Hyperliquid (HYPE) Leads Perp Volume — Is More Upside Ahead?

Key Takeaways

-

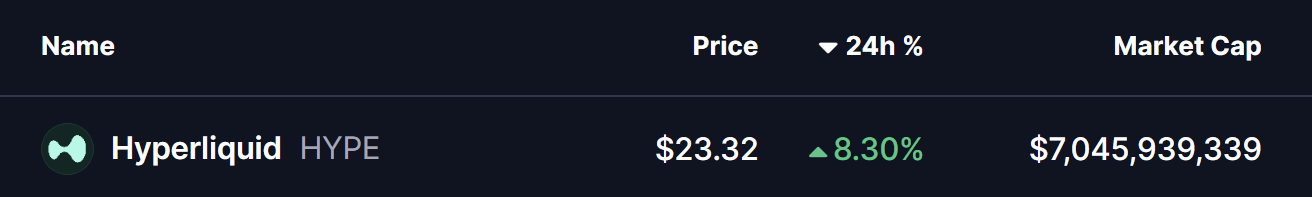

Hyperliquid (HYPE) surged over 8%, reclaiming the $23.30 level amid rising market interest.

-

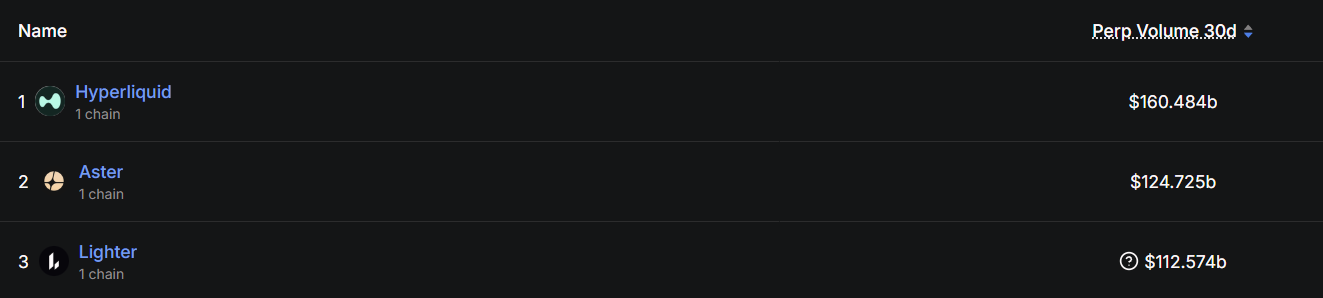

DefiLlama data shows Hyperliquid leading perpetual futures volume over the last 30 days, topping $160 billion.

-

Strong derivatives activity suggests sustained trader demand and growing ecosystem traction.

-

The daily chart highlights a Bearish Shark harmonic pattern, allowing room for short-term upside.

Hyperliquid’s native token, HYPE, is back in the spotlight today after posting a 8%+ price jump, pushing above the $23.30 level. While the price move itself has caught traders’ attention, a deeper look at on-chain metrics and the daily chart suggests there may be more developing beneath the surface.

Source: Coinmarketcap

Hyperliquid (HYPE) Leads Perp Volume

According to DefiLlama data, **Hyperliquid **has emerged as the **top perpetual futures **platform by trading volume over the last 30 days, significantly outperforming its closest competitors. The protocol recorded approximately $160.4 billion in perpetual volume, comfortably ahead of Aster and Lighter, which logged around $124.7 billion and $112.5 billion, respectively.

Source: Defillama

This surge in activity highlights growing trader preference for Hyperliquid’s ecosystem, signaling strong demand, deep liquidity, and sustained engagement. Historically, rising derivatives volume often acts as a leading indicator for increased interest in a project’s native token — something that appears to be playing out in HYPE’s recent price action.

Is More Upside Ahead?

From a technical perspective, HYPE’s daily chart reveals the development of a Bearish Shark harmonic pattern, a well-known formation in technical analysis. While this pattern ultimately suggests a potential reversal once fully completed, it often allows for short-term bullish continuation as price moves toward the “C” point.

Following the completion of the O-X-A-B structure, HYPE is currently trading around $23.26, holding above its recent lows. The next key challenge for bulls lies at the 50-day moving average near $25.72, which has acted as a dynamic resistance zone.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

A decisive daily close above the 50-day MA ($25.72) would strengthen the recovery narrative and could open the door for a broader upside move. If momentum continues to build, the chart projects a potential advance toward the C-point near $38.72, aligning with the Shark pattern’s 1.13 Fibonacci extension.

However, downside risks remain. A failure to hold the B-point support zone would invalidate the bullish continuation setup and could expose HYPE to extended consolidation or further downside pressure in the near term.

Bottom Line

HYPE’s price rebound is being backed by strong on-chain fundamentals, with Hyperliquid clearly dominating the perpetual trading landscape. While the broader harmonic structure suggests caution in the longer term, short-term technicals still favor a recovery move as long as key support levels remain intact. All eyes now remain on the $25.72 reclaim, which could act as the trigger for the next leg higher.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Sui Price Sees Modest Growth as Grayscale’s $GSUI ETF Nears Launch

Weekly Strategy Report February 20, 2026

Bitcoin futures open interest plummets 55%, marking the largest decline in nearly three years

Glassnode: Bitcoin recently repeatedly surged past $70,000, with weak liquidity putting pressure on the rebound

HYPE Token Faces Critical Crossroads After Significant Decline

Interest in "Bitcoin to 0" hits a peak on Google Trends