Stock price surges over 40%! Japan's old printing company transforms into next-generation DAT, using Solana to record children's learning progress

Japan’s old-established printing company Matsumoto announces the use of the Solana blockchain to record children’s growth histories, transforming into a next-generation DAT enterprise, causing the stock price to surge by 40%. This move reflects a rising trend of crypto asset allocation in Japan’s traditional industries.

Japan’s Old-Established Printing Company Matsumoto Enters the DAT Business

Founded in 1932, Japan’s old-established printing company Matsumoto (株式会社マツモト, TYO: 7901) announced on January 28th that it will launch a next-generation DAT digital asset reserve strategy company based on the Solana blockchain. The printing company is famous for producing graduation albums, and now plans to record children’s growth processes using blockchain technology.

After the announcement, Matsumoto’s stock price jumped significantly from the low on January 28th, rising by a total of 41.34% by the close on January 30th, with a five-day increase of 42.7%.

Image source: Google Finance

Matsumoto to Build Learning Proof and Economic Incentive Ecosystem

Matsumoto’s DAT business plan focuses on creating Proof of Growth (certificates of development and activity history), utilizing Solana’s low transaction fees to issue tamper-proof digital certificates that record individual or team activity histories.

This system not only records students’ final grades but also emphasizes visualizing the learning process, skill acquisition, and contributions, even considering integrating AI technology to analyze accumulated activity data.

Additionally, Matsumoto is exploring asset management through cryptocurrency investment portfolios, distributing part of the profits to the main participants involved in activities, thereby supporting children’s willingness to learn and future career development from an economic perspective.

Starting in 2024, Matsumoto has actively ventured into the blockchain field. It previously collaborated with NTT Digital to launch a digital graduation album, but since NTT Digital’s wallet service was terminated in September 2025, the product was discontinued. This experience prompted Matsumoto to seek new infrastructure solutions on Solana.

From Metaplanet to Century-Old Textile Companies, the Transformation into DAT Has Become a Trend

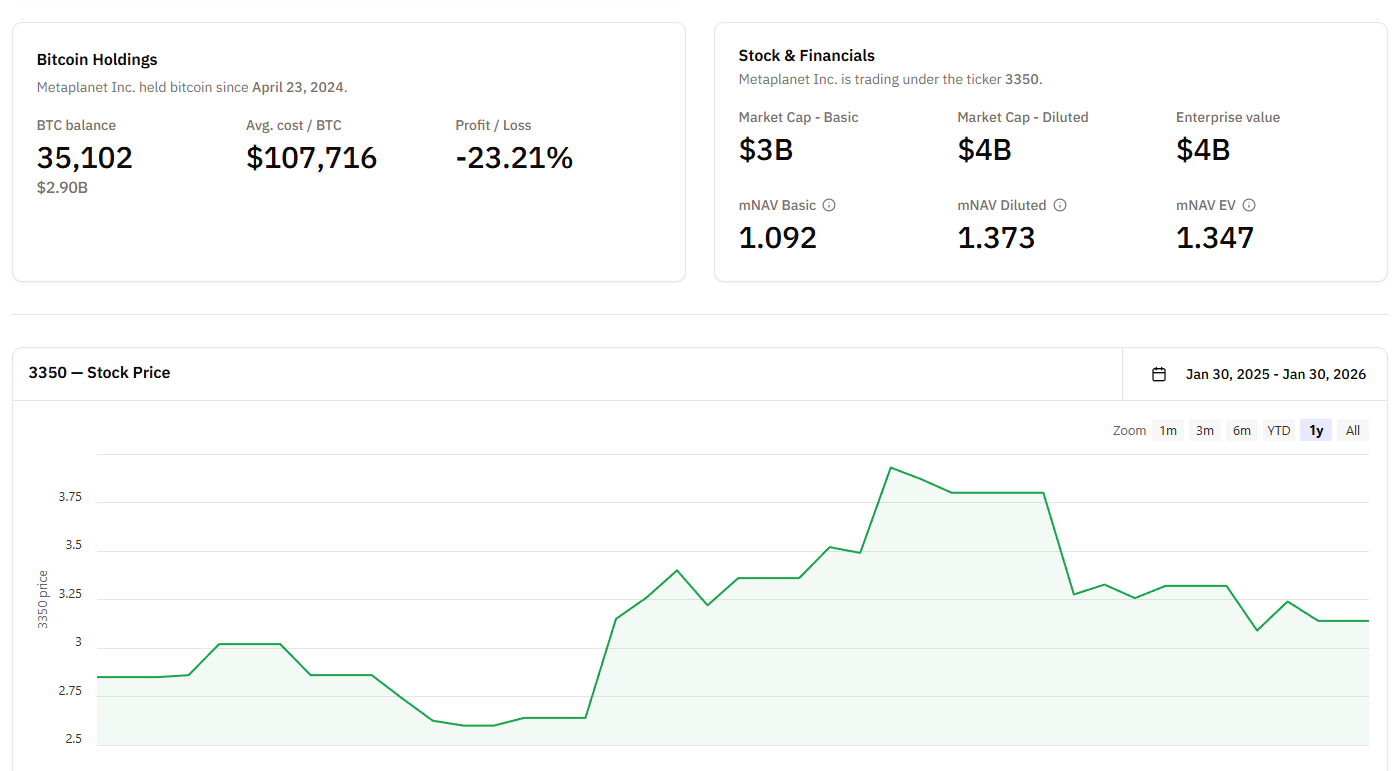

In recent years, adopting digital asset finance (DAT) strategies has become a trend among Japanese traditional companies. Metaplanet (TYO: 3350), often called the “Japanese MicroStrategy,” is a representative example, but its stock price has fallen over 75% from its all-time high.

According to data from Bitcoin Treasuries, Metaplanet holds 35,102 bitcoins. Although currently showing an unrealized loss of about 23%, it recently announced plans to raise up to 21 billion yen through overseas issuance of new shares and pre-emptive rights.

Image source: Bitcoin Treasuries

Metaplanet states that it will continue its Bitcoin strategy into 2026, planning to use 14 billion yen of the raised funds to purchase Bitcoin, aiming to maximize Bitcoin holdings per share.

Similar transformation companies include the nearly century-old Japanese textile factory “Kitabou” (formerly: North Japan Spinning). Due to consecutive losses in its core business, it announced in July 2025 an investment of 800 million yen to buy Bitcoin, and plans to allocate some assets to lending profits and mining operations, attempting to improve its financial health through crypto strategies.

Moreover, Japanese game developer Gumi invested in Bitcoin and Ripple last year, and Mobcast Holdings also announced a plan to purchase Solana worth 500 million yen.

From printing and textiles to gaming, many listed Japanese companies are transforming into DAT enterprises or adding crypto assets to their balance sheets. Bitcoin investor and financial accountant Rajat Soni has pointed out that holding Bitcoin can effectively extend a company’s financial sustainability, providing management with more time and space to respond to market changes.

Further reading:

Steak’n Shake’s Bitcoin reserves increase by tens of millions! Using BTC payments boosts performance, surpassing McDonald’s

Related Articles

Solana Leads DEX Trading Volume As Layer-2 Solutions and Emerging Chains Reform the DeFi Landscape

Jupiter Unlocks $30B in Staked SOL for DeFi Borrowing

Premium Staking on Solana: Ilya Tarutov on Tramplin.io and Savings-Style Rewards for Smaller Holders

Bitcoin ETFs Record $127.65M Daily Outflow, Ethereum and Solana ETFs Show Mixed Performance

Solana Expands Institutional Outreach With New Lightspeed IR Platform

Wall Street Giant Morgan Stanley Loads Up on Solana as Real-World Assets Reach $1.66B