Plasma A High Performance Layer 1 for Stablecoins

What Is Plasma?

(Source: PlasmaFDN)

Plasma is a purpose-built, high-performance Layer 1 blockchain designed for stablecoin payments and settlements. It supports the Ethereum Virtual Machine (EVM) and incorporates the security strengths of Bitcoin sidechains. Its primary mission is to deliver a zero-fee stablecoin payments network with high throughput and swift clearing. This makes blockchain technology a practical solution for everyday transactions.

Technical Highlights

- PlasmaBFT Consensus

Plasma implements its proprietary PlasmaBFT protocol, an advanced variant of HotStuff. By streamlining consensus steps and enabling parallel processing, it delivers sub-second finality and processes over 2,000 transactions per second. - EVM Compatibility and Multi-Model Architecture

Leveraging the Reth client, Plasma fully supports Solidity smart contracts and seamlessly integrates with Ethereum tools like MetaMask and Hardhat. Additionally, it is compatible with Bitcoin’s UTXO model, allowing BTC to be used to pay transaction fees. - Native Bitcoin Bridge

Plasma includes a secure Bitcoin Bridge that anchors its on-chain state to the Bitcoin mainnet, maximizing safety and transparency. This blend offers both the decentralization of Bitcoin and the programmability of Ethereum. - Customizable Gas Model

Plasma provides fee-free stablecoin payment channels for USDT transfers and paid channels for time-sensitive transactions, providing flexible payment options for a range of user needs. - Privacy and Compliance

Plasma is developing a privacy module to obfuscate transaction data and selectively disclose details for regulatory compliance—balancing user privacy with legal requirements.

Use Cases

- Zero-Fee Payments: Users can send USDT with no fees on Plasma, ideal for everyday transactions and merchant settlements.

- Cross-Border Remittances: Due to its cost efficiency and high throughput, Plasma is particularly suited for regions facing currency instability or sanctions.

- Regulatory-Compliant Digital Finance: Enables banks and payment processors to quickly integrate stablecoin-based clearing.

- Merchant and Micropayments: Supports microtransactions and subscription business models; already in use by Yellow Card, Africa’s leading stablecoin infrastructure provider.

- Stablecoin DeFi: Plasma is actively engaging with projects such as Curve, Maker, and Aave to establish a diverse DeFi ecosystem.

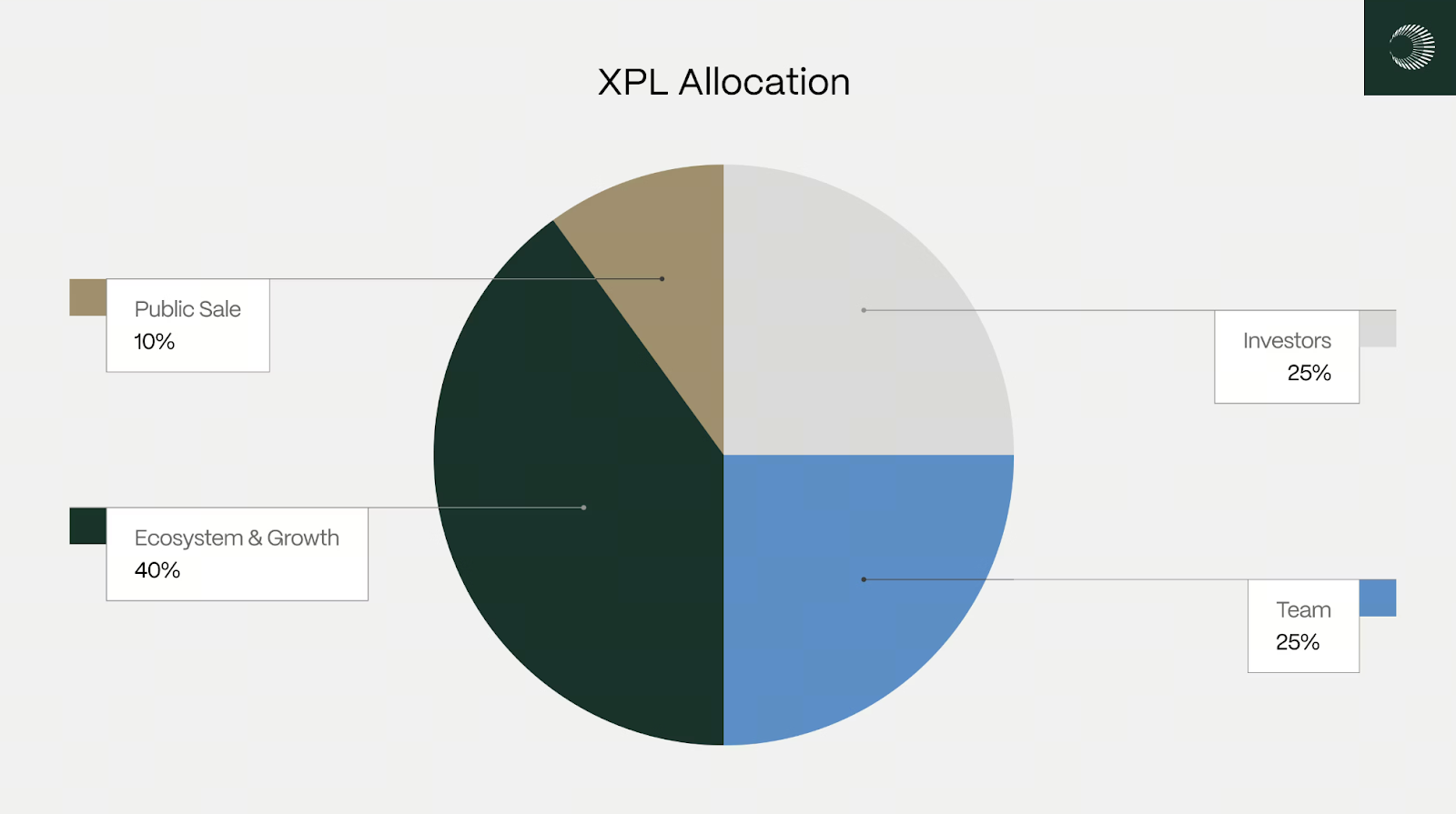

XPL Tokenomics

XPL launched with an initial supply of 10 billion tokens during the Mainnet Beta phase. Future token releases will be governed by mechanisms set by the validator network. The allocation breakdown is as follows:

1. Public Sale – 10%

10% of the total supply (1 billion XPL) goes to early adopters. The public sale extends the deposit campaign, encouraging community participation in Plasma’s growth.

- Non-U.S. participants: Tokens fully unlock with the Mainnet Beta launch.

- U.S. participants: Tokens are subject to a 12-month lockup, unlocking completely on July 28, 2026.

2. Ecosystem & Growth – 40%

To drive DeFi and traditional market integration, 40% (4 billion XPL) is allocated to ecosystem growth and expansion.

- 8% (800 million XPL) unlocks immediately at Mainnet Beta for DeFi incentives, liquidity support, exchange connections, and early promotions.

- The remaining 32% unlocks linearly each month over three years, supporting sustained ecosystem development.

3. Team – 25%

To attract and retain top talent, 25% (2.5 billion XPL) serves as long-term team incentives.

- One-third unlocks after a one-year vesting cliff.

- The balance is vested monthly over the following two years, with a total three-year vesting period.

4. Investors – 25%

Plasma’s infrastructure is backed by top-tier investors, including Founder’s Fund, Framework, and Bitfinex. Investors receive 25% (2.5 billion XPL) under the same vesting terms as the team for long-term alignment.

(Source: docs.plasma)

Token Utility and Value

XPL is both Plasma’s gas token and governance token. Holders can stake XPL to participate in network security and vote on protocol upgrades and fund allocation.

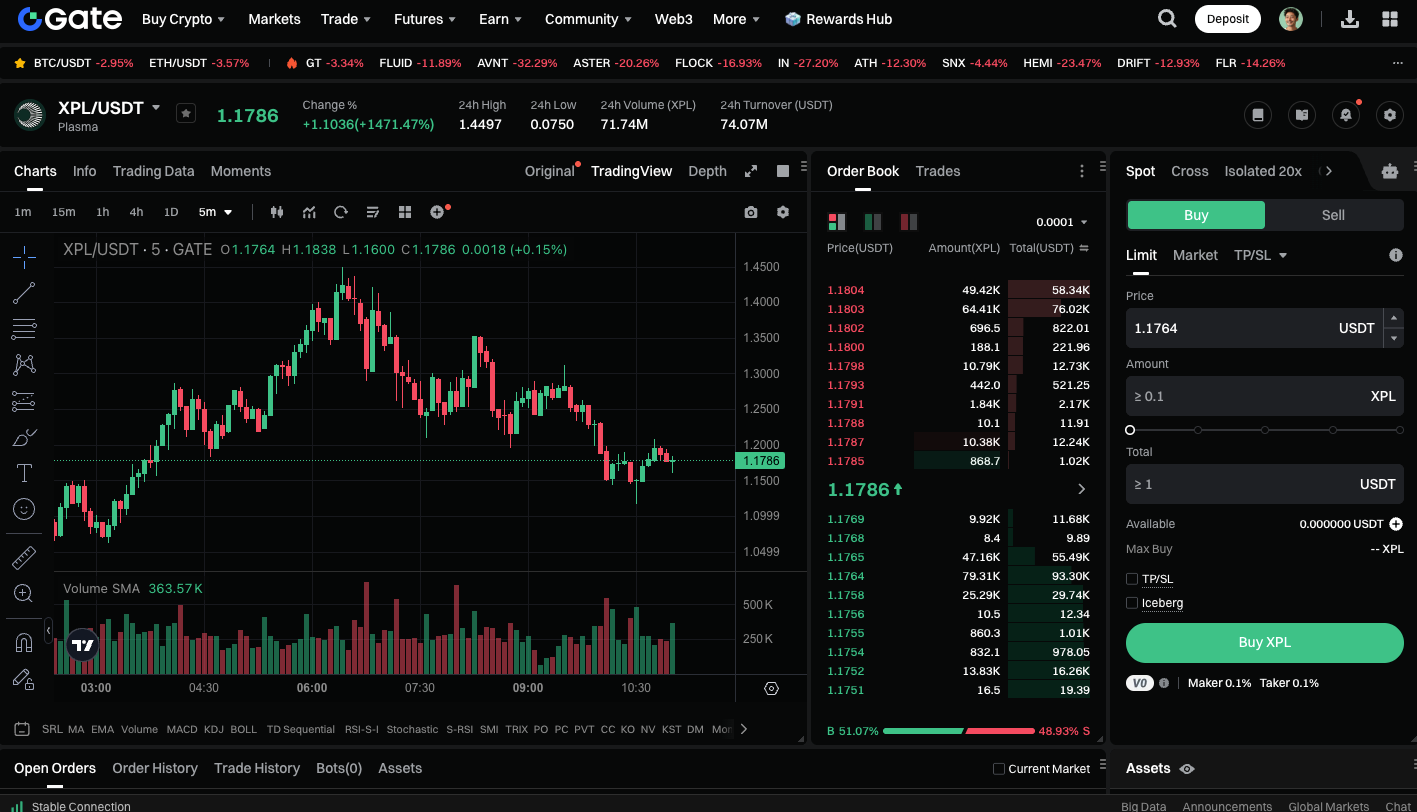

Start trading XPL spot instantly: https://www.gate.com/trade/XPL_USDT

Summary

Plasma stands out for its zero-fee stablecoin payments and Bitcoin-anchored security, establishing a unique position in the stablecoin-focused market. With a dedicated approach to stablecoin payments, a clear differentiated strategy, robust backing from Bitfinex and Founders Fund, and collaborations with projects like Ethena and Yellow Card, Plasma is rapidly expanding its ecosystem. As global demand for stablecoins accelerates, Plasma has the potential to become the foundational clearing infrastructure for stablecoin networks. Plasma’s ascent as a mainstream blockchain solution depends on its ability to achieve broad adoption and strong network effects.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks