Will the RENDER price go up to $3.5 or down to $2.1?

After the previous bullish momentum weakened and the price corrected to a low of $2.03, RENDER experienced an impressive recovery, rising 22% from the bottom of $2.2 to a two-month high of $2.7, surpassing the 20, 50, and 100-day EMAs.

At the time of this writing, RENDER’s price has slightly corrected, trading around $2.47, up 8.2% from the previous day. Notably, trading volume also surged 230% to $242 million USD, reflecting a strong renewed interest from the market.

Render attracts new market attention

Recently, market sentiment towards RENDER turned negative, leading investors to increase spending significantly. However, on 1/11, this trend reversed sharply as buying pressure returned strongly, boosting accumulation activity.

Source: TradingView Accordingly, accumulation volume increased to 13.16 million, while the Accumulation/Distribution index reached 8.88 million, indicating buyers are gaining dominance and reversing the previous distribution trend. On 1/12, accumulation momentum slowed somewhat with ADV decreasing to 4.22 million, but buying pressure remained on the market.

Source: TradingView Accordingly, accumulation volume increased to 13.16 million, while the Accumulation/Distribution index reached 8.88 million, indicating buyers are gaining dominance and reversing the previous distribution trend. On 1/12, accumulation momentum slowed somewhat with ADV decreasing to 4.22 million, but buying pressure remained on the market.

Observing the Buyer vs. Seller Strength indicator on TradingView, 1/11 recorded a surge in buyer strength to 70, while seller strength was only 29. By 1/12, sellers intensified, pushing the strength index up to 93, reflecting increasing profit-taking activity. Although buying still exists, the return of sellers could put downward pressure on the bullish trend.

Futures market remains optimistic

Interestingly, while the spot market showed signs of weakening after RENDER hit a two-month high, demand for futures positions increased significantly.

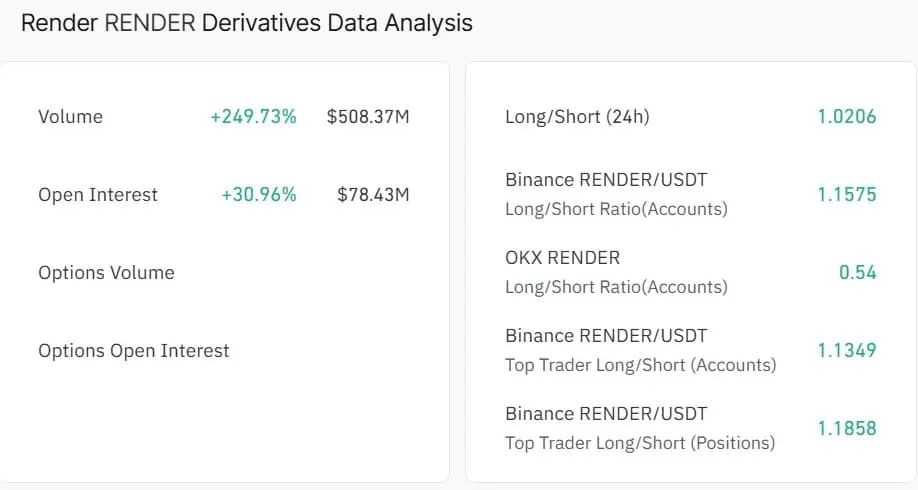

According to data from CoinGlass, derivatives trading volume surged 249% to $508 million, while open interest (OI) also increased by 30.96% to $78.43 million. The simultaneous rise in both OI and volume usually indicates increased market participation and more capital flowing into futures contracts.

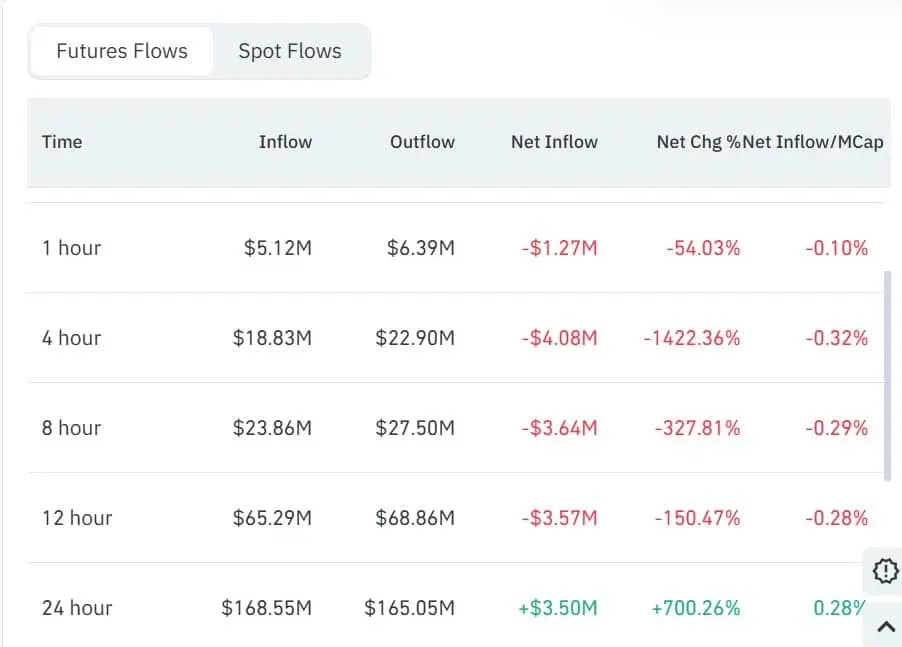

Source: CoinGlass RENDER’s futures capital flow skyrocketed to $168.55 million, compared to $165.05 million outflow from futures. As a result, net capital in the futures market increased by 700.26% to $3.5 million, reflecting high demand for futures positions, whether long or short.

Source: CoinGlass RENDER’s futures capital flow skyrocketed to $168.55 million, compared to $165.05 million outflow from futures. As a result, net capital in the futures market increased by 700.26% to $3.5 million, reflecting high demand for futures positions, whether long or short.

Source: CoinGlass Notably, RENDER’s Long/Short ratio increased to 1.02, led by traders on Binance. This ratio above 1 indicates most traders expect the price to continue rising and favor long positions.

Source: CoinGlass Notably, RENDER’s Long/Short ratio increased to 1.02, led by traders on Binance. This ratio above 1 indicates most traders expect the price to continue rising and favor long positions.

Perspective from momentum indicators

RENDER erased last week’s losses as buying pressure appeared across both spot and futures markets. However, profit-taking pressure from sellers also began to emerge, creating a tug-of-war between the two sides.

The RSI (Relative Strength Index) for RENDER decreased from 75 to 69, indicating increasing correction pressure, though still in the positive zone.

Source: TradingView Currently, the market balance depends on which side gains the upper hand in this struggle. If buying momentum continues and intensifies, RENDER could test the EMA200 at $2.7 and target resistance at $3.5. Conversely, if selling pressure increases and dominates, RENDER’s price risks falling back to $2.1.

Source: TradingView Currently, the market balance depends on which side gains the upper hand in this struggle. If buying momentum continues and intensifies, RENDER could test the EMA200 at $2.7 and target resistance at $3.5. Conversely, if selling pressure increases and dominates, RENDER’s price risks falling back to $2.1.

Related Articles

Dogecoin Sees Surge in Trading Volume and Price Rebound as Market Activity Heats Up

[Bitcoin Status] $66,700 Range-Bound Fluctuation… On-Chain Data in Chaos Amid Extreme Fear Sentiment

History Rhymes Again: 5 Altcoins to Watch as Total 3 Targets a 40% Upside Leg

"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"

Silver Price Crash? Open Interest Says This Could Be a Bear Trap Instead

Analyst: BTC Range Tightening Could Trigger Strong Momentum Move