# GoldandSilverHitNewHighs

124.82K

Gold and silver reach record highs as investors seek safe havens amid geopolitical risks and weak dollar, withdrawing over $1.3B from Bitcoin ETFs toward precious metals and stocks. Bitcoin prices stagnate and decline, with its role as macro hedge questioned, causing significant shifts in capital flows.

Pin

Gate广场_Official

Gate Plaza|1/24–25 Weekend Exclusive Benefits Topic: #Gold and Silver Reach New Highs

🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

As risk aversion rises, precious metals surge strongly, spot gold breaks through $4,950/ounce, and silver surpasses $97/ounce. Did you catch this wave? Besides gold and silver, what other precious or non-ferrous metals have you invested in?

💡 Sample Post: I recently bought ___, current profit ___, main idea/reason is ___.

Share your precious metals gains or trading ideas in one sentence to participate i

View Original🎁 Post with the topic, 100 lucky posters * each receive $50 position experience voucher weekend benefits

As risk aversion rises, precious metals surge strongly, spot gold breaks through $4,950/ounce, and silver surpasses $97/ounce. Did you catch this wave? Besides gold and silver, what other precious or non-ferrous metals have you invested in?

💡 Sample Post: I recently bought ___, current profit ___, main idea/reason is ___.

Share your precious metals gains or trading ideas in one sentence to participate i

- Reward

- 23

- 16

- Repost

- Share

jkioo :

:

Silver has been even more "crazy" than gold in this round of performance, with its logic undergoing a fundamental reversal: • Rigid industrial demand: Silver is shifting from an investment asset to a core industrial material. The photovoltaic industry (especially high-silver-consuming HJT and TOPCon cell technologies) and AI servers' demand for high-performance conductive materials have led to a structural shortage of silver lasting 5-7 years.

• Supply rigidity: 70% of global silver is a byproduct of copper, lead, and zinc mining. Its production does not fluctuate rapidly with silver prices. This "inelastic supply" has caused intense short squeezes during demand surges.

3. Macroeconomic environment and credit hedging

• Central banks' fervent gold purchases: Central banks (such as Poland and global monthly gold purchase forecasts by Goldman Sachs) continue to buy large amounts to hedge geopolitical risks and optimize foreign exchange reserves, providing a solid floor for gold prices.

• US dollar credit concerns: Policy uncertainties after the US elections and market worries about the independence of the Federal Reserve have weakened the appeal of US Treasuries and the dollar, leading to large capital flows into physical assets.

View More

$BTC is sitting near $82,500, after breaking down from the $88,000–90,000 support zone. Sellers are strong right now and dips are getting sold fast. This is a make-or-break area — a bounce could bring relief, but losing this level may open the door to deeper downside.

$BTC #PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta #GoldandSilverHitNewHighs #TokenizedSilverTrend

$BTC #PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta #GoldandSilverHitNewHighs #TokenizedSilverTrend

BTC-1,77%

- Reward

- like

- Comment

- Repost

- Share

Gold, Silver, and Crypto — What Happens If the U.S. Government Shuts Down?

Right now, prediction markets like Polymarket are showing a high chance (around 80%) that the U.S. government could shut down. That’s making investors nervous — and when uncertainty rises, money usually flows into safe assets like Gold, and increasingly, Bitcoin.

Let’s break down what this could mean for Gold, Silver, and Crypto, both if a shutdown happens and if it doesn’t.

---

If the U.S. Government Shutdown Happens

Gold: Likely to Rise

Gold usually performs well when:

Governments look unstable

Investors lose confiden

Right now, prediction markets like Polymarket are showing a high chance (around 80%) that the U.S. government could shut down. That’s making investors nervous — and when uncertainty rises, money usually flows into safe assets like Gold, and increasingly, Bitcoin.

Let’s break down what this could mean for Gold, Silver, and Crypto, both if a shutdown happens and if it doesn’t.

---

If the U.S. Government Shutdown Happens

Gold: Likely to Rise

Gold usually performs well when:

Governments look unstable

Investors lose confiden

- Reward

- 5

- 6

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.View More

#GoldandSilverHitNewHighs #GoldandSilverHitNewHighs 🥇🌍📈

When both gold and silver break higher, it’s not coincidence — it’s capital speaking.

This move isn’t about a single candle or short-term fear. It’s about rotation.

While equities chop and crypto digests recent volatility, money is quietly finding shelter in hard assets. Gold printing new highs suggests growing skepticism around fiat stability and long-term policy direction.

Silver joining the move adds another layer. Historically, silver strength after gold isn’t just defensive — it often signals rising market volatility and shifting

When both gold and silver break higher, it’s not coincidence — it’s capital speaking.

This move isn’t about a single candle or short-term fear. It’s about rotation.

While equities chop and crypto digests recent volatility, money is quietly finding shelter in hard assets. Gold printing new highs suggests growing skepticism around fiat stability and long-term policy direction.

Silver joining the move adds another layer. Historically, silver strength after gold isn’t just defensive — it often signals rising market volatility and shifting

- Reward

- 10

- 14

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#GoldandSilverHitNewHighs The Breakout Breakdown: Precious Metals Go Parabolic

Gold:

· New All-Time High: $2,485/oz (up 18% YTD)

· Key breakout: Cleared 2020 resistance at $2,075 decisively

· Next target: $2,500 psychological, then $2,600 Fibonacci extension

Silver:

· 11-Year High: $32.16/oz (up 28% YTD)

· Significance: First time above $30 since 2013's taper tantrum

· Gold/Silver ratio: Dropping to 77 (from 92 in February) - silver outperforming

What's Driving This:

1. Central bank buying spree: 1,037 tonnes in 2023, continuing into 2024 (China leading)

2. ETF inflows: Largest weekly gold ETF

Gold:

· New All-Time High: $2,485/oz (up 18% YTD)

· Key breakout: Cleared 2020 resistance at $2,075 decisively

· Next target: $2,500 psychological, then $2,600 Fibonacci extension

Silver:

· 11-Year High: $32.16/oz (up 28% YTD)

· Significance: First time above $30 since 2013's taper tantrum

· Gold/Silver ratio: Dropping to 77 (from 92 in February) - silver outperforming

What's Driving This:

1. Central bank buying spree: 1,037 tonnes in 2023, continuing into 2024 (China leading)

2. ETF inflows: Largest weekly gold ETF

- Reward

- 14

- 13

- Repost

- Share

Unoshi :

:

Thanks for informationView More

#GoldandSilverHitNewHighs Gold and Silver Reach Record Highs — What It Means for Markets and Investors

Gold and silver have surged to new all-time highs, signaling a powerful return of safe-haven demand across global markets. As volatility increases across equities, crypto, and currencies, investors are once again rotating capital into precious metals — reaffirming their long-standing role as stores of value and defensive portfolio assets.

This rally is not driven by speculation alone. It reflects deeper structural concerns surrounding inflation persistence, geopolitical uncertainty, and fragi

Gold and silver have surged to new all-time highs, signaling a powerful return of safe-haven demand across global markets. As volatility increases across equities, crypto, and currencies, investors are once again rotating capital into precious metals — reaffirming their long-standing role as stores of value and defensive portfolio assets.

This rally is not driven by speculation alone. It reflects deeper structural concerns surrounding inflation persistence, geopolitical uncertainty, and fragi

- Reward

- 12

- 6

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

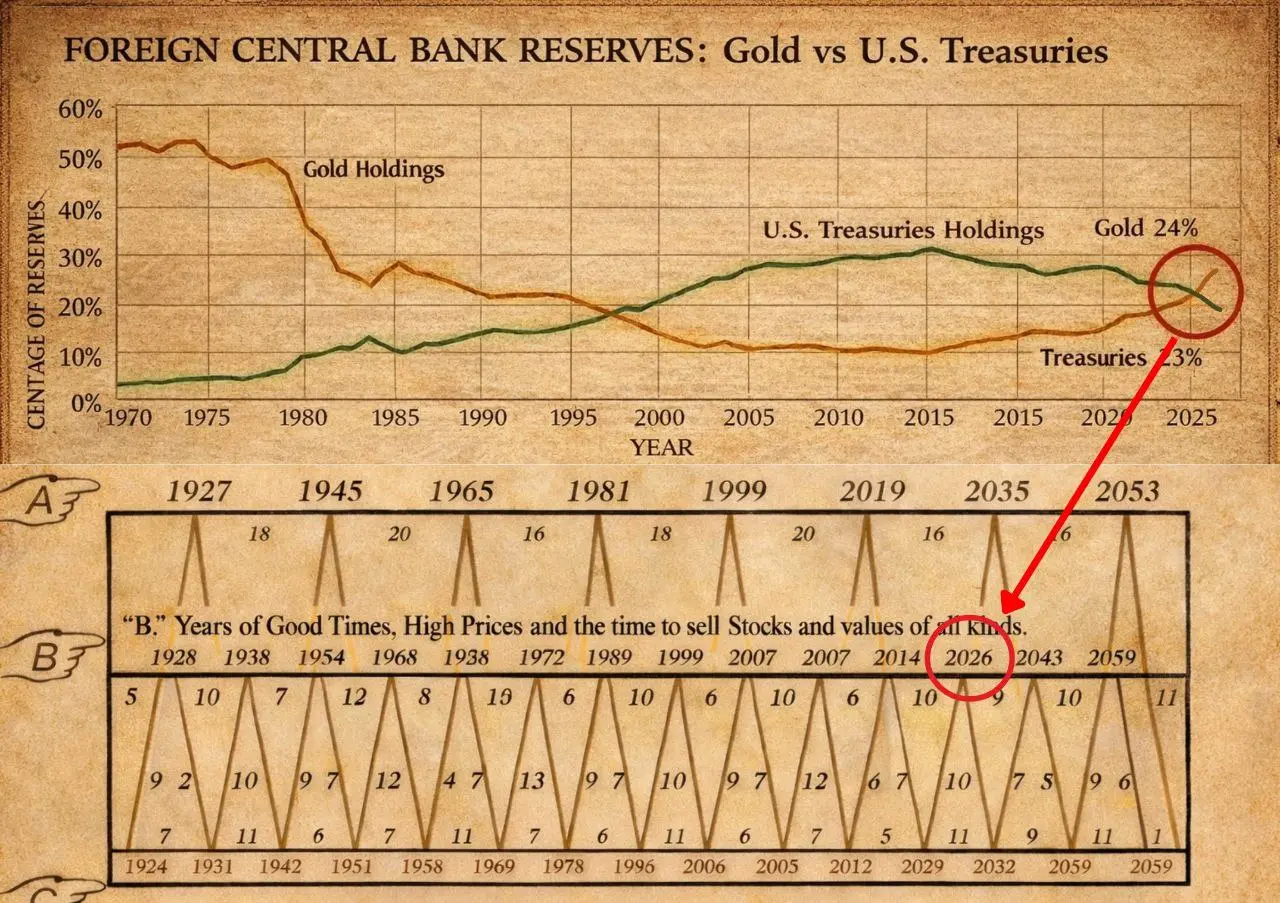

#GoldandSilverHitNewHighs

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 14

- 13

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs A New Chapter in the Transformation of Global Value

As 2026 unfolds, gold and silver are no longer moving solely in response to short-term fear or economic uncertainty. Their sustained upward trajectory reflects a structural shift in the global financial, technological, and geopolitical order, signaling a profound reassessment of what constitutes reliable value in a rapidly evolving world.

Gold is advancing steadily toward the $5,000 per ounce level, a region once considered extreme or speculative. This rise is not fueled by hype but by a growing erosion of confidenc

As 2026 unfolds, gold and silver are no longer moving solely in response to short-term fear or economic uncertainty. Their sustained upward trajectory reflects a structural shift in the global financial, technological, and geopolitical order, signaling a profound reassessment of what constitutes reliable value in a rapidly evolving world.

Gold is advancing steadily toward the $5,000 per ounce level, a region once considered extreme or speculative. This rise is not fueled by hype but by a growing erosion of confidenc

- Reward

- 5

- 4

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs The "Supercycle" Question

The data suggests we are in the early stages of a commodity supercycle. While gold and silver have hit all-time highs, broad investor allocation to commodities (excluding metals) remains historically low. This suggests the rally could broaden into other raw materials as the year progresses.

Peer-to-Peer Check: You mentioned Bitcoin stabilizing. We’re actually seeing that "dual safe-haven" narrative play out right now. BTC and Gold are increasingly being held in the same "store of value" bucket by institutional desks, even if their daily cor

The data suggests we are in the early stages of a commodity supercycle. While gold and silver have hit all-time highs, broad investor allocation to commodities (excluding metals) remains historically low. This suggests the rally could broaden into other raw materials as the year progresses.

Peer-to-Peer Check: You mentioned Bitcoin stabilizing. We’re actually seeing that "dual safe-haven" narrative play out right now. BTC and Gold are increasingly being held in the same "store of value" bucket by institutional desks, even if their daily cor

BTC-1,77%

- Reward

- 16

- 14

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

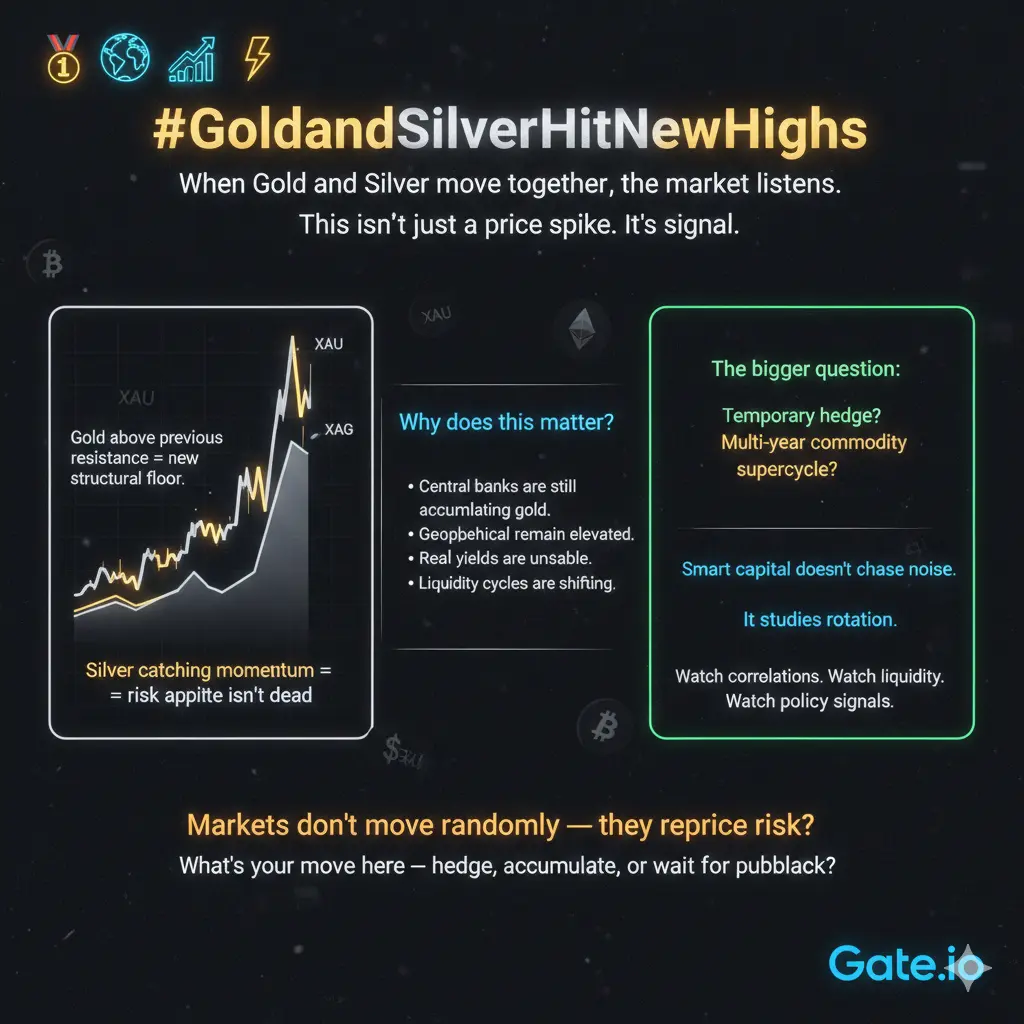

#GoldandSilverHitNewHighs 🥇🌍📈⚡

When Gold and Silver move together, the market listens.

#GoldandSilverHitNewHighs

This isn’t just a price spike.

It’s a signal.

While equities fluctuate and crypto consolidates, capital is quietly rotating into hard assets. Gold pushing new highs confirms one thing: confidence in fiat stability is being questioned again.

Silver following the breakout makes it even more interesting.

Historically, when silver accelerates after gold, volatility across broader markets tends to increase.

Why does this matter?

• Central banks are still accumulating gold.

• Geopoliti

When Gold and Silver move together, the market listens.

#GoldandSilverHitNewHighs

This isn’t just a price spike.

It’s a signal.

While equities fluctuate and crypto consolidates, capital is quietly rotating into hard assets. Gold pushing new highs confirms one thing: confidence in fiat stability is being questioned again.

Silver following the breakout makes it even more interesting.

Historically, when silver accelerates after gold, volatility across broader markets tends to increase.

Why does this matter?

• Central banks are still accumulating gold.

• Geopoliti

XAG3L-0,6%

- Reward

- 13

- 18

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

197.03K Popularity

282 Popularity

396 Popularity

5.18K Popularity

176 Popularity

30.27K Popularity

116 Popularity

20 Popularity

53.33K Popularity

24 Popularity

28 Popularity

9.55K Popularity

1.57K Popularity

16.97K Popularity

7.48K Popularity

News

View MoreNew Wallet Deposits 1.98M USDC to HyperLiquid for Leveraged ETH Long Position

9 m

Chainlink Co-Founder Discusses the Current State of Cryptocurrency: No Major Systemic Risks Have Emerged, and the Trend of Asset On-Chain Is Accelerating

15 m

The US Solana spot ETF experienced a total net outflow of $15,000 in a single day.

19 m

Data: If BTC drops below $66,092, the total long liquidation strength on major CEXs will reach $1.281 billion.

20 m

Data: If ETH breaks through $2,168, the total liquidation strength of long positions on mainstream CEXs will reach $698 million.

20 m

Pin