# BuyTheDipOrWaitNow?

311.61K

EagleEye

#BuyTheDipOrWaitNow?

The market is asking a deceptively simple question right now: Buy the dip, or wait for confirmation? Behind that question sits a far more complex reality. Solana is trading in a compressed range after sustained macro pressure, and participants are split between those seeing opportunity and those seeing unresolved risk. This is not a euphoric breakout phase, nor is it a full capitulation event. It is a tension zone the type of environment where positioning decisions matter more than predictions.

Solana is currently consolidating between strong horizontal support in the hi

The market is asking a deceptively simple question right now: Buy the dip, or wait for confirmation? Behind that question sits a far more complex reality. Solana is trading in a compressed range after sustained macro pressure, and participants are split between those seeing opportunity and those seeing unresolved risk. This is not a euphoric breakout phase, nor is it a full capitulation event. It is a tension zone the type of environment where positioning decisions matter more than predictions.

Solana is currently consolidating between strong horizontal support in the hi

SOL2,08%

- Reward

- 5

- 6

- Repost

- Share

GateUser-37edc23c :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

🔥 #BuyTheDipOrWaitNow? — LIQUIDITY DECIDES, NOT EMOTION 🔥

Every pullback creates the same debate.

“Is this the bottom?”

Or

“Is this just the start of a deeper move?”

The answer isn’t emotional — it’s structural. Let’s break it down properly 👇

📉 1️⃣ Identify the Trend First

Before buying any dip, define the environment:

• Uptrend → Higher Highs & Higher Lows

• Downtrend → Lower Highs & Lower Lows

• Range → Liquidity sweeps both sides

Buying dips in an uptrend = continuation strategy.

Buying dips in a downtrend = counter-trend gamble.

Structure changes everything.

💧 2️

🔥 #BuyTheDipOrWaitNow? — LIQUIDITY DECIDES, NOT EMOTION 🔥

Every pullback creates the same debate.

“Is this the bottom?”

Or

“Is this just the start of a deeper move?”

The answer isn’t emotional — it’s structural. Let’s break it down properly 👇

📉 1️⃣ Identify the Trend First

Before buying any dip, define the environment:

• Uptrend → Higher Highs & Higher Lows

• Downtrend → Lower Highs & Lower Lows

• Range → Liquidity sweeps both sides

Buying dips in an uptrend = continuation strategy.

Buying dips in a downtrend = counter-trend gamble.

Structure changes everything.

💧 2️

- Reward

- 6

- 10

- Repost

- Share

repanzal :

:

thanks for shairing latest info with usView More

🚨ALERT: Bitcoin ETFs lost over $125M in outflows this week!

Big investors are pulling out. 📉 The market is watching closely.

Are you buying the dip or waiting it out? Drop your thoughts below! 👇

$BTC

#Bitcoin #BTC #CryptoUpdate #BuyTheDipOrWaitNow? #CryptoSurvivalGuide

Big investors are pulling out. 📉 The market is watching closely.

Are you buying the dip or waiting it out? Drop your thoughts below! 👇

$BTC

#Bitcoin #BTC #CryptoUpdate #BuyTheDipOrWaitNow? #CryptoSurvivalGuide

BTC1%

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? :

#BuyTheDipOrWaitNow? 🔥💰

Bitcoin (BTC) is around $67,900–$68,000 on February 21, 2026. It’s bounced 0.8–1.5% in the last 24 hours after dipping to mid-$66k, but it’s still down ~45–46% from the 2025 peak of $126k+. Fear is everywhere—this is not hype, it’s a real multi-week correction testing nerves.

Here’s what’s happening, simply:

1️⃣ Why Some Say “Buy the Dip Now”

History: BTC corrections of 30–80% often turn into huge long-term gains. Past halving cycles show dips are the best entry points.

Institutions: Big players are buying sub-$70k. Large wallets are adding whil

#BuyTheDipOrWaitNow? 🔥💰

Bitcoin (BTC) is around $67,900–$68,000 on February 21, 2026. It’s bounced 0.8–1.5% in the last 24 hours after dipping to mid-$66k, but it’s still down ~45–46% from the 2025 peak of $126k+. Fear is everywhere—this is not hype, it’s a real multi-week correction testing nerves.

Here’s what’s happening, simply:

1️⃣ Why Some Say “Buy the Dip Now”

History: BTC corrections of 30–80% often turn into huge long-term gains. Past halving cycles show dips are the best entry points.

Institutions: Big players are buying sub-$70k. Large wallets are adding whil

BTC1%

- Reward

- 24

- 17

- Repost

- Share

Korean_Girl :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow?

#BuyTheDipOrWaitNow 📉🚀

Market pullbacks always divide investors — some see fear, others see opportunity. The real question isn’t just “Is this the dip?” but “Does the asset still have strong fundamentals and long-term conviction?”

In volatile conditions, emotional decisions often cost more than the dip itself. Strategic investors analyze liquidity, macro sentiment, on-chain activity, and overall trend structure before deploying capital. Timing the exact bottom is nearly impossible — but positioning wisely with risk management is what separates professionals from impuls

#BuyTheDipOrWaitNow 📉🚀

Market pullbacks always divide investors — some see fear, others see opportunity. The real question isn’t just “Is this the dip?” but “Does the asset still have strong fundamentals and long-term conviction?”

In volatile conditions, emotional decisions often cost more than the dip itself. Strategic investors analyze liquidity, macro sentiment, on-chain activity, and overall trend structure before deploying capital. Timing the exact bottom is nearly impossible — but positioning wisely with risk management is what separates professionals from impuls

- Reward

- 1

- 1

- Repost

- Share

EagleEye :

:

"Year of the Horse Wealth Score" #BuyTheDipOrWaitNow? What Is the Next Target for Bitcoin? 🧐

#WhenIsBestTimetoEnterTheMarket $BTC

📅 21 February 2026

Bitcoin (BTC) is currently trading around $67,800–$68,000, showing a modest +0.8% to +1% gain in the last 24 hours. The intra-day range has been roughly $66,450 (low) – $68,270 (high), with trading volumes around $47–53B, indicating active participation despite volatility.

After hitting an all-time high near $126,000 in October 2025, Bitcoin has retraced about 46%, reflecting a classic post-bull market consolidation. This retracement is influenced by macro pressures, profit-tak

#WhenIsBestTimetoEnterTheMarket $BTC

📅 21 February 2026

Bitcoin (BTC) is currently trading around $67,800–$68,000, showing a modest +0.8% to +1% gain in the last 24 hours. The intra-day range has been roughly $66,450 (low) – $68,270 (high), with trading volumes around $47–53B, indicating active participation despite volatility.

After hitting an all-time high near $126,000 in October 2025, Bitcoin has retraced about 46%, reflecting a classic post-bull market consolidation. This retracement is influenced by macro pressures, profit-tak

BTC1%

- Reward

- 8

- 11

- Repost

- Share

ShainingMoon :

:

To The Moon 🌕View More

#BuyTheDipOrWaitNow? Future Outlook for Market Participants

Bitcoin is currently trading around the $67,900–$68,000 region after showing a small intraday rebound from the mid-$66k level. Despite the minor recovery, the asset remains roughly 45–46% below its 2025 peak near $126k+, reflecting a prolonged corrective phase that is testing both retail sentiment and long-term investor patience. The market atmosphere is dominated by extreme fear, which historically has often coincided with later accumulation opportunities rather than immediate reversals.

The argument for buying the dip is based on hi

Bitcoin is currently trading around the $67,900–$68,000 region after showing a small intraday rebound from the mid-$66k level. Despite the minor recovery, the asset remains roughly 45–46% below its 2025 peak near $126k+, reflecting a prolonged corrective phase that is testing both retail sentiment and long-term investor patience. The market atmosphere is dominated by extreme fear, which historically has often coincided with later accumulation opportunities rather than immediate reversals.

The argument for buying the dip is based on hi

BTC1%

- Reward

- 7

- 9

- Repost

- Share

EagleEye :

:

"Year of the Horse Wealth Score" View More

#BuyTheDipOrWaitNow?

The market is at a crossroads, and traders are asking the same question: Is this the right time to buy the dip, or should you wait for more clarity?

📊 Market Snapshot:

Volatility is high, short-term swings are sharp

Some altcoins and top cryptos showing signs of stabilization

Global economic factors and liquidity trends still influencing sentiment

💡 Trading Insights:

Buying the Dip: Can capture opportunities if the market rebounds, but timing and risk management are key

Waiting: Reduces exposure to further downside but might miss quick gains

Use stop-losses and position

The market is at a crossroads, and traders are asking the same question: Is this the right time to buy the dip, or should you wait for more clarity?

📊 Market Snapshot:

Volatility is high, short-term swings are sharp

Some altcoins and top cryptos showing signs of stabilization

Global economic factors and liquidity trends still influencing sentiment

💡 Trading Insights:

Buying the Dip: Can capture opportunities if the market rebounds, but timing and risk management are key

Waiting: Reduces exposure to further downside but might miss quick gains

Use stop-losses and position

- Reward

- 5

- 7

- Repost

- Share

EagleEye :

:

"Year of the Horse Wealth Score" View More

#BuyTheDipOrWaitNow? Solana at a Critical Inflection Point

Solana is trading inside a high-compression range, forcing traders to answer a difficult question: accumulate near support or wait for structural confirmation? Price is currently trapped between strong demand in the high-$70s and resistance in the low-$90s. This compression reflects equilibrium — but equilibrium rarely lasts long. When volatility contracts, expansion typically follows.

From a technical standpoint, the $76–$78 region has historically acted as structural demand. Buyers have defended this zone in prior cycles, making it a

Solana is trading inside a high-compression range, forcing traders to answer a difficult question: accumulate near support or wait for structural confirmation? Price is currently trapped between strong demand in the high-$70s and resistance in the low-$90s. This compression reflects equilibrium — but equilibrium rarely lasts long. When volatility contracts, expansion typically follows.

From a technical standpoint, the $76–$78 region has historically acted as structural demand. Buyers have defended this zone in prior cycles, making it a

SOL2,08%

- Reward

- 16

- 21

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

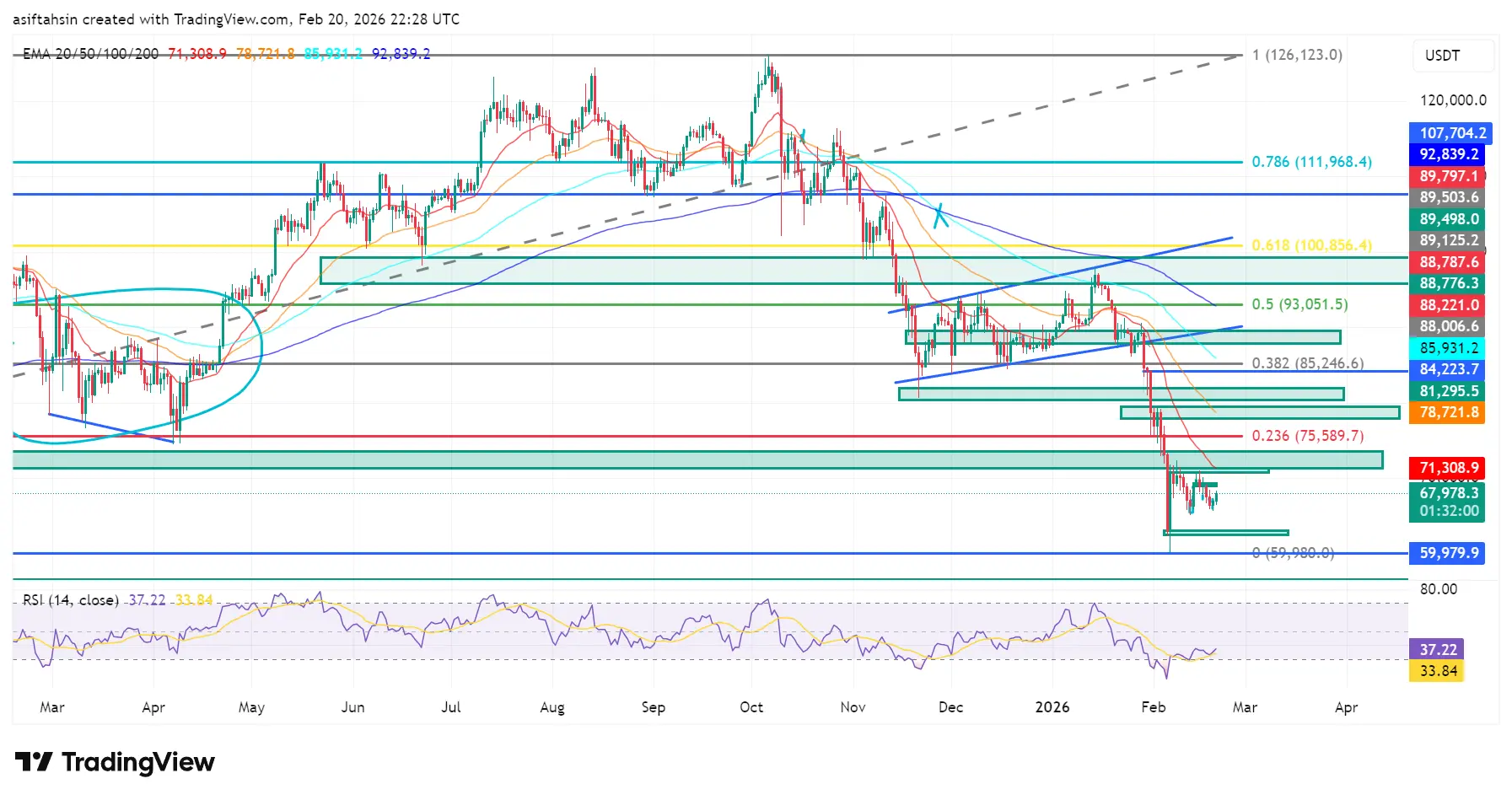

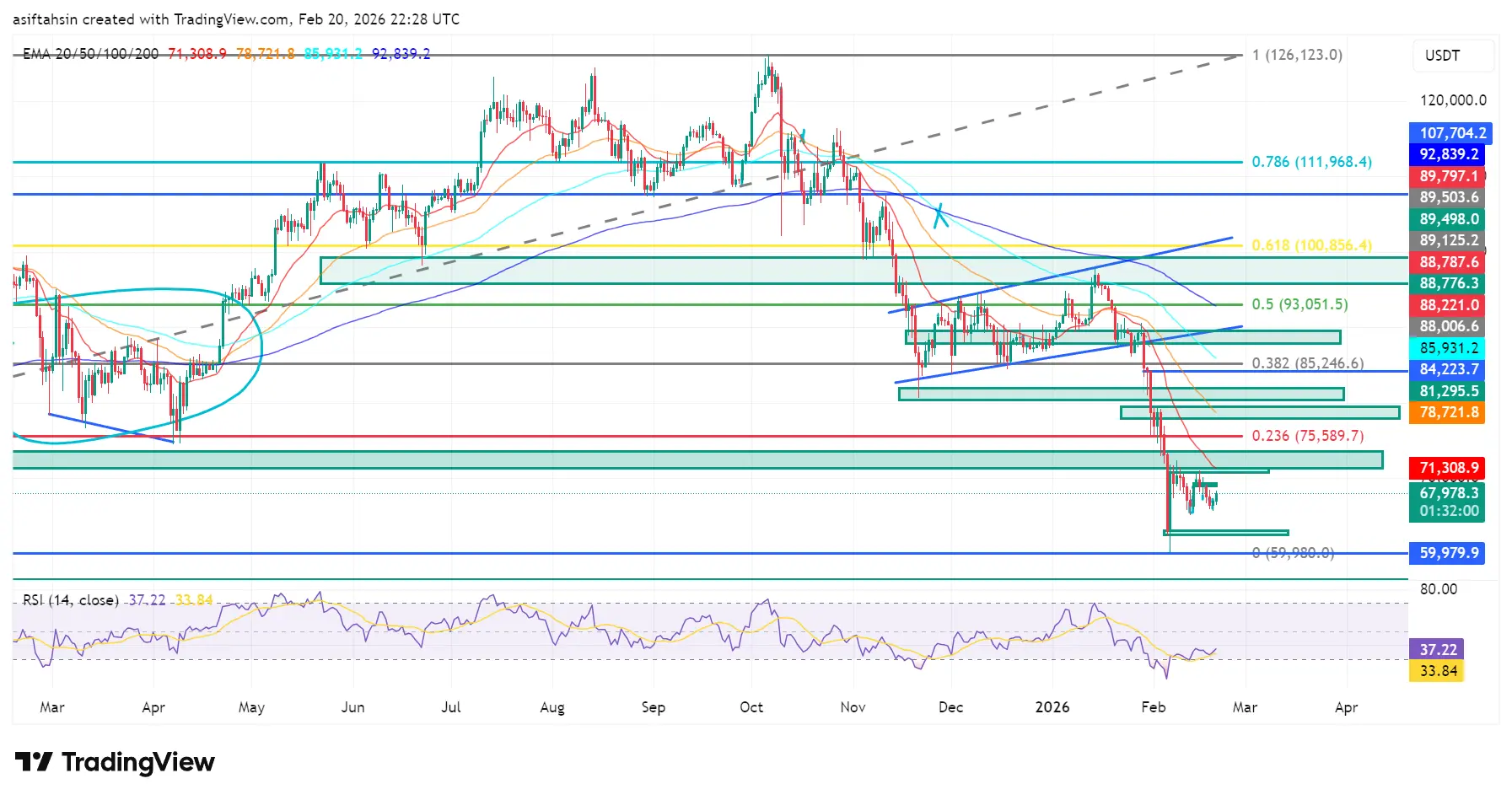

BTC Technical Outlook: Bitcoin Stabilizing Above Macro Support After Breakdown Below 0.236

Bitcoin remains in a broader corrective phase after failing to hold above the $93,000–$100,800 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($85,246) and then decisively below 0.236 ($75,589) confirmed structural weakness and triggered an accelerated decline toward macro support.

Price is now consolidating near $67,000–$71,000, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This area represents a major decision zone for BTC’s next directional move

Bitcoin remains in a broader corrective phase after failing to hold above the $93,000–$100,800 resistance cluster (0.5–0.618 Fibonacci zone).

The breakdown below 0.382 ($85,246) and then decisively below 0.236 ($75,589) confirmed structural weakness and triggered an accelerated decline toward macro support.

Price is now consolidating near $67,000–$71,000, forming a short-term base just above the macro Fibonacci 0 level at $59,980.

This area represents a major decision zone for BTC’s next directional move

BTC1%

- Reward

- 13

- 13

- Repost

- Share

CryptoChampion :

:

To The Moon 🌕View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

299.67K Popularity

95.45K Popularity

415.66K Popularity

112.8K Popularity

19.62K Popularity

311.61K Popularity

67.74K Popularity

613.78K Popularity

35.95K Popularity

33.95K Popularity

35.49K Popularity

29.9K Popularity

33.56K Popularity

61.51K Popularity

News

View MoreTrump: Raise global tariffs from 10% to 15%

2 m

Punch increased by 51.89% after launching Alpha, current price is 0.0386119409101489 USDT

24 m

The Bitcoin white paper is being exhibited at the New York Stock Exchange.

26 m

Bloomberg Analyst: The unique value of Bitcoin lies in its user-driven nature, along with its censorship resistance and anti-inflation properties.

36 m

OpenClaw Founder: There are still "AI companies" requesting phone discussions about Claw integration and will not insert random features into the core for exposure

58 m

Pin