What is Levva Protocol Token (LVVA)?

Preface

In the DeFi world, the complexity of yield farming and asset security issues have long hindered mainstream adoption. According to DefiLlama data, in 2025, the total value locked (TVL) in DeFi surpassed $500 billion, yet over 70% of the capital remains concentrated in the hands of institutions and professional players. Levva Protocol (formerly Open Custody Protocol) was created to address this by leveraging two major innovations—“AI Investment Manager” and “Keychain Aggregation”—to reduce DeFi barriers to zero.

What is Levva Protocol?

Levva Protocol is an AI-powered portfolio manager platform specifically designed for the DeFi world. Its goal is to enable investors, whether beginners or professionals, to manage their crypto assets simply, securely, and efficiently—without needing to understand smart contracts—while safely earning yields.

The standout feature of Levva Protocol is its AI assistant (AI Copilot), which crafts optimal strategies tailored to users’ investment goals and automates yield optimization tasks such as rebalancing, strategy adjustments, and risk control. Users no longer need to deeply understand complex liquidity mining, staking mechanisms, or manually switch between platforms. Levva Protocol handles these operations in the background, ensuring assets are optimally allocated across major DeFi protocols.

Core Technologies of Levva Protocol

Modular Permissionless Custody Protocol

Building on the foundation of Open Custody Protocol, Levva Protocol establishes a relay mechanism to seamlessly connect different DApps to its custody system. This protocol architecture not only supports mainstream DeFi protocols but also features high scalability and modularity, allowing developers to quickly integrate and deploy new functional modules.

Keychain Aggregation Technology

Key management has long been a pain point in DeFi. Levva Protocol’s “Keychain Aggregation” protocol functions like a decentralized mesh key management network, enabling users to uniformly use and manage private keys across different protocols. This eliminates the hassle of switching between multiple addresses and private keys, significantly improving user experience and security.

Automated Strategy Execution

The AI Copilot sets personalized portfolio allocations based on users’ risk preferences and return targets, continuously learning from market changes to make adjustments. Whether users are conservative, growth-oriented, or high-risk-high-reward investors, Levva Protocol offers suitable strategy models.

Why Have Over 350,000 Users Chosen Levva Protocol?

1. One-Click Replication of Wall Street Strategies

Levva Protocol has partnered with Jump Trading and Alameda Research to launch an “Institutional Strategy Vault,” allowing retail investors to replicate elite funds’ 20%+ annualized yield models with a minimum stake of $100 in LVVA tokens.

2. Anti-MEV Protection

In collaboration with Flashbots, Levva Protocol’s AI engine detects and bypasses “sandwich attacks.” Tests show this improves user yields by an average of 12%.

3. Compliant Custody Bridging

Institutional users can directly link their Fireblocks custody accounts to Levva Protocol, complying with SEC and MiCA regulations without needing to transfer assets to participate in DeFi.

Levva Protocol’s Tokenomics

LVVA Token Allocation and Usage Mechanism

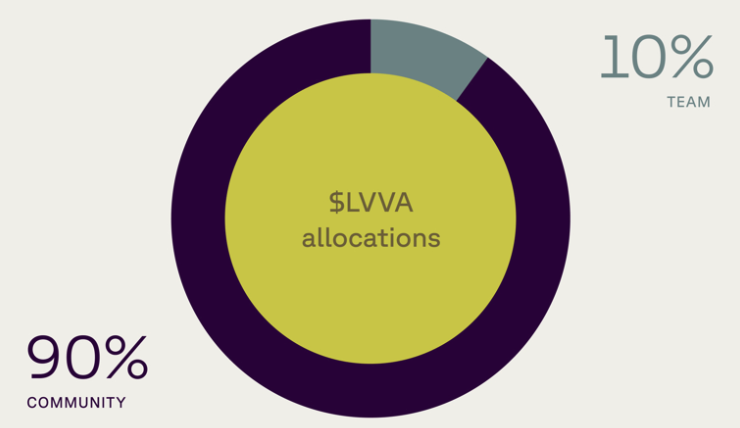

The LVVA token distribution is designed to promote ecosystem stability and growth, with a maximum supply of 2,000,000,000 (2 billion) LVVA tokens. The current total supply is 1,250,000,000 LVVA tokens, allocated as follows:

Token Partnerships (80%): The largest allocation, primarily for collaborations with existing projects and providing liquidity to centralized exchanges (CEXs). Unclaimed funds will be reallocated to the treasury and team quotas.

Community Allocation (5%): Incentivizes Spark yield farmers and key opinion leaders (KOLs) to boost community engagement.

Public Sale (5%): Reserved for public token sales, allowing general users to participate in the initial offering.

Treasury (5%): Funds project operations and expenditures to ensure sustained development.

Team (2.5%): Team allocation unlocks over 12 months, with a total release period of 24 months. The maximum team allocation is capped at 18% of total supply.

Early Adopters (2.5%): Rewards early contributors who supported the project in its initial stages.

Incentives and Inflation Mechanism

A total of 750,000,000 LVVA tokens will be released over the next five years, following this schedule:

Year 1: 375,000,000 LVVA (18.75% of total supply).

Year 2: 187,500,000 LVVA (cumulative 28.13%).

Year 3: 93,750,000 LVVA (cumulative 32.81%).

Year 4: 46,875,000 LVVA (cumulative 35.16%).

Year 5: 46,875,000 LVVA (final cumulative 37.5%).

Token issuance follows an annual halving model, with weekly releases as follows:

Year 1: ~7,211,538.46 LVVA/week

Year 2: ~3,605,769.23 LVVA/week

Year 3: ~1,802,884.62 LVVA/week

Year 4: ~901,442.31 LVVA/week

Year 5: ~901,442.31 LVVA/week

This design balances early user incentives with long-term scarcity control, creating a stable and sustainable token economy with potential long-term value for ecosystem participants and investors.

(Incentive Measures Distribution Plan - Source: docs.levva.fi)

(Incentives for Growth - Source: docs.levva.fi)

Token Utility

Governance: Holders can participate in protocol decisions, including strategy listings and fee structure adjustments.

Staking: Users can stake LVVA for additional rewards or reduced platform fees.

Incentives: Users earn LVVA for interactions, strategy sharing, or providing liquidity.

Utility: LVVA can be used to pay platform fees or unlock advanced AI features.

Start LVVA Spot Trading: https://www.Gate.com/trade/LVVA_USDT

Differences from Traditional DeFi Tools

Compared to existing DeFi aggregators like Yearn and Beefy, Levva Protocol stands out by:

Integrating AI for self-adjusting strategies and risk analysis.

Adopting a modular protocol for developer and integrator friendliness.

Solving key fragmentation issues to enhance multi-protocol interoperability.

Prioritizing a simple, intuitive interface to minimize entry barriers.

These features make Levva not just an asset management tool but a comprehensive smart investment infrastructure.

Conclusion

Levva Protocol represents a major leap forward in DeFi and could be a pivotal step toward Web3.0 financial freedom. Its ambition goes beyond yield optimization—it aims to redefine asset control, allowing users to maintain sovereignty through key aggregation while benefiting from AI automation. For retail investors, it’s a historic opportunity to escape complex code and security anxieties. For institutions, it’s the key bridge to compliant DeFi participation.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?