Assess the macro-financial risks of crypto assets

Recently, the International Monetary Fund released a working paper “Assessing Macrofinancial Risks from Crypto Assets”. Issues in the cryptocurrency space have sparked calls to strengthen the policy framework for crypto assets in various countries, with greater regulation and supervision. The article introduces a conceptual macro-financial framework to understand and track the systemic risks arising from crypto assets. Specifically, the paper proposes a national-level cryptocurrency risk assessment matrix (C-RAM) to summarize the main vulnerabilities, useful indicators, potential triggers, and potential policy responses related to the cryptocurrency industry. The article also discusses how experts and officials can incorporate specific vulnerabilities arising from crypto-asset activities into their assessment of systemic risk, and how they can provide policy advice and take action when needed to help contain systemic risk. The Institute of Financial Technology of Chinese Min University compiled the core part of the article.

Brief introduction

The article mainly discusses how to assess and manage the macro-financial risks of crypto assets such as Bitcoin and stablecoins. Crypto assets are a new form of digital asset that has potential benefits but also poses extremely high risks to financial stability, financial integrity, and other aspects of the economy. The paper proposes a conceptual framework and a cryptocurrency risk assessment matrix (C-RAM) tool to integrate crypto asset risk into systemic risk assessment and policy response. The article applies C-RAM to several countries, including El Salvador, the Central African Republic, and Vietnam, and discusses their policy challenges and implications.

Macro-Financial Risks and Industry Linkages of Cryptocurrencies

General Framework

The framework includes data, tools, information, vulnerability, contagion, amplification, feedback loops and policy recommendations. The framework explains how crypto assets differ from traditional financial markets in terms of indicators, tools, vulnerabilities, channels, and policies. Some of the new features and challenges posed by crypto assets were highlighted, such as currency substitution, operational risks, and legal uncertainty. The framework identifies the major players in the cryptocurrency ecosystem, such as issuers, miners, exchanges, wallets, investors, and payment providers. Key risks faced, such as credit risk, market risk, liquidity risk, concentration risk, cyber/operational risk, and legal/regulatory risk, are also analyzed. The framework uses a classification of crypto-assets based on four types: unsupported tokens, stablecoins, utility tokens, and security tokens.

Microprudential risk

The framework describes the major components and players of the crypto industry, such as issuers, miners, exchanges, wallets, investors, and payment providers. Explains how crypto assets differ from traditional financial assets in terms of creditor’s rights, decentralization, and governance. Key risks faced by cryptocurrency participants were identified, such as credit risk, market risk, liquidity risk, concentration risk, cyber/operational risk, and legal/regulatory risk. Use a classification of crypto assets based on four types: unsupported tokens, stablecoins, utility tokens, and security tokens. It analyzes how risks in the cryptocurrency space spill over to the traditional financial sector and other economic sectors through various channels, such as counterparty risk, contagion risk, currency substitution risk, and cyber risk. The challenges of regulation and supervision in decentralized and complex environments were highlighted.

Macroprudential risk

The framework explains how crypto assets affect the real economy by households and businesses that use them for investment, savings, or payment purposes. It discusses how crypto assets can generate wealth effects, affect profitability and cash flow, and lead to misallocation of resources. Examined how crypto assets affect the financial sector through revenue, expenditure, and financing channels. They also highlighted the potential fiscal risks posed by crypto-asset price volatility, tax evasion, financial sector bailouts, and unconventional financing. It analyzes how crypto assets affect the external sector through remittances and cross-border capital flows. The challenges faced by countries with high use of crypto assets in terms of reserve adequacy, external buffers and capital flow management measures were highlighted. It explores how crypto assets affect the monetary sector through transmission mechanisms, money substitution, money supply measurement, and interest rate setting. The need for coordination and cooperation between central banks and regulators to address the risks of crypto assets was also emphasized. The main connections and spillovers between the crypto sector and the traditional financial sector were identified. It also assesses the risks posed by concentration, contagion, cyberattacks, disintermediation and market volatility. It also proposes policy responses at the micro and macroprudential levels to mitigate these risks.

Financial Sector Connections

The framework describes how the main components and participants of the cryptocurrency sector, such as issuers, miners, exchanges, wallets, investors, and payment providers, interact with the traditional financial sector. Explains how crypto assets differ from traditional financial assets in terms of creditor’s rights, decentralization, and governance. Key risks faced by cryptocurrency participants and the traditional financial sector were identified, such as credit risk, market risk, liquidity risk, concentration risk, cyber/operational risk, and legal/regulatory risk risk. It analyzes how these risks spill over to other parts of the financial sector and the economy through various channels, such as counterparty risk, contagion risk, currency substitution risk and cyber risk. The challenges of regulation and supervision in decentralized and complex environments were highlighted. How crypto assets affect the structure and stability of the financial sector in the long term is studied. It discusses how crypto assets can lead to the disintermediation of bank deposits, disrupt credit supply and monetary policy transmission, and create parallel markets for exchange rates and local currencies. The need to identify and regulate systemically important cryptocurrency participants, such as large exchanges, DeFi platforms, or miners/validators, was also highlighted.

Unique features that crypto assets bring to the framework

In summary, the main distinguishing features that crypto assets bring to this framework are as follows:

• New business models and forms of financial intermediation, financial instruments, markets and infrastructure have created de facto parallel alternative financial systems

● Decentralized markets and governance structures for major cryptocurrency players

Crypto-assets constitute a new parallel financial system that includes a number of key elements (financial intermediaries and markets, financial market infrastructure and instruments, including similar currencies)

● Due to the automatic execution of transactions, the market reacts very quickly, leading to price fluctuations and financial instability, which can also create unexpected financial risks

● Some of the largest crypto assets have no claims on issuers

● High operational/cyber risk due to high technical complexity and weak governance

● Novel communication channels to the physical sector, including significantly reduced barriers to cross-border communication

● Lack of appropriate oversight and regulatory data

Rapidly evolving legal and regulatory frameworks, including the recognition of crypto assets as legal tender in some countries, affect fiscal and monetary policies

● Highly dynamic and innovative market environment hinders effective monitoring and supervision, and it is easy to circumvent regulatory measures

Cryptocurrency Risk Assessment Matrix (C-RAM)

The article proposes a three-step approach to incorporate the macro-financial risks of crypto assets into state surveillance. This approach aims to help policymakers and national experts assess the systemic risks and macro-financial implications of crypto assets in a systematic and comprehensive manner. It helps policymakers and national experts identify the main vulnerabilities and risks associated with the cryptocurrency industry, understand its potential triggers and impacts, and develop appropriate policy responses.

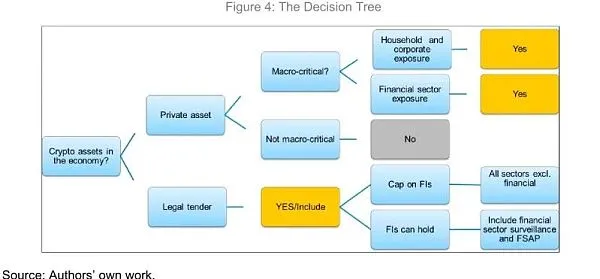

Step 1 Decision Tree: This step helps determine whether crypto assets are used in an economically meaningful way in a country and whether they are fiat currency or private assets. If crypto assets are used as legal tender (e.g. in El Salvador or the Central African Republic), then they should be subject to state surveillance, as this could further incentivize adoption, undermine the effectiveness of monetary policy or create fiscal risks. If crypto assets exist as private assets that have an impact on the economy as a whole, the coverage of state surveillance will depend on their macro importance. If considered macro critical, risk assessments should cover household and business risks to identify vulnerabilities and risks in the physical sector and the importance of the resulting macro linkages.

Step 2: Country Risk Mapping: This step involves studying some indicators that are comparable to those used in macro-financial surveillance of the traditional financial sector. The model identified seven sets of vulnerabilities based on the macro and microfinancial linkages of cryptocurrencies: systemic importance, credit risk, concentration risk, liquidity risk, market risk, regulatory risk, and operational risk. Metrics and data sources are also provided to measure these vulnerabilities, and some potential triggers that could lead to systemic events are presented.

Step 3 Global Cryptocurrency Risk Assessment Matrix: This step captures global risks that affect a country’s systemic risk assessment. These include risks from global regulatory arbitrage, cyberattacks, geopolitical shocks or cross-border contagion. It also discusses how to incorporate these global risks into country-level analysis and policy recommendations.

Application of C-RAM in country cases

The article applies the C-RAM framework to three countries with different levels of cryptocurrency adoption and regulation: El Salvador, the Central African Republic, and Vietnam. Use decision trees, country risk mappings, and global cryptocurrency risk assessment matrices to identify key risks and challenges in each country and propose possible policy options.

El Salvador: El Salvador was the first country to adopt Bitcoin as legal tender, which poses significant risks to macroeconomic and financial stability, financial integrity, consumer protection, and governance. The article found that El Salvador is highly vulnerable in terms of systemic importance, credit risk, liquidity risk, market risk, regulatory risk and operational risk. They also identified potential triggers, such as cyberattacks, legal challenges, social unrest, or external shocks. It is recommended that a comprehensive policy framework be developed to mitigate these risks, including strengthening regulation, improving transparency and data collection, ensuring adequate reserves and buffers, and promoting international cooperation.

Central African Republic: The Central African Republic plans to launch a national digital currency called Sango, which will be backed by a basket of commodities and crypto assets. The project poses high risks to fiscal sustainability, monetary policy effectiveness, financial stability, financial integrity and governance. They lack sufficient infrastructure, institutions, legal framework and capacity to support this ambitious initiative. Caution was advised when proceeding with the project and authorities were urged to address the prerequisites before launching Sango. Some of the main policy challenges are:

● Legal risk: The Sango project could violate the CEMAC Monetary Integration Agreement, which establishes a common currency (CFA franc) and a common central bank (BEAC) for the six member countries. It may also create legal conflicts with existing laws and regulations on payment systems, financial intermediation, taxation and consumer protection. It is recommended that legal clarity and consensus with regional partners be sought before proceeding with the project.

Fiscal risk: The Sango project could jeopardize fiscal sustainability by creating contingent liabilities to the government, increasing the cost of public debt servicing, reducing taxes, or demanding public bailouts for failed cryptocurrency businesses. It is recommended to strengthen fiscal discipline and transparency, diversify revenue sources, improve debt management, and avoid unconventional financing schemes.

Monetary Policy Risk: The Sango project could undermine the effectiveness of monetary policy by creating currency substitution risks, undermining reserve adequacy, complicating money supply measurement, or interfering with interest rate setting. It is recommended to maintain close coordination with the BEAC to ensure adequate external buffers, monitor changes in the demand for money and velocity of circulation, and respect the independence of monetary policy.

Financial stability risks: The Sango project threatens financial stability by increasing the volatility and complexity of the financial system, creating liquidity and solvency risks for banks and non-bank financial institutions, and facilitating illicit activity or capital flight. It is recommended to strengthen regulation and supervision of cryptocurrency-related activities, improve data and transparency, enhance cyber resilience, and enforce AML/CFT requirements.

Vietnam: Vietnam has a relatively high degree of adoption of cryptocurrencies among individuals and businesses, but also has a strict regulatory stance prohibiting the use of crypto assets as a means of payment or exchange. Vietnam faces moderate vulnerabilities in terms of systemic importance, credit risk, concentration risk, market risk, regulatory risk and operational risk. Potential triggers such as cybercrime, fraud, scams, or legal disputes are also highlighted. It is recommended to strengthen the legal and regulatory framework for crypto assets, improve data and transparency, strengthen supervision and enforcement, and promote regional and global cooperation.

Policy challenges and implications

Data acquisition

Sufficiently granular and high-frequency data is needed to provide a broad view of credit risk, including cryptocurrency providers and traditional financial intermediaries. In addition to payment providers and other service providers, this must also include foreign exposure to form a perception of their systemic importance in the financial or physical sector. While the decentralized structure of crypto assets and the high anonymity of blockchains can pose challenges for data collection, the design guarantees public access to the blockchain, which facilitates surveillance. To facilitate this task, regulators can formalize sufficiently granular and high-frequency data reporting requirements for cryptocurrency companies and financial institutions. This will also help with the coverage of cryptocurrency-related data in currency, external, and other official macroeconomic statistics. International data-sharing arrangements between national regulators could be developed to facilitate foreign data collection and analysis.

Establishment of regulatory bodies and international cooperation in view of cross-border risks

The decentralized market and governance structure of the crypto ecosystem hinders its effective monitoring and regulation. On the other hand, the nature of digital and the use of distributed ledgers favor real-time and highly granular data collection, as evidenced by multiple encrypted data and business intelligence providers. Priority should therefore be given to the establishment or strengthening of international oversight bodies and coordination among them.

Extending existing macroprudential policy toolkits with cryptocurrency and DeFi-specific measures

The first line of defense against the fragility of the crypto ecosystem is to strengthen micro and macro prudential regulation. Cross-risk between cryptocurrency participants and financial institutions should be properly monitored and appropriate risk weighting and maximum concentration applied. Stablecoin issuers are particularly vulnerable and should implement minimum requirements for adequate capital and liquidity. Regulations that reduce operational vulnerabilities and cyber risks are also particularly important.

More generally, a system-wide analysis of the cross-interdependencies between cryptocurrencies and traditional financial actors is required, and appropriate structural tools should be employed. For example, certain banks may be systemically important because they are particularly vulnerable to large cryptocurrency players. Interactions with other macro policies such as monetary policy, CFM and others should also be considered to ensure that cryptocurrency-specific policies have the desired overall impact.

Part 6

Conclusion

Over the past few years, the private crypto asset industry has experienced rapid growth and is increasingly integrated into the global economy. It represents a new shadow financial system with significant risk implications for the traditional financial sector and beyond. Due to potential systemic risk implications, the existing policy framework has not kept pace with this new financial market. The recent crypto winter, the failure of large cryptocurrency issuers and platforms, and banks’ calls for better data, monitoring, and policies illustrate this point.

The article proposes a conceptual framework for identifying the micro- and macroprudential risks posed by the fast-growing private crypto industry. A three-step tool, the Cryptocurrency Risk Assessment Matrix, is proposed to assess and monitor these risks and their systemic risk impact in national reviews. C-RAM includes country risk mapping and global risk assessment using the conceptual framework discussed in the first part of the article. Our goal is to provide a dynamic tool that can be updated as new analytics and data emerge.

Major policy challenges remain and require international cooperation. Lack of data and any centralized data collection is a key challenge that should be prioritized. Therefore, given the risks across borders, it is essential to establish or strengthen regulatory bodies and international cooperation. Given the pace of progress, innovation, and decentralized nature of the market, the current policy toolkit remains inadequate. This challenge calls for expanding current macroprudential policies with more cryptocurrency and DeFi-oriented policies. Cryptocurrency policy design should also consider interactions and complementarities with other macro policies.

Going forward, the conceptual framework proposed in the article will be updated as more data and country analysis become available. Coordinated efforts by international organizations will also help to refine this framework and develop effective policies to curb the macro-financial risks posed by crypto assets.