# DXY

239.54K

FenerliBaba

#CryptoMarketPullback

MARKET OVERVIEW

Gold hit a new record of $4,887/ounce, driven by increasing safe-haven demand amid tensions in Greenland.

Silver, slightly below $94.5, remains near all-time highs despite US-Europe tensions and global bond sell-offs.

#BTC 🇺🇸

The US is consolidating seized Bitcoins under the Strategic BTC Reserve. Auctions have been halted.

#DXY 🇺🇸

US–EU tensions pushed the dollar index to 98.5. Confidence in American assets is weakening.

#EUR 🇪🇺

EUR/USD retreated slightly to 1.1711. ING indicates the pair may fall below 1.17.

High inflation in the UK keeps the poun

MARKET OVERVIEW

Gold hit a new record of $4,887/ounce, driven by increasing safe-haven demand amid tensions in Greenland.

Silver, slightly below $94.5, remains near all-time highs despite US-Europe tensions and global bond sell-offs.

#BTC 🇺🇸

The US is consolidating seized Bitcoins under the Strategic BTC Reserve. Auctions have been halted.

#DXY 🇺🇸

US–EU tensions pushed the dollar index to 98.5. Confidence in American assets is weakening.

#EUR 🇪🇺

EUR/USD retreated slightly to 1.1711. ING indicates the pair may fall below 1.17.

High inflation in the UK keeps the poun

BTC-1,17%

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊The rebound of DXY has led to a tightening of global liquidity, putting downward pressure on risk assets such as BTC.

With the recent strength of the US dollar -- the US dollar index (DXY) rose to 101 dollars, the global liquidity situation is tightening, and risk assets like Bitcoin are under pressure.

Earlier this week, the world's largest cryptocurrency experienced a strong rebound, and BTC also reached a new high of over $126,000, but then it underwent a significant correction. Meanwhile, this morning, the price of BTC even dropped to as low as $102,000.

Market analyst Jamie Coutts poi

With the recent strength of the US dollar -- the US dollar index (DXY) rose to 101 dollars, the global liquidity situation is tightening, and risk assets like Bitcoin are under pressure.

Earlier this week, the world's largest cryptocurrency experienced a strong rebound, and BTC also reached a new high of over $126,000, but then it underwent a significant correction. Meanwhile, this morning, the price of BTC even dropped to as low as $102,000.

Market analyst Jamie Coutts poi

BTC-1,17%

- Reward

- like

- Comment

- Repost

- Share

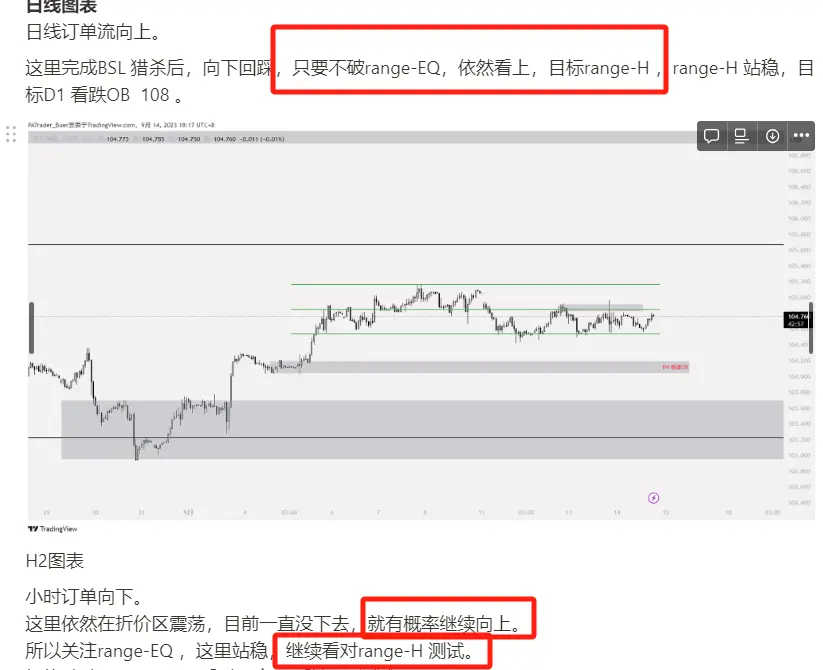

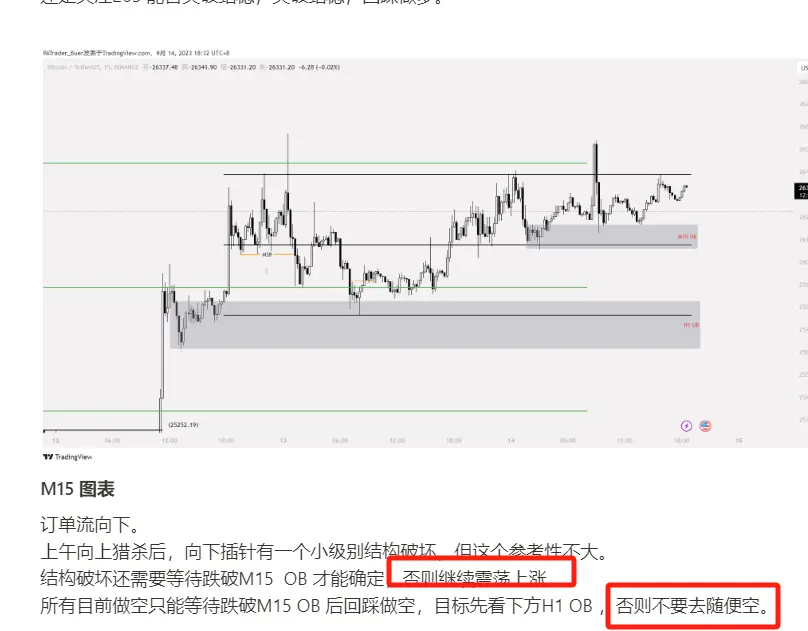

#DXY BTC #ETH Last night, all the bullish calls came true, but sometimes bullishness does not necessarily give you the opportunity to go long.

Of course, the long orders held by OB below will definitely continue to be held.

That's how volatile the market is.

#GameSwap #merc

View OriginalOf course, the long orders held by OB below will definitely continue to be held.

That's how volatile the market is.

#GameSwap #merc

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Global Carry Trade & BTC: Liquidity Drives the Market

The global carry trade fuels demand for the US dollar, reinforcing its status as the world's reserve currency. Investors borrow in low-rate economies (like Japan or the EU) and allocate funds into higher-yielding dollar-denominated assets. This cycle directly impacts risk assets like BTC—when liquidity is abundant, capital flows into crypto; when the dollar strengthens, markets face pressure.

💡 Key Takeaways:🔹 Liquidity Matters More Than Just Money Supply – The Fed's QE in the past didn’t always drive consumer inflation, but its effects o

The global carry trade fuels demand for the US dollar, reinforcing its status as the world's reserve currency. Investors borrow in low-rate economies (like Japan or the EU) and allocate funds into higher-yielding dollar-denominated assets. This cycle directly impacts risk assets like BTC—when liquidity is abundant, capital flows into crypto; when the dollar strengthens, markets face pressure.

💡 Key Takeaways:🔹 Liquidity Matters More Than Just Money Supply – The Fed's QE in the past didn’t always drive consumer inflation, but its effects o

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#DXY Usoil

Still rolling over as discussed.

If you think this is bullish please feel free to tell me how.

Still rolling over as discussed.

If you think this is bullish please feel free to tell me how.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

33.39K Popularity

14.44K Popularity

5.51K Popularity

54.5K Popularity

342.76K Popularity

4.53K Popularity

5.45K Popularity

14.31K Popularity

107.53K Popularity

21.36K Popularity

201.35K Popularity

17.12K Popularity

6.71K Popularity

13.09K Popularity

169.15K Popularity

News

View MorePudgy Penguins Team-Linked Wallet Deposits 397M PENGU to CEX

13 m

Swing whale nemorino.eth "buy low, sell high," bought back 3,000 WETH sold yesterday near $2,991

18 m

The Central Bank of Iran received over $500 million USDT last year and used it to support the local currency exchange rate.

30 m

Huang Licheng has lost $4.16 million this week, with a total profit and loss of -$24.5 million.

33 m

Trump's Davos Speech Summary: No Military Action Against Greenland, Reaffirms Support for Cryptocurrency

40 m

Pin