Post content & earn content mining yield

placeholder

MrFlower_

#ETHUnderPressure Ethereum is currently facing mounting pressure as multiple macro, on-chain, and ecosystem-specific forces converge. While ETH remains the backbone of DeFi, NFTs, and smart contract infrastructure, short- to mid-term headwinds are becoming increasingly visible. The challenge for Ethereum right now is not a lack of relevance, but a temporary mismatch between strong fundamentals and constrained market conditions.

Macro Liquidity Tightness

Global liquidity remains tight as central banks continue to maintain restrictive monetary policies. In such an environment, risk assets like E

Macro Liquidity Tightness

Global liquidity remains tight as central banks continue to maintain restrictive monetary policies. In such an environment, risk assets like E

ETH2,45%

- Reward

- 3

- 2

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3943?ref=UVhNB1EM&ref_type=132

- Reward

- like

- Comment

- Repost

- Share

#加密市场回调

Crypto Market Pullback & Smart Position Management

The crypto market is once again experiencing a pullback, a phase that tests not only portfolios but also investor psychology. While price declines can create fear, they also reveal something more important: how well an investor manages their position during uncertainty.

Understanding the Pullback

A market pullback is a temporary correction after an upward move, not a structural collapse. In crypto, pullbacks are frequent and necessary. They flush out excessive leverage, cool overheated sentiment, and allow the market to reset before i

Crypto Market Pullback & Smart Position Management

The crypto market is once again experiencing a pullback, a phase that tests not only portfolios but also investor psychology. While price declines can create fear, they also reveal something more important: how well an investor manages their position during uncertainty.

Understanding the Pullback

A market pullback is a temporary correction after an upward move, not a structural collapse. In crypto, pullbacks are frequent and necessary. They flush out excessive leverage, cool overheated sentiment, and allow the market to reset before i

RWA4,73%

- Reward

- 1

- Comment

- Repost

- Share

loser

loser

Created By@GateUser-8e1712fd

Listing Progress

0.00%

MC:

$2.87K

Create My Token

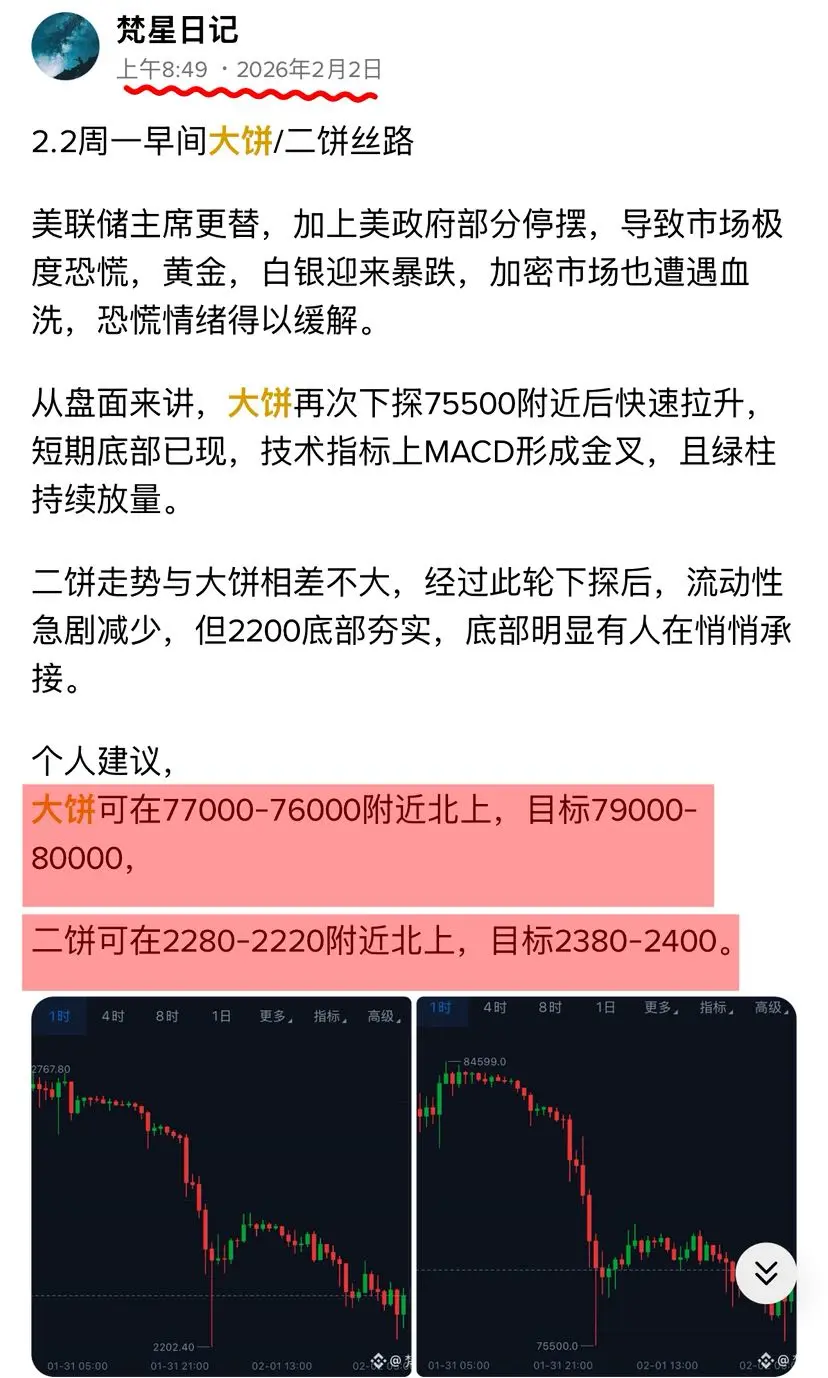

2.3 Tuesday Bitcoin Analysis

On the four-hour chart, the rebound is only a weak correction. From a technical perspective, although the price has risen above 78,000, the upper MA144 and MA169 moving averages form strong resistance. The rebound momentum has already weakened, with the MACD red histogram expanding at a slowing rate. The DIF and DEA lines are close to the moving average resistance zone, indicating that the bullish momentum is about to exhaust. In the short term, it is difficult to break through the 80,000 level. Support below at 77,000 is weak; if it falls below this, the price cou

On the four-hour chart, the rebound is only a weak correction. From a technical perspective, although the price has risen above 78,000, the upper MA144 and MA169 moving averages form strong resistance. The rebound momentum has already weakened, with the MACD red histogram expanding at a slowing rate. The DIF and DEA lines are close to the moving average resistance zone, indicating that the bullish momentum is about to exhaust. In the short term, it is difficult to break through the 80,000 level. Support below at 77,000 is weak; if it falls below this, the price cou

BTC1,84%

- Reward

- 1

- Comment

- Repost

- Share

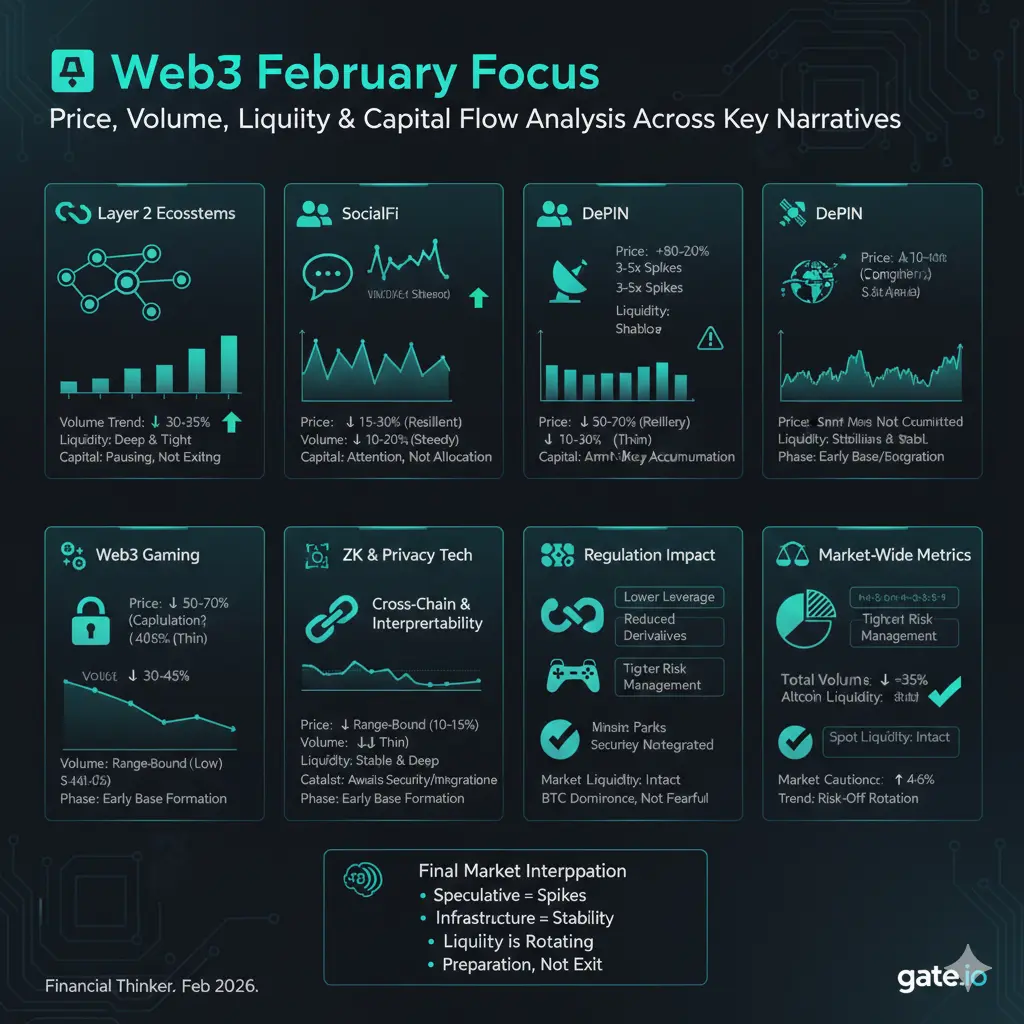

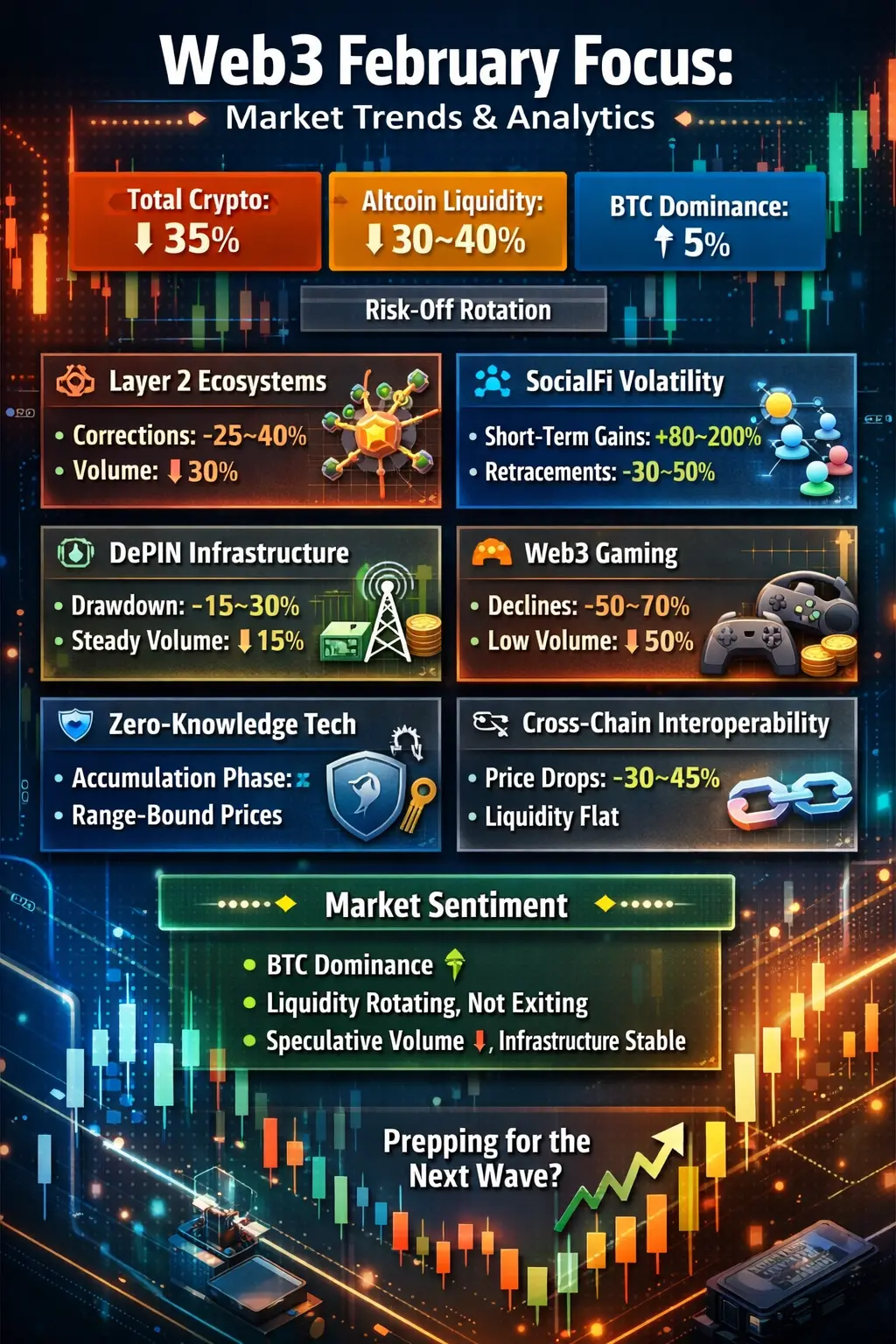

#Web3FebruaryFocus

📊 Web3 February Focus

🔗 1. Layer 2 Ecosystems: Liquidity Concentration Over Expansion

From a market perspective, Layer 2 tokens are showing relative strength vs the broader altcoin market, even during periods of BTC weakness.

Price behavior:

Most major L2 tokens have corrected 25–40% from recent local highs, which is less severe than mid-cap altcoins that dropped 45–60%.

Volume trend:

Spot volume across L2 tokens is down roughly 30–35% month-over-month, signaling consolidation rather than distribution.

Liquidity profile:

Liquidity remains deep on major venues (Gate.io inc

📊 Web3 February Focus

🔗 1. Layer 2 Ecosystems: Liquidity Concentration Over Expansion

From a market perspective, Layer 2 tokens are showing relative strength vs the broader altcoin market, even during periods of BTC weakness.

Price behavior:

Most major L2 tokens have corrected 25–40% from recent local highs, which is less severe than mid-cap altcoins that dropped 45–60%.

Volume trend:

Spot volume across L2 tokens is down roughly 30–35% month-over-month, signaling consolidation rather than distribution.

Liquidity profile:

Liquidity remains deep on major venues (Gate.io inc

- Reward

- 7

- 8

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

#Web3FebruaryFocus

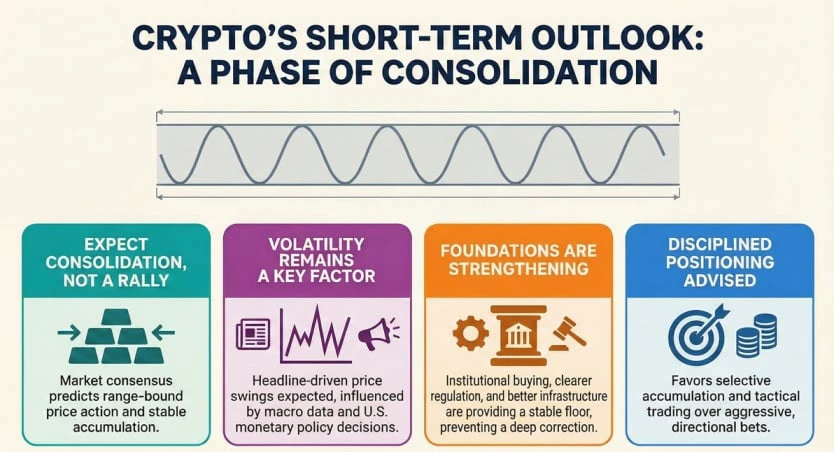

February represents a critical inflection point for the Web3 ecosystem, not because of a single headline event, but due to the convergence of multiple structural developments unfolding simultaneously. After months of rapid innovation, speculative cycles, and recent market deleveraging, the ecosystem is entering a phase where execution, sustainability, and real adoption matter more than short-term hype. This month should be viewed as a filtering period that separates narratives with long-term potential from those driven primarily by momentum. From a broader market perspectiv

February represents a critical inflection point for the Web3 ecosystem, not because of a single headline event, but due to the convergence of multiple structural developments unfolding simultaneously. After months of rapid innovation, speculative cycles, and recent market deleveraging, the ecosystem is entering a phase where execution, sustainability, and real adoption matter more than short-term hype. This month should be viewed as a filtering period that separates narratives with long-term potential from those driven primarily by momentum. From a broader market perspectiv

- Reward

- 3

- 4

- Repost

- Share

MrThanks77 :

:

Happy New Year! 🤑View More

#PreciousMetalsPullBack Markets are undergoing a sharp and synchronized correction across precious metals and cryptocurrencies after historic rallies in late 2025 and early January 2026. Gold briefly surged to around $5,595/oz, silver spiked near $121/oz, Bitcoin approached $90,000, and Ethereum traded above $3,000. As February begins, both asset classes have pulled back decisively. Importantly, this move reflects profit-taking, technical overextension, and macro repricing, rather than a breakdown of long-term bullish fundamentals.

A pullback is best understood as a temporary retracement after

A pullback is best understood as a temporary retracement after

- Reward

- 5

- 6

- Repost

- Share

MrThanks77 :

:

2026 GOGOGO 👊View More

🚨 #FedLeadershipImpact 🚨

The Fed’s leadership sets the tone for the global markets! 🌎📈

From interest rates to policy guidance, every move by the Fed Chair can shake markets, influence liquidity, and redefine investor sentiment. ⚡💹

💡 Key Insight:

Hawkish signals → Market volatility spikes, borrowing costs rise.

Dovish signals → Liquidity flows, risk assets surge.

Investors and traders, pay close attention — leadership at the Fed isn’t just about policy, it’s about market psychology. 🧠💥

📊 Pro Tip:

Watch speeches, minutes, and leadership shifts — these are your early warning systems for

The Fed’s leadership sets the tone for the global markets! 🌎📈

From interest rates to policy guidance, every move by the Fed Chair can shake markets, influence liquidity, and redefine investor sentiment. ⚡💹

💡 Key Insight:

Hawkish signals → Market volatility spikes, borrowing costs rise.

Dovish signals → Liquidity flows, risk assets surge.

Investors and traders, pay close attention — leadership at the Fed isn’t just about policy, it’s about market psychology. 🧠💥

📊 Pro Tip:

Watch speeches, minutes, and leadership shifts — these are your early warning systems for

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

Really inspiring post🔹 Bitcoin continues to probe lower, approaching a new 2025 low. Could panic be hiding a turning point?

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

Really inspiring post#WhaleActivityWatch: Why Smart Money Movements Matter More Than Ever in Crypto Markets

In the fast-moving world of cryptocurrency, few signals are as closely watched as whale activity. Whales—large holders of digital assets such as Bitcoin, Ethereum, or major altcoins—have the power to influence market direction through their trading behavior. Monitoring whale activity is no longer just an advanced strategy for institutional players; it has become a critical tool for retail traders who want to stay ahead of sudden price moves.

This is where #WhaleActivityWatch becomes essential.

Whales are ty

In the fast-moving world of cryptocurrency, few signals are as closely watched as whale activity. Whales—large holders of digital assets such as Bitcoin, Ethereum, or major altcoins—have the power to influence market direction through their trading behavior. Monitoring whale activity is no longer just an advanced strategy for institutional players; it has become a critical tool for retail traders who want to stay ahead of sudden price moves.

This is where #WhaleActivityWatch becomes essential.

Whales are ty

- Reward

- 1

- 1

- Repost

- Share

SheenCrypto :

:

Buy To Earn 💎BTC ETH XRP Markets Analysis

- Reward

- like

- Comment

- Repost

- Share

#AltcoinDivergence

Altcoin Divergence: Navigating a Split Crypto Market

The cryptocurrency market is currently showing a pronounced divergence among altcoins, even as Bitcoin and Ethereum demonstrate relative stability. While some digital assets maintain strength or post modest gains, a large subset is underperforming sharply. This divergence reflects a maturing crypto ecosystem, where capital is increasingly flowing into projects with strong fundamentals, liquidity, and real-world utility, while speculative or poorly supported tokens experience disproportionate pressure. The market is beginn

Altcoin Divergence: Navigating a Split Crypto Market

The cryptocurrency market is currently showing a pronounced divergence among altcoins, even as Bitcoin and Ethereum demonstrate relative stability. While some digital assets maintain strength or post modest gains, a large subset is underperforming sharply. This divergence reflects a maturing crypto ecosystem, where capital is increasingly flowing into projects with strong fundamentals, liquidity, and real-world utility, while speculative or poorly supported tokens experience disproportionate pressure. The market is beginn

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

Stay strong and HODL💎666

我创你来买

Created By@GateUser-cabdee6a

Listing Progress

0.00%

MC:

$0.1

Create My Token

How can I earn money? I still have no income. 😭😭😭

- Reward

- like

- Comment

- Repost

- Share

#加密市场观察 Golden Finance reports that Galaxy Research Director Alex Thorn posted on X platform stating that on-chain data, technical weakness at key price levels, macro uncertainties, and the lack of clear catalysts in the short term all indicate that BTC may continue to weaken over the coming weeks to months, potentially dropping to around the 200-week moving average.

Historically, these levels often serve as excellent entry points for long-term investors. From January 28 to January 31, Bitcoin declined a total of 15%, accelerating its downward move over the weekend. On Saturday alone, it fell

Historically, these levels often serve as excellent entry points for long-term investors. From January 28 to January 31, Bitcoin declined a total of 15%, accelerating its downward move over the weekend. On Saturday alone, it fell

BTC1,84%

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#MiddleEastTensionsEscalate

Geopolitical risks in the Middle East are intensifying, adding a fresh layer of uncertainty to global financial markets. Rising tensions are reshaping investor sentiment, driving volatility across commodities, currencies, and risk assets.

🌍 What’s Happening?

Escalating regional conflicts and diplomatic strains are increasing geopolitical risk premiums.

Energy-critical routes and infrastructure remain under close watch.

Global powers are closely involved, raising concerns about wider spillover risks.

📊 Market Impact So Far

Oil Prices: Supported by supply-disruptio

Geopolitical risks in the Middle East are intensifying, adding a fresh layer of uncertainty to global financial markets. Rising tensions are reshaping investor sentiment, driving volatility across commodities, currencies, and risk assets.

🌍 What’s Happening?

Escalating regional conflicts and diplomatic strains are increasing geopolitical risk premiums.

Energy-critical routes and infrastructure remain under close watch.

Global powers are closely involved, raising concerns about wider spillover risks.

📊 Market Impact So Far

Oil Prices: Supported by supply-disruptio

- Reward

- 3

- 3

- Repost

- Share

ybaser :

:

2026 Prosperity Prosperity😘View More

Yesterday, Silk Road completed perfect verification, and Bitcoin experienced a slight pullback, dropping below 3,800 points!

Ethereum is only one step away from the target, moving out of 240 points!

Ethereum is only one step away from the target, moving out of 240 points!

BTC1,84%

- Reward

- like

- Comment

- Repost

- Share

#TraditionalFinanceAcceleratesTokenization

One of the most consequential shifts in global finance is underway: traditional financial institutions are accelerating their embrace of tokenization, fundamentally reshaping how assets are issued, traded, settled, and accessed. What once was viewed as a niche application of blockchain technology has matured into a strategic priority for legacy banks, asset managers, regulators, and market infrastructure providers. The hashtag #TraditionalFinanceAcceleratesTokenization captures this transformation not as a speculative buzzword, but as a structural ev

One of the most consequential shifts in global finance is underway: traditional financial institutions are accelerating their embrace of tokenization, fundamentally reshaping how assets are issued, traded, settled, and accessed. What once was viewed as a niche application of blockchain technology has matured into a strategic priority for legacy banks, asset managers, regulators, and market infrastructure providers. The hashtag #TraditionalFinanceAcceleratesTokenization captures this transformation not as a speculative buzzword, but as a structural ev

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

Really inspiring post- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More383.43K Popularity

94 Popularity

123.4K Popularity

36.36K Popularity

6.76K Popularity

Hot Gate Fun

View More- MC:$2.87KHolders:10.00%

- MC:$2.87KHolders:10.00%

- MC:$0.1Holders:00.00%

- MC:$0.1Holders:10.00%

- MC:$2.87KHolders:10.00%

News

View MoreMarket Report: Top 5 Cryptocurrency Gainers on February 3, 2026, led by Stacks

1 m

Hong Kong hosts the International Criminal Police Organization Cyber Crime Experts Group Annual Meeting for the first time, covering topics such as virtual asset tracking

8 m

Delin Holdings: In January, mining output was 51.937 Bitcoin, with actual hash rate increasing to approximately 4.03 EH/s

9 m

Tria Announces TRIA Token Economics: 12% Will Be Distributed to Core Contributors

9 m

Bitwise CEO: Has increased Bitcoin holdings again

9 m

Pin