What is XAI Coin?

What Is XAI Token?

XAI is the native token of the Xai ecosystem, designed to power an “open trading” gaming experience. With XAI, players can own and trade in-game assets without directly interacting with a crypto wallet. Open trading refers to bringing in-game assets on-chain, making them transferable, tradable, and potentially interoperable across different games and platforms.

In practice, XAI is commonly used for paying on-chain transaction fees (gas fees, meaning the network charges required to execute transactions on a blockchain), ecosystem incentives, and governance voting. Actual use cases are determined by official project updates.

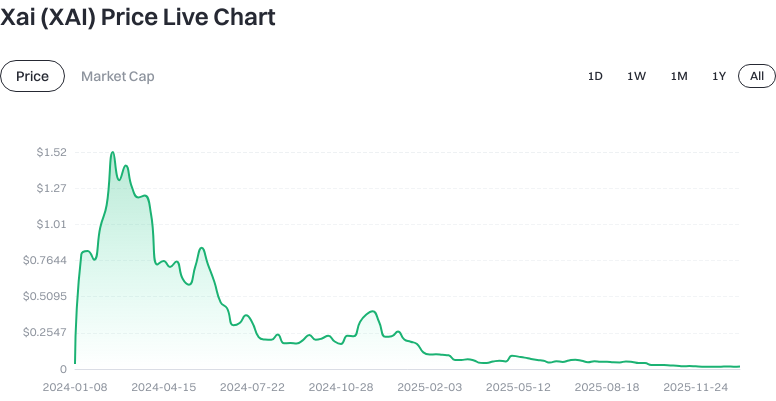

What Are the Current Price, Market Cap, and Circulating Supply of XAI (XAI)?

As of 2026-01-16 (source: input data):

- Latest price: $0.017240

- Circulating supply: 1,949,006,644.803240 XAI (tokens available for public trading)

- Total supply: 2,125,063,304.237423 XAI (total tokens minted)

- Maximum supply: 2,500,000,000 XAI (capped, no unlimited issuance)

- Market cap: $36,636,091.365053 (typically calculated as price × circulating supply)

- Fully diluted valuation: $36,636,091.365053 (estimated as price × max supply; methodology may vary by source)

- 1-hour change: +2.67%; 24-hour: +4.75%; 7-day: -1.32%; 30-day: +6.72%

- 24-hour trading volume: $628,228.057461 (reflects recent market activity)

View the latest XAI price data

These metrics help assess project scale and liquidity: market cap indicates overall size, trading volume shows activity, and price changes highlight short-term trends. However, this information does not constitute investment advice.

Check XAI USDT Price

Who Created XAI (XAI) and When?

XAI launched on January 8, 2024. The project focuses on the video gaming sector, aiming to allow hundreds of millions of mainstream gamers to own and trade valuable in-game items within familiar interfaces—lowering the barrier for crypto adoption. Through product and technical innovation, the team works to seamlessly integrate “on-chain ownership” into everyday gaming experiences.

How Does XAI (XAI) Work?

Xai’s core concept is to put in-game assets on-chain so that players have verifiable ownership and transfer rights. To reduce friction for users, several approaches are used:

- Account Abstraction: Complex processes like private key signatures and wallet operations are managed by the system in the background. Players can simply use their email or social accounts for authorization, improving accessibility.

- Custodial and Non-Custodial Wallets: Custodial wallets are managed by a service provider—convenient but requiring trust; non-custodial wallets give users full control over their private keys—more secure but with a steeper learning curve.

- Gas Fee Optimization and Batching: Technical methods are used to minimize direct network fee payments by players or to bundle multiple actions together, reducing costs and complexity.

On-chain transactions are validated and recorded by the network, creating an auditable history of asset transfers. Developers can use smart contracts to define item properties and trading rules.

What Can You Do with XAI (XAI)?

For both players and developers, main use cases include:

- Paying On-Chain Operation Costs: Such as fees for minting, transferring, or trading in-game assets.

- Ecosystem Incentives: Rewards for developers, content creators, or early participants to encourage network activity.

- Governance Participation: Community members or token holders can vote on protocol parameters or incentive allocation (subject to official rules).

For example, after purchasing a game skin, a player can hold its ownership on-chain—even if the game migrates or shuts down, the asset remains tradable on supported marketplaces.

What Are the Main Risks and Regulatory Considerations for XAI (XAI)?

- Price Volatility: Crypto assets can be highly volatile; short-term moves do not guarantee long-term trends.

- Technical and Contract Risks: Vulnerabilities in smart contracts, cross-chain bridge failures, or custodial issues may result in asset loss.

- Uncertain Ecosystem Adoption: The speed of game integrations, user growth, and partner onboarding affects long-term value.

- Regulatory Uncertainty: Token trading, NFTs, and game asset regulations differ across jurisdictions; policy shifts may impact usage and compliance costs.

- Exchange and Operational Risks: Account security breaches, incorrect network selection for withdrawals, phishing links, and social engineering scams may lead to losses.

Recommended precautions include enabling two-factor authentication (2FA), using withdrawal whitelists, verifying network and contract addresses strictly, and relying on official channels and documentation.

What Drives Long-Term Value for XAI (XAI)?

- Sector Advantage: Gaming is a major consumer industry; open trading and asset ownership unlock new market opportunities.

- Lowered Barriers: Account abstraction and wallet-free interactions make it easier for mainstream gamers to join the on-chain economy.

- Capped Supply: The maximum supply is 2.5 billion XAI; inflation rate and release schedule should be assessed based on official disclosures.

- Ecosystem Growth: More games joining the network, improved tools, and increased market liquidity will enhance utility.

Long-term value depends on high-quality game integrations, user retention rates, fee structures, and sound governance mechanisms.

How Can I Buy and Safely Store XAI (XAI) on Gate?

Step 1: Register and Complete KYC

Sign up at gate.com and complete identity verification as required—this enhances account security and ensures compliance.

Step 2: Deposit Funds

On the “Wallet” page, deposit crypto assets (such as USDT) or use fiat gateways to add funds to your account balance.

Step 3: Select Trading Pair and Place Order

On the “Trade” page, search for “XAI” and choose a spot trading pair (e.g., XAI/USDT). Use limit or market orders as appropriate to complete your purchase.

Step 4: Strengthen Account Security

Enable two-factor authentication (2FA), set withdrawal whitelists and anti-phishing codes to reduce risks from malicious links.

Step 5: Withdraw to Self-Custody Wallet (Optional)

If you wish to self-custody your assets, first verify supported networks and contract details via the project’s official site or documentation. Select the matching network when withdrawing from Gate. Carefully record your mnemonic phrase offline—avoid taking photos or storing it in the cloud.

Step 6: Ongoing Maintenance

Regularly check wallet security updates, monitor project announcements, and avoid connecting wallets or signing transactions with untrusted DApps.

How Does XAI (XAI) Differ from IMX?

- Positioning & Focus: IMX focuses on providing infrastructure and marketplace tools for games and NFTs—serving developers and traders; XAI emphasizes a seamless experience where everyday players can own and trade items in-game.

- Token Utility: Both are used for fees and incentives but differ in fee structure, governance design, and specific applications—refer to each project’s official documentation for details.

- Target Users: IMX caters to developer ecosystems and broader NFT traders; XAI aims to popularize asset ownership among mainstream gamers.

- Technical Approach: IMX relies on its own tech stack and partner networks; XAI highlights account abstraction, hybrid custody options, and fee optimization for frictionless interactions.

The two projects are not mutually exclusive—developers or players may choose whichever network or tools best fit their needs.

Summary of XAI (XAI)

XAI aims to bring “open trading” and on-chain ownership experiences to video games by leveraging account abstraction and fee optimization to lower user barriers. This enables traditional gamers to own and trade in-game assets within familiar interfaces. Current data shows XAI’s market cap and trading volume are developing; its supply is capped. Long-term value depends on quality game integrations, ecosystem growth, and regulatory progress. For newcomers, it’s crucial to understand market cap, circulating supply, and wallet security before buying or storing XAI on Gate. Given ongoing technical evolution and regulatory changes, using reliable information sources, ensuring robust account security, and adopting a cautious approach are prudent ways to participate in this space.

FAQ

What Is Xai Token?

Xai is a governance token issued by an AI layer2 project backed by OpenAI founder Sam Altman. It primarily serves governance and incentive functions within the Xai network—holders can participate in protocol decisions. The project’s mission is to combine artificial intelligence with blockchain technology to build a decentralized AI application ecosystem.

What Is the Main Focus of the xAI Project?

The xAI project specializes in building a Layer 2 blockchain optimized for AI applications. It uses the Xai token to incentivize both developers and users to build and engage with AI-powered applications—creating a fusion ecosystem of AI plus blockchain. The goal is to lower deployment costs for AI applications so developers can more easily launch AI-driven solutions on-chain.

What Are the Uses of Holding Xai Tokens?

Xai tokens have three main uses: participating in network governance votes; paying transaction fees; earning ecosystem incentive rewards. Holders can vote on key project decisions, trade tokens on major exchanges like Gate for market gains, and potentially earn extra rewards through staking programs.

Where Can You Trade Xai Tokens?

Xai tokens are listed on major crypto exchanges such as Gate, Binance, OKX, among others. It’s recommended to use reputable platforms (like Gate) for security—always verify trading pairs. New users should consult official announcements or trusted exchanges for up-to-date listing information to avoid scam platforms.

What Are the Key Risks Associated with Xai Tokens?

As an emerging project in the AI sector, Xai tokens face risks related to technology development, market volatility, and regulatory changes. The price may fluctuate significantly—invest with caution. Network deployment delays could impact expectations; evolving AI regulations may also affect the project’s future. It’s important to monitor project updates closely, manage risk exposure wisely, and never invest more than you can afford to lose.

Glossary of Key Terms Related to XAI (XAI)

- AI Blockchain: Integrating artificial intelligence technologies with blockchain to enable intelligent decentralized applications and decision-making mechanisms.

- Tokenomics: The economic model that uses token supply, distribution mechanisms, and circulation rules to incentivize network participants.

- Liquidity Mining: A DeFi mechanism where users provide liquidity to trading pairs in exchange for token rewards.

- Smart Contract: Program code that automatically executes preset terms—enabling transactions without intermediaries.

- Decentralized Governance: Community self-governance achieved through token-holder voting rather than centralized control.

Reference & Further Reading

-

Official Site / Whitepaper:

-

Development / Documentation:

-

Media & Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is ORDI in 2025? All You Need to Know About ORDI