Tokenization without Risk: 60 Days

Early-stage founders are often forced to commit significant personal and reputational capital before validating market demand. Traditional accelerators, venture funding, and token launches typically require early commitment with limited feedback loops.

60 Days introduces a trial-based approach.

Founders build publicly for 60 days while real users discover the product and capital accumulates through Automatic Capital Formation (ACF), token trading fees and an optional Growth Allocation.

At the end of the window, the founder decides whether to commit. If they commit, the token continues and funds raised unlock over time for further growth and development. If they don’t, the token winds down and all raised funds return to token holders.

The 60 Days framework is built on five core principles:

- Founder Sovereignty: Founders retain full control over whether to commit or walk away at the end of the 60-day window. Nothing unlocks automatically.

- Market Testing: Demand forms through real user behavior and voluntary support.

- Reversibility by Design: Every launch begins in a fully reversible state. Shutting down is an expected and legitimate outcome, not a failure condition.

- Credibility Preservation: If a project winds down, all raised funds return to supporters and the founder’s reputation remains intact. No permanent onchain stain.

- Aligned Risk and Reward: Supporters back real progress, not promises. Founders only access capital after choosing to commit. Upside and downside are shared transparently.

60 Days Launch Mechanism

Each participating founder enters a 60-day public build and test period.

During this period, founders are expected to:

- Build and ship product updates regularly

- Engage users and collect feedback

- Iterate, pivot and publish progress reports

- Maintain transparent metrics

- Participate in community reviews

At the end of Day 60, founders must declare one of two outcomes:

- Commit: Transitions into long-term development

- Not Commit: If the project winds down, all funds accumulated will be refunded.

Launch 60 Days

Tokenization

Projects can launch a public token using a standardized bonding curve. Tokens can be traded during the build and test period. Pricing adjusts dynamically based on demand. All 60 Days launches occur on the BASE network. Projects initially operate in private pools. Once cumulative volume reaches 42,000 VIRTUAL, liquidity migrates to a Uniswap V2 pool, enabling open market access.

Token holders are able to participate in project milestones and performances yet still be insulated through refund mechanisms if the founder does not commit.

Economic Model

The economic model of 60 Days is primarily designed to support long-term founder sustainability while aligning incentives with backers.

It consists of three core components:

- Trading Tax

- Automated Capital Formation (ACF)

- Growth Allocation (GA)

Founders are also supported during the 60 days, with a stipend obtained through these mechanisms.

Trading Tax

All token trades incur a 1% trading fee.

- 30% is allocated to the protocol

- 70% is allocated to the founder (Founder’s Trading Tax)

The founder’s share is locked during the trial period and released only after commitment.

If the founder does NOT COMMIT, this allocation is redirected to the refund pool.

This mechanism rewards founders who complete the program and discourages uncommitted launches.

Automated Capital Formation (ACF)

ACF is an automated funding mechanism that continuously allocates capital to founders based on market participation and trading activity.

- Released ACF funds contribute to operational runway, infrastructure, and early scaling.

- Unreleased ACF allocations remain locked and are excluded from refund calculations until formally released.

ACF enables founders to raise capital progressively without relying on traditional fundraising rounds.

More details about ACF can be found here.

Growth Allocation

Founders may optionally open a Growth Allocation (GA) pool funded from the sale of tokens from their team allocation (up to 5%). Participants deposit USDC in exchange for token allocations at a fixed publicised FDV decided by the founder(s).

GA funds are held in escrow until a commitment outcome and refunded in FULL if the founder does NOT COMMIT.

Growth Allocation Vesting Model

Funds from the Growth Allocation (GA) pool are subject to a mandatory vesting period of six months, if founder(s) commit. After commitment, Growth Allocation (GA) tokens are released linearly over the 6 months vesting period.

If a founder does NOT COMMIT, all GA funds are refunded and vesting is cancelled. This structure protects both founders and early supporters from short-term speculation.

Stipend

To support founders during the 60 days, founder are provided a stipend. After every 30 days (Day 30 and Day 60), founder(s) will obtain a stipend of either 10% of the presently collected funds (from trading tax revenue and released ACF) capped at a maximum of $5000 USDC.

Example:

Day 30 Calculation:

- Total collected funds from Founders trading tax revenue and any released ACF: $35,000 USDC

- 10% calculation: $35,000 × 0.10 = $3,500 USDC

- Cap check: $3,500 < $5,000 maximum

- Founder stipend paid: $3,500 USDC

Day 60 Calculation:

- Total collected funds from Founders trading tax revenue and any released ACF: $58,000 USDC

- 10% calculation: $58,000 × 0.10 = $5,800 USDC

- Cap check: $5,800 > $5,000 maximum

- Founder stipend paid: $5,000 USDC (capped)

End of 60 Days: Outcomes

Founder COMMITS at the end of Day 60

Founders may choose to commit at any time during the 60-day trial period. Early commitment is permitted once sufficient traction and validation have been achieved.

If a founder commits:

- Founder trading fee allocations are released immediately to Founder Wallet

- Released ACF funds are unlocked

- Growth Allocation (if any) vesting schedules begin

- Participants of the Growth Allocation obtain tokens

- Long-term infrastructure and distribution support is activated

- The project transitions into sustained development

Commitment signals that the founder is prepared to pursue longer-term execution and accountability.

Growth Allocation Distribution Mechanism

Allocations are distributed proportionally based on each participant’s contribution to the Growth Allocation Pool. If the pool is oversubscribed, allocations will be pro-rated and any unused USDC will be automatically refunded.

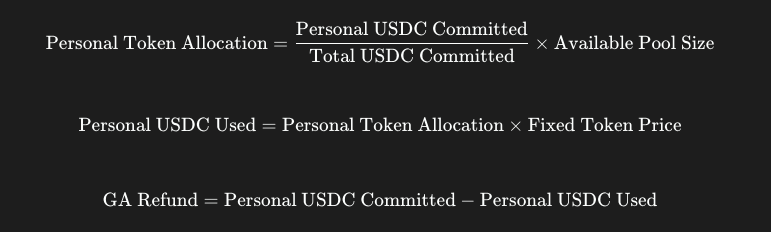

Pro-Rated Allocation Calculation

Each participant receives a proportional allocation based on their USDC contribution:

Example

Available Growth Allocation Pool: 50,000 tokens

GA Token Price: $0.20 USDC per token

Maximum Possible Raise: 50,000 × $0.20 = $10,000 USDC

Total USDC Committed by All Participants: $15,000 USDC

Example Participant Contributions

Alice

$5,000 USDC committed | 25,000 tokens requested at $0.20

Bob

$4,000 USDC committed | 20,000 tokens requested at $0.20

Carol

$3,500 USDC committed | 17,500 tokens requested at $0.20

Dave

$2,500 USDC committed | 12,500 tokens requested at $0.20

Total: $15,000 USDC | 75,000 tokens requested

Since participants requested 75,000 tokens but only 50,000 tokens are available, the pool is oversubscribed by 150% (75,000 ÷ 50,000).

All participants will receive tokens at the same fixed price of $0.20 USDC per token.

Example Pro-rated Individual Allocations

Alice:

Proportion: $5,000 ÷ $15,000 = 33.33%

Token Allocation: 50,000 × 0.3333 = 16,667 tokens

USDC Used: 16,667 × $0.20 = $3,333

Refund: $1,667 USDC

Bob:

Proportion: $4,000 ÷ $15,000 = 26.67%

Token Allocation: 50,000 × 0.2667 = 13,333 tokens

USDC Used: 13,333 × $0.20 = $2,667

Refund: $1,333 USDC

Carol:

Proportion: $3,500 ÷ $15,000 = 23.33%

Token Allocation: 50,000 × 0.2333 = 11,667 tokens

USDC Used: 11,667 × $0.20 = $2,333

Refund: $1,167 USDC

Dave:

Proportion: $2,500 ÷ $15,000 = 16.67%

Token Allocation: 50,000 × 0.1667 = 8,333 tokens

USDC Used: 8,333 × $0.20 = $1,667

Refund: $833 USDC

Founder does NOT COMMIT by the end of Day 60

- The trial period ends

- The liquidity pool is drained

- Token issuance is wound down

- Refund mechanisms are triggered

- Accumulated funds are distributed to eligible holders

In this case, the project is formally closed within the 60 Days framework, and no further capital is released.

Refund Mechanism

If a founder does not commit, remaining funds are distributed to eligible token holders from the accumulated fund pool.

The accumulated funds comes from three sources

Accumulated Funds=Released ACF Funds+Founder Trading Tax+Remaining $VIRTUAL in LP

Founder Trading Tax = 70% of the 1% Trading Fees Collected

How Refunds are Calculated

The total refund is made up of funds coming from two sources.

1. Refund from Released ACF Funds and Founder Trading Tax

This portion is calculated from released ACF funds and Founder Trading Tax (i.e. 70% of token trading fees collected). Your share is based on your proportion of eligible holdings:

Refund(Released ACF + Founder Trading Tax)=Your Token HoldingEligible Holdings×(Released ACF Funds+Founder Trading Tax)

2. Refund from Liquidity Pool ($VIRTUAL)

This portion is calculated from the remaining $VIRTUAL in the liquidity pool (LP). Your share is based on total eligible holdings, including Team Initial Buys:

Refund(LP $VIRTUAL)=Your Token HoldingEligible Holdings (including Team Initial Buy)×Remaining $VIRTUAL in LP

Eligible Holdings

Only the following balances are included in refund calculations:

- Tokens purchased through public launches

- Ecosystem airdrops that are held until snapshot

Excluded from Refunds

The following are excluded:

- Team reserved tokens

- Unreleased ACF allocations

- Tokens from Anti-Sniper tax buyback

Tokens obtained from Team Initial Buys are only eligible for refunds from the liquidity pool portion and DO NOT obtain refunds from ACF or trading fee refunds.

Important Notes

⚠️ Refunds are distributed proportionally based on relative ownership at the snapshot time.

⚠️ Because fund balances may change during the 60-day period, full refunds are not guaranteed.

⚠️ Please review project details and risks before participating.

Refunds are dependent on available funds and are not guaranteed to be full.

Lowering the Risk of Building in Public

For credible AI founders, launching a token has historically required disproportionate reputational exposure. The traditional model forces early, irreversible commitment before product-market validation is complete. Once launched, expectations harden, capital unlocks immediately, and reputational consequences persist regardless of outcome.

This dynamic deters serious builders.

60 Days is designed to materially lower that risk.

It creates a structured trial window where experimentation is expected, reversibility is embedded, and commitment remains voluntary. Founders can test distribution, validate demand, and iterate rapidly without permanently anchoring their reputation to an unfinished product. Capital accumulates transparently, but access to that capital remains conditional on an explicit decision to commit.

For high-caliber AI teams, whether building agent infrastructure, robotics systems, or coordination layers, this matters. It allows them to leverage crypto-native distribution and monetization without assuming irreversible downside at the earliest stage of research and product development.

Supporters, in turn, back observable progress rather than static promises. If conviction strengthens, projects transition into sustained development. If conviction weakens, funds return and reputational damage is minimized.

60 Days reframes tokenization from a one-way launch event into a reversible experimentation framework.

In doing so, it aligns capital formation with how serious AI innovation actually happens: iterative, public, accountable, and conditional.

aGDP.

Disclaimer:

- This article is reprinted from [virtuals_io]. All copyrights belong to the original author [virtuals_io]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets