What is ARB Coin?

What Is Arbitrum?

Arbitrum is a Layer 2 scaling network built on top of Ethereum, designed to increase throughput and reduce transaction costs while preserving Ethereum’s security. It leverages an "Optimistic Rollup" approach, meaning transactions are assumed valid by default and only challenged if someone disputes them, at which point a "fraud proof" is used to resolve discrepancies. The associated token, ARB, functions as a governance token for participating in proposals and voting within the ArbitrumDAO. It is not used for paying on-chain gas fees.

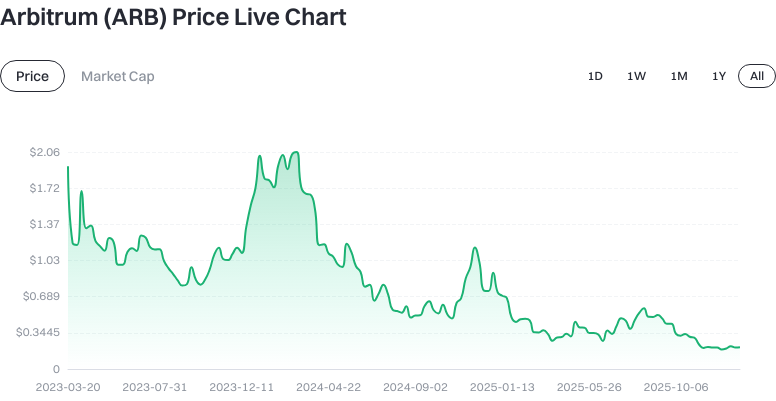

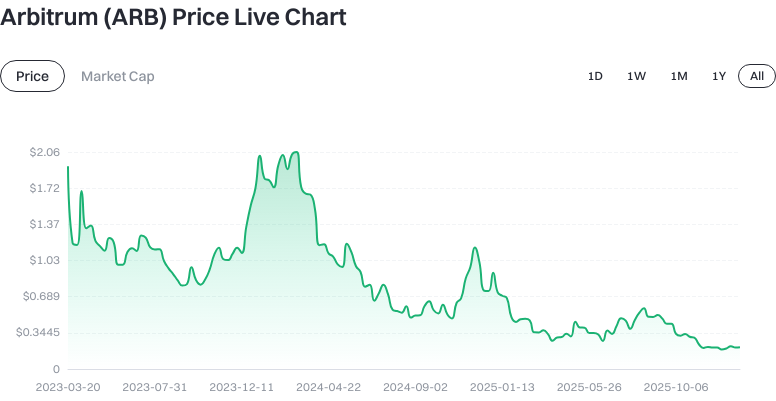

Current Price, Market Cap, and Circulating Supply of Arbitrum (ARB)

As of January 16, 2026 (Source: provided data), ARB is priced at $0.207100; its circulating supply stands at 5,719,286,371 tokens; the circulating market cap is $2,071,000,000; fully diluted market cap is also $2,071,000,000; both total and maximum supply are capped at 10,000,000,000 tokens; the market cap dominance is approximately 0.061%.

View ARB USDT Price

During the same period, ARB’s price changes were: -0.29% over 1 hour, -2.63% over 24 hours, -1.05% over 7 days, and +4.22% over 30 days. The 24-hour trading volume was approximately $1,786,912.52.

Circulating market cap is calculated as “price × circulating supply”; fully diluted market cap is “price × maximum supply.” These metrics estimate potential valuation but actual performance depends on token unlock schedules and market demand.

Who Created Arbitrum (ARB) and When?

Arbitrum was initiated by the Offchain Labs team, whose core members have backgrounds in academia and engineering. The Arbitrum One mainnet was opened to developers in 2021; in 2022, it upgraded to the Nitro architecture for better compatibility and performance. The governance token ARB launched via an airdrop to early users around March 22–23, 2023, marking the start of ArbitrumDAO. The community now governs protocol parameters and treasury allocation through governance proposals. (Sources: Arbitrum Docs and Offchain Labs public info, as of January 16, 2026)

How Does Arbitrum (ARB) Work?

Arbitrum operates using the Optimistic Rollup mechanism:

- Transactions are first submitted to Layer 2 sequencers for batching and execution. Compressed data and state roots are then regularly posted to Ethereum mainnet to guarantee data availability and finality.

- If any participant suspects incorrect state submissions, they can initiate a fraud proof during the challenge window. The system verifies correctness by comparing execution steps, ensuring security.

- Fees are paid in ETH. Developers can deploy Ethereum-compatible smart contracts directly on Arbitrum; users benefit from lower costs and faster confirmations similar to Ethereum.

Relevant terminology: Layer 2 refers to scaling layers built atop the main chain; Rollup denotes aggregating multiple transactions before posting essential data on-chain; “Optimistic” means transactions are assumed valid unless disputed; fraud proofs provide an “after-the-fact” correction mechanism for security.

What Can You Do With Arbitrum (ARB)?

On the network level, users can access decentralized trading, lending, NFT, blockchain gaming, and other Web3 applications on Arbitrum with lower fees and faster confirmations. As a token, ARB enables governance:

- Vote on ecosystem incentives and treasury grants to decide funding support for developers and the protocol.

- Participate in decisions on protocol upgrades and parameter adjustments, influencing the network’s future direction. Note: Gas for transfers and contract interactions is settled in ETH; ARB’s primary role is governance—it does not serve as gas or staking collateral.

Major Risks and Regulatory Considerations for Arbitrum (ARB)

- Market Volatility: Crypto asset prices are highly volatile; short-term price swings may exceed expectations.

- Governance & Unlock Risk: Governance proposals can alter incentives and treasury distribution; future unlocks may increase circulating supply and impact prices.

- Smart Contract & Bridge Risk: Vulnerabilities may exist in smart contracts; cross-chain bridges and withdrawal delays introduce operational and counterparty risk.

- Operational & Centralization Risk: Progress toward decentralizing sequencers and fault proofs affects security and censorship resistance.

- Regulatory Uncertainty: Token classification and compliance requirements vary by jurisdiction—be mindful of local obligations such as KYC, reporting, or taxation.

- Account Security: Both exchanges and self-custody have risks; enable two-factor authentication and securely back up seed phrases/private keys.

What Is the Long-Term Value Proposition of Arbitrum (ARB)?

ARB’s value lies mainly in governance rights and resource allocation authority. The more robust the ecosystem becomes, the more important governance over incentives, protocol upgrades, and treasury management grows. Since gas fees are paid in ETH, ARB does not directly capture transaction revenue; its potential value depends on network adoption, governance influence, treasury effectiveness, and system design. Historically, Arbitrum has been a leading Layer 2 solution in the Ethereum ecosystem—its developer activity and community engagement are widely tracked (see L2Beat and ecosystem stats as of 2024). Looking ahead, key factors include technical advancements (like trustless fault proofs), developer/user growth, governance transparency, and efficient resource use.

How to Buy and Safely Store Arbitrum (ARB) on Gate

Step 1: Register an account at gate.com via browser. Complete email or phone verification and follow prompts for KYC to unlock higher limits and features.

Step 2: Fund your account. Use “Buy Crypto” for fiat purchases of USDT or deposit USDT/ETH from another wallet to Gate. Check your balance under “Funds.”

Step 3: Search for “ARB” under “Spot Trading,” select a trading pair such as ARB/USDT, and view order book or price charts in the trading interface.

Step 4: Place your order. Limit orders let you set your ideal price; market orders prioritize speed. Confirm quantity and price before submitting—after execution, check your ARB holdings under “Assets.”

Step 5: Secure storage. For long-term holding or self-custody, withdraw ARB to a wallet supporting the Arbitrum network (such as a browser extension wallet). Add the Arbitrum network and ARB contract in your wallet, copy your receive address, paste it into Gate’s withdrawal page (select correct network), test with a small amount first before larger transfers.

Step 6: Risk management & backup. Enable two-factor authentication and withdrawal whitelist; cold backup your seed phrases/private keys—never screenshot or store online; beware of phishing sites or fake airdrop links.

How Does Arbitrum (ARB) Compare to Optimism?

- Technical Approach: Both are Optimistic Rollups leveraging Ethereum’s security guarantees. Arbitrum excels in compatibility and execution efficiency with interactive multi-round fraud proofs historically; Optimism focuses on protocol simplification and funding public goods. Both aim for advanced fault proof systems and decentralized sequencer models.

- Tokenomics: ARB (Arbitrum) and OP (Optimism) are governance tokens—gas fees are paid in ETH. Their value derives from governance power and resource allocation within their ecosystems rather than direct transaction fee sharing.

- Ecosystem & Governance: Both have vibrant ecosystems with incentive programs—differences lie in governance processes, treasury size, and allocation strategies. Choosing between them depends more on application focus, governance culture, and technical roadmap rather than single metrics.

Overall, both networks drive Ethereum scalability forward—their competition fosters improvements in technology and governance.

Summary on Arbitrum (ARB)

Arbitrum is positioned as a Layer 2 scaling solution for Ethereum that uses Optimistic Rollup technology to deliver faster transactions at lower cost without sacrificing security. ARB is its governance token—used primarily for voting within ArbitrumDAO on proposals and resource allocation rather than gas payments. As of January 16, 2026 data shows clear supply limits and active trading; long-term value depends on adoption rates, technical progress, and quality of governance. Beginners should first understand the difference between Layer 2 networks and governance tokens; purchase ARB compliantly on Gate following step-by-step procedures; prioritize account security and backup of private keys. Pay attention to unlock schedules, governance proposals, and ecosystem growth—make decisions gradually with thorough information.

FAQ

What Is the Relationship Between ARB Token and the Arbitrum Blockchain?

The ARB token is the native governance token of the Arbitrum blockchain—a Layer 2 scaling solution for Ethereum. As a governance token, ARB holders participate in community decision-making. In short, ARB serves as both an "entry pass" to the ecosystem and proof of governance rights.

Why Hold ARB Token?

Holding ARB delivers two key benefits: gaining governance power to influence major protocol decisions; enabling access to ecosystem applications—many DeFi projects on Arbitrum offer benefits or airdrops for ARB holders. Additionally, ARB’s value is closely tied to adoption rates and development prospects within the Arbitrum ecosystem.

What Is ARB’s Total Supply? Is There Inflation?

ARB has a capped total supply of 10 billion tokens—allocated among initial airdrop recipients, team incentives, and ecosystem development. It follows a scheduled release mechanism with low initial circulation that increases over time. Investors should monitor token unlocks as well as community votes that may adjust inflation policies.

How Can Beginners Evaluate Whether ARB Is Worth Investing In?

Assess ARB’s value through three lenses: ecosystem development (quality DeFi apps and daily activity), technical advantages (Layer 2 scalability’s impact on Ethereum), market position (rank among Layer 2 tokens and holder distribution). Match this research with your own risk tolerance—use trusted platforms like Gate to conduct due diligence before deciding.

How Do You Buy ARB on Exchanges? What Should You Watch Out For?

On Gate you can search for ARB to trade spot or derivatives. New users should start with small spot trades to avoid leverage risks. After purchase you may transfer tokens to a hardware wallet for self-custody or participate in Gate’s financial products—always be vigilant about platform security, private key storage, and market volatility.

Key Terms Related to Arbitrum (ARB)

- Layer 2 (L2): An expansion solution built atop Ethereum that reduces transaction costs and increases speed via off-chain computation.

- Optimistic Rollup: The scaling technology used by Arbitrum—transactions are presumed valid unless challenged by fraud proofs.

- Gas Fees: Transaction costs for executing trades or smart contracts on Arbitrum—significantly lower than Ethereum mainnet.

- Smart Contract: Self-executing programs deployed on Arbitrum supporting DeFi, NFTs, etc.

- Cross-Chain Bridge: Mechanisms for transferring assets between Ethereum mainnet and Arbitrum—enabling interoperability between chains.

- Governance Token: ARB holders participate in ecosystem decision-making through voting rights.

References & Further Reading on Arbitrum (ARB)

-

Official Site / Whitepaper:

-

Developer Resources / Documentation:

-

Authoritative Media / Research:

Related Articles

Exploration of the Layer2 Solution: zkLink

What is Plume Network