Monero (XMR): From all-time high to sharp correction – will the downtrend continue?

Monero (XMR) experienced a remarkable surge in January, reaching an all-time high of $798. However, shortly after, Bitcoin (BTC) lost momentum, triggering a strong sell-off. As a result, XMR underwent a deep correction, dropping by 63.7% in just 22 days.

Although social media engagement with this privacy coin reached impressive levels, Coinphoton warned that this could be a clear sign of “FOMO from the crowd.” At the same time, indicators on the trading volume bubble map also signaled that the market was overheating.

These warnings quickly materialized as XMR faced a sharp correction just a few days later. The inability to defend the long-term support line put XMR at risk of a deeper decline, down to $266. In fact, on February 6, XMR hit a low of $276.

Sellers regain control of key retracement levels

The A/D (Accumulation/Distribution) indicator fell to its lowest point in months, reflecting strong selling pressure over the past three weeks. The sharp correction accompanied by high trading volume explains the decline in the A/D indicator and indicates very limited short-term recovery potential.

Source: TradingViewAdditionally, the 20-day and 50-day moving averages have formed a bearish crossover after maintaining an uptrend for four months. The DMI (Directional Movement Index) also confirms the presence of a strong downtrend.

Source: TradingViewAdditionally, the 20-day and 50-day moving averages have formed a bearish crossover after maintaining an uptrend for four months. The DMI (Directional Movement Index) also confirms the presence of a strong downtrend.

These signs become even clearer when looking at XMR’s recent decline. The final hope for buyers lies at $352, corresponding to the 78.6% Fibonacci retracement from the rally between $230 and $799. However, price levels that served as support just weeks ago have now become strong supply zones. The selling pressure is so intense that testing the $352 level does not trigger any positive reaction.

Expectations for traders and investors

In the current environment, traders and investors should prepare for the continuation of XMR’s downtrend. Still, Monero may pause at certain price levels and form trading ranges, especially as Bitcoin [BTC] and other major altcoins show signs of recovery within the long-term downtrend.

XMR faces further retracement zones

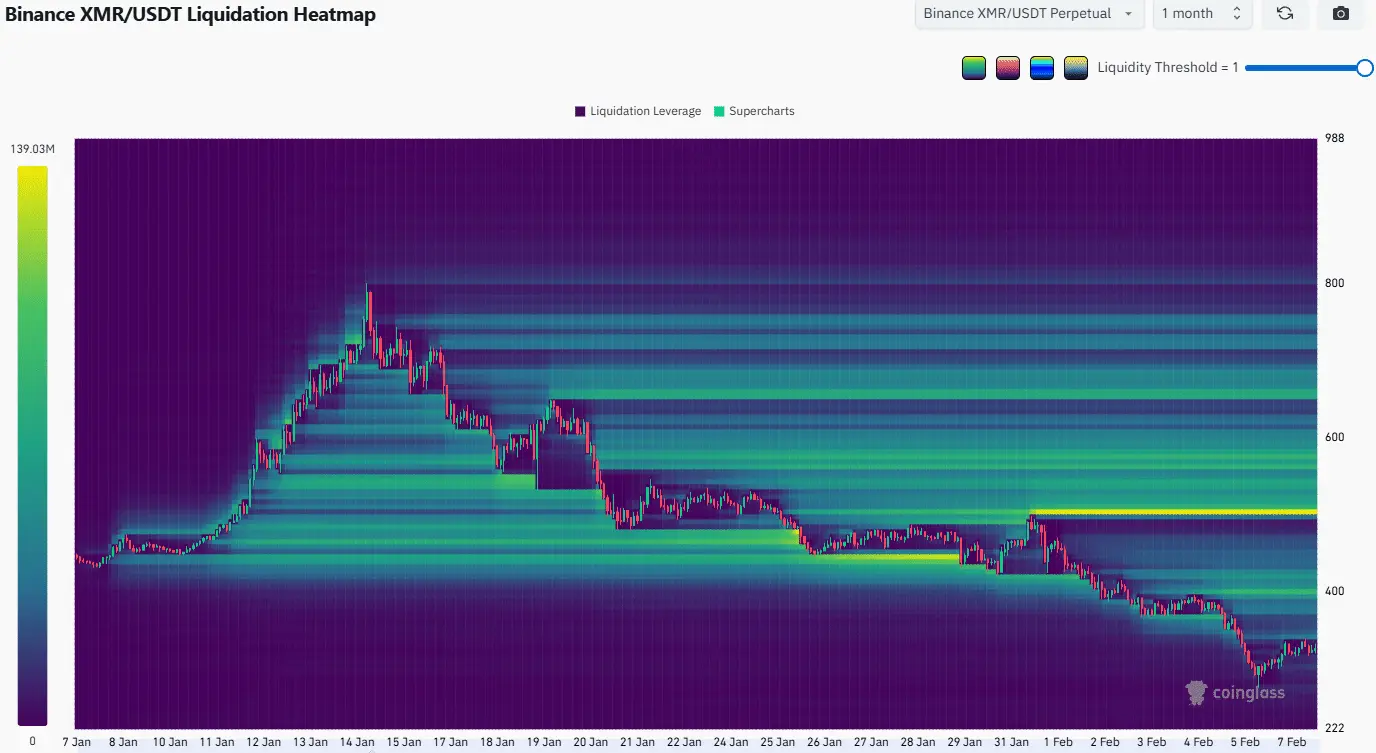

XMR’s growth phase has officially ended. A Bitcoin rebound could support XMR’s recovery, but the liquidation heatmap indicates that the $390-$420 and $500 levels are the next significant zones to watch.

Source: CoinGlass Revisiting these areas could lead to another price decline, with selling pressure still dominant in the market.

Source: CoinGlass Revisiting these areas could lead to another price decline, with selling pressure still dominant in the market.

Mr. Teacher