What is Stellar?

Definition

What is Stellar Lumens (XLM)? Stellar Lumens (XLM) is the native cryptocurrency of the Stellar blockchain, designed to pay network transaction fees and facilitate value settlement between accounts. Stellar serves as a global value transfer layer, connecting banks, payment providers, and individuals, enabling fast and low-cost conversions and settlements between fiat currencies and digital assets on-chain.

XLM also acts as an anti-spam mechanism for the network by requiring small transaction fees to prevent meaningless transaction spam. For users, it is commonly used for cross-border remittances, platform settlements, and as a foundational asset for settling stablecoin and tokenized asset transactions.

Market Data

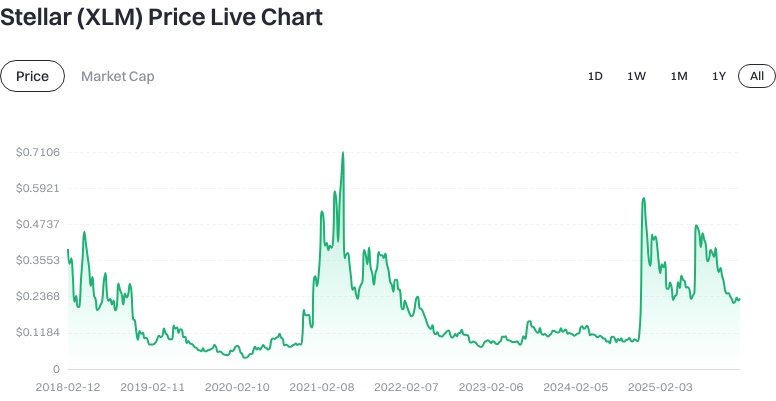

What are the current price, market cap, and circulating supply of Stellar Lumens (XLM)? As of January 15, 2026, XLM is priced at approximately $0.230870. The circulating supply stands at about 32,415,396,759.52 XLM, with both total and maximum supply capped at around 50,001,786,892 XLM. The circulating market cap is approximately $11,543,912,539.76, with a fully diluted market cap matching at $11,543,912,539.76. XLM accounts for roughly 0.33% of the total crypto market cap, and the 24-hour trading volume is about $3,020,729.74.

Click to view XLM USDT Price

Short-term volatility: The 1-hour price change is about +0.37%, the 24-hour change is -5.59%, the 7-day change is -0.51%, and the 30-day change is +5.58% (data as of January 15, 2026).

Click to view Latest XLM Price Trends

Crypto markets are highly volatile. Always check live quotes and order book depth before placing trades.

Historical Background

Who created Stellar Lumens (XLM) and when? Stellar was launched in 2014 by Jed McCaleb and collaborators with the goal of building an open network for global payments and settlement, allowing institutions and individuals to transfer value on shared infrastructure.

The network’s early design drew on federated Byzantine agreement concepts, eventually formalizing into the Stellar Consensus Protocol (SCP). In 2019, the Stellar Development Foundation (SDF) burned part of the XLM supply and fixed the maximum cap at approximately 50 billion coins to ensure long-term supply stability. Since then, the network has continuously upgraded for scalability and developer experience.

Technical Mechanism

How does Stellar Lumens (XLM) work? Stellar uses SCP (Stellar Consensus Protocol), a form of Federated Byzantine Agreement (FBA). In simple terms, validators choose "quorum sets"—trusted peers—to reach overlapping consensus groups. This allows transaction ordering agreement within seconds without energy-intensive mining.

Accounts & Assets: Each account is identified by a public key and must maintain a minimum balance to prevent spam accounts. Beyond XLM, institutions can issue tokenized assets (such as fiat IOUs or stablecoins). These entities are known as "anchors," responsible for off-chain custody and on-chain issuance.

Fees & Throughput: Network fees are generally very low and denominated in XLM, making Stellar suitable for micropayments and high-frequency settlements. The protocol offers high throughput for small-value transactions.

Smart Contracts: Stellar is progressively introducing more robust smart contract capabilities—developer-focused extensions are underway to support complex application logic (see SDF public resources; as of 2024 these features are actively being developed).

Use Cases

What can Stellar Lumens (XLM) be used for?

- Cross-border remittances: Individuals and businesses can transfer funds internationally within seconds at low cost—ideal for frequent small payments.

- Fiat & stablecoin settlement: Anchors issue fiat tokens and stablecoins (e.g., USDC on Stellar), enabling on-chain payments and reconciliation.

- Path payments: When payer and recipient require different assets, the network automatically finds optimal conversion paths from Asset A to Asset B—eliminating manual currency exchanges.

- Platform clearing & merchant settlement: Payment processors leverage Stellar as a settlement layer to accelerate payouts and reduce operational expenses.

Risks & Regulatory Considerations

What are the main risks and regulatory issues for Stellar Lumens (XLM)?

- Market volatility: Crypto asset prices are sensitive to liquidity and macroeconomic factors; price swings can be significant.

- Protocol & network risks: Consensus upgrades and new features require coordination among validators and ecosystem participants; upgrades may impact user experience. Smart contracts and multi-asset support introduce compliance and technical complexity.

- Regulatory compliance: Cross-border payments touch multiple jurisdictions; anchors must adhere to KYC/AML requirements. Policy changes may affect service availability.

- Custody & operations: Depositing XLM to exchanges or custodial platforms typically requires a Memo (tag identifying deposits); omission or error can lead to delays or irretrievable funds. For self-custody wallets, securely storing seed phrases and private keys is essential to prevent phishing or malware loss.

Value Analysis

What is the long-term value proposition of Stellar Lumens (XLM)?

- Positioning & efficiency: As a settlement layer optimized for cross-border and micro-payments, XLM offers low fees and fast confirmations that are advantageous for payment and clearing use cases.

- Network effect: Increased adoption by anchors, stablecoin issuers, and merchants boosts liquidity and utility across the network. Growing enterprise and developer use can strengthen demand for XLM in settlements and fee payments.

- Feature evolution: Advanced smart contract functionality and developer tools will expand DeFi, payment routing, and enterprise clearing scenarios—unlocking new network growth.

- External variables: Macro interest rates, regulatory developments, and competition from other payment or stablecoin networks may shift relative advantages—ongoing monitoring is required.

Purchase & Storage

How do I buy and safely store Stellar Lumens (XLM) on Gate? Step 1: Register & complete KYC. Create an account on Gate’s website and finish identity verification to meet compliance and withdrawal limits.

Step 2: Deposit funds. Buy USDT with fiat or deposit USDT/USDC to exchange for XLM. Confirm your deposit before trading.

Step 3: Search trading pairs. Navigate to spot trading, search “XLM”, choose a pair such as XLM/USDT, then review live prices and order book depth.

Step 4: Place an order. Beginners can use “Market Order” to buy at current market price; “Limit Order” executes at your chosen price. Always double-check quantity and fees before submitting.

Step 5: Withdraw to self-custody wallet (optional). For long-term holding or frequent receiving, consider transferring XLM to your own wallet. Create your wallet and securely back up your seed phrase (usually 12/24 words for recovery), set a strong password, and keep offline backups. When depositing XLM to an exchange, always enter the required Memo; withdrawing to your own wallet usually does not require a Memo.

Step 6: Strengthen security. Enable two-factor authentication (2FA), withdrawal whitelist, anti-phishing code on your Gate account; regularly review login history and update your password.

Comparison

What are the differences between Stellar Lumens (XLM) and Ripple (XRP)?

- Consensus mechanism: Stellar uses SCP (an FBA model), where nodes reach agreement via “quorum sets”; XRP uses Ripple’s consensus protocol with UNL (Unique Node List). Both aim for fast consensus but differ in technical implementation.

- Governance & issuance: XLM has a fixed supply cap around 50 billion; XRP’s initial cap was 100 billion. Stellar’s network growth is driven by SDF and its community; XRP development centers around Ripple Labs with distinct commercial partnerships.

- Fees & use cases: Both prioritize speed and low fees; however, Stellar excels in multi-asset issuance and path payments, while XRP has a stronger focus on institutional cross-border settlement and liquidity solutions.

- Feature evolution: Stellar is upgrading smart contract capabilities and developer tools; XRP Ledger is also exploring broader functionality. Both compete and cooperate in payment infrastructure innovation.

Summary

Stellar Lumens (XLM) serves as the native asset for the Stellar network—targeted at cross-border and micro-payment use cases with low fees and rapid confirmation times, providing foundational infrastructure for fiat-digital asset conversion. Its current price and market cap indicate significant scale and liquidity (as of January 15, 2026). Technically, SCP delivers efficient settlement with multi-asset support; real-world use includes remittances, stablecoin transactions, and path payments. Key risks include market volatility, regulatory shifts, protocol upgrades, custody security—especially Memo management on exchanges and seed phrase protection in self-custody wallets. To purchase XLM on Gate securely: follow registration/KYC steps, deposit funds, place trades carefully, implement security best practices—and consider self-custody based on your use case. Long-term value will depend on anchor adoption, merchant participation, stablecoin circulation, developer ecosystem growth, and regulatory progress.

FAQ

What is Stellar Lumens (XLM)?

Stellar Lumens is the native token of the Stellar blockchain network—abbreviated as XLM. It’s primarily used for paying transaction fees on the network and incentivizing validators, similar to ETH on Ethereum. XLM was designed to facilitate cross-border payments and asset transfers—especially serving developing markets and financial inclusion initiatives.

Can I buy XLM on Gate? How do I purchase?

Yes—Gate supports XLM trading. To buy: Log in to your Gate account → Go to spot trading → Search for XLM pairs (such as XLM/USDT) → Select Buy → Enter purchase amount/price → Confirm order. For beginners it’s recommended to deposit stablecoins (e.g., USDT) before trading.

How does Stellar compare to Bitcoin or Ethereum?

Stellar’s positioning differs from Bitcoin or Ethereum: Bitcoin focuses on peer-to-peer payments; Ethereum is a smart contract platform; while Stellar specializes in cross-border payments and asset issuance. Stellar offers faster transactions (3–5 seconds confirmation), extremely low fees—but its ecosystem is less extensive than Ethereum’s, mainly serving payments and financial inclusion.

Is XLM price volatile? What are investment risks?

As a major crypto asset, XLM experiences typical market volatility risks. Key risk factors include market sentiment swings, regulatory changes, technical issues. Before investing—understand crypto market dynamics fully; don’t invest more than you can afford to lose; use leverage cautiously; monitor project updates regularly.

How does Stellar enable low-fee cross-border transfers?

Stellar leverages its unique consensus mechanism—the Stellar Consensus Protocol (SCP)—and decentralized federated architecture for rapid transaction finality at minimal cost. By building an anchor-based ecosystem connecting users across countries, it enables cost-effective local currency exchange—well suited for remittances and payment needs in emerging markets.

Key Terms Glossary for Stellar (XLM)

- Federated consensus: Stellar’s unique consensus method—transactions are confirmed by a distributed validator network without mining.

- Anchor: Trusted entities bridging fiat currencies with digital assets; users exchange assets or remit funds via anchors.

- Cross-asset settlement: Automated asset swaps within a single transaction—enabling efficient multi-currency payments.

- Lumens (XLM): The native token of the Stellar network—used for transaction fees and preventing network abuse.

- Smart contract: Programmable transaction functionality on Stellar—developers create automated financial protocols/applications.

- Payment channel: Off-chain interaction between two accounts—enables rapid micropayments without each transaction being recorded on-chain.

Further Reading & Resources

-

Official / Whitepaper:

-

Development / Docs:

-

Media / Research:

Related Articles

What Is USDT0

Web3 Payment Research Report: How Stablecoins Will Evolve in 2025