What is Luna Coin?

What Is Terra?

Terra is a blockchain-based payment protocol built around stablecoins, designed to deliver settlement and cross-border transactions with a user experience similar to traditional fiat currencies. Stablecoins are cryptocurrencies pegged to fiat currencies like the US dollar, aiming to maintain price stability. LUNA is Terra’s native token, powering the protocol’s stability mechanisms, covering on-chain transaction fees, and enabling participation in governance proposals and voting.

From a user perspective, merchants and applications can accept Terra stablecoins for faster settlement and lower fees. LUNA holders can engage in network governance, while developers can integrate stable payment functionality into their DApps.

Terra (LUNA): Current Price, Market Cap, and Supply

As of 2026-01-14, according to the provided data: the latest price of LUNA is $0.092120; circulating supply is 687,660,230.000000 LUNA; total supply is 1,078,518,456.257780 LUNA; max supply is ∞ LUNA; circulating market cap is $99,353,120.190467; fully diluted market cap is $99,353,120.190467; market cap dominance is 0.002900%; 1-hour price change is -0.620000%; 24-hour price change is 3.710000%; 7-day price change is -3.540000%; 30-day price change is -40.770000%; and 24-hour trading volume is $259,738.826144.

Click to view LUNA’s latest price data

The data field “Active: No” may refer to collection or maintenance status—please refer to official sources for confirmation.

Market cap is calculated as price times circulating supply and is used to gauge relative size. Fully diluted market cap estimates potential valuation based on total or maximum supply. Price changes reflect performance across different time frames. Trading volume indicates the total value exchanged within a given period. A max supply of “∞” usually means there’s no hard cap, but as the input states “Is unlimited supply: No”, it suggests there may be dynamic parameters or governance adjustments at the protocol level; refer to official documentation and on-chain data for specifics.

Who Founded Terra (LUNA) and When?

Terra was initiated by Daniel Shin and Do Kwon in 2018, with the goal of advancing global payments and settlements using stablecoins pegged to fiat currencies. According to input data, LUNA launched on 2022-05-27, marking a period of rebuilding and iteration following major events in the ecosystem.

Historically, the Terra ecosystem has undergone significant changes—including community and technical splits—and stablecoin and mainnet positioning have also evolved. For the current state, always reference official announcements and on-chain parameters to avoid conflating legacy mechanisms with new versions.

How Does Terra (LUNA) Work?

Terra’s design centers on stablecoin payments: stablecoins aim for price stability by being pegged to fiat currencies, making them suitable for everyday settlement. LUNA plays two critical roles: first, it supports the stability mechanism by being minted, burned, or otherwise managed to help maintain the peg during price deviations; second, it serves as the governance token for submitting and voting on network proposals that determine parameter changes and ecosystem direction.

At the protocol level, the network is maintained by validators. Transactions require network fees (gas), and LUNA holders can stake tokens to secure the network and earn on-chain rewards. Governance proposals typically cover economic parameters, system upgrades, and use of community funds, with decisions made through token-holder voting.

What Are the Use Cases for Terra (LUNA)?

Terra stablecoins can be used for e-commerce, cross-border payments, and on-chain settlements—offering merchants and users lower fees and faster transactions. LUNA is used to pay transaction fees, participate in governance proposals and voting, and can be staked to help secure the network.

For developers, Terra’s stable payment infrastructure can be embedded in wallets, merchant payment tools, or DeFi applications. For example, cross-border merchants can price goods and settle payments in stablecoins to avoid delays and fees typical of traditional channels; users can send remittances via mobile wallets without complex intermediaries.

What Are the Main Risks and Regulatory Considerations for Terra (LUNA)?

Risks associated with stablecoins include depegging—where the asset’s value drifts from its target—and potential volatility due to algorithmic or design flaws under extreme market conditions. Governance risks involve low participation in proposals or voting, centralized decision-making, or execution errors. Technical risks include smart contract vulnerabilities, cross-chain bridge security concerns, or validator node attacks.

From a regulatory perspective, countries impose different compliance requirements regarding stablecoin issuance, reserve transparency, and payment usage. Users and developers must adhere to local laws and disclosure standards. Using exchanges involves custodial risks—enable two-factor authentication (2FA) and withdrawal whitelists for added security; self-custody introduces risks of losing private keys or seed phrases—ensure secure offline backups.

What Is the Long-Term Value Proposition of Terra (LUNA)?

Terra’s long-term value depends on real-world adoption of its stablecoins, penetration of payment applications, developer activity within its ecosystem, and quality of governance. If more merchants and applications adopt stable payments, LUNA’s role in covering fees, governance, and economic adjustments becomes increasingly significant.

The token’s value is also influenced by its mint-and-burn mechanism, staking rewards, network fee cycles, transparent reserves and risk management practices, robust technology upgrades, and compliance trajectory—all foundational for trust and adoption. Investors should combine value assessment with risk management by monitoring actual ecosystem usage metrics and governance progress.

How to Buy and Safely Store Terra (LUNA) on Gate

Step 1: Register an account at Gate (gate.com) and complete KYC verification—a process that enhances account security and regulatory compliance.

Step 2: Deposit or purchase USDT. You can use fiat onramps or deposit digital assets into your Gate account; ensure funds have arrived before trading.

Step 3: Search for “LUNA” and choose a spot trading pair (e.g., LUNA/USDT). Place a market order (executes at current price) or limit order (executes at your set price).

Step 4: Set up risk controls—enable two-factor authentication (2FA), withdrawal whitelists, and anti-phishing login codes to reduce theft risk.

Step 5: Withdraw your assets to a personal wallet for safekeeping. Wallets are either custodial or non-custodial. With non-custodial wallets you control your private keys and seed phrase—encrypt backups offline and store securely. Double-check network and address before withdrawing; test with a small amount first.

Step 6: Ongoing management—track your purchase cost and withdrawal transaction hashes; regularly audit wallet security. If you participate in staking or governance, understand lock-up periods and on-chain operations.

What Is the Difference Between Terra (LUNA) and TerraClassic (LUNC)?

Though they share a common origin, their paths diverged. Terra (LUNA) represents the current mainnet and token symbol—focused on stable payments and ecosystem rebuilding—while TerraClassic (LUNC) continues the legacy chain with different economic parameters, supply structures, and community governance models.

On exchanges and block explorers, “LUNA” refers to the new chain while “LUNC” identifies TerraClassic; contract addresses and network environments also differ. Always confirm symbols and networks before trading or withdrawing assets to prevent cross-chain errors or losses.

Summary of Terra (LUNA)

Terra positions itself as a stablecoin-driven payment protocol with LUNA at its core—supporting stability mechanisms, transaction fees, and governance functions. Current market data shows both scale and volatility; long-term value hinges on stablecoin adoption rates, ecosystem activity levels, and governance quality. For investors: use Gate for compliant deposits and risk controls; prioritize private key management and network verification for asset custody; research transparency of mechanisms, supply/economic cycles, regulatory developments, and developer ecosystem growth. Maintain a prudent and diversified allocation while continuously monitoring official announcements and on-chain updates.

FAQ

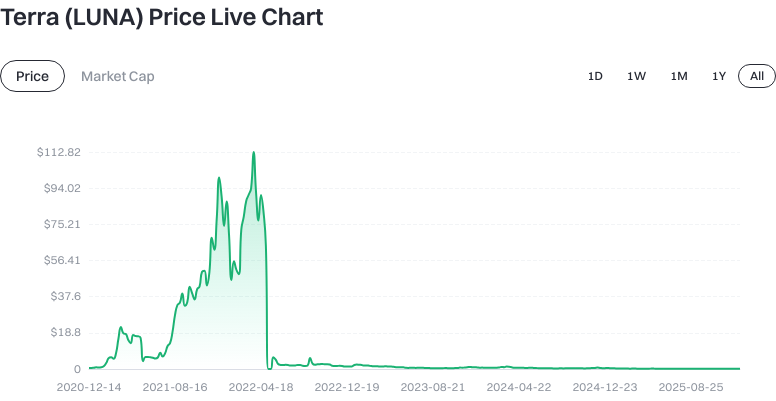

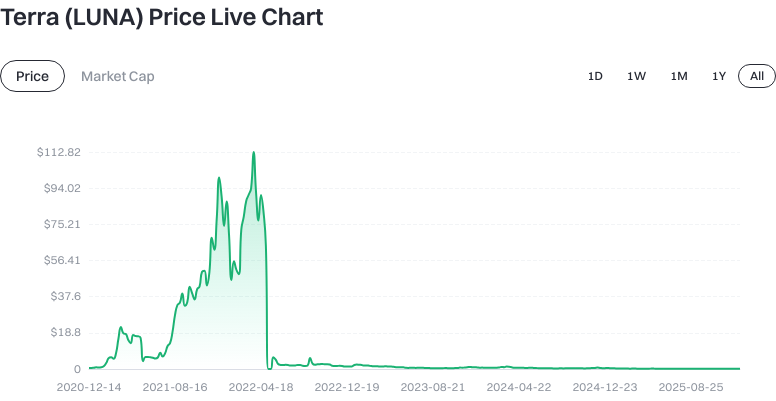

Can Luna Recover After Its Crash?

Click to view LUNA’s latest price data

After the severe crash in May 2022, Luna has struggled to return to previous highs. It now primarily serves as the governance token within the Terra ecosystem—mainly for protocol decision-making and staking rewards—not as an investment vehicle for short-term appreciation. If you participate in Luna now, consider it a long-term bet on ecosystem development rather than a speculative opportunity.

How Are Staking Rewards for Luna?

Luna does not offer traditional mining rewards; instead, users earn income through staking. By staking Luna on exchanges or wallets, users receive a share of protocol gas fees and newly minted tokens. Actual returns depend on network activity—always check real-time APY on platforms like Gate before participating.

Should I Worry About Another Crash If I Hold Luna?

While Luna underwent an extreme risk event in 2022, several risks remain—including ecosystem adoption levels, regulatory changes, and market liquidity constraints. Only invest what you can afford to lose; do not treat Luna as a core holding. Stay updated on developments within the Terra ecosystem as well as risk alerts.

How Does Luna Compare to Other Layer1 Tokens?

Luna gives holders governance rights within the Terra ecosystem. Its competitive edge over other Layer1 tokens depends largely on ecosystem adoption rates. Currently in a rebuilding phase, Terra offers fewer applications and lower user activity compared to established networks like Solana or Polygon. Carefully assess ecosystem prospects before investing; you can track real-time data on platforms such as Gate.

How Can Beginners Safely Buy And Store Luna?

You can purchase Luna through reputable exchanges like Gate that support spot trading with various payment options. For maximum security after purchase, transfer your Luna to a self-custody wallet (e.g., Ledger hardware wallet)—do not keep large amounts on exchanges long-term. For your first transaction start small to familiarize yourself with the process before scaling up.

Key Luna (LUNA) Terminology

- Smart Contract: Self-executing code on the blockchain that enforces agreement terms without third-party intervention.

- Staking: Locking tokens to participate in network validation—earning rewards while supporting blockchain security.

- Gas Fee: Transaction fees paid on blockchain networks to incentivize validators for processing transactions or smart contracts.

- Virtual Machine: The execution environment on blockchains that runs smart contract code consistently across distributed nodes.

- Cross-Chain Bridge: Protocols connecting different blockchains—enabling asset and data transfers between networks.

- Oracle: Middleware that securely brings real-world data onto blockchains as trusted information sources for smart contracts.

Further Reading & References

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Media / Research:

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025