What is Toshi Coin?

What is Toshi?

Toshi is a community-driven meme token, emphasizing decentralized governance and transparent decision-making. Major proposals and voting are facilitated by Meow DAO. A meme token refers to a crypto asset inspired by internet culture and community consensus. Typically, these tokens feature simple technical functionality, with most of their value derived from community engagement and viral spread.

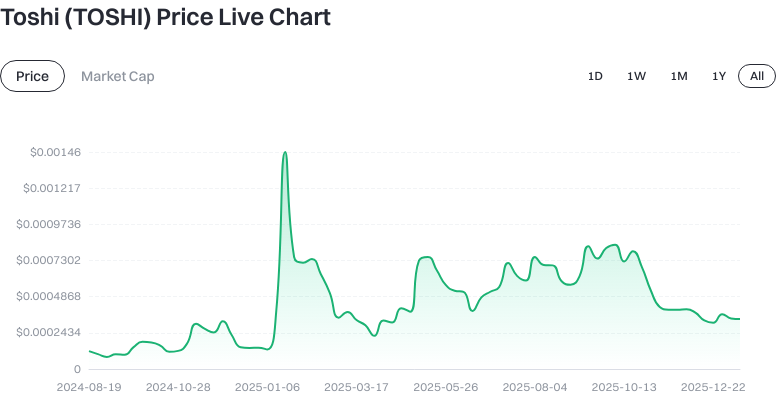

What are the current price, market cap, and supply statistics for Toshi (TOSHI)?

As of January 15, 2026, Toshi trades at approximately $0.000336. The circulating supply is 420,690,000,000 TOSHI, which is also the total and maximum supply. Circulating market cap is around $141,562,185, with a fully diluted valuation of $141,562,185. Toshi represents about 0.0041% of the overall market cap. The 24-hour trading volume is roughly $465,468.56. Price changes: +0.77% over 1 hour, -4.37% over 24 hours, -1.66% over 7 days, and -2.09% over 30 days.

Click to view TOSHI live price updates

Source: Market data provided in this article (updated: January 15, 2026). A “Not Active” label may indicate lower activity on some channels or certain data source flags; this does not necessarily reflect tradability. Always check Gate for real-time data before trading. For beginners: Circulating supply refers to the amount of tokens available for trading on the market. Market capitalization is calculated by multiplying the token price by the circulating supply. Fully diluted market cap is the price multiplied by the total supply. Trading volume represents the transaction amount over a set period and is an indicator of market activity.

Who created Toshi (TOSHI) and when?

Toshi was launched on August 20, 2024, positioning itself as “the largest community acquisition project in history,” highlighting shared project ownership and ongoing collective development. Governance is led by Meow DAO—a decentralized autonomous organization (DAO) where collaboration and decisions are executed through on-chain rules and voting mechanisms.

How does Toshi (TOSHI) work?

Toshi uses smart contracts for token minting, transfers, and holdings management. Smart contracts are self-executing code deployed on the blockchain, ensuring transparent rules. With a fixed supply and full community circulation, governance relies heavily on DAO proposals and voting for major decisions (such as fund usage or community initiatives). For security, multi-signature management is often used for critical permissions. Multi-signature means multiple independent keys must approve an operation, reducing single-point risk. All transactions adhere to on-chain rules, with fees paid as gas to validators or miners.

What can you do with Toshi (TOSHI)?

Toshi can be traded or held on the market for price discovery and liquidity provision. It also serves as proof of community membership and governance; holders can participate in DAO proposals, voting, and events. Common community uses include tipping, lotteries, joint marketing campaigns, and content co-creation—leveraging meme culture for broader influence. Experienced users may provide liquidity to decentralized trading pools to earn fees but should assess impermanent loss risks.

What are the main risks and regulatory considerations for Toshi (TOSHI)?

Price volatility: Meme tokens are highly sensitive to sentiment and viral trends, leading to sharp short-term fluctuations. Liquidity risk: Low trading volume can cause higher slippage and difficulty executing orders quickly. Governance and contract risk: Poorly designed DAO proposals or improper multi-signature management may jeopardize funds or decisions; smart contract vulnerabilities can threaten asset safety. Activity and information asymmetry: “Inactive” data labels signal the need to verify real-time prices and updates to avoid outdated info. Regulatory risk: Legal treatment of DAOs and meme tokens varies across jurisdictions; compliance requirements may change. Account and private key security: Exchange accounts require strong security settings; self-custody wallets demand careful backup of seed phrases (used to recover wallets) to prevent theft or loss.

What is the long-term value proposition for Toshi (TOSHI)?

Long-term value hinges on community size, engagement level, and ongoing quality of activities. Fixed supply provides a clear value framework; DAO governance enhances transparency and participation. Key metrics include number of wallet addresses and growth trend, proposal activity and voter turnout, trading volume and liquidity depth, external partnerships, and cultural impact. Sustained content creation and collaboration can amplify TOSHI’s brand and network effects; declining momentum may erode consensus.

Click to view TOSHI USDT price

How do I buy and securely store Toshi (TOSHI) on Gate?

Step 1: Register at gate.com and complete identity verification. Use a strong password and enable two-factor authentication (2FA) to boost account security.

Step 2: Deposit funds—either fiat or crypto assets. On the funds page, select your preferred currency and network; double-check network name and address to avoid cross-chain deposit errors.

Step 3: Search “TOSHI” in the spot market and place an order. Spot trading means direct buying/selling of tokens; market orders execute instantly at current prices—best for speed; limit orders let you set your buy price—suited for cost control.

Step 4: Secure storage. For short-term trading, keep assets in your account with enhanced security settings; for medium-to-long-term holding, withdraw coins to a self-custody wallet, securely back up your seed phrase (used for wallet recovery), test transfers with small amounts first, and verify network/address details. Remember that gas fees—paid to validators on-chain—require you to maintain sufficient balance for transaction costs.

Step 5: Ongoing management. Set price alerts, monitor Gate announcements and project updates; never authorize or reveal private keys, seed phrases, or verification codes in suspicious links or fake groups.

How is Toshi (TOSHI) different from Shiba Inu (SHIB)?

Issuance & Supply: TOSHI has a fixed total supply of 42.069 billion focused on community circulation; Shiba Inu (SHIB) started with a much larger supply plus subsequent burns and ecosystem expansion—supply mechanisms and history differ. Governance & Ecosystem: TOSHI centers around Meow DAO with an emphasis on community voting; SHIB boasts a mature “ShibArmy” with a diverse ecosystem (including its own chain and applications), offering more governance options and product lines. Use & Positioning: TOSHI leans toward community culture and governance participation; SHIB spans trading, DeFi, and brand expansion. Both are meme tokens but differ in maturity and scale. Risk & Scale: SHIB has a longer history and greater scale; TOSHI is newer—pay attention to activity levels and liquidity. Choose based on personal risk tolerance and depth of research.

Summary of Toshi (TOSHI)

Toshi is a meme token governed by Meow DAO with fixed supply fully circulating in the community. As of January 15, 2026, its price, market cap, and trading volume signal that further activity verification is needed—always check real-time stats on Gate before investing or participating. Its value depends largely on community consensus, governance engagement, and ongoing activities; main risks include price volatility, liquidity challenges, contract/governance issues. If considering entry, follow step-by-step account security measures, fund deposits, spot orders; assess withdrawal/self-custody options for medium-to-long-term holding; stay updated on proposals/community news to make decisions aligned with your risk tolerance.

FAQ

Is Toshi suitable for beginners?

As a cryptocurrency project, Toshi offers newcomers an opportunity to learn about blockchain technology with small-scale involvement. Note that crypto markets are volatile—start by learning fundamentals before investing. On Gate, beginners can try small purchases to get familiar with trading while practicing strong risk management and asset protection.

How liquid is Toshi?

Liquidity depends on trading volume and market activity. On major exchanges like Gate, liquidity is generally strong with tight bid-ask spreads; smaller platforms may offer less liquidity—use established exchanges for fast execution and fair pricing.

Are there any fees for holding Toshi?

There are no holding fees for Toshi itself. However, trading incurs platform fees; rates depend on your account tier at Gate. Withdrawing tokens to a wallet requires paying network gas fees—transact during low congestion periods to minimize costs.

What features does Toshi share with other “dog” meme coins?

Like other community-driven cryptocurrencies, Toshi features decentralization, community governance, and large supply. Such tokens rely on community hype and discussions for momentum—with substantial price volatility. Investors should recognize their limited utility value; main risks stem from sentiment-driven markets.

How can I evaluate the future potential of Toshi?

Assess Toshi’s prospects from several angles: review the official team/development progress; analyze community size/activity; check ecosystem adoption/use cases; look for technical innovations. Also monitor market acceptance, exchange listings, global adoption trends. Consult official project updates and third-party research—avoid blindly following trends; make informed decisions.

Quick Glossary for Toshi (TOSHI)

- Token: A digital asset issued on a blockchain with transferable and tradable characteristics.

- Circulating Supply: The total number of tokens currently available in the market—directly affects token price.

- Market Cap: Current price multiplied by circulating supply—measures project scale.

- Trading Volume: Total amount of tokens traded on exchanges within a specific period—indicates market activity.

- Volatility: Degree of short-term price fluctuation—reflects risk level.

References & Further Reading for Toshi (TOSHI)

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Authoritative Media / Research:

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025