The USDT supply is expected to decrease the most this month since the collapse of FTX in 2022

Tether USDT, the world’s largest stablecoin pegged to the US dollar, is experiencing its strongest monthly supply reduction in years as major investors increase withdrawal activity, according to blockchain data.

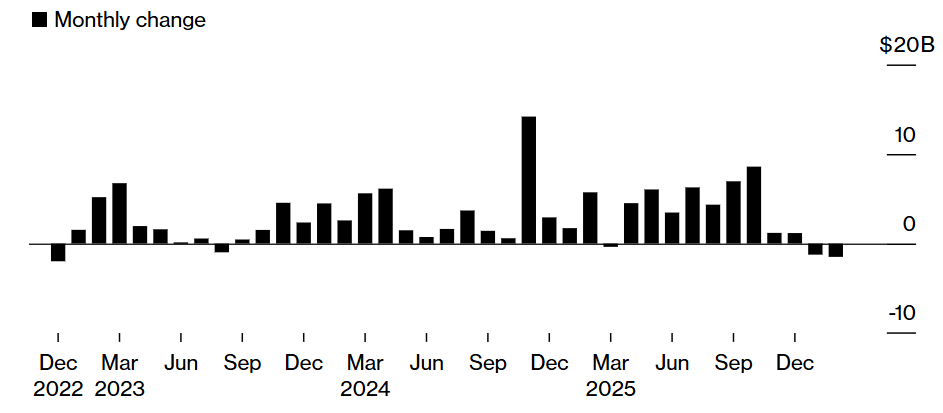

Based on a Bloomberg report citing Artemis Analytics data, the circulating supply of USDT has decreased by approximately 1.5 billion USD so far in February, after a 1.2 billion USD decline in January. This puts USDT on its steepest downward trend in three years, since the collapse of the FTX cryptocurrency exchange in November 2022.

Previously, in December 2022, USDT’s supply had fallen by 2 billion USD following the collapse of FTX and its 150 subsidiaries, which caused significant shocks in the crypto industry.

Cryptocurrency Market Liquidity Shows Signs of Contraction

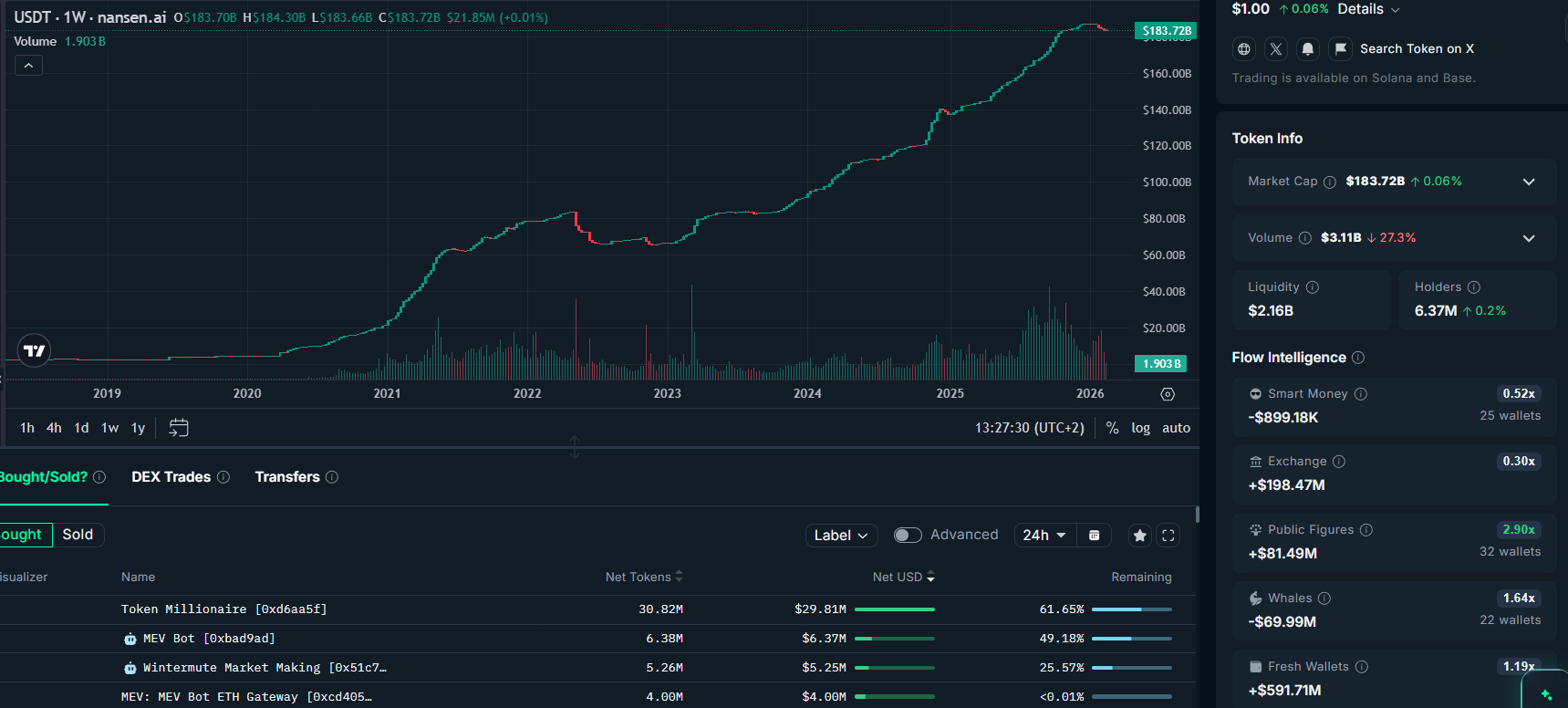

The recent decline in USDT supply may indicate shrinking liquidity in the crypto market. As the largest stablecoin, USDT plays a crucial role as a gateway for investors entering the crypto space. With a market capitalization of 183 billion USD, USDT currently accounts for about 71% of the total stablecoin market cap, according to CoinMarketCap data.

Tether USDT, Monthly Supply Change Rate, Monthly Summary | Source: Artemis Analytics, BloombergCointelegraph reached out to Tether for comment on the reasons behind the supply decrease in February but has not received a response as of publication.

Tether USDT, Monthly Supply Change Rate, Monthly Summary | Source: Artemis Analytics, BloombergCointelegraph reached out to Tether for comment on the reasons behind the supply decrease in February but has not received a response as of publication.

Stablecoin Market Remains Stable in February

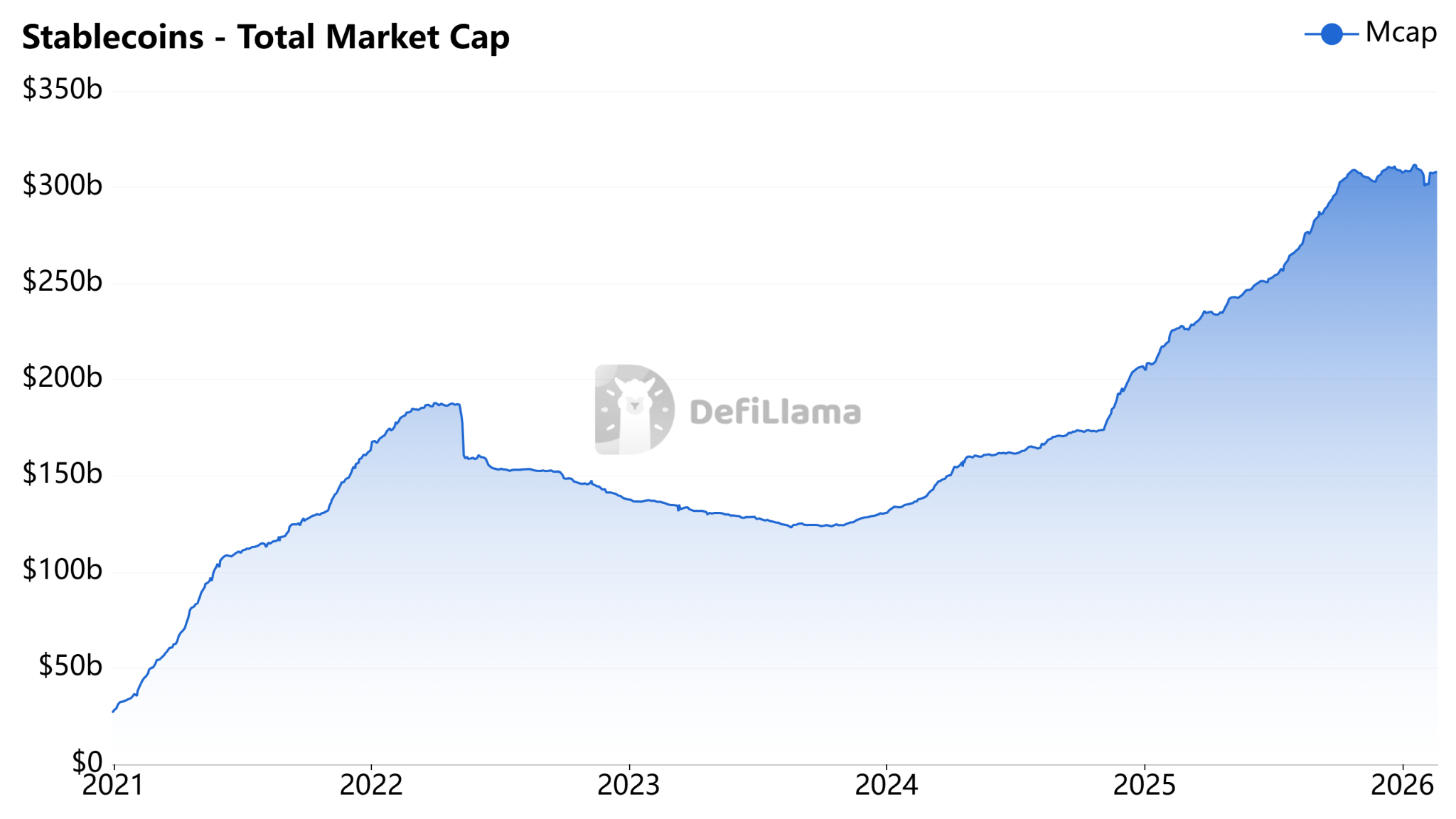

Despite the significant reduction in USDT supply, this does not necessarily mean the entire stablecoin market is in decline. According to data from DeFiLlama, the total market cap of stablecoins across all exchanges increased by 2.33% in February, rising from 300 billion USD to 307 billion USD.

Total Stablecoin Market Cap | Source: DeFiLlama While the two largest stablecoins, USDT and Circle’s USDC, decreased by 1.7% and 0.9% respectively, USD1—a stablecoin linked to the Trump family and issued by World Liberty Financial—saw an impressive 50% growth in market cap, reaching 5.1 billion USD as of Friday, according to DeFiLlama.

Total Stablecoin Market Cap | Source: DeFiLlama While the two largest stablecoins, USDT and Circle’s USDC, decreased by 1.7% and 0.9% respectively, USD1—a stablecoin linked to the Trump family and issued by World Liberty Financial—saw an impressive 50% growth in market cap, reaching 5.1 billion USD as of Friday, according to DeFiLlama.

Diverging Trends: Whales Reduce Holdings, New Wallets Increase Purchases

Large investors, known as “whales,” are significantly reducing their USDT holdings. According to analytics platform Nansen, in the past week, 22 whale wallets sold a total of 69.9 million USD worth of USDT, with selling speed increasing 1.6 times compared to previous periods.

Additionally, top traders tracked under the “smart money” category have also become net sellers of USDT. However, a notable development is that new wallets created within the past 15 days have purchased approximately 591 million USD worth of USDT during the same period, according to Nansen data.

Mr. Giáo

Related Articles

The value of Strategy assets is approximately six times the liabilities, with cash reserves sufficient to pay dividends for over 30 months.

Bitcoin Winter! Mining company Bitcoin Little Deer sells all BTC, Wu Jihan: This doesn't mean I won't hold in the future

Michael Saylor releases Bitcoin Tracker information again; increased holdings data may be disclosed next week

Wu Jihan responds to Bitdeer clearing Bitcoin: it doesn't mean they won't hold it in the future

Silicon Valley venture capital legend is quitting! Peter Thiel liquidates his holdings in the "ETHZilla" crypto company