Gate Research: Evolution of Crypto Wallets and CEX Going On-Chain

This report systematically traces the evolution of crypto wallets from private key management tools in the Bitcoin era to becoming the central gateway to on-chain finance. It reviews how successive waves — including DeFi Summer, inscriptions, memes, and on-chain derivatives — have continuously expanded the functional boundaries of wallets, driving their transformation from passive asset management tools into All-In-One on-chain platforms resembling CEXs. The report also analyzes the breakthroughs in wallet monetization across asset issuance, trading, and distribution scenarios.Summary

- The Bitcoin white paper defined the essence of a wallet: it is a tool for private keys and signatures, not an account-based system. The private key represents control, forming a core consensus in the crypto industry — “Not your keys, not your coins.”

- DeFi Summer elevated wallets from low-frequency asset management tools to essential gateways for on-chain DeFi.

- The bear market did not halt wallet evolution; instead, it propelled the All-In-One approach into the mainstream, validated through high-frequency real-world use cases like inscriptions and meme trends.

- CEXs have extended their boundaries through embedded wallets, leveraging their existing advantages into the on-chain ecosystem, enabling a seamless Web3 experience for exchange users with one click.

I. The Starting Point of Wallets

The origin of crypto wallets can be traced back to the birth of the Bitcoin network.

1.1 The Original Definition of Wallets: Private Key Management Tools

On October 31, 2008, an anonymous developer or group under the pseudonym Satoshi Nakamoto released the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System,” which established the core logic of the modern crypto wallet: a wallet is essentially a tool for generating, managing, and signing with private keys, rather than a traditional “account” or “fund repository.”

Bitcoin’s genesis block was mined on January 3, 2009. That same year, the release of Bitcoin Core (initially known as Bitcoin-Qt) became the first complete reference implementation. Its built-in wallet functionality was, from the start, positioned as a manager for a collection of private keys.

According to Bitcoin developer documentation, the earliest Bitcoin Core wallets adopted a Loose-Key or JBOK (“Just a Bunch Of Keys”) model: the software automatically generated a batch of private/public key pairs (100 by default in early versions) using a pseudo-random number generator (PRNG). These key pairs were stored in a local file called wallet.dat. The core responsibilities of the wallet were: generating private keys, deriving corresponding public keys and addresses, monitoring the blockchain for unspent transaction outputs (UTXOs) associated with those addresses, signing transactions locally with private keys, and broadcasting the signed transactions.

Users’ BTC were not stored in the wallet software or on their devices, but always existed on the blockchain’s distributed ledger. The wallet merely held the private keys that proved ownership and authorized the movement of assets. Losing the private key meant permanently losing control of the corresponding UTXO, laying the early foundation for the industry’s iron rule: “Not your keys, not your coins.”

It is important to note that, unlike traditional bank accounts, the Bitcoin network does not have a centralized concept of account balances. Each UTXO exists independently and is locked by a script to a specific public key hash (P2PKH was the early standard). To “spend” these UTXOs, users must provide a signature that unlocks the script — a signature that can only be generated by the corresponding private key. Therefore, the role of wallet software is closer to that of a signer and monitor, rather than a custodian or bookkeeper. While Satoshi did not explicitly use the term “wallet” in the white paper to define the software, he mentioned private keys being used to sign transactions multiple times, implying the necessity of local key management. Later implementations of Bitcoin Core solidified this logic as the default wallet behavior.

Wallet functionality during this phase was extremely pure: it was merely the “entry key” to on-chain assets. User experience was poor and technical barriers were high — with virtually no user education, interface polish, or additional services. There was no business model at all; Bitcoin Core was free and open-source software, and developers charged nothing.

II. From a Transfer Tool to a DeFi Gateway

The summer of 2020, known in the crypto industry as “DeFi Summer,” marked the most vibrant period of financial innovation in crypto history. It directly drove the first major user migration toward non-custodial wallets and laid the foundation for the modern DeFi ecosystem.

2.1 The Impact of DeFi Summer on Wallets

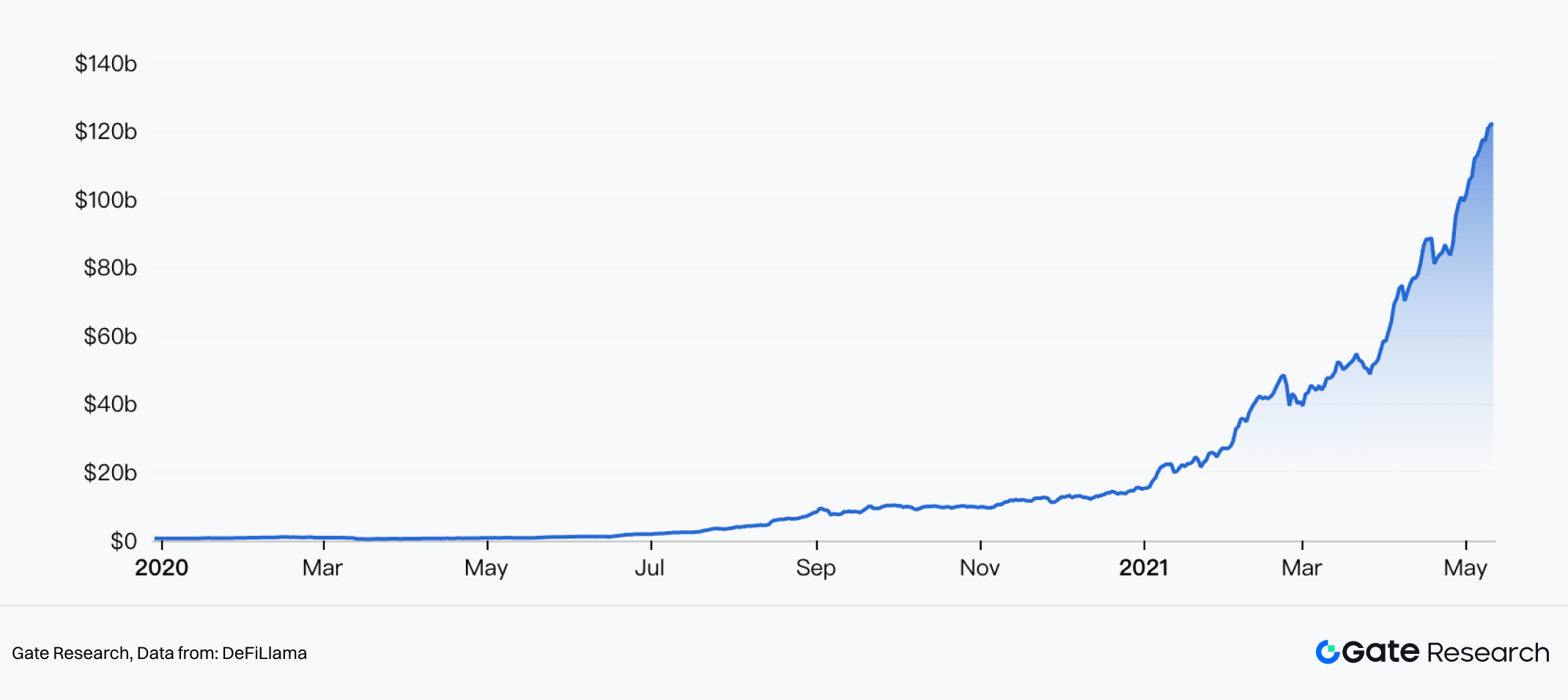

DeFi Summer marked DeFi’s transition from a fringe experiment to a period of explosive growth. During this time, innovation across multiple core protocols within the Ethereum ecosystem, combined with liquidity incentive mechanisms, led to a surge in on-chain financial activity. Total Value Locked (TVL) skyrocketed from around $600 million at the beginning of 2020 to surpass $1 billion for the first time in October, and broke through the $10 billion mark for the first time in April of the following year.

The catalysts of DeFi Summer primarily stemmed from the maturation and incentive innovations of three major protocols: Compound, Uniswap, and Aave.

(1) Compound In mid-June 2020, Compound launched its governance token COMP and introduced a liquidity mining mechanism — users could earn COMP tokens in real time simply by supplying or borrowing assets. This design was the first to deeply tie protocol governance rights with economic incentives, rapidly attracting large-scale liquidity. After COMP’s launch, Compound’s TVL jumped from under $100 million to over $1 billion within four months, serving as the direct ignition point of DeFi Summer. By April 2021, it had surpassed the $10 billion mark for the first time.

(2) Uniswap Uniswap v1 went live as early as November 2018, but v2, launched in May 2020, significantly improved capital efficiency and user experience by introducing ERC-20/ERC-20 trading pair liquidity pools. Then, in mid-September 2020, Uniswap airdropped UNI tokens to all historical users and launched its own liquidity mining, further amplifying its user base. In September of that year, Uniswap’s monthly trading volume exceeded $10 billion for the first time, prompting excitement in the community that DEXs might rival centralized exchanges.

(3) Aave Aave completed its V1 upgrade in early 2020, introducing innovative features like flash loans. During DeFi Summer, Aave’s TVL grew from just tens of millions of dollars in early June to surpassing $1 billion for the first time in August, making it a leading player in the lending sector.

What these protocols had in common was that they used token incentives to scale liquidity from scattered individuals to coordinated masses. As a result, users’ on-chain interaction frequency and strategy complexity surged dramatically.

2.2 Wallets Became the Essential Gateway to dApps

Before DeFi Summer, wallets were mainly used for simple transfers, asset viewing, and limited dApp interactions, with a relatively small user base. In the summer of 2020, as DeFi protocols surged, users were required to interact directly with smart contracts through wallets — signing transactions, approving spending limits, supplying or withdrawing liquidity, and more. As a result, wallets shifted from being an “optional tool” to a mandatory gateway into DeFi.

The most typical example of this transformation was the explosive growth in MetaMask usage.

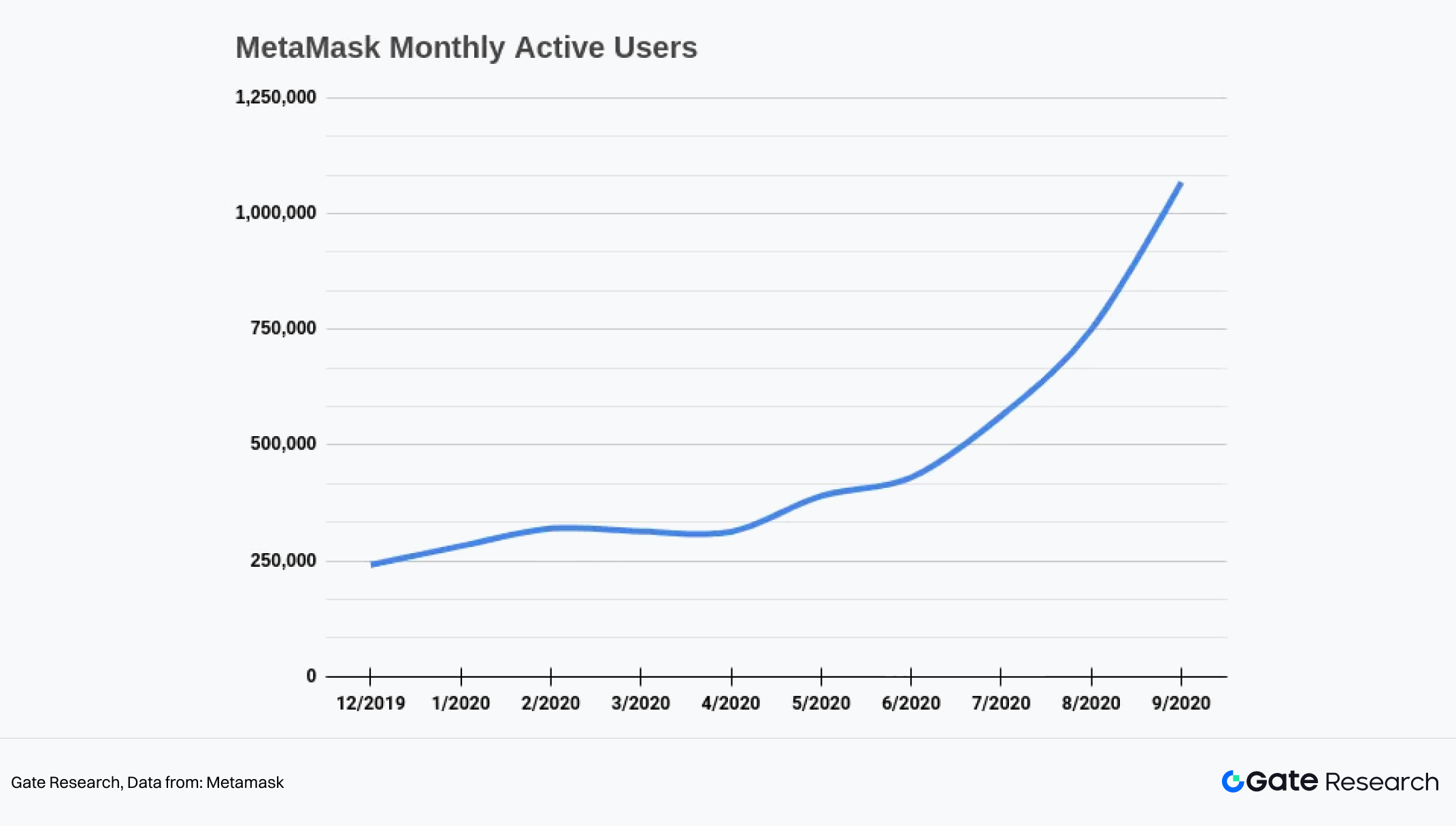

In October 2020, MetaMask published an article celebrating its first-ever milestone of surpassing 1 million monthly active users — a growth of over 400% compared to the same period in 2019. MetaMask’s growth curve closely mirrored the adoption trend of DeFi, indicating that new users were joining the DeFi revolution through MetaMask, primarily to interact with protocols like Uniswap, Compound, Aave, Curve, and Yearn.

Wallets evolved from simple on-chain asset management tools into early prototypes of DeFi operating systems. For the first time, users experienced the browser extension wallet paradigm at scale — connecting directly to dApps and signing complex transactions within the wallet itself. This not only lowered the barrier to DeFi participation, but also enabled wallets to capture significant on-chain user activity, laying the cognitive foundation for later features like built-in swaps and cross-chain functionality.

2.3 DeFi Summer Opened the Traffic Gate, But Wallets Were Still Exploring Business Models

Although DeFi Summer significantly increased wallet usage frequency and traffic, transforming wallets from mere asset management tools into essential gateways for DeFi interactions, the commercialization dilemma remained fundamentally unresolved. The core issue was that while wallets attracted considerable on-chain traffic, they struggled to effectively “intercept” and convert it into sustainable, high-margin revenue. Value capture primarily occurred at the protocol layer, not at the wallet layer.

First, wallets did not control trade pricing. In DeFi interactions, key pricing elements (such as slippage, price discovery, and liquidity depth) were always determined by the underlying DEXs or lending protocols. Wallets functioned merely as signers and routing relays to facilitate dApp usage. For example, when a user connects to Uniswap via MetaMask to perform a swap, the actual execution price, slippage, and gas fees are determined by Uniswap’s AMM pools and Ethereum network congestion — MetaMask has no control over or ability to extract value from these aspects.

Secondly, most non-custodial wallets during that phase were still operated under the logic of being free tools. Their revenue either came from very minimal profit-sharing as distribution channels, or they had no revenue at all (relying instead on ecosystem influence or subsidies from parent companies). MetaMask was among the first wallets to launch a built-in Swaps feature — acting as an aggregator that pulled quotes from sources like 1inch, Paraswap, and 0x API. This was one of the few monetization attempts by leading wallets at the time. MetaMask charged a 0.875% fee per swap transaction. That meant users executing swaps via MetaMask paid multiple fees: LP fees, any applicable DEX protocol fees, and MetaMask’s 0.875% swap fee.

From today’s perspective, built-in swaps have become a standard feature and important revenue source for wallets. But at that time, few believed this model would succeed — and many wallets didn’t even consider offering similar built-in swap functions in their early stages.

III. The Evolution of Wallets Toward a “CEX-like” Structure

DeFi Summer established wallets as the entry point to on-chain finance. However, as the bull market moved into 2021, the market narrative shifted rapidly: the NFT boom (peaking in Q1–Q3 2021) and the GameFi/P2E craze (from Q3 2021 to early 2022) took over as the new engines driving user traffic. Although these waves did not directly solve the wallet monetization loop, they significantly expanded functional demands and diversified user behavior patterns. This laid the critical groundwork for the later evolution toward “All-In-One” CEX-like wallet structures.

3.1 The Development of All-In-One Wallets

After entering a bear market in 2022, overall trading activity in the crypto market declined, but wallet product development did not stall. Some wallet developers seized upon the strong user demand for convenience and high-frequency interaction — exposed during the previous bull cycle — and quickly iterated their products. Wallets gradually evolved into on-chain financial super apps, integrating asset management, trading, cross-chain functionality, fiat on/off ramps, and emerging asset access all in one.

Against this backdrop, the All-In-One wallet model began to take shape. Wallets were restructured around the complete on-chain behavior path of users, embedding multiple features into a unified interface. Key components included: unified management and auto-detection of multi-chain assets; built-in swap aggregation and cross-chain bridge services; NFT browsing, trading, and portfolio display; fiat on/off ramp interfaces; and quick integration capabilities for new assets and protocols.

The All-In-One model marked a commercial inflection point, where wallets began shifting from passive gateways to active platforms. On one hand, wallets started to directly host trading and asset allocation activities, significantly increasing user dwell time within a single app. On the other hand, wallets gradually gained control over transaction routing and traffic distribution — reducing reliance on incentives or fee-sharing from underlying protocols, and opening the door to building their own fee and service charge models.

From a business logic standpoint, this represented a key turning point: wallets were transitioning from “passive entry points” to “active platforms.”

3.2 The Trial by Fire of Inscriptions and Memes

By late 2022 to early 2023, after continuous iterations, mainstream non-custodial wallets had reached a nearly mature state in terms of functionality. At that point, what wallets lacked was not product capability, but an external catalyst — something that could re-engage a broad user base and bring complex features into mainstream awareness.

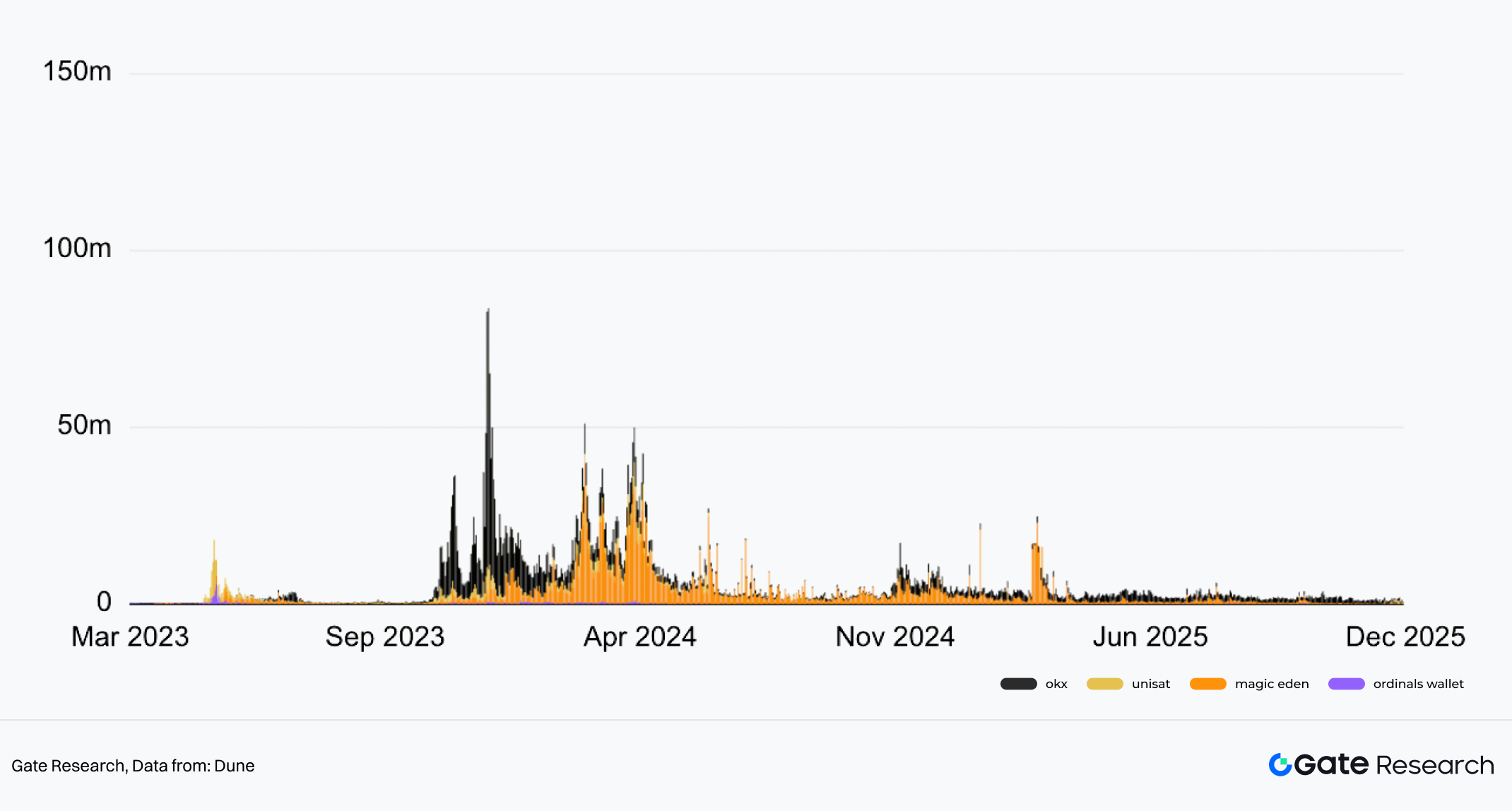

The emergence of inscriptions became that catalyst, propelling All-In-One wallets into the public spotlight. In December 2022, Casey Rodarmor introduced the Bitcoin Ordinals protocol, which allowed data (such as images, text, videos) to be inscribed onto individual Satoshi — the smallest unit of Bitcoin. This enabled new forms of expression within Bitcoin’s block space without altering the network’s consensus rules.

Building on this, in March 2023, domo proposed a token issuance standard based on textual conventions: BRC-20. This standard did not modify the Ordinals protocol itself, but instead used JSON-formatted inscription content to implement a mechanism for issuing and transferring fungible tokens on the Bitcoin network.

The arrival of BRC-20 quickly captured community attention and speculative enthusiasm, leading to a surge of on-chain trading and minting activity in the first half of 2023. This wave brought new demands to wallets: support for visualizing inscription assets, simplified and packaged interfaces for minting and transferring, and optimizations for high-frequency, small-value on-chain transactions on the Bitcoin network.

Wallets that were able to quickly support inscription-related features experienced significant user growth and transaction traffic in a short period of time. At the same time, the fees and service charges generated by inscription activities became one of the first directly observable revenue sources for wallets in 2023.

Although inscriptions were not the starting point of the All-In-One wallet model, they were the first real-world use case to fully demonstrate and validate the operational boundaries of wallets as comprehensive on-chain platforms.

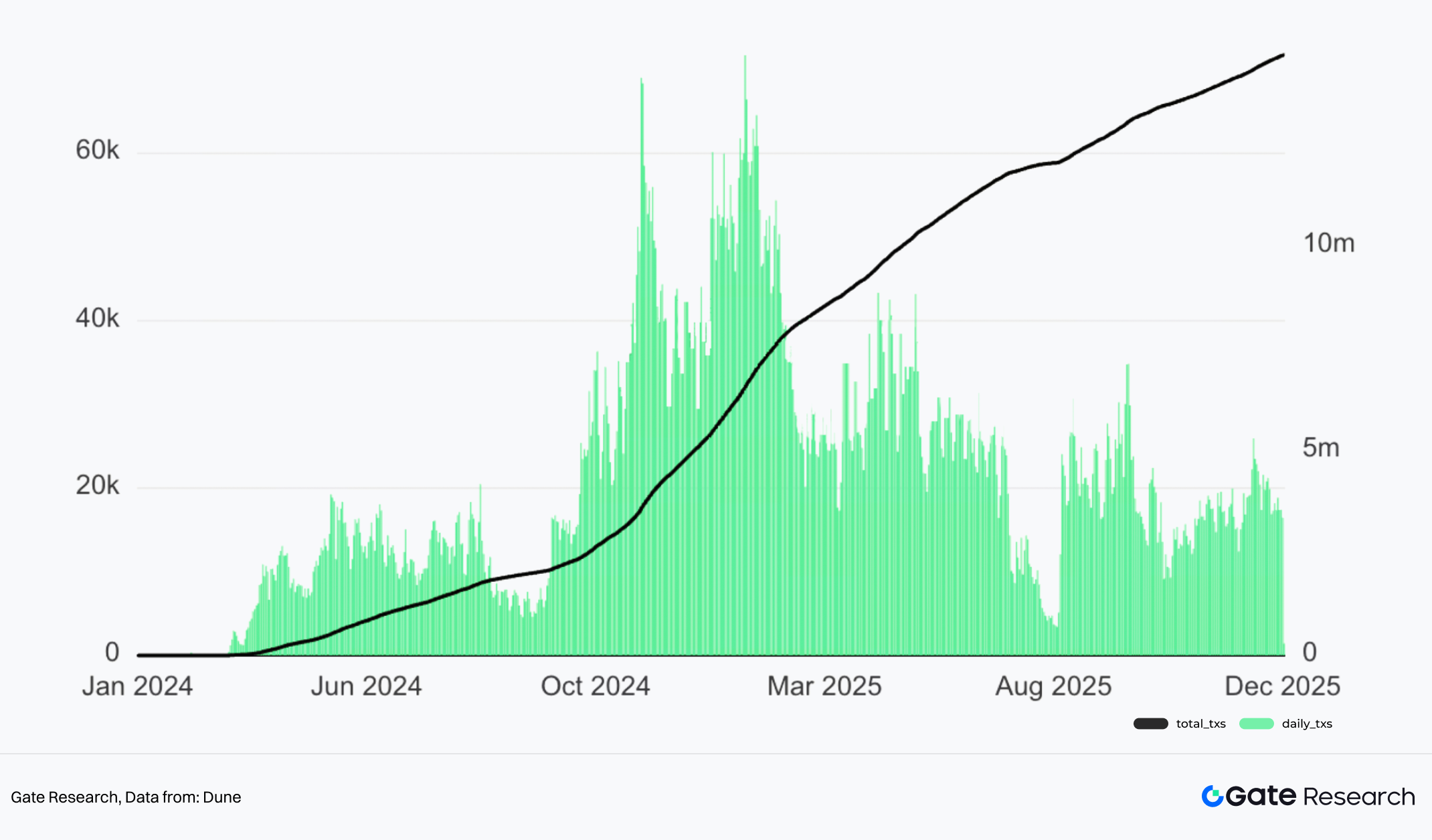

After the inscription wave subsided, the Meme boom in the Solana ecosystem throughout 2024 took over as the next critical proving ground for the All-In-One wallet model. This wave, with Pump.fun as its core infrastructure, quickly exploded following its official launch in 2024: the platform used an extremely simple bonding curve mechanism and ultra-low token issuance costs to lower the barrier for creating memecoins — enabling anyone to launch a token in just a few seconds. Throughout 2024, Pump.fun dominated meme token issuance on Solana. This shift demanded in-depth functional optimization from wallets, prompting them to accelerate the integration of meme-specific tools — such as one-click token launching and monitoring via Launchpads like Pump.fun, real-time bonding curve charts, flash trading mode, take-profit/stop-loss settings, MEV protection, social sharing buttons, and more.

Amid high-frequency interactions and trading activity related to inscriptions and memes, the roles of wallets in asset issuance and management, trade execution, and user onboarding were significantly magnified — leading the market to form a clearer understanding of the wallet’s potential for commercialization and platformization: the frenzied trading volume brought huge traffic to wallet-integrated swap functions, enabling more aggressive fee extraction; wallet routing became a key point of flow capture; and monetization opportunities like ad placements and revenue-sharing partnerships emerged.

As these capabilities continued to manifest in real-world use cases, wallets gradually came to be seen not just as entry tools for trading, but as comprehensive platforms capable of covering on-chain native assets and behavioral scenarios that CEXs struggle to reach — laying the groundwork for CEXs to adopt CEX-On-Chain strategies and embedded wallet solutions.

3.3 Derivatives Expand the Boundaries of Wallets

Perpetual contracts, as a core category of crypto derivatives, have long been considered a stronghold of centralized exchanges (CEXs) — characterized by high leverage, high-frequency trading, deep liquidity, and, as a result, a high-ARPU (average revenue per user) user base.

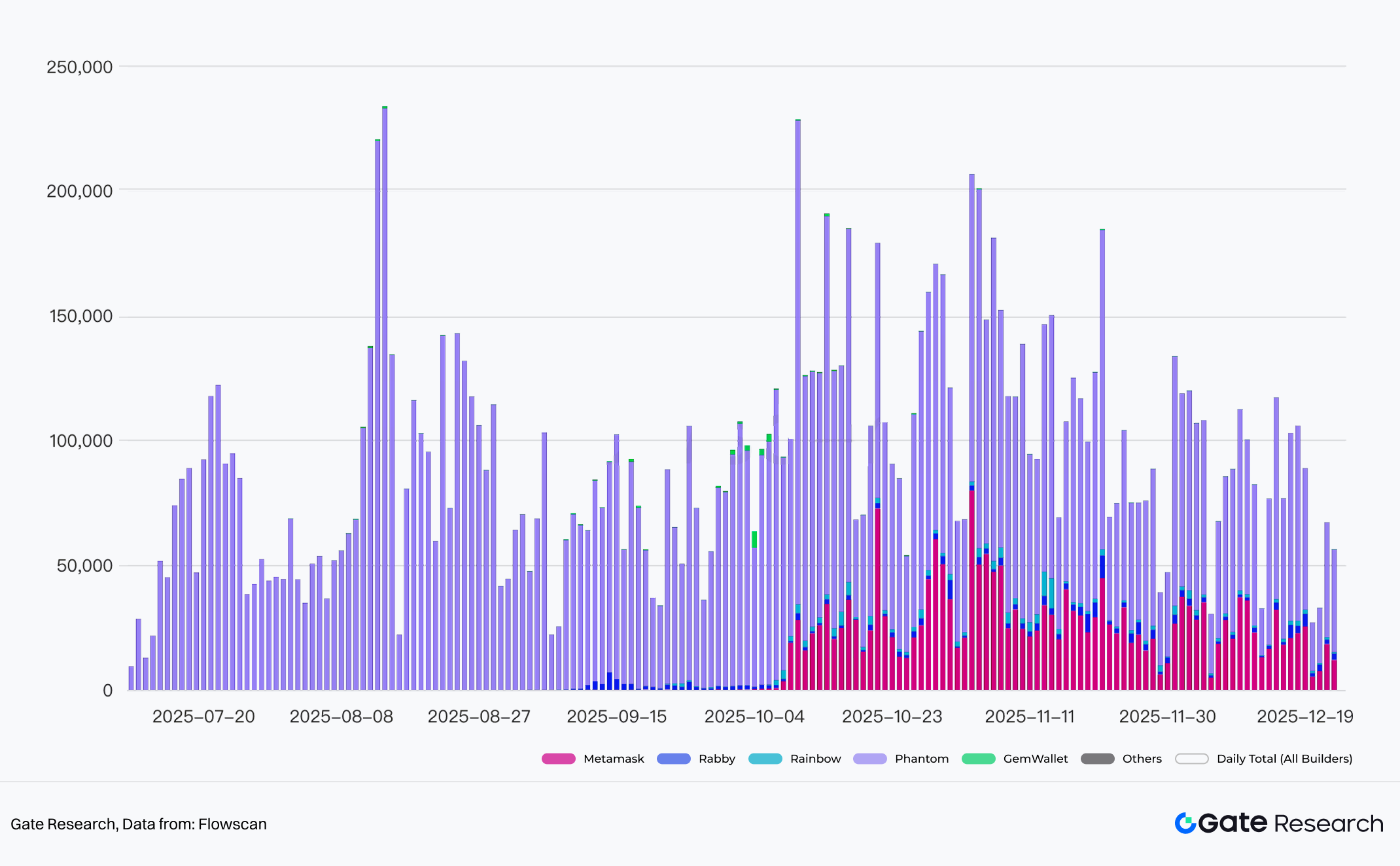

Between late 2024 and 2025, with the explosive rise of high-performance Layer 1 derivative protocols like Hyperliquid, and the deep integration of Builder Codes into mainstream non-custodial wallets, perpetual contracts began to permeate from the exclusive domain of CEXs into the on-chain wallet ecosystem. This marked yet another significant functional expansion in the evolution of All-In-One wallets.

Hyperliquid’s impact goes far beyond a simple technical upgrade — it is reshaping the entire on-chain derivatives trading ecosystem and accelerating the adoption of a “CEX-like experience” on-chain: a fully on-chain central limit order book (on-chain CLOB), sub-10ms execution latency, gas-free trading (enabled by consensus-level optimization), leverage of up to 100x, and a diversified market supporting over 100 crypto assets and RWAs (such as the tokenized stock market under HIP-3).

Hyperliquid’s Builder Codes are the key to its two-way integration with wallets. They allow third-party applications (such as trading terminals and wallets) to relay trades to Hyperliquid’s HyperCore layer via custom code. This enables users to sign and execute trades directly within their wallet without needing to access the Hyperliquid interface. For Hyperliquid, Builders significantly enhance distribution; for wallets, the value is equally significant — they can seamlessly integrate Hyperliquid’s full suite of markets (including new permissionless Perp pairs under HIP-3) without having to build their own order book or liquidity infrastructure. Through Builder Codes, wallets can earn routing fees or revenue shares while maintaining non-custodial principles — user funds remain in the wallet until settlement. Phantom adopted this model to integrate directly with Hyperliquid, quickly capturing derivatives traffic and becoming the most profitable Builder — generating over $12.6 million in fee revenue since its early July launch. Other wallets such as Rabby, MetaMask, and Rainbow have also integrated Hyperliquid Builders, allowing users to trade perpetual contracts directly within their wallet apps.

The rise of high-performance Perp DEXs like Hyperliquid, combined with the dual-sided innovation of Builder Codes as a distribution channel, is the decisive force behind the expansion of wallet boundaries into derivatives in 2025. It equips non-custodial wallets with true CEX-level capabilities for high-frequency, high-leverage trading, enabling them to capture high-ARPU professional user segments while building sustainable revenue models through routing incentives. This not only breaks CEXs’ long-standing monopoly in the derivatives space, but also accelerates the CeDeFi convergence trend: wallets are becoming the primary gateway for native on-chain derivatives, while CEXs are forced to respond by embedding wallets, going on-chain, or even building their own on-chain perpetual platforms — setting the stage for the most intense phase of competition and coexistence in 2025–2026.

IV. The Diverging Evolution Paths of Wallets: Non-Custodial vs. Embedded

In late 2024 and early 2025, CEXs faced dual pressures: internally, highly valued VCcoins launched without generating any wealth effect; externally, Solana meme coins were experiencing 100x–1000x surges, yet CEXs couldn’t list them early enough. As a result, users stuck within exchanges were unable to access high-yield on-chain opportunities, leading to continuous outflows of both assets and users. This forced CEXs to accelerate their transition toward on-chain integration.

However, not all CEXs pursued a full shift toward user self-custody. Instead, many adopted a more pragmatic hybrid or embedded wallet strategy. In this model, wallets are no longer standalone tools — they become on-chain extensions of the user’s CEX account.

4.1 Strengths and Weaknesses of Native Web3 Wallets

Native Web3 wallets — also known as non-custodial or self-custody wallets — are best represented by MetaMask and Phantom. From their inception, these wallets have adhered to the core principle of “Not your keys, not your coins.” Users have full control over their private keys and do not need to rely on third-party custodians.

By 2025, non-custodial wallets have fully evolved into All-In-One on-chain super apps, supporting unified multi-chain asset management, built-in swaps, cross-chain bridges, fiat on/off ramps, rapid support for new assets, meme token launches and monitoring, and perpetual derivatives trading. Their commercialization paths are also becoming clearer, with sustainable revenue models built around swap and perp fee sharing, routing fees, MEV protection services, and app promotion channels.

The core advantage of native Web3 wallets lies in users’ exclusive control over private keys, which avoids the custodial risks common to CEXs — such as hacking incidents, platform bankruptcies and freezes, asset seizures, or regulatory account lockouts. After the FTX collapse in 2022, this advantage was repeatedly validated: users of non-custodial wallets were unaffected by platform failures, whereas CEX users are still fighting for restitution and may face partial or permanent losses. As crypto increasingly aligns with traditional finance, global regulators are paying more attention to both centralized platforms and even some DeFi protocols — making the importance of self-custody all the more evident.

However, the user education cost of self-custodial wallets remains high. Historically, large-scale wallet adoption has been driven by the rise of new assets and narratives — such as DeFi, inscriptions, and memes. Under the strong wealth effect triggered by new trends, users often develop much higher-than-usual motivation to learn. But being able to use a wallet to trade doesn’t mean users fully understand or know how to manage it. Concepts such as seed phrase backups, private key/signature security, gas fee mechanics, and phishing risk prevention still pose significant barriers.

New users, especially those migrating from Web2, are prone to making fatal mistakes — such as approving malicious contracts or losing their seed phrase, leading to irreversible asset loss.

In addition, under a purely non-custodial model, fiat on/off ramp services rely heavily on third-party aggregators (like MoonPay), requiring users to complete KYC/AML verification themselves. These services have uneven regional coverage, with many countries facing restrictions or high fees, leading to friction in onboarding. Under regulatory pressure, aggregators may suddenly adjust policies or increase fees, resulting in an unstable user experience.

4.2 The CEX Embedded Wallet Path

CEX embedded wallets, represented by examples like Gate Web3 Wallet, treat wallets as a natural extension of the CEX ecosystem. The core objective is not to replace the CEX or fully pivot to decentralization, but rather to extend the boundaries of the CEX — seamlessly connecting its existing advantages (compliance, fiat channels, user base, customer support, deep liquidity) into the on-chain ecosystem. This creates a closed-loop Web3 experience where CeFi users can enter Web3 with one click.

Some embedded CEX wallets no longer pursue full self-custody. Instead, they use technologies like MPC (Multi-Party Computation) or TEE (Trusted Execution Environment) to build keyless wallets that offer a “pseudo self-custody” experience — private keys are sharded or encrypted and stored securely, users don’t need to manage seed phrases, but must still authorize recovery and signing. The platform retains partial control, enabling compliance, risk management, and customer support intervention when needed. These wallets are tightly integrated with CEX accounts, allowing users to seamlessly move funds from the exchange to on-chain activities and vice versa — offering a unified experience where “exchange accounts are bound to on-chain addresses.”

However, for some CEXs, full user custody remains a guiding principle. Gate Web3 Wallet, for instance, emphasizes user-held private keys and asset sovereignty, differentiating it from traditional CEX custodial accounts. Still, its design is deeply embedded in the Gate CEX ecosystem, making it a textbook example of a CEX-led on-chain non-custodial approach — one that preserves the self-custody core while maximizing the scale and convenience advantages of the centralized exchange.

4.3 Case Study: Breaking Down the CEX Wallet Evolution Path with Gate Web3 as an Example

4.3.1 Strategic Positioning of Gate Web3: All-In-Web3

Gate Web3 Wallet is positioned as a key entry point for Gate’s core strategic initiative, All-In-Web3. The All-In-Web3 strategy, officially advanced by Gate in 2025, is a long-term plan aimed at deeply integrating the traditional advantages of centralized exchanges (such as user base, regulatory compliance, deep liquidity, and security expertise) with the decentralized potential of Web3, in order to build an open, scalable, and user-friendly fully on-chain ecosystem.

With Gate Web3 Wallet as the entry point, Gate is accelerating the construction of an integrated Web3 ecosystem, which includes: the high-performance Layer 2 network Gate Layer, providing low-cost infrastructure; the decentralized perpetual contract platform Gate Perp DEX, combining CEX performance with DeFi transparency; the no-code on-chain token launch platform Gate Fun, supporting rapid memecoin issuance; and Meme Go, enabling real-time cross-chain meme token trading and data analytics.

4.3.2 Product Design and User Perception

The product design of Gate Web3 Wallet revolves around the core principle of non-custody: users have full control over their private keys and assets, while the wallet is deeply integrated into the Gate CEX ecosystem, enabling seamless connection between CEX and Web3. The design focuses on balancing security, convenience, multi-chain compatibility, and user-friendliness. After its 2025 upgrade, the wallet further enhanced AI capabilities and adopted a modular feature layout. The core design principles and technical foundations of Gate Web3 Wallet include:

(1) Non-custodial architecture: Users hold complete control of their private keys; Gate has no access to or control over assets. This guarantees the sovereignty of “Not your keys, not your coins” and supports private key export, seed phrase backup, and hardware wallet connections (such as Ledger/Trezor), allowing users to independently manage recovery.

(2) Multi-platform and multi-chain support: Available on web, mobile app, and browser extension (Chrome), with synchronized access across all three. It supports over 100 public chains, including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Solana, Base, and other major EVM and non-EVM chains. Features include unified asset management, auto-recognition, and cross-chain transfers.

(3) Security protection model: The 2025 upgrade introduced hardware-level security combined with AI-powered defenses, including chip-level seed phrase protection, biometric authentication (fingerprint/face) + cloud-encrypted backup, and AI risk scanning for abnormal transaction alerts, smart contract audit prompts, phishing detection, and more.

(4) User-experience-driven interface and interaction: The onboarding flow is guided, with a simplified interface allowing users to complete initialization in just a few steps. It supports Gate account/email/Google login without requiring users to memorize seed phrases (while still offering full self-custody options).

(5) Seamless integration with the Gate ecosystem: One-click fund transfers between CEX accounts and the wallet (in both directions), shared KYC/compliance channels, and direct access to Gate Layer, Gate Perp DEX, Gate Fun, and Meme Go. The wallet supports connection to thousands of dApps and includes one-click risk marking for high-risk applications.

The product-level design of Gate Web3 Wallet represents a typical paradigm of CEX-led on-chain non-custodial evolution: grounded in non-custody, it achieves a balance of convenience without sacrificing user sovereignty through unified multi-end access, multi-chain compatibility, triple-layer security, AI empowerment, and deep integration with the CEX ecosystem.

4.3.3 Business Logic

Gate Web3 Wallet is not merely an accessory to the Gate ecosystem or a simple on-chain tool — it is positioned as the next growth engine. Its business logic is closely aligned with the overall revenue structure of the CEX platform. By extending user behavior from centralized trading to on-chain activity, the wallet enables multi-channel incremental monetization, prolongs user lifecycle, and improves asset retention. The core principle is: on-chain traffic is not lost, but converted into value that the platform can capture.

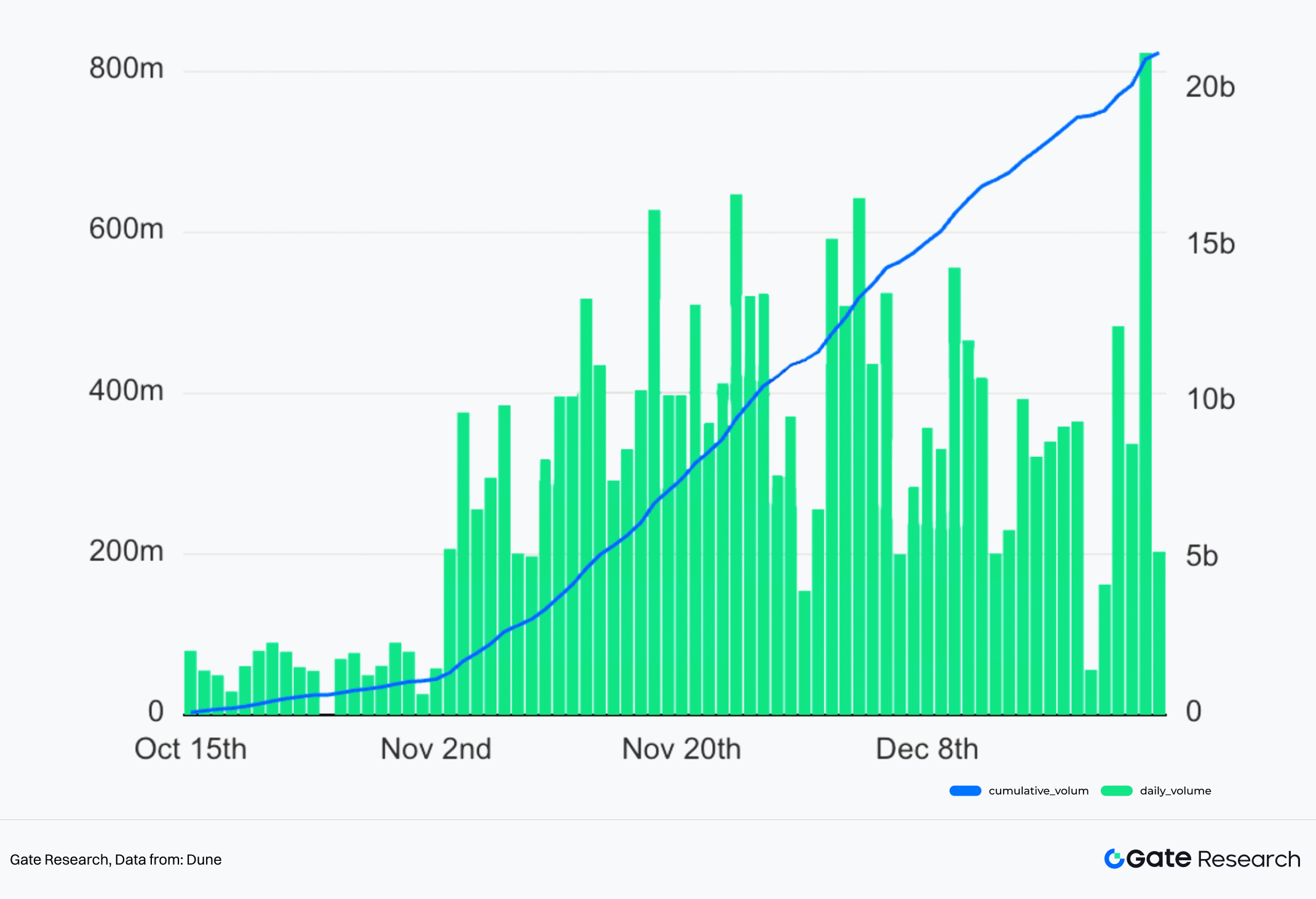

Gate Web3 Wallet captures on-chain transaction fee revenue directly through its built-in Swap, cross-chain bridge, and Perp DEX functionalities. Among these, Gate Perp DEX has seen the fastest growth and is expected to become a major revenue contributor to the overall CEX platform in the future. Since its launch at the end of September, Gate Perp DEX has surpassed $21 billion in cumulative trading volume in less than three months, reaching a new single-day high of over $800 million in trading volume on December 24.

Through Gate Web3 Wallet, users can quickly extend from their exchange accounts to full on-chain scenarios, keeping their assets within the Gate ecosystem while effectively prolonging their active lifecycle.

V. Future Outlook: The Next Phase of Wallet Competition

Wallets are not the endgame, but rather the starting point of a new round of competition in on-chain finance.

5.1 Key Dimensions of Competition

As wallets have completed their structural transition from tools to platforms, the next stage of competition will no longer focus on who offers more features, but rather on who can build sustainable moats across four key dimensions: transaction quality, UX abstraction, compliance and risk control, and intelligent execution — and consistently convert these capabilities into user retention and revenue.

(1) Transaction Depth

Wallet trading competition centers around three key areas: deeper accessible liquidity with composable depth across chains, protocols, and assets; stronger routing and execution mechanisms — smart order routing has become a baseline capability for aggregators, with growing use of intent-based execution to improve efficiency and MEV resistance; and more systematic MEV protection — evolving from “prompting users to increase slippage” to “default user protection,” such as through intent matching/solver competition, batch/atomic execution, etc., to reduce risks of sandwich attacks and frontrunning. Overall, competitive metrics are becoming more aligned with CEX standards (effective spread, slippage distribution, failure rate, execution time), with brand reputation built around delivering reliable execution outcomes.

(2) UX Abstraction Capability

The upper limit of wallet UX is not in the UI itself, but in abstracting away on-chain complexity so users don’t see it. Account abstraction (ERC-4337) may become a real differentiator — through programmable accounts, gas sponsorship, batch transactions, social recovery, etc., enabling productized experiences more suited for the mass market. This means consolidating fragmented interactions like gas payments, cross-chain operations, signature popups, approval management, and retry handling into a default flow that requires no explanation.

(3) Risk Control and Compliance

As wallets offer services such as trade aggregation, fiat on/off ramps, (semi-)custody, yield products, and derivatives access, they may be regarded as service providers under various legal jurisdictions — needing to meet corresponding compliance and consumer protection requirements. A wallet’s ability to manage compliance and risk may directly define how far it can scale. In the future, a wallet may no longer be just a department of a CEX, but increasingly resemble a regulated fintech company, with KYC/AML, transaction monitoring, blacklists, and risk alert systems becoming standard features.

(4) AI + Wallets

AI’s impact on wallets isn’t limited to generative customer support — it lies in its closer integration with trading and execution, forming an intent-driven paradigm. For example, if a user says they want an investment product with x% annual yield, AI can generate a customized DeFi strategy based on the user’s historical behavior, and upon user authorization, automatically execute these complex operations and manage their positions and holdings in a fully automated way.

5.2 Endgame Speculation for Wallets

(1) All-In-One Wallets vs. Vertical Wallets It is foreseeable that All-In-One will remain the mainstream evolution path for wallet products for quite some time, whether for non-custodial wallets or embedded CEX wallets. Wallets are continuously expanding their service boundaries across different chains and asset types, systematically tapping into monetization potential. As more feature modules are added, wallets no longer depend on a single narrative or short-term hype, but instead gradually develop comprehensive service capabilities that span multiple assets and protocols.

Correspondingly, there will be periodic opportunities for vertical wallets in specific niche domains. These wallets typically focus on a clearly defined vertical and offer highly specialized experiences based on deep understanding of asset standards, interaction models, and user needs. For example, UniSat, which focuses on Bitcoin-native assets like Ordinals inscriptions and Runes, was among the first to support these new asset types before mainstream wallets fully covered them — successfully attracting a cohort of highly active early users.

The advantage of vertical wallets often lies in the flexibility of their teams and product structures. Compared to larger mainstream wallets, small teams can integrate and iterate quickly in the early stages of new assets or standards, allowing them to serve unmet user demands first. This “first-mover—validate—accumulate” path has repeatedly occurred across multiple segments of crypto assets.

However, in the longer term, the advantages built by vertical wallets are not inherently defensible. As mainstream All-In-One wallets continue to accumulate in product completeness and tech stack maturity, their speed of identifying, evaluating, and integrating new assets is improving significantly. Once a mainstream wallet chooses to enter a niche that’s gaining traction, its large user base and mature distribution capabilities often amplify market awareness of that asset — in turn creating competitive pressure on vertical wallets. Thus, the timing of when a new asset gets adopted by mainstream wallets itself is becoming a critical variable in narrative diffusion and market structure formation.

(2) Wallets Replacing Some CEX Functions Historically, CEXs have held five core advantages over DEXs or wallets: fiat on/off ramp access; aggregation of multi-chain token trading and liquidity on a single platform; superior perpetual contract trading experience; large-scale customer support; and regulatory coverage. These have formed the core moat of CEXs. However, as wallet products continue to evolve, some of these advantages are gradually being eroded.

In terms of fiat on/off ramps, CEXs have traditionally been the sole entry point for most users into the crypto world. This dominance stemmed from their integration of banking channels, regulatory licenses, and localized operations. But with third-party fiat providers like MoonPay widely integrated into major wallets, fiat capabilities are becoming modular and embeddable. While CEXs still remain important fiat gateways, their monopoly over entry is weakening.

In terms of multi-chain trading and liquidity aggregation, CEXs were long the only platforms offering deep cross-chain liquidity in a unified interface. Now, DEX aggregators and wallet-integrated routing engines can already achieve similar cross-chain liquidity aggregation.

In perpetual contracts, CEXs have historically monopolized the high-leverage, sub-second execution, unified margin, and real-time risk control experience. However, on-chain derivatives protocols like Hyperliquid, using dedicated execution environments and on-chain matching mechanisms, have significantly narrowed the gap with CEXs in terms of trade ordering, latency, and user experience. At the same time, integrations like Builder Codes allow wallets to directly access Hyperliquid’s perp liquidity without building their own derivatives exchange — enabling users to open/close positions, adjust leverage, and monitor funding rates directly within the wallet, all while maintaining full non-custodial control.

In contrast, for customer support and regulatory protection, CEXs still hold clear advantages that are difficult to replicate in the short term. Most top exchanges offer 24/7 live support, robust ticket systems, and multi-language services — allowing them to respond rapidly to account issues, user errors, or system outages. Even a protocol as impactful as Hyperliquid has a core team of only a dozen people, a far cry from the thousands-strong global teams of major CEXs. Compliance also remains one of the strongest moats for CEXs. Through KYC/AML, regulatory licensing, proof of reserves, and insurance funds, CEXs are able to provide structured backstops during hacks, platform risks, or regulatory events.

In summary, the core advantages of CEXs have not disappeared in the short term, but their moats are undergoing structural change. Capabilities such as fiat ramps, liquidity aggregation, and some derivatives services are being unbundled into modular components and gradually migrating to wallets and on-chain infrastructure layers. This indicates the industry’s direction is not a simple wallet-versus-CEX zero-sum game, but rather a deeper functional reconfiguration: wallets are steadily taking over financial functionalities that can be productized, standardized, and made on-chain — becoming the default interface for users engaging with on-chain assets and high-frequency trading behavior.

At the same time, CEXs are responding to the erosion of their boundaries by embracing embedded wallets, on-chain trading strategies, and tighter ecosystem integration — extending their advantages in compliance, fiat access, and institutional services into the on-chain world. The key to future competition is not about who eliminates whom, but who can build a more stable combination across security, experience, liquidity, and compliance, and ultimately anchor user relationships and transaction flows within their own ecosystem over the long term.

VI. Reference

- bitcoindeveloper, https://developer.bitcoin.org

- Metamask, https://medium.com/@ JS_MetaMask/metamask-exceeds-1-million-monthly-active-users-9da72a1e915d

- Dune, https://dune.com/gateresearch/gate-perp-dex

- Dune, https://dune.com/domo/ordinals-marketplaces

- Flowscan, https://www.flowscan.xyz/builders?builder=all

- Dune, https://dune.com/hashed_official/pumpdotfun

- DeFiLlama, https://defillama.com/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

How to Do Your Own Research (DYOR)?

What Is Fundamental Analysis?

What Is Ethereum 2.0? Understanding The Merge

What Is a Cold Wallet?

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast