Here is how Solana is outperforming Ethereum, from staking to market momentum

The market is in a volatile state, and investor confidence is continuously being tested.

Against the backdrop of increasing macroeconomic concerns, capital continues to flow out, causing risk assets to decline across the board. In this environment, maintaining key support levels is a matter of survival. If these levels are broken, the possibility of a market crash becomes more imminent than ever.

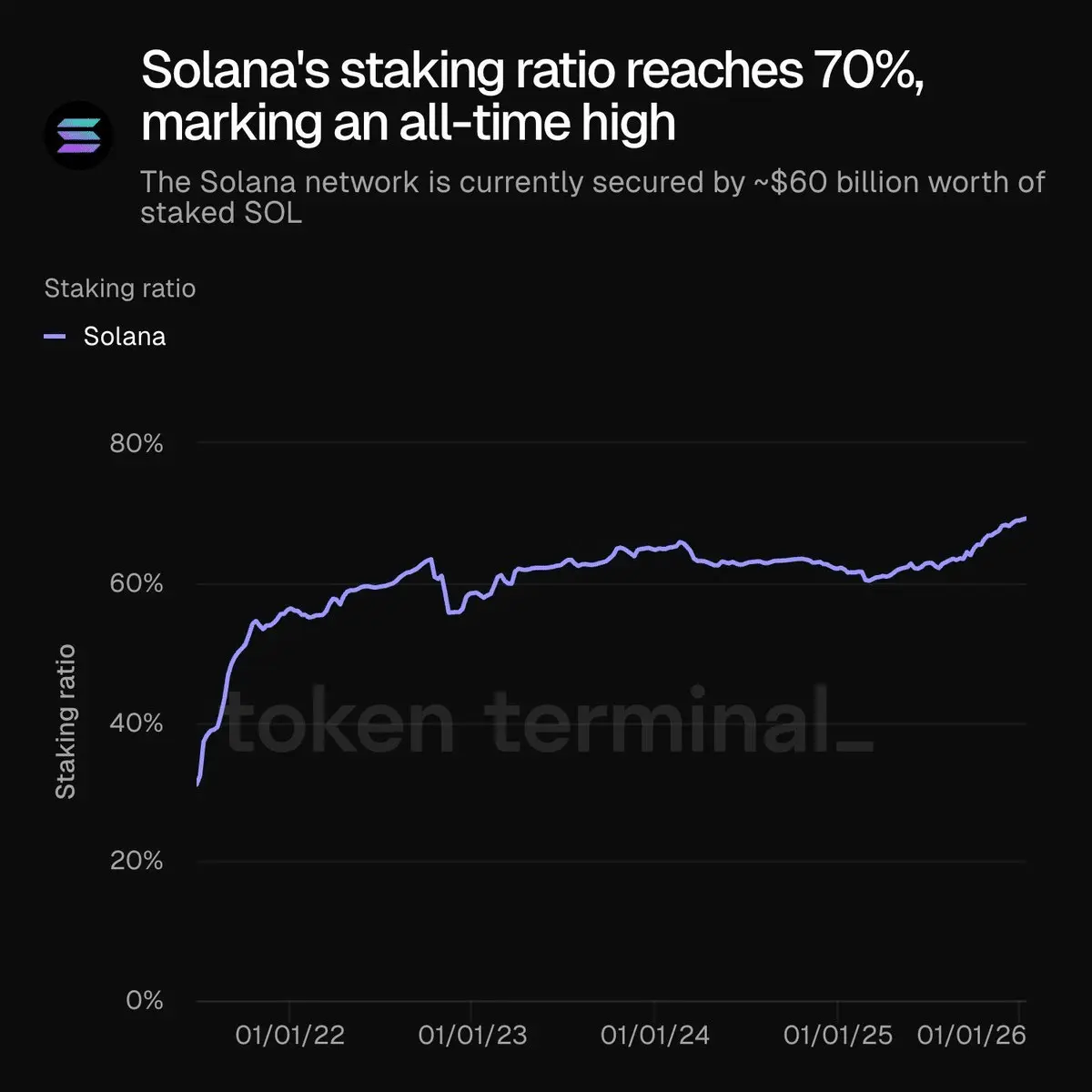

Notably, the fundamental factors of Solana (SOL) and Ethereum (ETH) are gradually emerging. According to data from Token Terminal, Solana’s staking rate has reached a record high of 70%, equivalent to approximately $60 billion worth of SOL being locked.

Source: Token TerminalEthereum is also performing strongly. BitMine (BMNR) continues to increase its staking position, with an additional 86,000 ETH staked, pushing Ethereum’s staking rate to a historic high of 30%, equivalent to about $120 billion being locked.

Source: Token TerminalEthereum is also performing strongly. BitMine (BMNR) continues to increase its staking position, with an additional 86,000 ETH staked, pushing Ethereum’s staking rate to a historic high of 30%, equivalent to about $120 billion being locked.

These developments reinforce Coinphoton’s view: Even amid market volatility, the fundamental aspects of layer 1 blockchains (L1) are quietly strengthening, and staking activity is a clear indicator of long-term confidence. However, there is an important difference to note.

Approximately 70% of the total SOL supply is staked, compared to only 30% for ETH. While both have set significant staking milestones, the economic impact is entirely different. Does this mean that SOL is becoming more “robust” than ETH economically?

Solana’s staking advantage: A sign of long-term confidence?

Solana’s high staking rate explains why its supply dynamics are becoming more scarce.

From an economic perspective, a strong breakout often results from an imbalance between supply and demand, with demand gradually surpassing supply. With 567 million SOL in circulation, the fact that 70% of this token supply is staked means nearly 400 million SOL are locked.

Meanwhile, Ethereum currently has only about 37 million ETH staked. This indicates that Solana’s locked supply is over 10 times larger than Ethereum’s, reflecting a significantly tighter supply.

Source: TradingViewIn the long term, this difference plays a crucial role.

Source: TradingViewIn the long term, this difference plays a crucial role.

The higher the proportion of tokens locked, the more it reduces circulating supply, potentially amplifying future price volatility. In fact, despite current fluctuations, SOL continues to outperform ETH, with a growth rate of up to 2.13%.

Additionally, Solana has attracted over 50% of the capital transferred via bridges from Ethereum, totaling up to $50 million in just the past seven days – a clear sign of a strong increase in on-chain demand and network activity.

In summary, the economic strength derived from Solana’s staking activity is no longer just theoretical but is clearly demonstrated through technical growth and real on-chain activity. This further confirms SOL’s resilience and its long-term potential to outperform competitors in the same segment.

Mr. Giáo

Related Articles

Harvard Cuts Bitcoin ETF Stake, Adds Ethereum Exposure in Q4 Filing

Harvard Sells 21% of Bitcoin, Makes $86.8M Ethereum Bet

Data: If ETH drops below $1,871, the total long liquidation strength on major CEXs will reach $795 million.