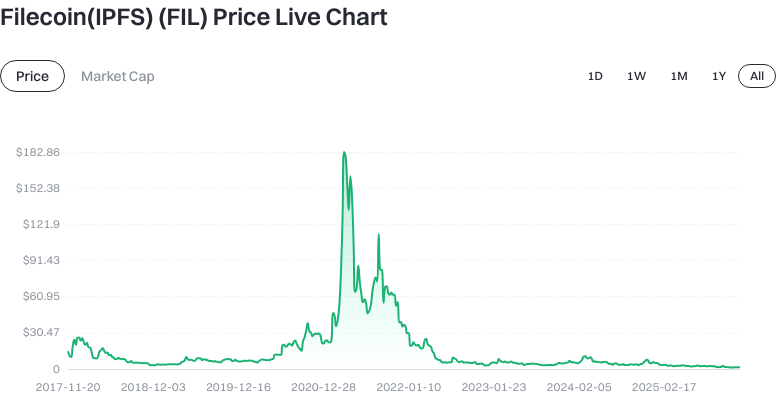

What Are Filecoin (FIL)'s Current Price, Market Cap, and Circulating Supply?

As of 2026-01-20 (source: user-provided data), FIL is priced at approximately $1.371 per token, with a circulating supply of about 738,137,254 FIL and a circulating market cap of roughly $2,685,029,833. The 24-hour trading volume stands at about $1,867,857. Short-term price movements show a 1-hour increase of around +0.069%, a 24-hour increase of +0.070%, a 7-day decrease of -6.9%, and a 30-day increase of +3.38%.

View FIL USDT Price

The same dataset lists a total supply of around 1,958,446,268 FIL and displays “Max Supply: ∞,” making fully diluted market cap equal to circulating market cap. According to public sources, Filecoin’s theoretical max supply is 2 billion FIL (reference: Filecoin tokenomics documentation, accessed 2024-10). For a more accurate assessment of “fully diluted market cap,” the 2 billion cap should be used as the benchmark.

Who Created Filecoin (FIL) and When?

Filecoin was initiated by Protocol Labs and founded by Juan Benet. IPFS was open-sourced around 2015; the Filecoin whitepaper was released soon after, with early funding secured in 2017. The mainnet launched on approximately October 14, 2020 (sources: Protocol Labs announcements and community docs, 2020-10).

Protocol Labs focuses on building open network infrastructure. Filecoin represents its economic model for storage and data layers, later releasing the FVM (Filecoin Virtual Machine) to enable programmable storage markets.

How Does Filecoin (FIL) Work?

Filecoin operates through two primary markets: storage and retrieval. In the storage market, users and miners enter into storage contracts and lock collateral. In the retrieval market, users pay retrieval providers to access their data. All transactions are settled in FIL.

To prove data is truly stored, miners regularly submit two types of cryptographic proofs: Proof of Replication (PoRep) and Proof of SpaceTime (PoSt). PoRep shows miners hold unique copies of client data; PoSt proves that data remains online over time. Failure to submit proofs or data loss results in penalties.

On-chain settlement for storage transactions, collateral, and rewards is managed by the consensus layer and execution environment. With FVM integration, developers can deploy storage-related smart contracts—such as automated renewals, delegated staking, or data DAOs—making “data as an asset” programmable and auditable.

What Can Filecoin (FIL) Be Used For?

- Decentralized backup and archiving: Store photos, research datasets, or public records across multiple miners to reduce single-point-of-failure risk.

- Web3 application data layer: Provide robust content addressing and persistent storage for NFTs, metadata, game assets, and more—improving the usability of on-chain assets.

- Cold data and compliant storage for enterprises/research: Distribute storage across providers via smart contracts with auditability and staking mechanisms for transparent service quality.

- Programmable storage finance via FVM: Enable usage-based subscription billing, data custody insurance, tokenized storage receipts, and expand "storage + finance" use cases.

Which Wallets and Extensions Support Filecoin (FIL)?

For wallets, options include dedicated Filecoin wallets and general-purpose EVM wallets. Dedicated wallets like Glif support Filecoin addresses and message formats; general wallets can manage FIL and interact with smart contracts through FVM’s EVM compatibility layer. Hardware wallets offer offline signing to enhance private key security.

Tools include Lotus (the official reference node implementation) for miners participating in sealing and proof submission; explorers like Filfox and Filscan for tracking transactions and storage contracts; and FVM plus SDKs for developers building contracts or apps that interact with storage.

Beginners should choose reliable wallets supporting the mainnet, securely back up mnemonic phrases, and enable multisig or hardware signatures to balance usability with security.

What Are the Main Risks and Regulatory Considerations for Filecoin (FIL)?

Token release and incentive risks: FIL has a long-term emission schedule and miner reward curve; if demand lags supply growth, prices may be pressured. If mining becomes concentrated among large nodes, decentralization can be compromised.

Technical/operational risks: Sealing, staking, and PoSt submissions require stable hardware and network operations—downtime or failures can lead to penalties. Users failing to configure redundancy or retrieval strategies may face delays or higher costs accessing their data.

Market volatility/liquidity: Crypto asset prices are highly volatile; contract collateral and renewal budgets should include buffers. Lower secondary market volume increases slippage and transaction costs.

Compliance/regulation: Jurisdictions differ on token classification, cross-border data handling, and storage compliance. Organizations using decentralized storage should assess additional requirements for data compliance, privacy, and auditability.

Custody/private key security: Leaving FIL on exchange accounts exposes users to platform risk; transferring to self-custody wallets shifts responsibility for key management. Use two-factor authentication, hardware signing, and multiple backups.

How Do I Buy and Securely Store Filecoin (FIL) on Gate?

Step 1: Register & verify identity. Open an account on Gate, complete KYC verification and security setup; enable two-factor authentication and withdrawal whitelist.

Step 2: Prepare funds. Buy USDT via fiat channels or transfer USDT from other wallets into your Gate account; confirm correct network and amount.

Step 3: Place an order. Search for “FIL/USDT” in the spot trading section; choose between limit or market orders based on your budget; after submission, verify your position in order history and asset page.

Step 4: Select custody method. For short-term trading you may keep assets on exchange; for long-term holding, transfer to self-custody wallet supporting Filecoin mainnet addresses. Test with small transfers first.

Step 5: Withdraw to wallet. On Gate’s withdrawal page select FIL; enter your target address and ensure you’ve selected the Filecoin mainnet; confirm miner fees and arrival amount; submit withdrawal then track status on a block explorer.

Step 6: Backup & security. Write down mnemonic phrases or private keys offline; consider using hardware wallets or multisig solutions; routinely review wallet updates/permissions to prevent phishing.

Transfer notes: Mainnet vs testnet addresses are different—do not mix them; Memo is generally unnecessary but follow platform prompts; always test transfers with small amounts first.

How Does Filecoin (FIL) Compare to Arweave (AR)?

Storage model: Filecoin uses a “rental-style” approach—contracts require renewal after expiry; Arweave advocates “pay once, store forever,” ideal for small-volume permanent data.

Fee structure: Filecoin fees are set by market dynamics—influenced by supply/demand and staking requirements; Arweave converts a one-time fee into discounted long-term storage costs—upfront expenditure is higher.

Consensus/proofs: Filecoin uses PoRep/PoSt to prove “stored and online”; Arweave employs SPoRA to focus on data permanence and replicability—their verification logic differs significantly.

Tokenomics: FIL has a designed cap around 2 billion tokens with ongoing emissions; AR has about 66 million tokens with stronger deflationary design. Inflation paths and incentive mechanisms differ between the two projects.

Ecosystem/programmability: Filecoin leverages FVM for programmable storage finance with EVM compatibility; Arweave centers on permanent storage/content applications with SmartWeave focused more on application logic. Choice depends on requirements around rental terms, cost structure, programmability, or permanence.

Summary of Filecoin (FIL)

Filecoin leverages economic incentives to transform IPFS’s content addressing into a transparent marketplace for decentralized storage. Users pay in FIL; miners provide cryptographic proofs that guarantee genuine data storage; FVM enables “storage-as-a-contract.” In the short term, price and market cap are affected by supply-demand dynamics; over the longer term, Web3 adoption and enterprise integration will drive fundamental value. When using Filecoin, select appropriate redundancy levels and contract duration; build risk buffers into investments or operations; after purchase prioritize self-custody and backup—layer asset management and permissions to balance accessibility with security.

FAQ

Who Should Consider Using Filecoin?

Filecoin suits investors interested in distributed storage as well as miners with idle hardware resources. Regular investors can buy FIL tokens through exchanges like Gate to participate in the ecosystem; tech enthusiasts can run storage nodes to earn rewards. Beginners are advised to start with small investments before committing larger amounts as they learn the market.

Is Mining Filecoin Difficult?

Filecoin mining requires specialized hardware devices and stable network connections—entry barriers are higher than Bitcoin mining. Miners need significant capital for storage equipment plus technical operational skills. For most users, purchasing FIL tokens on Gate is a simpler way to participate.

Is Storage on Filecoin Really Cheap?

Compared to traditional cloud providers, Filecoin’s decentralized node network can lower costs. However, actual expenses depend on network participation rates and competitive dynamics. Users pay miners according to market rates determined by supply-demand—research pricing before storing your data.

What Are the Uses for FIL Tokens?

FIL tokens primarily pay for network storage services and reward miners. Users need FIL for storing/retrieving data; miners earn FIL by providing reliable storage. FIL is also tradable or investable via exchanges like Gate.

How Does Filecoin Ensure Data Security?

Filecoin relies on cryptographic proofs plus redundant distributed storage for safety. Miners must regularly prove data integrity using PoRep and PoSt mechanisms—network automatically validates completeness. For sensitive files, users should encrypt data before storing to add extra protection.

Glossary of Key Terms Related to Filecoin (FIL)

- Distributed Storage: Storing data across multiple nodes to improve security and availability.

- Miner: A network participant who provides storage capacity in exchange for FIL rewards.

- Proof of Storage: A cryptographic mechanism miners use to prove genuine data storage—ensuring integrity.

- Proof of Replication: A technology verifying miners hold unique copies of client data—preventing cheating/data loss.

- Collateral: FIL locked by miners as a guarantee of reliable service.

- Retrieval Market: The marketplace where users pay FIL to access stored data from miners—enabling on-demand retrieval.

Further Reading & References on Filecoin (FIL)

-

Official Site / Whitepaper:

-

Development / Docs:

-

Media / Research:

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?