#BitMineBuys40KETH

1. What is BitMine? Company Background

BitMine Immersion Technologies (ticker: BMNR on NYSE American) is a publicly traded company positioning itself as the world's leading Ethereum treasury firm. Chaired by Tom Lee (co-founder of Fundstrat Global Advisors, a prominent Wall Street crypto bull), BitMine focuses on long-term accumulation of Ethereum (ETH) as its primary reserve asset, similar to how MicroStrategy treats Bitcoin.

The firm pursues the "Alchemy of 5%" strategy: Aiming to own 5% of Ethereum's total circulating supply (currently around 120.7 million ETH) over time.

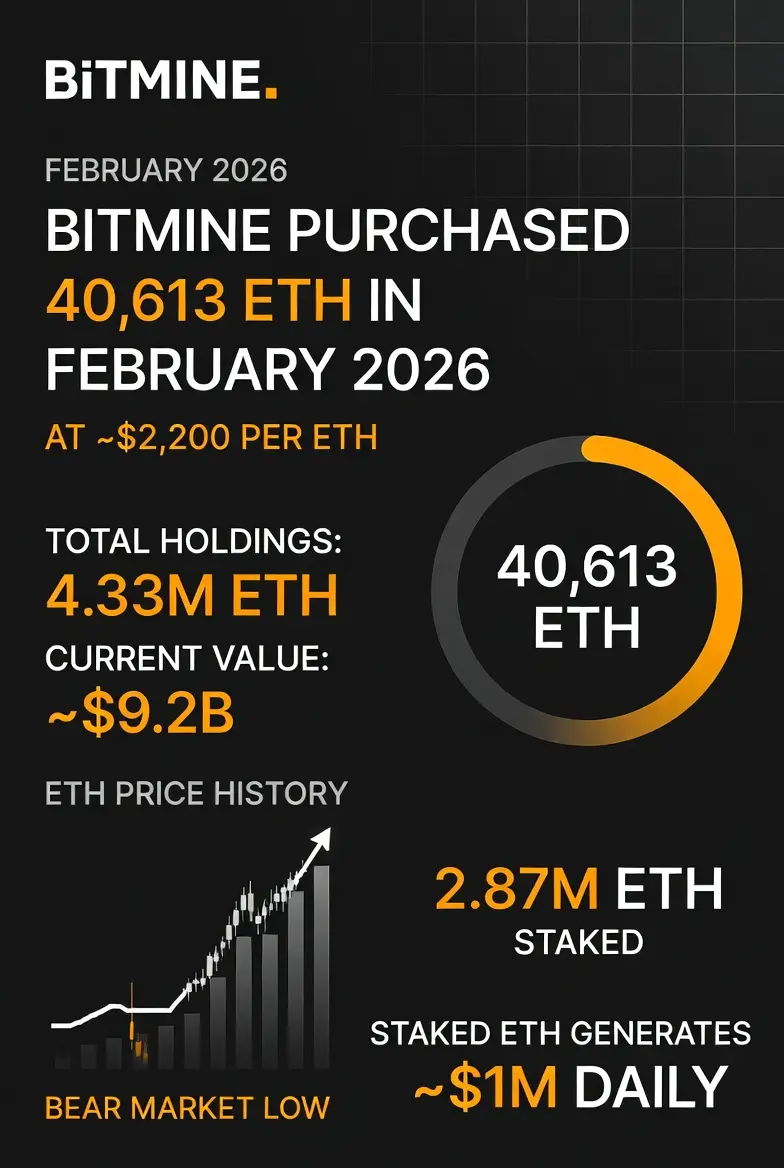

As of the most recent disclosures (February 8–10, 2026), BitMine holds approximately 4.325 million to 4.326 million ETH, representing about 3.58% of the total ETH supply — making it the largest known corporate holder of Ethereum by a wide margin.

Beyond ETH, holdings include small amounts of Bitcoin (~193 BTC), $595 million in cash, and "moonshot" investments like a $200 million stake in Beast Industries and ~$19 million in Eightco Holdings (ORBS).

Total assets (crypto + cash + investments) recently crossed $10 billion.

A large portion (~2.87–2.90 million ETH) is staked via the Ethereum network and upcoming proprietary MAVAN (Made-in-America Validator Network) staking solution, set to launch in Q1 2026. This generates staking rewards estimated at $202–374 million annually (based on ~3.1–3.3% yields), providing yield income even during price dips.

BitMine views ETH pullbacks as buying opportunities, emphasizing strengthening fundamentals like staking growth, DeFi utility, and network upgrades.

2. Details of the 40,000 ETH Purchase

The phrase "BitMine buys 40K ETH" (or 40,000 Ethereum) refers to a specific large-scale acquisition reported in early February 2026:

On or around February 9–10, 2026 (with some reports pinpointing Monday activity), BitMine acquired approximately 40,000 ETH in a single day — often broken into two tranches of 20,000 ETH each.

Sources: Purchased via institutional OTC desks like FalconX and BitGo.

Value of the purchase: Around $83–84 million (at an average price of roughly $2,085–$2,090 per ETH during the transaction window).

This followed a similar buy the prior week: 40,613 ETH (also ~$82–83 million).

Cumulative effect: These buys pushed BitMine's total holdings to 4.325–4.326 million ETH.

Average acquisition cost across the entire treasury: Around $3,850–$3,825 per ETH (higher due to earlier buys at peak prices).

This is part of an aggressive, ongoing accumulation strategy during a market dip — BitMine has added hundreds of thousands of ETH over recent months/weeks, ignoring short-term losses.

3. Current Ethereum Price Context (as of February 11, 2026)

Spot ETH price: Hovering around $2,000–$2,130 (with recent trades near $2,009–$2,125 in disclosures; some intraday lows below $2,000).

Recent performance: ETH is down sharply — about 60–62% from its 2025 all-time high (around $4,900–$4,946 in August 2025).

This places BitMine's position deep in unrealized losses: Paper losses estimated at $7.5–$7.8 billion (or more in some analytics), as the average cost basis far exceeds current levels.

Despite this, Tom Lee describes the dip as an "attractive entry point" and predicts a potential V-shaped recovery in 2026, with historical patterns showing strong rebounds after similar corrections.

4. Market Impact & Bullish Signals

This large buy is widely viewed as a strong bullish signal for Ethereum:

Institutional confidence: A public company (with Tom Lee's backing) doubling down on ETH during a 60%+ drawdown shows conviction in long-term growth (staking, DeFi, layer-2 scaling, network upgrades).

Supply reduction effect: Removing 40,000 ETH from circulation (especially when staked) tightens available supply on exchanges, which can support price floors during sell-offs.

Market attention: On-chain trackers like Lookonchain, Arkham Intelligence, and EmberCN highlighted the buys, sparking buzz on social media, news, and trading communities. This often attracts retail/institutional follow-on buying.

Sentiment boost: Reinforces narratives around corporate treasuries adopting crypto (like MicroStrategy for BTC). BitMine's actions counter "crypto winter" fears and signal "smart money" accumulation.

Broader implications: Could encourage other firms to view ETH dips as opportunities, potentially accelerating institutional inflows.

5. Percentage, Liquidity, Volume, and Risk Discussion

Percentage of supply: The 40,000 ETH buy is ~0.033% of total ETH supply — small individually but meaningful in context (BitMine now controls ~3.58%, nearing 5% goal). Weekly buys like this add ~0.03–0.034% incrementally.

Liquidity impact: OTC trades (via FalconX/BitGo) minimize immediate market slippage — these are negotiated off-exchange to avoid pushing price down further. However, repeated large buys signal sustained demand, which can improve overall liquidity perception and reduce sell pressure over time.

Trading volume: Ethereum's 24-hour spot volume typically ranges in the billions; a $83M buy is notable but not overwhelming (represents ~1–2% of daily volume on major exchanges). It contributes to momentum without causing extreme spikes.

Downside risks: Heavy unrealized losses could pressure BMNR stock (which has seen volatility/dips). If ETH stays depressed long-term, staking yields help but don't offset capital erosion. Market risks include macro factors (Fed policy, risk-off sentiment) or ETH-specific issues (competition from other L1s).

Upside potential: If ETH rebounds (as Tom Lee forecasts, potentially to higher levels in 2026), BitMine's position could generate massive gains + staking revenue.

6. Bottom Line & Trader/Investor Takeaways

BitMine's 40,000 ETH purchase (valued at ~$83–84 million) is a classic example of aggressive institutional accumulation during weakness — treating a 60%+ correction as a "buy the dip" moment. It signals deep confidence in Ethereum's fundamentals despite current unrealized losses of billions.

Bullish for ETH: Reinforces long-term uptrend potential, reduces circulating supply pressure, and draws attention to staking yields.

Not financial advice: While exciting, crypto remains volatile — large holders like BitMine can influence sentiment, but price depends on broader adoption, tech progress, and macro conditions.

Watch for: Upcoming MAVAN staking launch (Q1 2026), further buys toward 5% supply goal, and any ETH price recovery signs.

1. What is BitMine? Company Background

BitMine Immersion Technologies (ticker: BMNR on NYSE American) is a publicly traded company positioning itself as the world's leading Ethereum treasury firm. Chaired by Tom Lee (co-founder of Fundstrat Global Advisors, a prominent Wall Street crypto bull), BitMine focuses on long-term accumulation of Ethereum (ETH) as its primary reserve asset, similar to how MicroStrategy treats Bitcoin.

The firm pursues the "Alchemy of 5%" strategy: Aiming to own 5% of Ethereum's total circulating supply (currently around 120.7 million ETH) over time.

As of the most recent disclosures (February 8–10, 2026), BitMine holds approximately 4.325 million to 4.326 million ETH, representing about 3.58% of the total ETH supply — making it the largest known corporate holder of Ethereum by a wide margin.

Beyond ETH, holdings include small amounts of Bitcoin (~193 BTC), $595 million in cash, and "moonshot" investments like a $200 million stake in Beast Industries and ~$19 million in Eightco Holdings (ORBS).

Total assets (crypto + cash + investments) recently crossed $10 billion.

A large portion (~2.87–2.90 million ETH) is staked via the Ethereum network and upcoming proprietary MAVAN (Made-in-America Validator Network) staking solution, set to launch in Q1 2026. This generates staking rewards estimated at $202–374 million annually (based on ~3.1–3.3% yields), providing yield income even during price dips.

BitMine views ETH pullbacks as buying opportunities, emphasizing strengthening fundamentals like staking growth, DeFi utility, and network upgrades.

2. Details of the 40,000 ETH Purchase

The phrase "BitMine buys 40K ETH" (or 40,000 Ethereum) refers to a specific large-scale acquisition reported in early February 2026:

On or around February 9–10, 2026 (with some reports pinpointing Monday activity), BitMine acquired approximately 40,000 ETH in a single day — often broken into two tranches of 20,000 ETH each.

Sources: Purchased via institutional OTC desks like FalconX and BitGo.

Value of the purchase: Around $83–84 million (at an average price of roughly $2,085–$2,090 per ETH during the transaction window).

This followed a similar buy the prior week: 40,613 ETH (also ~$82–83 million).

Cumulative effect: These buys pushed BitMine's total holdings to 4.325–4.326 million ETH.

Average acquisition cost across the entire treasury: Around $3,850–$3,825 per ETH (higher due to earlier buys at peak prices).

This is part of an aggressive, ongoing accumulation strategy during a market dip — BitMine has added hundreds of thousands of ETH over recent months/weeks, ignoring short-term losses.

3. Current Ethereum Price Context (as of February 11, 2026)

Spot ETH price: Hovering around $2,000–$2,130 (with recent trades near $2,009–$2,125 in disclosures; some intraday lows below $2,000).

Recent performance: ETH is down sharply — about 60–62% from its 2025 all-time high (around $4,900–$4,946 in August 2025).

This places BitMine's position deep in unrealized losses: Paper losses estimated at $7.5–$7.8 billion (or more in some analytics), as the average cost basis far exceeds current levels.

Despite this, Tom Lee describes the dip as an "attractive entry point" and predicts a potential V-shaped recovery in 2026, with historical patterns showing strong rebounds after similar corrections.

4. Market Impact & Bullish Signals

This large buy is widely viewed as a strong bullish signal for Ethereum:

Institutional confidence: A public company (with Tom Lee's backing) doubling down on ETH during a 60%+ drawdown shows conviction in long-term growth (staking, DeFi, layer-2 scaling, network upgrades).

Supply reduction effect: Removing 40,000 ETH from circulation (especially when staked) tightens available supply on exchanges, which can support price floors during sell-offs.

Market attention: On-chain trackers like Lookonchain, Arkham Intelligence, and EmberCN highlighted the buys, sparking buzz on social media, news, and trading communities. This often attracts retail/institutional follow-on buying.

Sentiment boost: Reinforces narratives around corporate treasuries adopting crypto (like MicroStrategy for BTC). BitMine's actions counter "crypto winter" fears and signal "smart money" accumulation.

Broader implications: Could encourage other firms to view ETH dips as opportunities, potentially accelerating institutional inflows.

5. Percentage, Liquidity, Volume, and Risk Discussion

Percentage of supply: The 40,000 ETH buy is ~0.033% of total ETH supply — small individually but meaningful in context (BitMine now controls ~3.58%, nearing 5% goal). Weekly buys like this add ~0.03–0.034% incrementally.

Liquidity impact: OTC trades (via FalconX/BitGo) minimize immediate market slippage — these are negotiated off-exchange to avoid pushing price down further. However, repeated large buys signal sustained demand, which can improve overall liquidity perception and reduce sell pressure over time.

Trading volume: Ethereum's 24-hour spot volume typically ranges in the billions; a $83M buy is notable but not overwhelming (represents ~1–2% of daily volume on major exchanges). It contributes to momentum without causing extreme spikes.

Downside risks: Heavy unrealized losses could pressure BMNR stock (which has seen volatility/dips). If ETH stays depressed long-term, staking yields help but don't offset capital erosion. Market risks include macro factors (Fed policy, risk-off sentiment) or ETH-specific issues (competition from other L1s).

Upside potential: If ETH rebounds (as Tom Lee forecasts, potentially to higher levels in 2026), BitMine's position could generate massive gains + staking revenue.

6. Bottom Line & Trader/Investor Takeaways

BitMine's 40,000 ETH purchase (valued at ~$83–84 million) is a classic example of aggressive institutional accumulation during weakness — treating a 60%+ correction as a "buy the dip" moment. It signals deep confidence in Ethereum's fundamentals despite current unrealized losses of billions.

Bullish for ETH: Reinforces long-term uptrend potential, reduces circulating supply pressure, and draws attention to staking yields.

Not financial advice: While exciting, crypto remains volatile — large holders like BitMine can influence sentiment, but price depends on broader adoption, tech progress, and macro conditions.

Watch for: Upcoming MAVAN staking launch (Q1 2026), further buys toward 5% supply goal, and any ETH price recovery signs.