U.S. PPI index remains high, leading to a decline in the three major U.S. stock indices! Why can Bitcoin still surge to nearly 98,000 USD?

US November PPI data exceeds expectations, leading to a decline in US stocks. However, Bitcoin has shown an independent upward trend, reaching a high of $97,924 in the past 24 hours, breaking through the 99-day moving average. What is the reason?

High US PPI index causes US stocks to fall, but Bitcoin surges

Last night, the US released the Producer Price Index (PPI) for November, with a month-over-month increase of 0.2%, higher than the market expectation of 0.1%, and an annual increase of 3.0%.

The market was still optimistic the day before about December CPI data meeting expectations, but after the PPI data was released, concerns about future rate cuts resurfaced.

The three major US indices closed lower, including the S&P which fell 0.53%, marking the first consecutive two-day decline since 2026. The Nasdaq also dropped 1%. However, Bitcoin ($BTC) has shown an independent rally, reaching a high of $97,924 in the past 24 hours, breaking through the 99-day moving average, and currently pulling back to $96,552.

Image source: CoinMarketCap Bitcoin reached a high of $97,924 in the past 24 hours

Why did Bitcoin rise for two consecutive days?

According to comprehensive analysis from foreign media, Bitcoin’s ability to ignore the adverse PPI index and rise is mainly due to large capital inflows into Bitcoin ETFs, short squeeze effects, and the Goldilocks phenomenon.

SoSoValue data shows that US Bitcoin spot ETF saw inflows of $753 million on Tuesday, the largest single-day inflow since October 7 last year.

Analysts believe that ETF capital inflows indicate that traditional and institutional investors, after rebalancing their portfolios, are reallocating funds back into risk assets.

Image source: SoSoValue US Bitcoin spot ETF inflowed $753 million on Tuesday

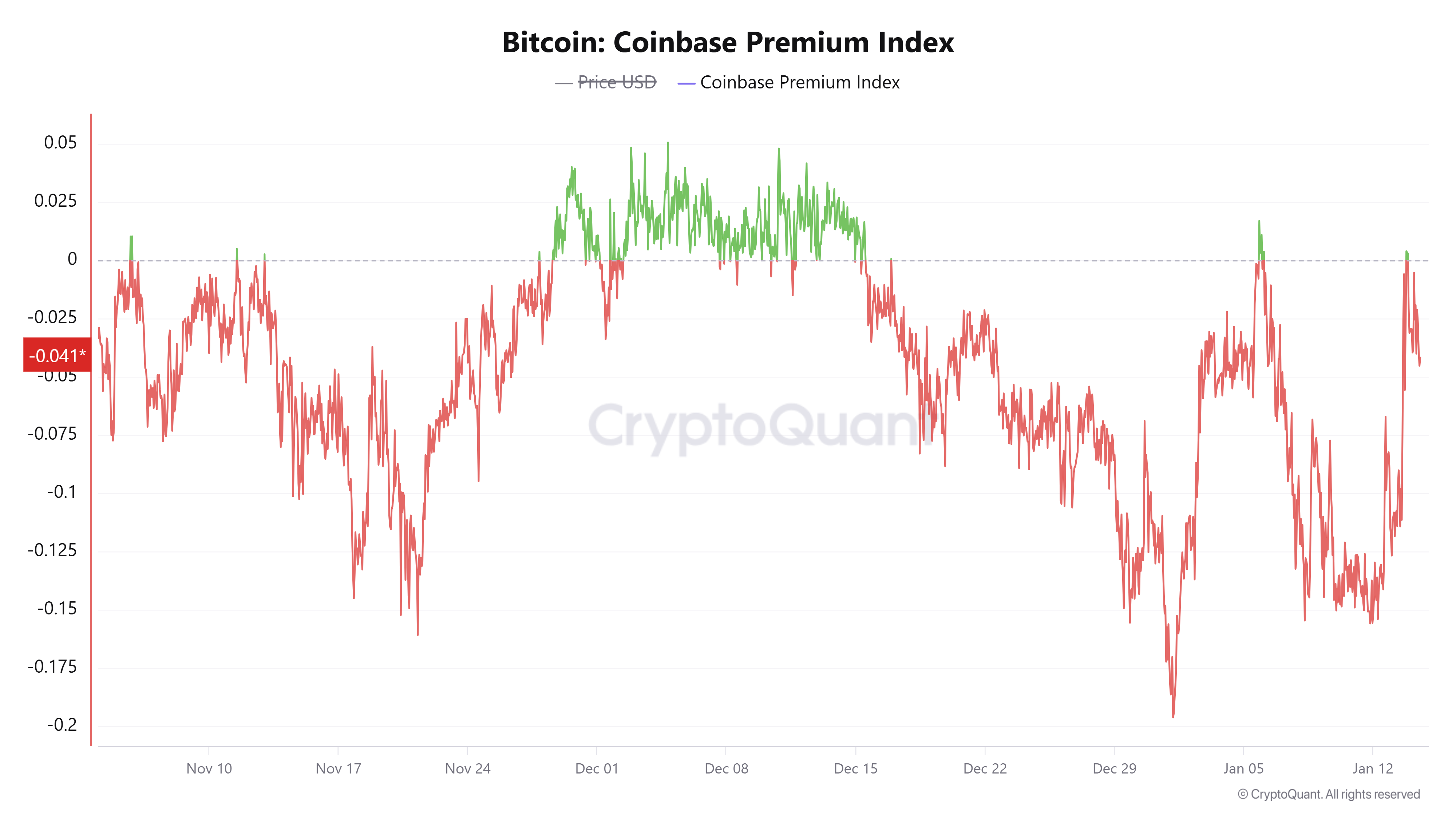

Cointelegraph analysis points out that Coinbase premium index shows easing selling pressure from the US, and inflows into Coinbase Advanced are 2.5 times the baseline, suggesting active institutional positioning. Additionally, Binance’s hourly net buy volume exceeded $500 million, and the funding rate for perpetual contracts hit multi-month lows, reflecting excessive short positions in the market, which triggered short squeezes and pushed spot prices higher.

Image source: Cointelegraph Coinbase premium index shows easing US selling pressure, with inflows into Coinbase Advanced reaching 2.5 times the baseline

Crypto trading firm QCP Capital also believes that despite turbulence in Venezuela and Iran, and US involvement, the overall economic environment remains in a Goldilocks state, indicating moderate growth—neither overheating (high inflation) nor cooling (recession), low unemployment, and stable interest rates.

Furthermore, as the US advances the legislative review of the crypto market structure bill and improves regulatory transparency, investor risk appetite for cryptocurrencies and other asset classes has increased.

Does Bitcoin need to hold the $93,500 support, with $100,000 within reach?

As Bitcoin approaches its all-time high, well-known analyst Rekt Capital states that Bitcoin needs to hold the critical support level of $93,500. If the price continues to rise, there is little resistance before reaching $100,000, but between $103,300 and $107,500, there could be significant selling pressure.

Image source: RektCapital Well-known analyst Rekt Capital states that Bitcoin needs to hold the critical support of $93,500

On the other hand, senior analyst Marcel Pechman points out that the Delta slope indicator of Bitcoin options shows that the trading price of puts remains higher than calls, indicating that professional traders are still skeptical about Bitcoin’s ability to sustain above $100,000.

Bloomberg also added that although some wealth management firms believe the US stock market is off to a good start this year, with upcoming tech earnings reports and geopolitical concerns, market volatility could increase. For Bitcoin, whether it can continue to rely on ETF capital inflows to maintain an independent trend amid these concerns will be a key focus moving forward.

Further reading:

Rumors say Venezuela has $60 billion worth of Bitcoin, will the US take it? SEC: Whether to confiscate remains to be seen

Related Articles

Bitcoin Bleeds 29% But Sellers Are Exhausted, VanEck Says - U.Today

Bitcoin Stuck Until Nasdaq Breaks Out, Expert Warns Amid Market Choppiness

XRP Trades Near $1.45 Support as Bitcoin Fractal Comparison Emerges

SHIB Surges 9.2% as Price Pressures $0.057215 Resistance Within Tight Trading Range

IMX Stuck Near $0.17 as Resistance and $0.20 S/R Flip Define the Current Range

Solana Price Faces Crucial Test at $86.90 Amid Bearish Trend