2026 Top-10 Telegram Bot List: The Shift from Trading Tools to AI Agents

Core Infrastructure: TON's Sovereign Status

Recently, AlphaTON Capital Corp, the TON token treasury, signed a $46 million computing power agreement that will fund the decentralized AI network Cocoon AI. This marks a pivotal shift: Telegram Bots are evolving from basic "reply machines" into autonomous, agentic AI with independent reasoning capabilities.

By 2026, Telegram's active user base has surpassed one billion. Supported by the TON blockchain's settlement layer, the Telegram Bot ecosystem is transitioning from a "command-driven" to an "intent-driven" paradigm.

- Native Settlement Layer: Telegram Stars, Telegram's online points system, allows users to purchase digital goods and services. Deep integration with TON-based stablecoins (such as USDT-TON) has established it as the standard for in-bot purchases, tipping, and gaming expenditures.

- Seamless Web3 Access: With Telegram's built-in custodial wallet (Wallet) and non-custodial wallet (TON Space), 900 million users can use their accounts as wallets, eliminating mnemonic phrase barriers entirely.

- TMA (Telegram Mini Apps): Users can now access decentralized exchanges (DEX), lending protocols, and NFT marketplace tools in the Mini App store. These apps offer smooth, integrated mini-program experiences and support one-click transaction signing.

2026 Top 10 Crypto Trading Bots

Based on type, automation level, trading win rate, and TON ecosystem compatibility, we've identified the most noteworthy crypto bots for 2026:

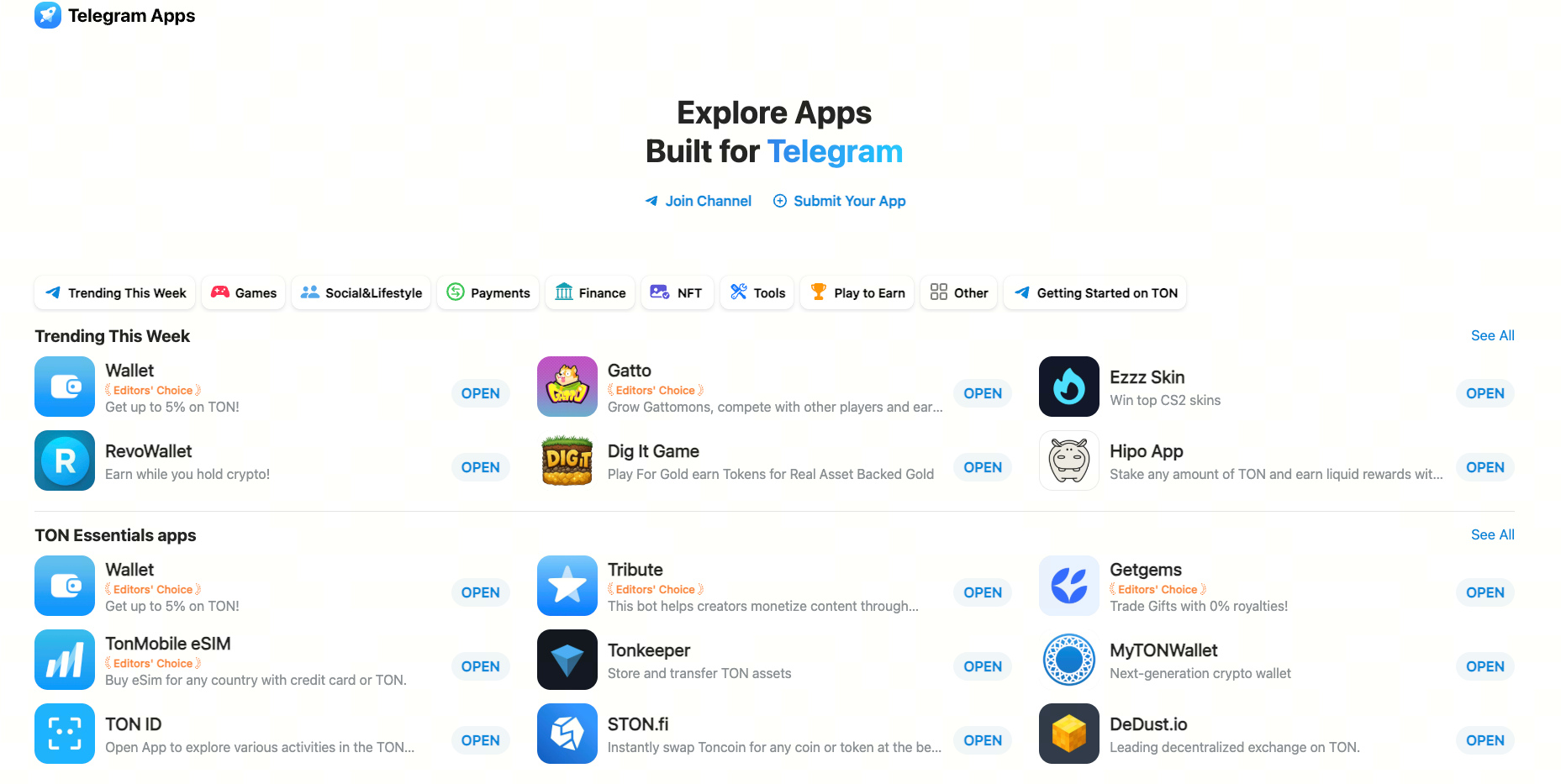

Screenshot source: Telegram Apps website Tapps Center

STON.fi Bot: A decentralized exchange (DEX) platform, currently the most liquid trading gateway in the TON ecosystem, supporting ultra-low slippage swaps and serving 940,000 subscribers.

3Commas / Cryptohopper: Delivers AI-driven grid and DCA strategies for cross-exchange asset management.

Wolf of Trading: With more than 156,000 subscribers, this bot is known for high-frequency, high-quality free technical analysis.

TradeWiz AI: Automates monitoring of token launches and integrates Web3 APIs for real-time governance alerts.

CoinTrendzBot: Tracks on-chain trending tokens, social media sentiment, and large transfer alerts.

Fragment Bot: Enables secure trading of Telegram numbers and premium usernames.

Raven Signals Pro: Provides daily curated AI research reports with advanced risk management tools, serving roughly 140,000 subscribers.

Notcoin / GameFi Bots: An evolved Tap-to-Earn model that distributes TON ecosystem rewards via a task system, remaining a leading TON project.

Hipo App: The TON ecosystem's gateway for one-click staking and liquidity mining, supporting crypto asset staking.

Banana Bot: Profits by earning trading fees, distinguished by its speed, low cost, and high stability.

Telegram Bot: The Leap from "Tool" to Agentic AI

Since 2024, Telegram Mini Apps have seen significant fluctuations in development. With a user base of one billion, bots must keep pace with rapid advances in agentic AI. According to official documentation, STON.fi, which now has 940,000 subscribers, supports users in leveraging tools such as Claude Code, GitHub Copilot, and Cursor Agent for liquidity configuration.

As a result, bots that meet user needs are no longer limited to text-based interactions—they now include tools providing "visual web applications." Key trends include:

Autonomy: Agents no longer wait passively for /buy commands. Instead, based on user-set risk preferences (such as "maximum drawdown 5%"), AI scans on-chain pools continuously and executes at optimal times.

Adaptive Position Control: After Qwen3 Max demonstrated aggressive strategies in the Hyperliquid sector in early November 2025, trading bots began exploring dynamic position adjustments based on win rates. For example, when the AI model predicts a win rate over 70%, it automatically shifts from a 1% light position to a 5% aggressive position.

Multi-Step Planning: In the future, agentic bots in Telegram will support multi-step logic, including automatically identifying social media trends, summarizing research reports, executing cross-chain flash loans, and triggering take-profit actions.

Summary: Telegram Bots Will Move Beyond Crypto

2026 marks a milestone for true infrastructure-level integration of AI and cryptocurrency.

Following AlphaTON's $46 million computing power agreement in early January and the subsequent announcement on January 16 of an additional $15 million raised via common stock registration for Cocoon AI's GPU deployment, substantial capital will further unlock AI computing capacity across the Telegram ecosystem. Bots, as a key commercial component, will undergo a fundamental transformation from simple scripts into autonomous intelligent agents.

Further Reading:

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

What Is Fundamental Analysis?