Bitcoin Liquidation Map Analysis: Identifying Market Flashpoints

Image: https://www.coinglass.com/pro/futures/LiquidationHeatMap?coin=BTC

1. What Is a Bitcoin Liquidation Heat Map?

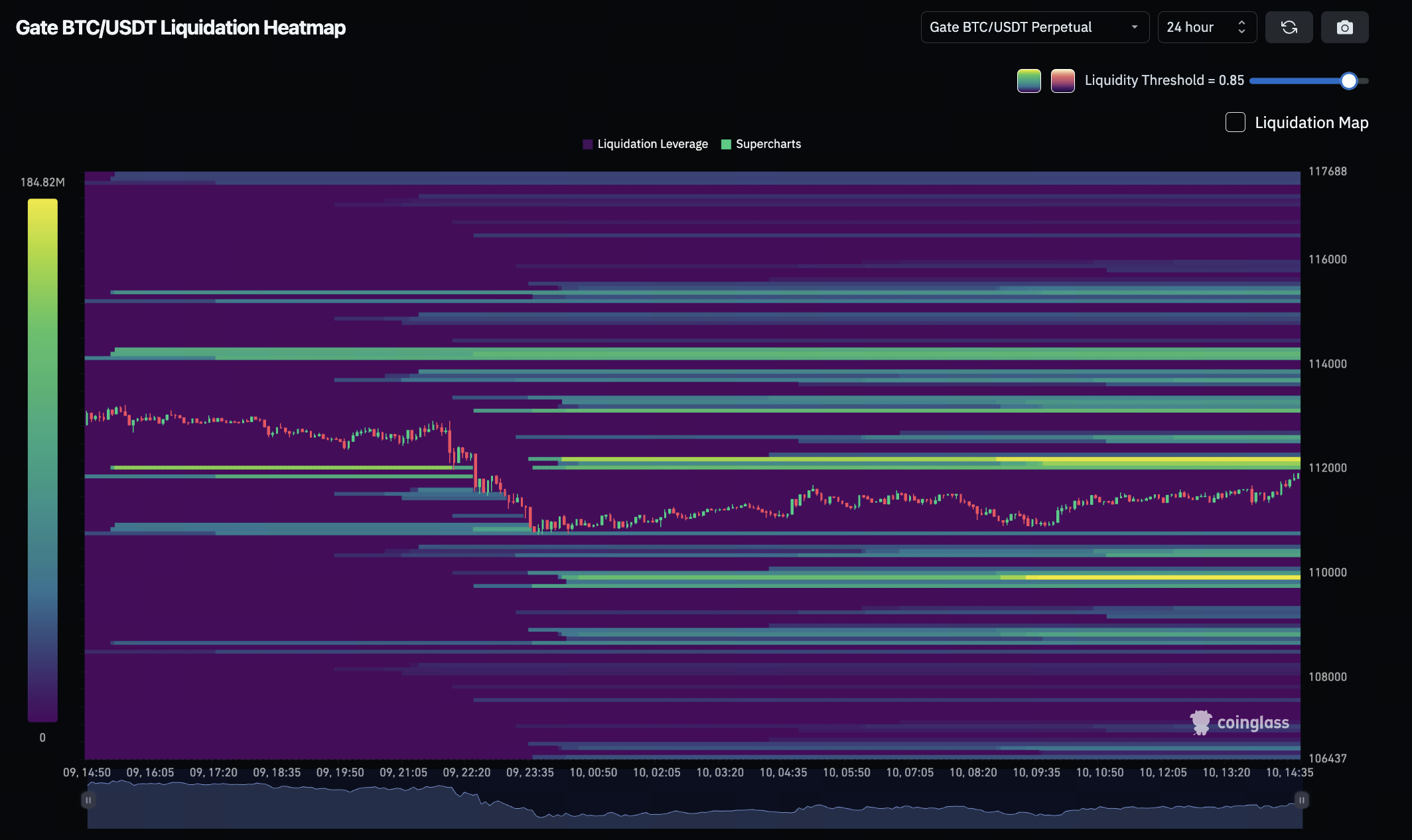

A Bitcoin Liquidation Heat Map is a charting tool that highlights price ranges where forced liquidations—margin calls caused by leveraged trading—cluster in the market. Traders using leverage may have their positions automatically sold by the platform if the price reaches their stop-loss or maintenance margin threshold. This process triggers liquidation events that are visualized on the heat map.

2. Why Does It Matter for Traders?

The liquidation heat map identifies key “liquidation clusters,” which serve as leading indicators for market risk and potential reversal zones. By analyzing these areas, traders can:

- Minimize the risk of being stopped out by market-driven “stop-loss sweeps” designed to trigger liquidations.

- Set more strategic stop-loss levels outside common liquidation zones.

- Assess market sentiment by determining if liquidations are skewed toward longs or shorts.

3. Case Study: Where Are Liquidation Hotspots Now?

Recent data indicates:

- Bitcoin is currently trading around $105,380.

- Short positions are being liquidated in the $102,000 to $103,500 range.

- Long liquidations are clustering above $106,800.

If BTC breaks above $106,800, a short squeeze could fuel rapid upward momentum toward $109,000. On the other hand, if prices fall below $103,500, long positions may be forced to liquidate, potentially resulting in a decline toward the $100,000 region.

4. How to Use the Liquidation Heat Map When Building Trading Strategies

- Set Strategic Stop-Losses: Avoid placing stop-loss orders in areas with high liquidation density to prevent getting caught by market-wide sweeps.

- Spot Potential Reversals: A sharp increase in short liquidations often indicates a short-term bullish reversal.

- Wait for Confirmation Before Entering: Avoid impulsive trades. Instead, wait for the price to break out from a liquidation zone with strong volume before entering a position.

- Integrate with Other Indicators: Combine the liquidation heat map with metrics like funding rates, open interest, or the RSI for more robust decision-making.

5. Cautions and Actionable Guidance

- While liquidation clusters are valuable, be cautious of “false breakouts” and confirm signals using volume and market liquidity data.

- Do not rely solely on a single tool. Combining heat maps with broader market trend and structural analysis leads to stronger strategies.

- New traders, in particular, should manage leverage cautiously to avoid liquidation caused by normal price swings.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks