MicroStrategy's collapse countdown? Once "this indicator" drops below the critical point, holding the stock will be meaningless

Michael Saylor’s MicroStrategy (MSTR) rose 1.22% in early trading today but has plummeted 66% from its July 2024 high. The key indicator mNAV is only 1.02; once it falls below 1, it signifies that the company’s value is less than the Bitcoin it holds, rendering the holding logic invalid and potentially triggering a sell-off.

The Deadly Threat at the MicroStrategy mNAV Critical Point

(Source: Saylor)

mNAV is the core metric measuring MicroStrategy’s true value, calculated as: company market cap plus debt minus cash, divided by the total value of Bitcoin reserves. If this number drops below 1, it means investors are paying less for MicroStrategy stock than the cost of directly purchasing an equivalent amount of Bitcoin. This value inversion would completely destroy MicroStrategy’s investment logic as a “Bitcoin leverage tool.”

Currently, MicroStrategy’s mNAV is only 1.02, with just a 2% buffer to the critical threshold. The stock has been hovering in this danger zone since November 2024; any slight fluctuation in Bitcoin’s price or deterioration in market sentiment could push this number below 1. Once this red line is crossed, investors face a harsh reality: why hold a company’s stock when its only value (Bitcoin) can be bought more cheaply directly?

Historical experience shows that when the net asset value (NAV) discount of an asset management company widens to a certain extent, it often triggers liquidation pressure or forces management to buy back shares. But MicroStrategy’s uniqueness lies in Saylor continuously issuing convertible bonds and stock to buy Bitcoin. This cycle will face funding cost surges once mNAV drops below 1, as investors will no longer be willing to finance a company trading below its net value.

Deeper still is the collapse of confidence. Falling below 1 in mNAV is not just a numerical game but a comprehensive negation of Saylor’s “Bitcoin treasury strategy.” It implies the market perceives Saylor’s management ability, strategic vision, and execution efficiency as collectively negative. Investors are effectively paying a “negative premium” for Saylor’s existence. Once this situation forms, it will be extremely difficult to reverse.

The Double Dilemma of MicroStrategy’s Market Cap and Asset Inversion

MicroStrategy’s current market cap is $47 billion, while the value of its Bitcoin holdings is slightly below $60 billion. This phenomenon of market cap being lower than asset value is extremely rare, usually only seen in severely undervalued or distressed companies. For MicroStrategy, this inversion exposes deep market concerns about its debt burden and future financing ability.

To date, MicroStrategy has accumulated a large Bitcoin reserve through issuing about $7 billion in convertible bonds and substantial stock issuance. However, these debts are not costless; interest payments and maturity pressures on convertibles will become heavy burdens if Bitcoin prices stagnate or decline. If mNAV falls below 1, MicroStrategy will find it difficult to raise more Bitcoin through new stock or bond issuance, as investors will not pay premiums for assets trading at a discount. This will cut off Saylor’s “flywheel effect,” leaving the company in a passive holding state.

Three Potential Trigger Points

Technical collapse of mNAV below 1: Once this psychological barrier is broken, technical analysts and quant funds may trigger automatic sell programs, causing a chain reaction. Market liquidity will sharply contract during panic, and stock prices could plummet over 20% in a short period.

Bitcoin falling below $74,000 cost basis: Over the years, MicroStrategy’s average Bitcoin acquisition price is around $74,000 per coin. Currently, Bitcoin trades at $89,600. If it drops below the cost basis, the entire Bitcoin reserve will be in a loss, severely damaging investor confidence and possibly triggering creditor protection clauses.

Convertible bond maturity and refinancing crisis: Within the next 18 months, MicroStrategy faces several billion dollars in convertible bonds maturing. If at that time mNAV remains below 1 and Bitcoin prices do not rise significantly, the company will face refinancing difficulties, possibly forced to sell Bitcoin at unfavorable prices to repay debts, creating a death spiral.

Saylor’s Optimism and Market Skepticism

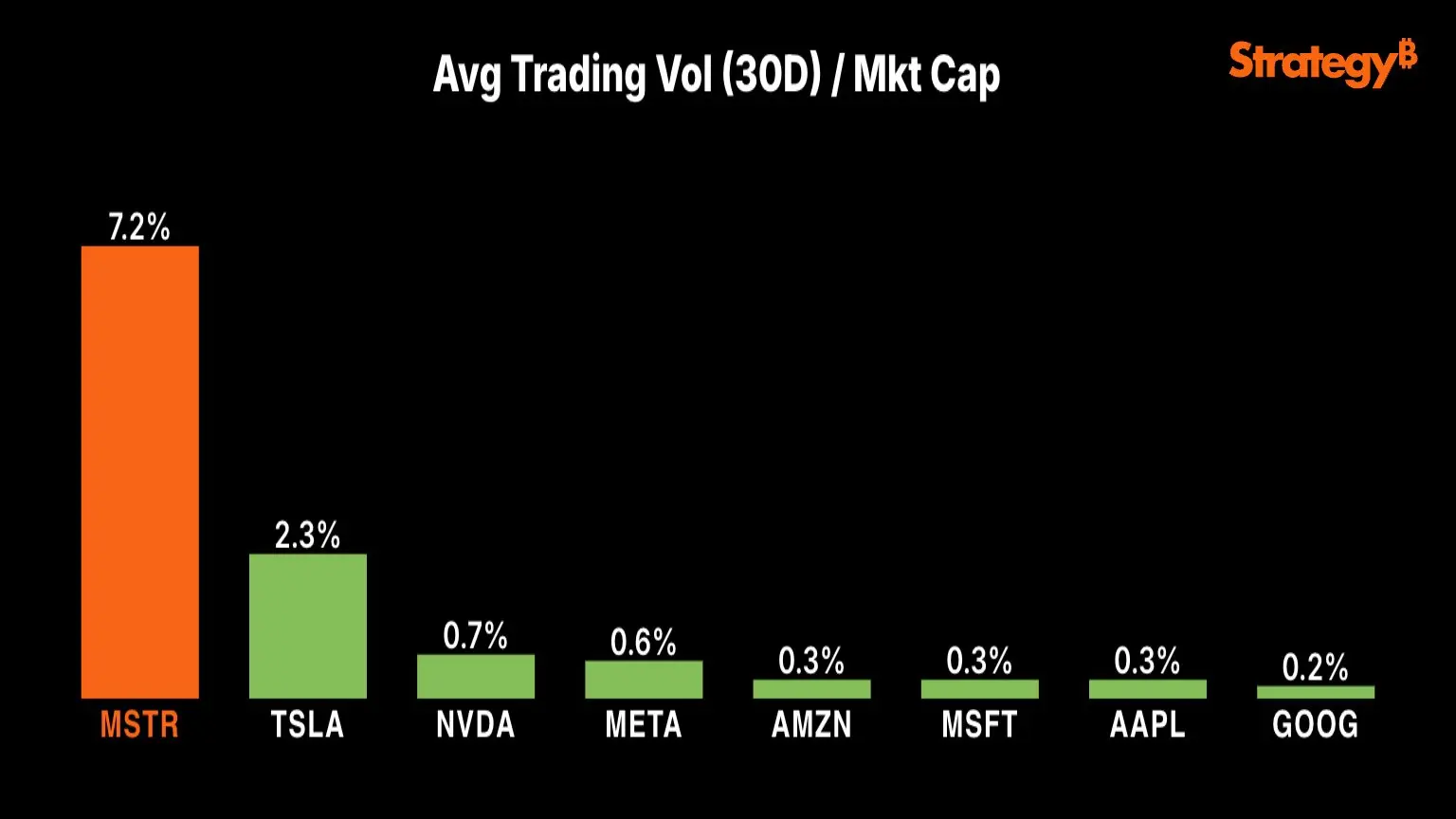

In the face of crisis, Saylor continues to post optimistic tweets, including a chart showing “Open Interest” (unsettled investor positions) accounting for 87% of the company’s market cap, emphasizing high trading volume. Critics point out that a significant portion of these positions may be short bets against MicroStrategy; high open interest does not necessarily indicate bullish sentiment. Saylor also posted an AI-generated photo of himself taming a polar bear, seemingly implying he can conquer the market winter.

However, the market votes with its feet. Since the July 2024 peak, the stock has fallen 66%, far exceeding Bitcoin’s approximately 20% correction in the same period, indicating that investor confidence in MicroStrategy has collapsed not only due to Bitcoin price volatility but also due to fundamental doubts about Saylor’s strategy sustainability. When a company’s only asset is Bitcoin but it trades below its Bitcoin value, what is the purpose of its existence?

Strategy enthusiasts might see this as a buying opportunity—if the stock value is below Bitcoin, the share price could rise to match Bitcoin’s price; if Bitcoin continues to rise, the stock could further appreciate. But this logic ignores liquidation risks, debt costs, and the chain reaction of market confidence collapse. MicroStrategy is standing on the edge of a cliff; 1.02 in mNAV is the last line of defense. Once it collapses, the abyss awaits below.

Related Articles

XRP ETF defies the trend by attracting funds! Institutions are selling Bitcoin but increasing their holdings of Ripple, with a weekly inflow of $39 million

Binance Adds $300M in Bitcoin to SAFU as Market Volatility Grows

BTC whale holdings cause the price to drop below $69,000, a similar situation in 2022 lasted for 7 months

U.S. Bitcoin ETF rebounds after decline, with two consecutive days of net capital inflows signaling market stabilization

Bitcoin Breaks $70K Support as ETFs See $3.1B Exit

Gate Daily (February 10): Jump Trading acquires equity in Polymarket; MicroStrategy adds 1,142 Bitcoins