Coin release this week unlocks 82 million coins! RSI drops below 30 indicating oversold, CEX listing becomes a lifeline

February 9th, Pi Coin temporarily reports $0.1448, close to the low of $0.1305. This week, 82 million tokens (1.1 million) will be unlocked, bringing the total unlocks for February to 206 million tokens. Validator rewards are adding pressure in March. Market rumors suggest Pi Coin will initiate a new round of CEX listings, but the official has not confirmed any news yet. Pi Coin’s RSI is below 30, indicating oversold conditions, with a break below the $0.1520 support level.

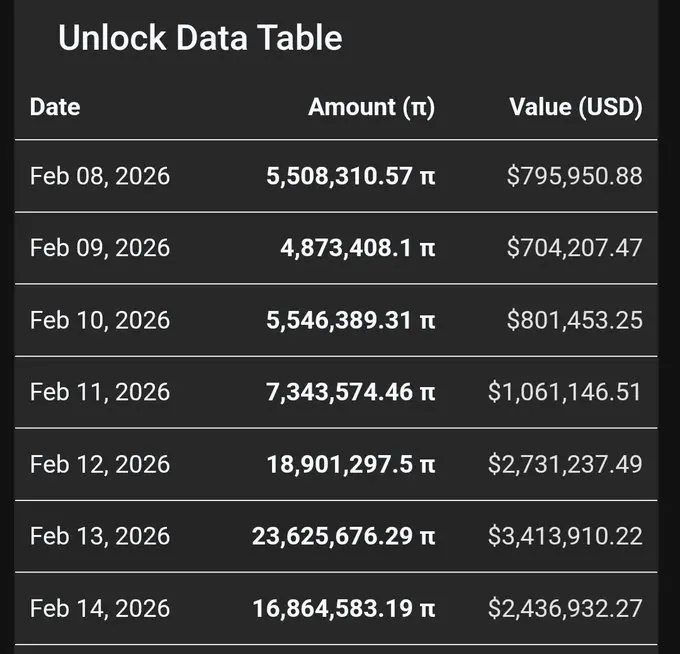

Pi Coin 206 Million Unlock Wave Approaching

(Source: X)

This week, Pi Coin tokens may face pressure as over 82 million tokens are set to unlock within the next seven days. Based on current prices, these tokens are worth over $11 million. These tokens are part of the 206 million tokens unlocked this month. Token unlocks pose risks for cryptocurrencies because they increase circulating supply. Without growing demand, a surge in supply will inevitably put downward pressure on prices.

The weekly unlock of 82 million tokens is among the largest in Pi Coin’s history. This adds approximately 11.7 million tokens daily, equivalent to a potential sell pressure of about $1.67 million per day entering the market. If holders choose to sell immediately, the market needs an equal amount of buy-side support to maintain stability. However, in the current bearish market sentiment, additional buy volume is very limited, making supply-demand imbalance almost inevitable.

The monthly unlock of 206 million tokens is unprecedented. This accounts for a significant proportion of Pi Coin’s current circulating supply. Assuming a market cap of $1.4 billion and a current price of $0.145, the circulating supply is approximately 966 million tokens, with 206 million representing about 2.1%. A 2% increase in supply in a single month is a huge pressure for any crypto asset, especially amid shrinking market demand.

Overview of February Unlock Pressure

Weekly unlock: 82 million tokens (worth $11 million)

Monthly total unlock: 206 million tokens, about 2.1% of circulating supply

Daily supply increase: approximately 11.7 million tokens ($1.67 million)

Current daily trading volume: below $1.67 million may be unable to absorb sell pressure

Pi Coin’s supply will also increase significantly in March, as the team will distribute validator rewards. They recently stated that the design is complete and testing is underway, with an official launch expected in March. While many validators will hold their tokens, some may sell, leading to a gradual decline in price over time. This ongoing unlock pressure for several months makes it difficult for Pi Coin to establish a sustained upward trend.

The scale of validator rewards has not yet been announced, but according to Pi Coin’s economic model, this portion could constitute a significant part of the total supply. If validator rewards reach hundreds of millions of tokens, combined with the 206 million unlocks in February, Pi Coin could face an addition of over 500 million tokens in the first quarter. Without corresponding demand growth, this flood of supply almost guarantees continued price decline.

CEX Listing as the Last Hope but Timing Uncertain

On the positive side, Pi Network has gained a key catalyst: it has been included in the roadmap for listing on mainstream CEXs. The exchange is the second-largest crypto exchange in the US after Coinbase, making Pi Coin’s listing on it undoubtedly good news. Usually, this is the first step for tokens to be listed on exchanges.

The importance of CEX listing lies in liquidity and user reach. Major exchanges have millions of users and deep liquidity; once listed, trading volume and exposure will increase exponentially. For tokens like Pi Coin, which are mainly traded on smaller exchanges, landing on a large CEX could be a crucial step from fringe to mainstream. Additionally, large exchanges tend to have strict listing reviews, and being listed is a form of endorsement for the project.

However, timing is critical. If Pi Coin is listed during the peak of the February unlock, the new liquidity might be absorbed by sell pressure, failing to provide effective price support. Ideally, listing would occur after unlock pressures have eased and market sentiment stabilizes, allowing new buy support to truly push prices higher. But exchange listing schedules are often beyond the project’s control; if the timing is poor, the positive news may turn into “buy the rumor, sell the news.”

Historically, many tokens experience a “pump at listing” pattern. Early holders and project teams often sell into the increased liquidity and attention, while retail investors FOMO in at high prices, leading to subsequent declines. If Pi Coin lists during the unlock peak, this risk will be amplified.

Market expectations for CEX listing may already be priced into the current price. “Buy the rumor, sell the news” is a well-known crypto market pattern. When rumors circulate, speculators buy early; when the listing is officially announced, they take profits. The current price of Pi Coin may already reflect optimistic expectations for the listing, and actual listing could trigger disappointment-driven sell-offs.

RSI Below 30 Oversold but Technicals Fully Bearish

(Source: Trading View)

The daily chart shows that Pi Coin’s price has been under continuous pressure for months. Recently, it broke below the key support at $0.1520, which was also its previous low. The price has been below the 50-day and 100-day exponential moving averages, as well as below the Supertrend indicator, signaling a strong bearish trend.

The Supertrend indicator, based on ATR (Average True Range), is a trend-following tool. When the price is below the indicator, it indicates a clear downtrend. Pi Coin is also below the 50 EMA, 100 EMA, and Supertrend, creating a rare confluence of multiple bearish signals, often indicating a sustained downward trend.

On the positive side, the coin is severely oversold, with the Relative Strength Index (RSI) continuously below 30. The most likely scenario is that the price will fluctuate within this zone this week. If the price breaks above the critical resistance at $0.1520, the bearish outlook will be invalidated, opening larger upside potential. RSI below 30 is an extreme oversold signal, historically often preceding a short-term rebound.

However, oversold conditions do not guarantee an immediate bounce. In a strong downtrend, RSI can remain in the 20-30 range for a long time. Pi Coin needs some catalyst (such as official CEX listing announcement, unlock completion, or major application deployment) to reverse the current technical structure. Relying solely on oversold rebounds may have limited strength and be difficult to sustain.

Pi Network’s price on Sunday was $0.1450, slightly above the historical low of $0.1305. It has fallen over 90% from its all-time high, wiping out billions of dollars in market value. This sharp decline of over 90% is not uncommon in crypto, but for a project with tens of millions of users, this collapse severely damages community confidence. Many early supporters may have already exited in disappointment.

For current investors considering entry, Pi Coin presents high risk and uncertainty. Unlock pressures, bearish technicals, and lack of fundamental highlights are all negative factors. The only potential positives are CEX listing and extreme oversold conditions possibly triggering a rebound. This asymmetric risk makes Pi Coin more suitable for small positions aiming for a rebound rather than heavy allocation.

Related Articles

Pi Network Issues Upgrade Reminder to Mainnet Node Operators — Key Deadline Looms

Pi Network Sets February 15 Deadline for Mandatory Mainnet Node Upgrade

Pi Network Enforces 2FA as Node Upgrade Deadline Nears

Pi Coin Price Pops 18% Ahead of Critical Mainnet Upgrade Deadline: Is a Breakout to $0.20 Next?

Pi Network Pushes Deeper Into Full Decentralization