Gate DeFi Daily ( October 15 ): Monad Airdrop officially launched; Lighter compensates users affected by the big dump.

On October 15, influenced by Fed Chairman Powell's speech, the overall market risk appetite has improved. BTC stabilized around $112,000, and ETH returned above $4,100, leading to a mild recovery in liquidity within the DeFi zone. The total DeFi TVL across the network is reported at $15.7862 billion, although it has decreased by 1.77% in the last 24 hours, mainstream protocols Lido and ETH.fi both recorded a rise, indicating a rebound in liquid staking demand. The daily trading volume on DEX has risen to $25.995 billion, with Uniswap, PancakeSwap, and HumidiFi ranking in the top three, and Solana's ecosystem activity has significantly increased. Multiple airdrops, TGEs, and integration collaborations have injected a new round of momentum into the market, signaling that the DeFi zone is gradually regaining confidence after the previous pullback.

DeFi Market Overview

(Source: DeFiLlama)

Total DeFi TVL across the network: Today (October 15), influenced by the latest speech from Fed Chairman Powell, the crypto market is once again showing signs of recovery after experiencing a pullback. BTC is currently trading around $112,000, and ETH has returned above $4,100; the total DeFi TVL across the network is currently $15.7862 billion, down 1.77% in the past 24 hours.

DEX 24-hour volume: approximately $25.995 billion, with the top three being: Uniswap ($7.452 billion), PancakeSwap ($4.489 billion), HumidiFi ($1.836 billion).

Popular Protocols and On-chain Performance

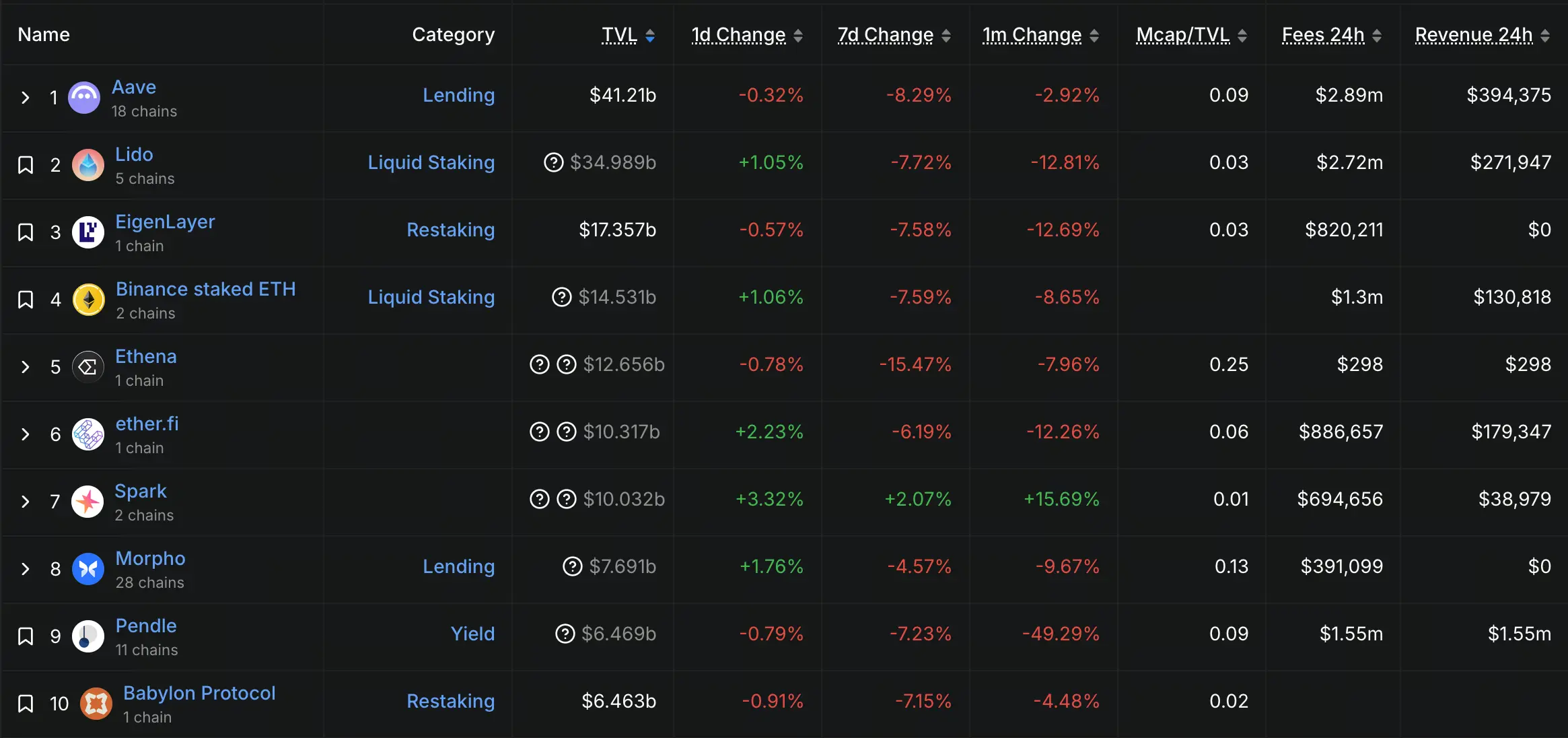

Based on TVL, the data for the top ten DeFi protocols is as follows:

(Source: DeFiLlama)

Among them, the top-ranked protocol data performances are as follows:

Aave: TVL approximately 41.21 billion USD, 24-hour drop of 0.32%;

Lido: TVL approximately $34.989 billion, 24-hour rise 1.05%;

EigenLayer: TVL approximately $17.357 billion, 24-hour drop of 0.57%;

Ethena: TVL approximately 12.656 billion USD, 24-hour decline of 0.78%;

ETH. fi: TVL is approximately 10.317 billion USD, with a 24-hour rise of 2.23%.

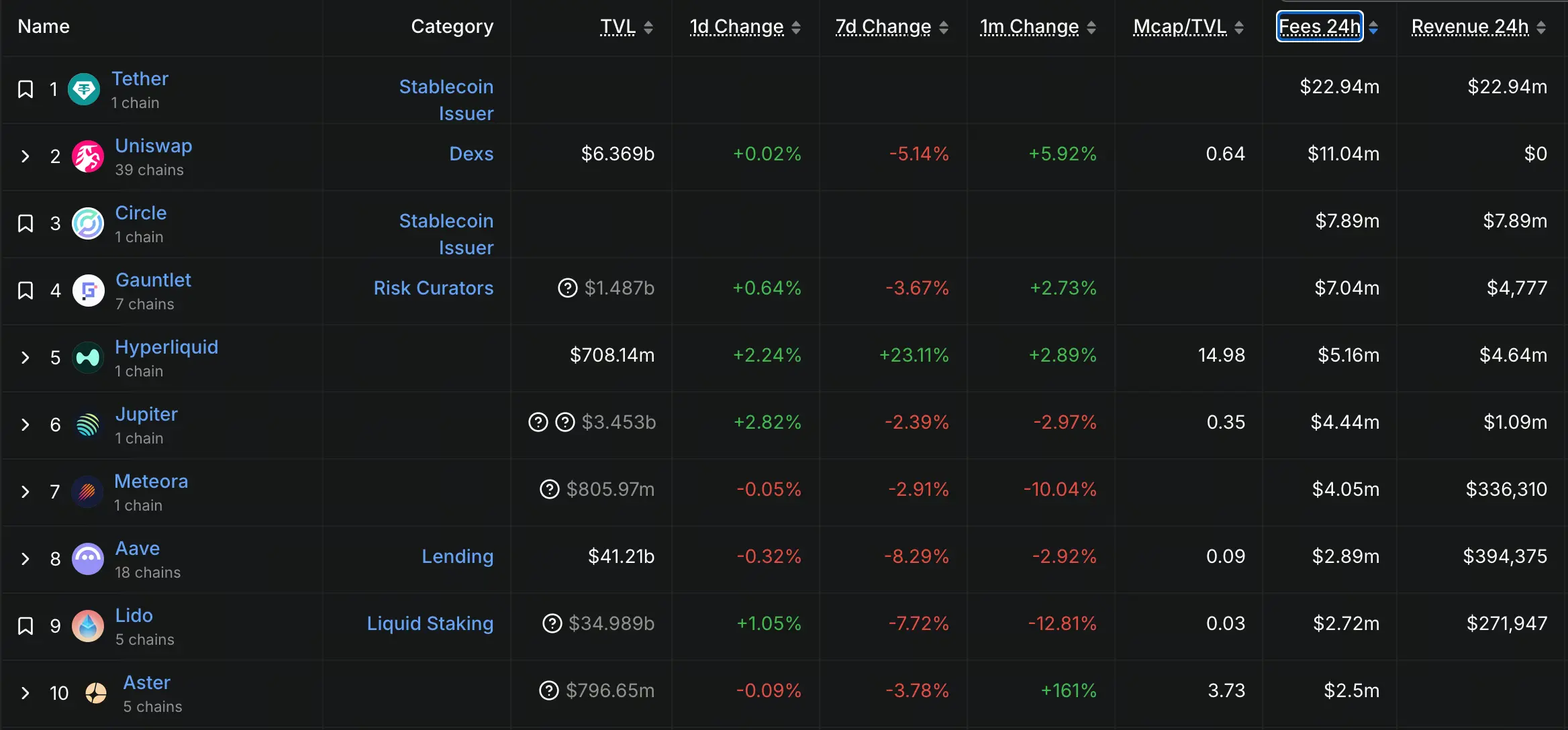

In addition, the top ten projects ranked by protocol fees in the past 24 hours are as follows:

(Source: DeFiLlama)

Among them, Uniswap's protocol fees reached $11.04 million in the past 24 hours, second only to Tether ($22.94 million); Gauntlet's protocol fees reached $7.04 million, ranking fourth; Hyperliquid ranked fifth with $5.16 million.

Project News Review

-

Farcaster announced that over 2000 active Farcaster users are eligible for the Monad Airdrop, and it has sent push notifications to qualifying users.

-

The Solana ecosystem liquidity protocol Meteora announced that a special community meeting will be held tonight at 21:00. The agenda includes: unveiling of the MET TGE website, update on the Airdrop checker, details on the (token) starting price range, and other information.

-

Base co-founder Jesse Pollak stated in an interview with Cointelegraph that Base chose to develop on Ethereum in hopes of achieving ecological interoperability. In addition, Jesse mentioned that the Base token is set to launch soon.

-

Hayden Adams, the founder of Uniswap, stated that decentralized exchanges (DEX) and automated market makers (AMM) are now able to provide free listing, trading, and liquidity support for any assets. He pointed out that if a project chooses to pay high listing fees to CEX, its real purpose is more about marketing rather than a necessary demand at the market structure level. Hayden emphasized: “The development of DEX and AMM allows anyone to freely create markets, and we are proud to play a role in achieving this goal.”

-

MetaMask announced a partnership with Polymarket to natively integrate on-chain prediction markets within the MetaMask wallet. Through this integration, users will be able to trade predictions in categories including sports, cryptocurrencies, and politics directly within MetaMask.

-

The liquid staking protocol Kinetiq on Hyperliquid has announced the final kPoints snapshot, and the kPoints distribution will take place on October 16.

-

Lighter announced that it is distributing a special reward of 250,000 points to compensate traders affected by the market crash on October 10. The second season of rewards will be distributed every Friday starting from October 17, with an initial reward of 600,000 points to cover the compensation for the past 2.5 weeks.

Affected users can be mainly divided into three categories, and the platform is responsible for these issues:

Platform performance degradation: Occurred a few hours before the market crash on October 10. During this period, traders incurred total losses of approximately 25 million dollars, thus 150,000 points were issued as compensation. Additionally, the liquidation fees will also be refunded in the form of USDC.

Market crash: At that time, the exchange system was operating normally, but LLP holders suffered a loss of about 5%. Although the system performed normally, we still bear some responsibility, as some LLP participants had insufficient understanding of the liquidity provided by LLP and its mechanism as a last source of liquidity when necessary. We have previously clarified the operation of LLP through in-depth analysis, and LLP holders received a compensation of 25,000 points.

Database failure after market calm: 5 hours after the market crash, the database used for the sequencer failed (see the incident report from October 12), resulting in Lighter being offline for 4.5 hours. During this period, the market was relatively stable, with total trader losses of 7 million USD. The compensation for this period is 75,000 points, and the liquidation fees are also refunded in USDC.

- According to official news, the Monad Airdrop is officially open for claims, and the claiming portal will remain open until November 3rd. The MON Airdrop includes highly active users of major mainnet blockchains, who are identified through on-chain activities, NFT holdings, and other relevant metrics. Such airdrop allocations are given to EVM and Solana addresses that have historically generated significant value on-chain, covering several priority value forms as follows:

Important DEX traders, including those trading on Hyperliquid and Phantom Wallet (spot and perpetual contracts), as well as token traders on Pump.fun, Virtuals, and other meme coins.

Major DeFi protocols' important depositors, including Aave, Euler, Morpho, Pendle, Lighter, Curve, PancakeSwap, and Uniswap.

Users who hold various NFTs for the long term, including Azuki, Chimpers, CryptoPunks, Doodles, Fluffle, Hypurr, Mad Lads, Meebits, Milady Maker, Moonbirds, Pudgy Penguins, Redacted Remilio Babies, Sappy Seals, Solana Monkey Business, and Wassies.

Recently active participants in Ethereum's main Decentralized Finance protocol DAO governance.

The criteria for screening on-chain users are based on the snapshot taken on September 30, 2025, at 23:59 UTC, and some criteria are derived from data retrospective calculations over several months.

- SolanaFloor announced on platform X that DApps on Solana generated over $18 million in revenue over the past 7 days. Among them, Pump.fun's revenue exceeded $8.63 million.

Overview of Major Ecological Leaders in Decentralized Finance Projects

Solana DEX's 24-hour volume has once again surpassed Ethereum, returning to the top with approximately $6.078 billion, a week-on-week rise of 44.6%. The top three projects are:

HumidiFi ($1.836 billion), Meteora ($1.23 billion), Orca ($1.037 billion);

Ethereum DEX ranks second in 24-hour trading volume, approximately $5.944 billion, with a week-on-week rise of 64.31%. The top three projects are:

Uniswap ($4.173 billion), Fluid ($755.9 million), Curve Finance ($661 million);

BSC DEX ranks third in 24-hour trading volume, approximately $4.947 billion, with a week-on-week rise of 29.67%; among them, the top three projects are:

PancakeSwap (3.543 billion USD), Uniswap (892.46 million USD), four.meme (232.65 million USD).

Gate DeFi zone token market data

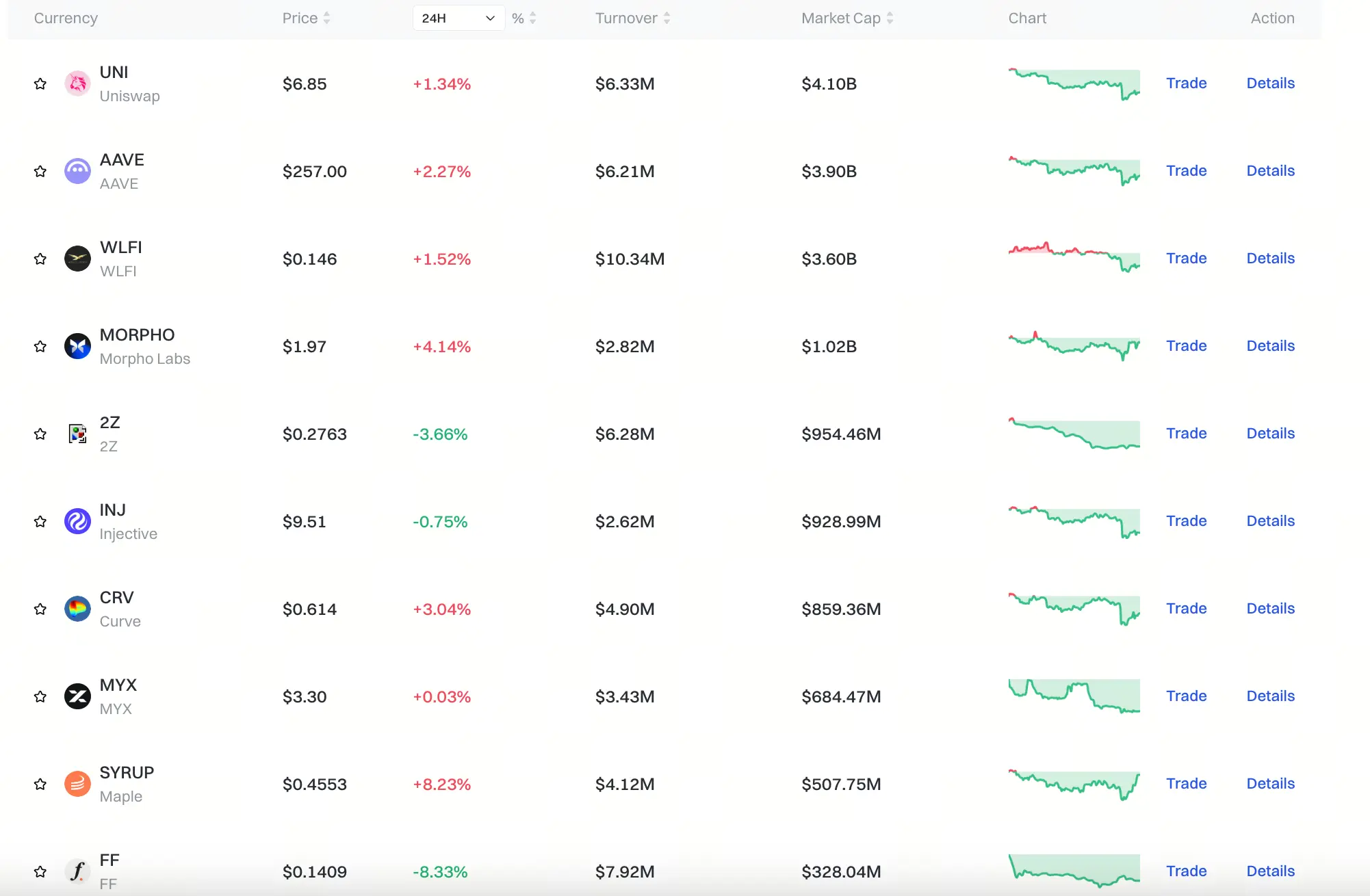

According to the data on the Gate market page, the price performance of the top ten tokens in the DeFi zone is as follows:

(Source: Gate DeFi zone market)

As of October 15, the cryptocurrency market rebounded after a decline the previous day, with DeFi zone tokens mostly falling, specifically:

UNI is currently reported at 6.85 USD, with a 24-hour rise of 1.34%;

AAVE is currently priced at 257 USD, with a 24-hour rise of 2.27%;

WLFI is currently priced at 0.146 USD, with a 24-hour rise of 1.52%;

MORPHO is currently reported at 1.97 USD, with a 24-hour rise of 4.14%;

INJ is currently at 9.51 USD, with a 24-hour decrease of 0.75%;

MYX is currently reported at 3.3 USD, with a 24-hour rise of 0.03%;

CRV is currently priced at 0.614 USD, with a 24-hour rise of 3.04%;

SYRUP is currently priced at 0.4553 USD, with a 24-hour rise of 8.23%;

FF is currently reported at 0.1409 USD, with a 24-hour decline of 8.33%.

Market Trend Interpretation

Mainstream assets stabilize, DeFi market sentiment is recovering With Powell's speech easing market concerns over long-term tightening, risk asset sentiment rebounds. ETH rises above $4100, leading to a reallocation of funds in the LSD sector, with Lido and ETH.fi's TVL increasing by 1.05% and 2.23%, respectively, becoming the main players in this round of recovery.

DEX activity surges, Solana regains trading volume championship Solana DEX's 24-hour trading volume reached $6.078 billion, a rise of 44.6% compared to the previous day, surpassing Ethereum once again. Both HumidiFi and Meteora performed excellently, indicating that on-chain trading demand remains strong, suggesting that the market has returned to an active trading phase after a short-term risk aversion.

On-chain airdrop wave surges, user activity significantly increases Monad airdrop is officially open for collection, and Farcaster users can directly claim it, triggering activity among multi-chain users. Projects like Enso, Kinetiq, and Lighter have simultaneously started reward distribution, creating a multi-point resonance “airdrop effect,” which has increased on-chain interaction and liquidity demand in the short term.

The expansion of the protocol ecosystem is evident, and infrastructure is迎来新的创新动力 Uniswap founder Hayden Adams emphasized the market structure advantages of DEX's freedom to list tokens, while MetaMask's integration of Polymarket's prediction market functionality symbolizes the accelerated evolution of DeFi applications from liquidity tools to a comprehensive Web3 ecosystem.

Funding structure stabilizes, token market shows significant differentiation DeFi zone tokens generally saw a slight rebound, with UNI, AAVE, WLFI, CRV, and others recording gains, and SYRUP rising by 8.23%, becoming a highlight. However, FF and INJ continue to decline, indicating that the zone's recovery is still in a structural phase, and short-term funds are more focused on assets with event-driven or yield logic.

Analyst Views

Market pullback appears to be ending, stability of mainstream protocols is strengthening Multiple analysts point out that although DeFi TVL still declined on the day, the relative stability of mainstream protocols like Lido and Aave indicates that bottom funds are accumulating. Ethereum's return to the $4100 mark is seen as an important support for sentiment recovery.

Solana ecosystem's strong rebound may trigger cross-chain capital flow Solana's volume surpassing Ethereum means liquidity is flowing back to high-performance public chains. Protocols like HumidiFi and Meteora have become new focal points, and analysts believe this will drive some Ethereum DeFi users to participate across chains, promoting ecological complementarity.

Airdrop frenzy becomes the short-term mainline, user retention is key From Monad, Kinetiq to Lighter, the acceleration of airdrop rhythms has become a direct driving force for the rise in Decentralized Finance activity. However, analysts warn that without continued incentives and lock-up designs, this enthusiasm may be difficult to maintain in the long term.

Institutional interest is rising, and on-chain infrastructure remains the core value The integration of MetaMask and Polymarket indicates that DeFi is no longer limited to trading and lending, but is moving towards “application layer integration.” Analysts believe this will further solidify the ecological barrier for Ethereum projects in long-term competition.

Conclusion The DeFi market has demonstrated structural resilience during the correction in mid-October. Although funds remain cautious, protocol innovation, cross-chain liquidity, and Airdrop incentives are rekindling interest. If mainstream assets continue to stabilize, the DeFi zone is expected to see a turning point in net capital inflows in the coming week.