Falcon Finance Tokenomics: FF Value Capture Explained

Falcon Finance is a universal collateral protocol designed for the multi-chain DeFi ecosystem. It aims to unify various on-chain and off-chain assets into a single collateral and yield engine through a generalized collateral infrastructure protocol, thereby reshaping the underlying logic of stablecoins and DeFi lending.

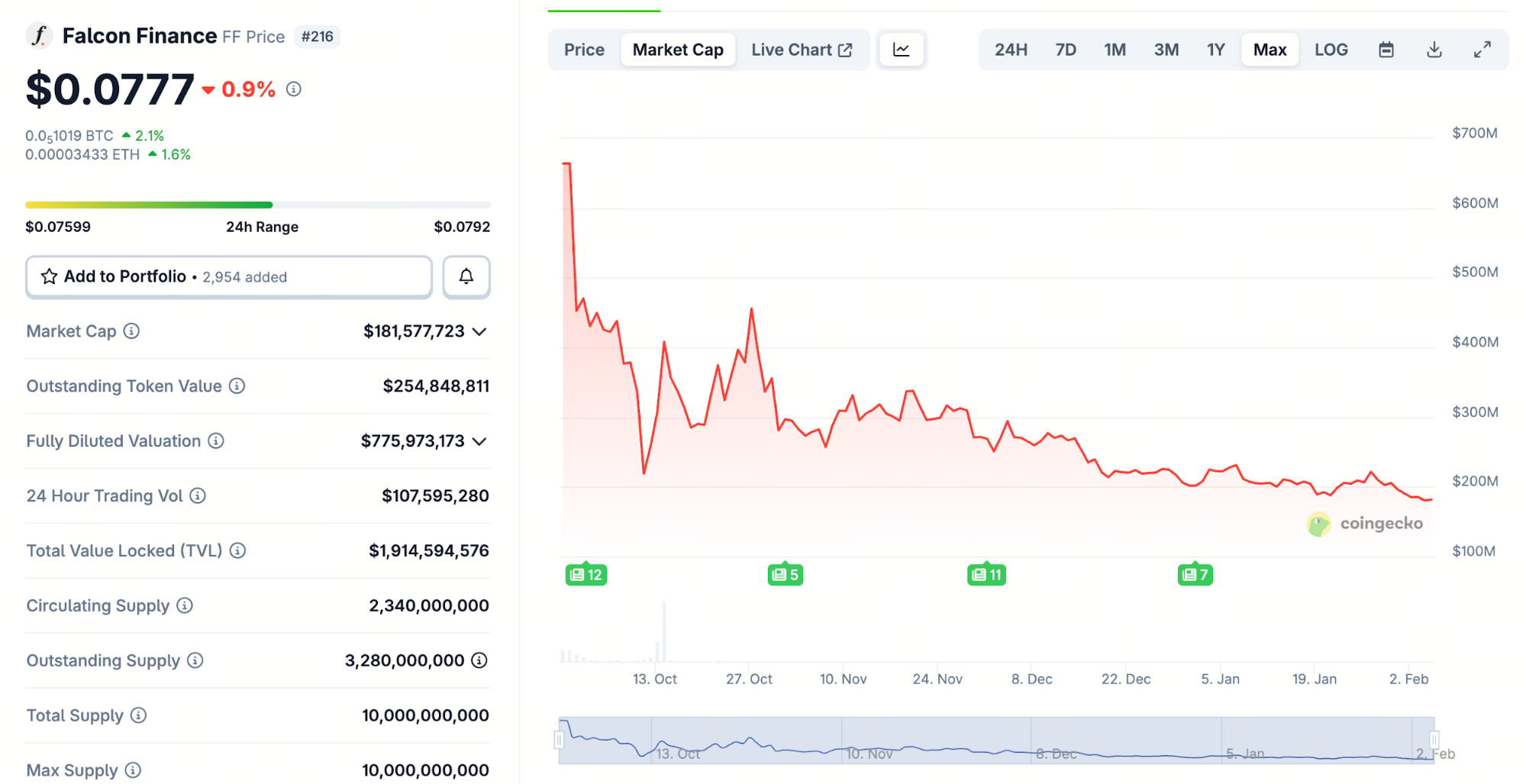

As of February 4, 2026, the governance token FF of Falcon Finance has a current market capitalization of approximately USD 182 million (FDV USD 780 million), with a circulating supply ratio of only 23.4%. Since February of last year, the supply of USDf has continued to grow, with total supply now exceeding USD 2.1 billion.

This article provides a detailed analysis of Falcon Finance’s token value capture mechanisms, covering governance rights and staking yields, ecosystem participation incentives, and ecosystem fund value feedback. It also compiles key project metrics and analyzes the project’s 2026 roadmap and development outlook.

Sources of FF token value capture

As the governance and value capture core of the Falcon Finance ecosystem, the total supply of FF is set at 10 billion tokens. According to the latest planning, FF’s value capture path has evolved from single governance utility into a “three-in-one” economic model.

Governance rights and staking yield

- Prime Staking (long-term lock-up): Users who lock $FF for 180 days can earn 5.22% native token yield and unlock governance voting power weighted up to 10×.

- Yield multipliers (Boosters): Users who stake $FF and hold sUSDf (yield-bearing synthetic USD) can receive additional yield boosts, increasing APY to more than 1.5× that of comparable protocols.

Ecosystem participation incentives

- Falcon Miles program: Users accumulate Miles points by minting USDf, providing liquidity, or participating in governance, which can be redeemed for seasonal $FF rewards.

- Privileged access rights: FF holders gain priority access to Delta-Neutral high-yield vaults and early subscription rights to structured RWA products.

Ecosystem fund value feedback

On January 30, 2026, Falcon announced the launch of a USD 50 million ecosystem fund, focused on supporting teams building yield infrastructure, RWA integrations, and structured products on Ethereum and BNB Chain.

According to official disclosures, the fund prioritizes investments in RWA yield infrastructure. Returns from successful projects will be fed back to FF holders through buybacks and treasury growth.

Key metrics and analysis (data as of February 4, 2026)

FF is currently listed on multiple major centralized and decentralized exchanges. Below is a summary of key Falcon Finance metrics:

- FF token price: $0.0779

- FF market capitalization: $182 million, current market rank 216, with significant growth potential

- FDV: $780 million

- FF circulating supply: 2.34 billion, representing 23.4% of the total 10 billion supply

- TVL: $1.917 billion, ranking among the top projects in the RWA sector

- USDf supply: $2.147 billion, continuing to grow with strong market demand

- FDV / TVL: 0.41×

Source: CoinGecko

Source: Dune Analytics

It should be noted that the above data is aggregated from DeFiLlama, CoinGecko, and Dune Analytics, with all figures current as of February 4, 2026.

From this data, several conclusions can be drawn. Falcon Finance’s current FDV/TVL ratio of 0.41× is significantly lower than that of other DeFi protocols (Ethena typically ranges between 1.5× and 2.5×). In addition, relative to the USD 2.1 billion USDf supply, the project’s FDV of USD 780 million remains conservative, providing a substantial margin of safety.

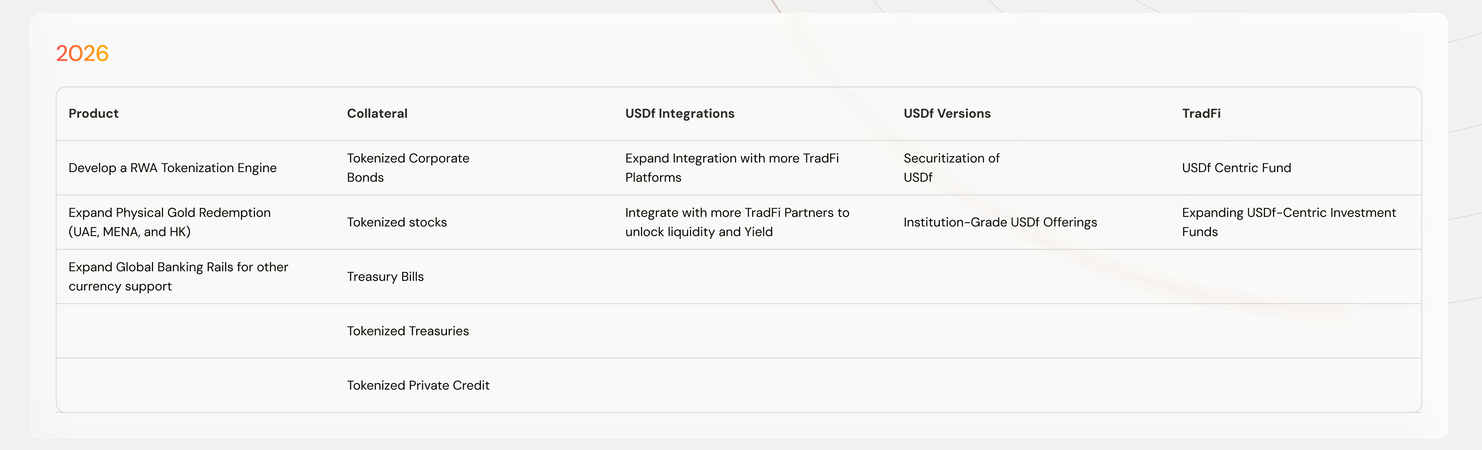

2026 roadmap: full-scale expansion of the RWA engine

According to the official 2026 roadmap and whitepaper updates, Falcon Finance’s core strategy is focused on the full deployment of its RWA (real-world asset) engine and deep integration with institution-grade financial products.

In 2026, Falcon Finance will achieve a major upgrade in collateral types. Through its RWA Tokenization Engine, traditional financial assets will be transformed into on-chain liquidity.

Source: Falcon Finance

To meet institutional investor requirements, Falcon Finance has made targeted investments in compliance and real-world asset interaction. For example, within regulatory frameworks such as MiCA, it plans to launch tokenized money market funds and overnight yield cash management solutions, accompanied by bank-grade audit reports to meet stringent regulatory standards.

In addition, to improve user experience and expand market coverage, Falcon Finance is advancing multiple technical and product innovations, including “Institution-Grade USDf Offerings” tailored to different markets, as well as USDf-centric investment funds.

Final thoughts

Unlike Ethena, which relies purely on crypto market funding rates, Falcon Finance addresses the sustainability of yield through a dual-engine model combining crypto assets and RWA.

With a valuation advantage of 0.41× FDV/TVL, USD 2.1 billion in stablecoin demand, and a fully launched RWA engine scheduled for Q1, Falcon Finance is one of the RWA and stablecoin projects worth close attention in 2026.

Frequently Asked Questions (FAQs)

What is the source of USDf yield?

It combines on-chain delta-neutral arbitrage returns with off-chain RWA income, such as real yield from U.S. Treasuries.

Does the FF token have a burn mechanism?

A portion of protocol fees and RWA premiums will be used for ecosystem buybacks. Depending on governance voting outcomes, these funds will be allocated to token burns or the treasury.

Further reading

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025

What Is Dogecoin?