What is USDT Full Form?

What Is Tether (USDT)?

Tether (USDT) is a stablecoin pegged 1:1 to the US dollar, issued by Tether Limited. Its primary purpose is to maintain on-chain value as close as possible to one US dollar. Tether achieves this peg through reserve backing and a “minting (issuance)” and “burning (redemption)” mechanism, adjusting supply according to demand. USDT circulates as a token across multiple public blockchains and is widely used for trading pairs, hedging, and settlement.

A stablecoin is a type of crypto asset whose price is linked to a reference asset—commonly the US dollar—to reduce volatility. USDT is classified as a USD stablecoin, with issuance and redemption managed by a centralized entity. The transfer of USDT tokens on-chain follows the technical rules of their respective blockchains.

What Are the Current Price, Market Cap, and Circulating Supply of Tether (USDT)?

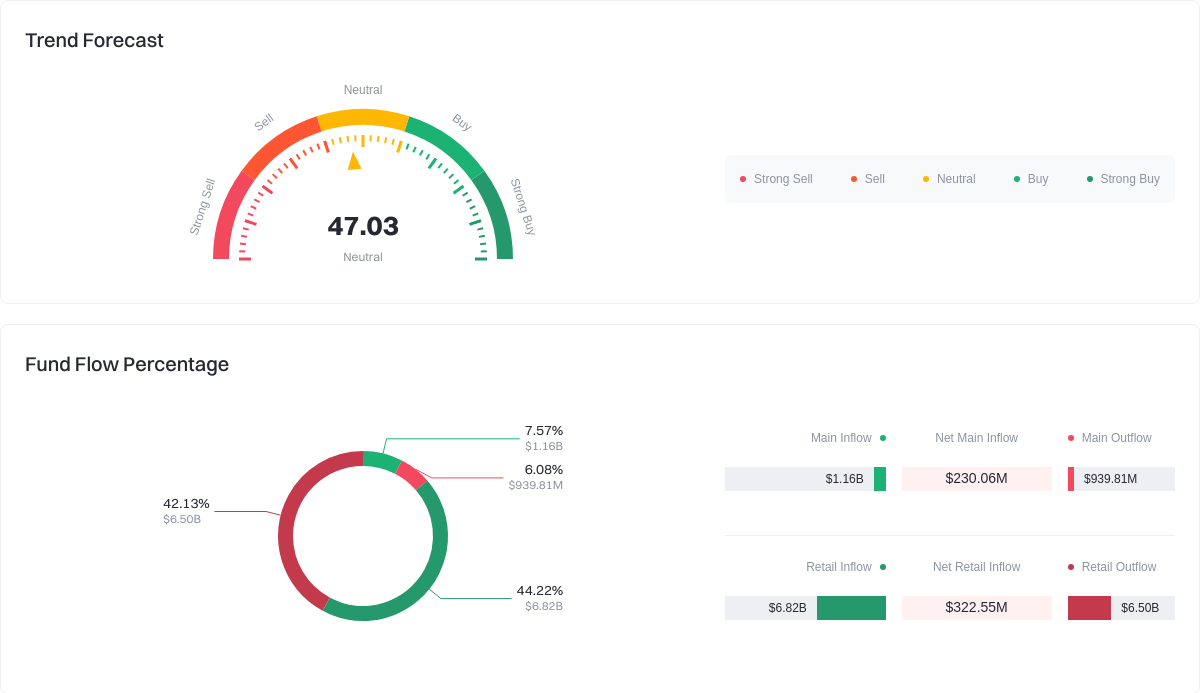

As of 2026-01-19 04:56 (data provided by users), USDT trades at approximately $0.999469. The circulating supply is about 186,994,926,138.2123 tokens, with a total supply of 190,747,369,719.72656 tokens—there is no fixed maximum supply. The circulating market cap is roughly $186,895,707,205.71, while the fully diluted market cap is about $190,646,159,752.20, representing around 5.963% of the total crypto market cap. Over the past hour, the price changed by -0.0113%; over 24 hours by -0.0086%; 7 days by 0.0903%; and 30 days by -0.0032%. The 24-hour trading volume stands at approximately $82,612,303,192.17 across around 167,229 active trading pairs.

View USDT Price

For beginners: Circulating market cap is calculated as “current circulating tokens × current price” and reflects the asset’s scale in the market. Fully diluted market cap uses “total supply × current price” to estimate potential valuation if all tokens are in circulation. Since USDT supply fluctuates with redemptions and demand changes, these values can differ.

Who Created Tether (USDT) and When?

USDT is issued by Tether Limited, with origins dating back to 2014 (initially named Realcoin before being rebranded as Tether). It was launched on several blockchains to bring the stability of the US dollar to the blockchain ecosystem. For details, see Tether’s official site and public documentation as of 2026-01-19 (https://tether.to).

Over time, Tether’s reserve composition and disclosure practices have evolved—from primarily cash and cash equivalents to a focus on highly liquid assets like US Treasury Bills—with periodic “attestation reports” published by third-party accounting firms to verify holdings. These changes aim to enhance transparency and market trust.

How Does Tether (USDT) Work?

USDT maintains its peg through a minting-and-redemption process: Institutions can request new USDT by depositing dollars or equivalent assets with Tether, which then mints new tokens. When institutions redeem USDT for dollars, Tether burns (destroys) the corresponding tokens. This supply adjusts dynamically based on market demand, so there is no hard-capped maximum.

The peg mechanism relies on reserve backing—typically cash and high-liquidity short-term assets (such as Treasury Bills)—disclosed through regular attestation reports from third-party auditors. As USDT is centrally issued, confidence in its peg depends on the quality, liquidity, and transparency of reserves.

Technically, USDT exists on multiple blockchains (e.g., Ethereum’s ERC-20, TRON’s TRC-20). Transfer speeds and fees depend on the selected network; address formats also differ. Users must select the correct network and verify contract addresses for transfers to avoid loss of funds. For more information, see Tether’s Transparency page as of 2026-01-19.

What Can You Do With Tether (USDT)?

In trading, USDT commonly serves as a “quote and settlement currency,” allowing users to quickly move into a stable USD value amidst volatile crypto assets.

For fund management, many users treat USDT as a short-term hedging and liquidity tool—holding it during uncertain markets while waiting to deploy capital or lock in profits.

For cross-border transactions, USDT can be transferred between wallets and used for payments, reducing traditional international remittance times and fees—though users must still comply with local laws and platform requirements.

Within Web3 applications, USDT is widely used as a DeFi base asset for market making, lending, and yield strategies—though users should remain aware of smart contract risks within protocols.

What Wallets and Extensions Exist in the Tether (USDT) Ecosystem?

Common storage options include hot wallets and cold wallets. Hot wallets are online software wallets ideal for frequent transfers and interactions; cold wallets are offline hardware devices or paper backups that keep private keys off the internet for greater security but less convenience. A private key is a secret string controlling your tokens; if compromised, your funds can be lost.

As a multi-chain token, withdrawing USDT requires verifying the target network and address type—ERC-20 and TRC-20 addresses differ in both format and transfer fees/speeds. Always check contract addresses through official channels and conduct small test transfers.

For enhanced security, users can utilize address whitelists, two-factor authentication (2FA), withdrawal limits, and multisignature setups to minimize operational mistakes or theft risks. For details, refer to Tether’s site and leading wallet documentation as of 2026-01-19.

What Are the Main Risks and Regulatory Considerations for Tether (USDT)?

Reserve and transparency risk: USDT’s stability depends on the quality and liquidity of its reserves; insufficient disclosure or volatile reserves can affect market confidence and price stability.

Depegging risk: During extreme market events or redemption surges/liquidity shortages, USDT’s price may temporarily deviate from $1. Historically it has restored its peg multiple times; however, users should monitor liquidity and any on-exchange/off-exchange price gaps.

Chain and smart contract risk: Network congestion, fluctuating fees, or contract vulnerabilities on different blockchains can impact transfer reliability and asset safety. Always confirm contract addresses and network choices before conducting on-chain operations.

Platform & private key risk: Keeping assets on exchanges or hot wallets requires strong account security controls—like risk monitoring and withdrawal limits. When self-custodying funds, losing or leaking your private key will result in permanent loss of access.

Regulatory & compliance: Stablecoin usage and conversion are regulated differently across jurisdictions; platforms typically require KYC (identity verification). Before large or cross-border usage, research local laws and compliance requirements.

How Can I Buy and Safely Store Tether (USDT) on Gate?

Step 1: Register a Gate account and complete KYC verification. Prepare identification documents and enable two-factor authentication plus a fund password for extra security.

Step 2: Choose a deposit method to buy crypto. Use fiat for quick purchases—select “Buy USDT,” enter your amount, and complete payment; or deposit other crypto assets first then swap them for USDT on the spot market.

Step 3: Confirm your balance and choose a network. Check your holdings; if you plan to withdraw to a personal wallet, compare ERC-20 or TRC-20 network fees/speeds to ensure compatibility with your receiving address.

Step 4: Withdraw using a small test transaction first. Copy your wallet address and send a small amount to confirm safe delivery before transferring larger sums. Note if you need to include any Memo/tag information.

Step 5: Store securely with robust risk controls. For long-term holding, transfer some or all funds to a cold wallet; backup your seed phrase/private key offline; enable withdrawal whitelists and login alerts on Gate to reduce account risk.

How Is Tether (USDT) Different From DAI?

Issuer & reserves: USDT is issued by centralized entity Tether Limited and backed by off-chain reserves; DAI is issued by a decentralized protocol with on-chain collateralization (like ETH or USDC), offering higher transparency but with stability dependent on collateral asset prices.

Peg mechanism: USDT maintains its $1 peg through institutional redemption and market-making; DAI uses over-collateralization, stability fees, and liquidation mechanisms to balance supply/demand.

Risk profile: USDT’s core risks involve reserve quality and regulatory environment; DAI’s risks center on collateral asset volatility and protocol parameters. Both may temporarily depeg in extreme situations but have distinct response mechanisms.

Ecosystem usage: USDT offers deep liquidity across exchanges and supports cross-chain activity; DAI is widely integrated in DeFi protocols for on-chain native operations and strategies. Users can choose the stablecoin that best fits their needs.

Summary of Tether (USDT)

As a USD stablecoin, USDT enables near-dollar transactions for trading and fund management on-chain. Current data shows high circulation volume and active trading; its peg relies on reserves and redemption mechanisms. Multi-chain deployment enhances usability but requires careful network selection. Practically, complete compliance/risk controls on Gate when buying; use hot/cold wallets as appropriate; always test small transfers first. In the long term, monitor Tether’s transparency reports, reserve composition, and regulatory updates—and diversify across stablecoins like USDT and DAI according to personal needs.

FAQ

What does USDT stand for?

USDT stands for Tether USD—a stablecoin issued by Tether Limited that maintains a 1:1 peg with the US dollar. Its purpose is to bring USD stability onto blockchain networks. USDT currently holds the highest liquidity and widest adoption among stablecoins in the crypto market.

Why is USDT sometimes called "U coin"?

"U coin" is a nickname traders use for USDT—derived from the “U” in its name. Such shorthand expressions are common in crypto communities for quick reference (just like BTC for Bitcoin or ETH for Ethereum).

Are there differences between USDT versions on different blockchains?

While all versions maintain the same value peg, technical differences exist across blockchains—such as Ethereum-based USDT (ERC-20), TRON-based USDT (TRC-20), Polygon-based USDT, etc. Transfer speeds, fees, and wallet compatibility vary but all versions can be exchanged on major platforms like Gate. Choose the version best suited for your use case.

Will holding USDT lead to depreciation?

USDT aims to maintain a strict 1:1 peg with USD; theoretically it should not depreciate. However, factors like Tether’s reserve adequacy or regulatory risks may affect stability. For long-term holding, monitor official audit reports and transact only through reputable exchanges like Gate to reduce risk.

Can I withdraw USDT directly as CNY?

You cannot directly withdraw USDT for Chinese Yuan (CNY). You must first sell your USDT for other cryptocurrencies or fiat currency via an exchange such as Gate—and then withdraw through compliant channels. Due to regulatory restrictions, fiat deposits/withdrawals must follow local laws; consult local regulations before proceeding.

Glossary of Key Tether (USDT) Terms

- Stablecoin: A cryptocurrency pegged to the value of the US dollar or other reference asset—designed for price stability in trading or savings.

- Reserves: The USD or equivalent assets held by Tether Limited to ensure every USDT token is fully backed.

- Cross-chain deployment: Issuance and circulation of USDT across multiple blockchain networks (e.g., Ethereum, TRON, Polygon), improving usability.

- On-chain transactions: Transfers or payments involving USDT directly on blockchain networks—transparent and immutable.

- Liquidity pool: Reserves of USDT paired with other assets in trading pairs that guarantee fast swaps or trades for users.

References & Further Reading

-

Official Website / Whitepaper:

-

Developer Documentation:

-

Media & Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?