# TrumpWithdrawsEUTariffThreats

23.94K

Amid ongoing trade tensions, Trump cancels tariffs on several European countries originally set for Feb 1. Do you think this easing signal will meaningfully impact market trends?

Discovery

#TrumpWithdrawsEUTariffThreats

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO Se

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO Se

- Reward

- 64

- 65

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

🌐 Macro Outlook 2026: The Structural Backdrop

From a macro perspective, the foundation is relatively stable:

Global GDP growth: ~3.1%–3.3% (IMF & Bloomberg estimates)

Growth supported by the U.S., Europe, and Asia

AI investment is becoming a core productivity and earnings driver

After 2025 rate cuts, markets expect the Fed in 2026 to remain

→ mostly neutral, possibly 1–2 limited cuts

This environment is broadly supportive for risk assets

However, key risks remain active:

Political uncertainty (Trump’s trade and fiscal policy reversals)

Geopolitical tensions

Slowing Chinese growth

The risk tha

From a macro perspective, the foundation is relatively stable:

Global GDP growth: ~3.1%–3.3% (IMF & Bloomberg estimates)

Growth supported by the U.S., Europe, and Asia

AI investment is becoming a core productivity and earnings driver

After 2025 rate cuts, markets expect the Fed in 2026 to remain

→ mostly neutral, possibly 1–2 limited cuts

This environment is broadly supportive for risk assets

However, key risks remain active:

Political uncertainty (Trump’s trade and fiscal policy reversals)

Geopolitical tensions

Slowing Chinese growth

The risk tha

- Reward

- 34

- 39

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

#TrumpWithdrawsEUTariffThreats

🌈In a major market-moving decision, President Trump announced the withdrawal of EU tariff threats, citing a “Framework of a future deal” involving Greenland and the Arctic region. For traders, this is a key event that resets market sentiment and creates opportunities across traditional and crypto markets. Let’s break it down step by step.

1. The NATO Factor – From Coercion to Diplomatic Flow

The withdrawal followed a meeting with NATO Secretary-General Mark Rutte, signaling a move from Economic Coercion to Diplomatic Negotiation.

Trader Insight: When uncertaint

🌈In a major market-moving decision, President Trump announced the withdrawal of EU tariff threats, citing a “Framework of a future deal” involving Greenland and the Arctic region. For traders, this is a key event that resets market sentiment and creates opportunities across traditional and crypto markets. Let’s break it down step by step.

1. The NATO Factor – From Coercion to Diplomatic Flow

The withdrawal followed a meeting with NATO Secretary-General Mark Rutte, signaling a move from Economic Coercion to Diplomatic Negotiation.

Trader Insight: When uncertaint

- Reward

- 5

- 18

- Repost

- Share

楚老魔 :

:

Buy financial management 💎View More

#TrumpWithdrawsEUTariffThreats

Over the past few days, global markets were once again under pressure after signals emerged that Donald Trump could impose new tariffs on the European Union and the UK. For many investors, it immediately brought back memories of past trade wars — higher costs, market volatility, and uncertainty.

Now comes a moment of relief.

🕊️ Trump has withdrawn the tariff threat against the EU and the UK.

The decision followed diplomatic talks at the NATO level, linked to broader geopolitical discussions around Greenland and the Arctic region.

📈 Markets reacted quickly and c

Over the past few days, global markets were once again under pressure after signals emerged that Donald Trump could impose new tariffs on the European Union and the UK. For many investors, it immediately brought back memories of past trade wars — higher costs, market volatility, and uncertainty.

Now comes a moment of relief.

🕊️ Trump has withdrawn the tariff threat against the EU and the UK.

The decision followed diplomatic talks at the NATO level, linked to broader geopolitical discussions around Greenland and the Arctic region.

📈 Markets reacted quickly and c

- Reward

- 1

- 3

- Repost

- Share

DragonFlyOfficial :

:

Buy To Earn 💎View More

A Geopolitical Reading of the Greenland Statement

Recent remarks by Donald Trump have once again brought the idea of the United States purchasing Greenland into public discussion, with suggestions that talks on the matter should be initiated. Greenland is an autonomous territory under Danish sovereignty, but its strategic position has long made it a point of interest for global powers.

I don’t see this statement as merely a discussion about acquiring land. More importantly, it reflects the growing strategic importance of the Arctic region. Energy resources, emerging shipping routes, military p

Recent remarks by Donald Trump have once again brought the idea of the United States purchasing Greenland into public discussion, with suggestions that talks on the matter should be initiated. Greenland is an autonomous territory under Danish sovereignty, but its strategic position has long made it a point of interest for global powers.

I don’t see this statement as merely a discussion about acquiring land. More importantly, it reflects the growing strategic importance of the Arctic region. Energy resources, emerging shipping routes, military p

- Reward

- 31

- 31

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

##TrumpWithdrawsEUTariffThreats

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO S

From Threats to the Table: Trump’s Strategic Retreat

In the opening weeks of January 2026, U.S. President Donald Trump sent shockwaves through global markets by announcing additional customs tariffs—ranging from 10% to 25%—against eight European nations (UK, France, Germany, Denmark, Netherlands, Sweden, Finland, and Norway) that opposed his Arctic strategy and the proposal to purchase Greenland. However, the recent summit in Davos has fundamentally shifted the narrative.

Summit Diplomacy: Following what he described as a "highly productive" meeting with NATO S

- Reward

- 5

- 7

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

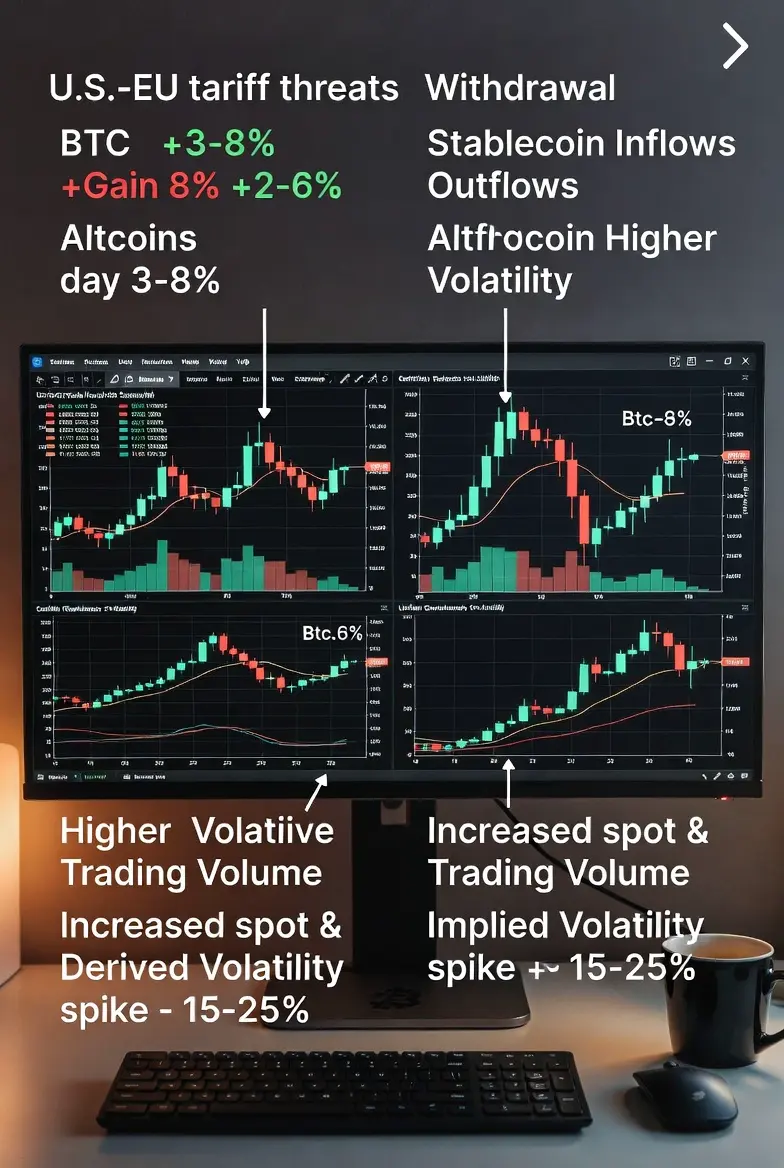

Trump Withdraws EU Tariff Threats: Macro Markets and Crypto React

In a surprising and potentially market-moving development, Trump has officially canceled tariffs on several European countries that were originally scheduled to take effect on February 1.

This decision comes amid a prolonged period of trade uncertainty and heightened geopolitical risk, which has been weighing on global equities, commodities, and risk-on assets, including cryptocurrencies.

The immediate effect is a relief in risk sentiment. U.S. and European equities are likely to see renewed buyin

Trump Withdraws EU Tariff Threats: Macro Markets and Crypto React

In a surprising and potentially market-moving development, Trump has officially canceled tariffs on several European countries that were originally scheduled to take effect on February 1.

This decision comes amid a prolonged period of trade uncertainty and heightened geopolitical risk, which has been weighing on global equities, commodities, and risk-on assets, including cryptocurrencies.

The immediate effect is a relief in risk sentiment. U.S. and European equities are likely to see renewed buyin

BTC-0,07%

- Reward

- 15

- 24

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

#TrumpWithdrawsEUTariffThreats

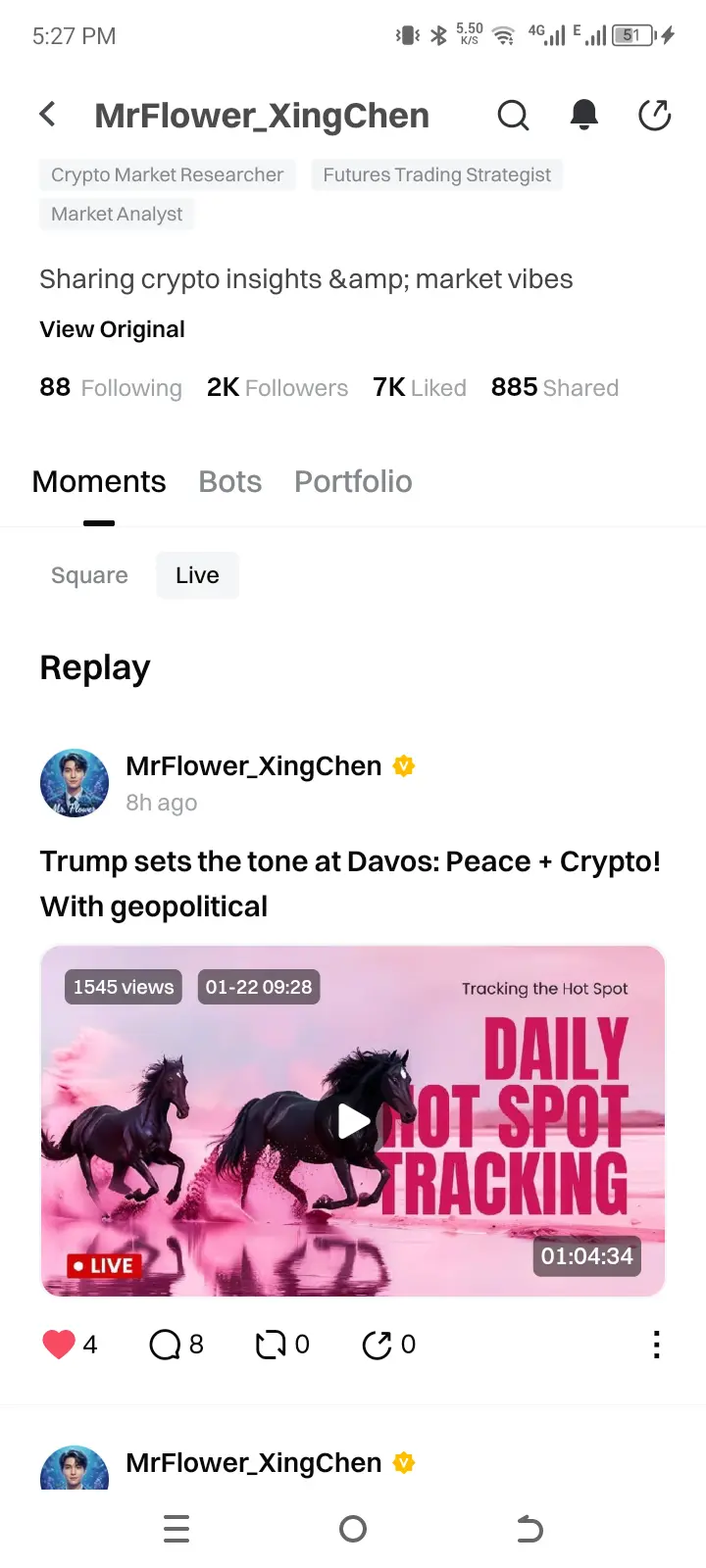

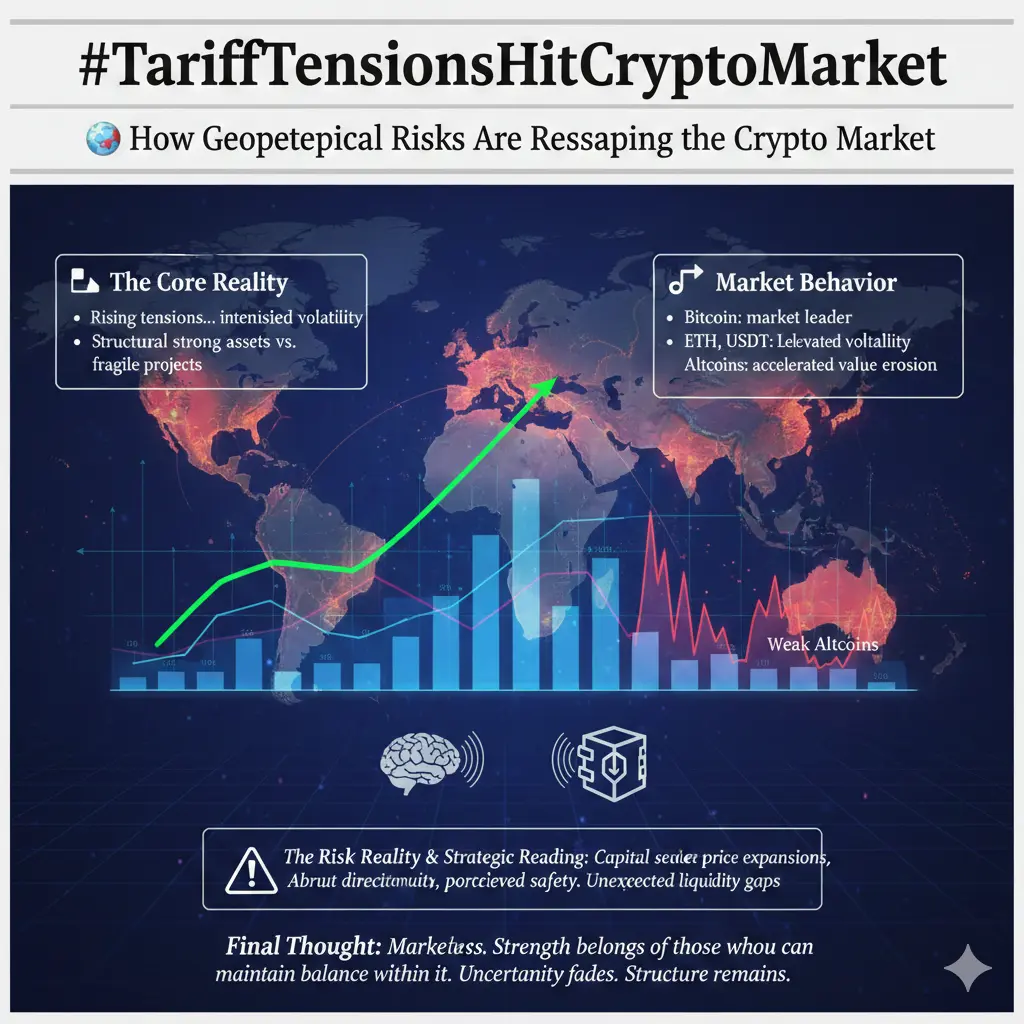

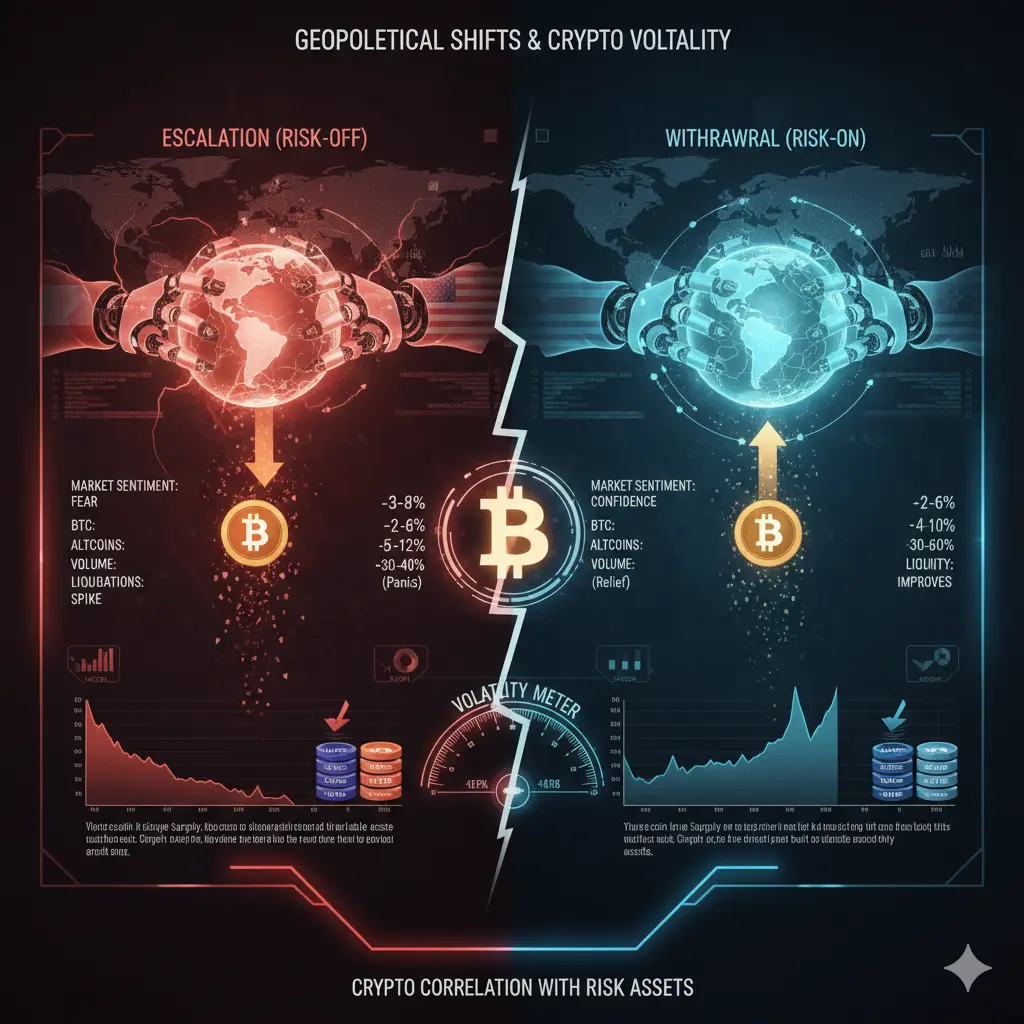

When geopolitical risk like U.S.–EU tariff threats escalates or is withdrawn, crypto markets respond dynamically.

1. Market Sentiment & Risk Appetite

Escalation → Risk-Off:

Investors move out of risky assets. Crypto behaves like equities, not gold, in the short term.

Withdrawal → Risk-On:

Relief restores confidence; traders re-enter positions, raising volume and leverage.

Key Insight:

Crypto’s correlation with traditional risk assets (equities, tech-heavy indices) strengthens during sudden tariff moves.

2. Price & Percentage Changes

Scenario

BTC

Altcoins

Stable

When geopolitical risk like U.S.–EU tariff threats escalates or is withdrawn, crypto markets respond dynamically.

1. Market Sentiment & Risk Appetite

Escalation → Risk-Off:

Investors move out of risky assets. Crypto behaves like equities, not gold, in the short term.

Withdrawal → Risk-On:

Relief restores confidence; traders re-enter positions, raising volume and leverage.

Key Insight:

Crypto’s correlation with traditional risk assets (equities, tech-heavy indices) strengthens during sudden tariff moves.

2. Price & Percentage Changes

Scenario

BTC

Altcoins

Stable

- Reward

- 24

- 30

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

President Trump has officially withdrawn his proposed tariff threats against several European Union and NATO countries, stepping back from plans to impose import duties tied to the Greenland dispute. The move follows diplomatic engagement at the World Economic Forum in Davos, where Trump and NATO Secretary-General Mark Rutte agreed on a framework to address Arctic security concerns, easing immediate trade tensions. This decision has been welcomed by global markets and signals a temporary de-escalation in transatlantic economic friction. European leaders continue to emphasize the importance of

- Reward

- 2

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

#TrumpWithdrawsEUTariffThreats shifts the tone in global markets from tension to temporary relief.

After recent risk-off reactions, this move could calm trade fears and improve short-term sentiment across equities and crypto.

Markets often react strongly to tariff headlines, and removing the threat may reduce pressure on risk assets.

But the real question is whether this relief is lasting or just a pause in a larger trade narrative.

If uncertainty fades, we might see confidence return and volatility cool down.

I’m watching how BTC and major assets respond to th

BTC-0,07%

- Reward

- 15

- 23

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

40.78K Popularity

23.94K Popularity

17.15K Popularity

5.32K Popularity

12.42K Popularity

11.11K Popularity

9.48K Popularity

76.99K Popularity

37.35K Popularity

21.3K Popularity

8.37K Popularity

110.37K Popularity

253.48K Popularity

20.82K Popularity

163.23K Popularity

News

View MoreA trader spent $54,000 to buy PENGUIN and made a profit of $739,000 within two days.

12 m

Data: USDC circulation decreased by approximately 1.4 billion tokens in the past 7 days

20 m

Rainbow will launch the CCA auction on Uniswap on February 2nd.

47 m

"Maqi" Ethereum long position currently has a floating profit of $60,000, with total holdings rising to 6,000 ETH.

1 h

The share of US dollar in global foreign exchange reserves drops below 60%

1 h

Pin