# BitcoinGoldBattle

200.83K

Gold and silver are soaring as the dollar weakens, while Bitcoin is cooling off after leverage wipeouts. Analysts expect BTC to rebound by 2026. Which inflation hedge are you betting on — precious metals or Bitcoin? Tell us why!

EagleEye

#BitcoinGoldBattle

Gold and silver are currently experiencing significant upward momentum amid a weakening U.S. dollar, while Bitcoin has cooled off after recent leverage-induced corrections. As of today, spot gold is trading around $4,381/oz, silver is near $55/oz, and Bitcoin is hovering around $34,500. These price levels highlight the contrasting dynamics of traditional versus digital inflation hedges and offer an opportunity to evaluate portfolio positioning in the context of macroeconomic uncertainty, monetary policy, and market sentiment.

Gold has long been the benchmark for a safe-have

Gold and silver are currently experiencing significant upward momentum amid a weakening U.S. dollar, while Bitcoin has cooled off after recent leverage-induced corrections. As of today, spot gold is trading around $4,381/oz, silver is near $55/oz, and Bitcoin is hovering around $34,500. These price levels highlight the contrasting dynamics of traditional versus digital inflation hedges and offer an opportunity to evaluate portfolio positioning in the context of macroeconomic uncertainty, monetary policy, and market sentiment.

Gold has long been the benchmark for a safe-have

BTC-3,61%

- Reward

- 11

- 13

- Repost

- Share

BabaJi :

:

Happy New Year! 🤑View More

#BitcoinGoldBattle

⚔️ #BitcoinGoldBattle | The Ultimate Clash: Digital Gold vs Real Gold

Bitcoin (BTC) – Current Price: $88,576

Bitcoin is charging into 2026 with strong bullish momentum. Short-term forecasts suggest it could test $92,000–$95,000 if demand continues to rise. Support lies at $85,000, making it a critical level for risk management. Trading strategy: Watch for breakouts above resistance, monitor institutional inflows, and manage positions with disciplined stop-losses. Bitcoin’s high volatility rewards timely entries and exits, making it ideal for aggressive traders seeking rapid

⚔️ #BitcoinGoldBattle | The Ultimate Clash: Digital Gold vs Real Gold

Bitcoin (BTC) – Current Price: $88,576

Bitcoin is charging into 2026 with strong bullish momentum. Short-term forecasts suggest it could test $92,000–$95,000 if demand continues to rise. Support lies at $85,000, making it a critical level for risk management. Trading strategy: Watch for breakouts above resistance, monitor institutional inflows, and manage positions with disciplined stop-losses. Bitcoin’s high volatility rewards timely entries and exits, making it ideal for aggressive traders seeking rapid

- Reward

- 34

- 30

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

#BitcoinGoldBattle 🔥 #BitcoinGoldBattle | Traditional Wealth vs Digital Power

As 2025 comes to a close, markets are witnessing a clear divide between Gold and Bitcoin — not as rivals, but as two different answers to uncertainty.

🥇 Gold: The Safe-Haven King

Gold pushing to new all-time highs reflects more than price action: • Central banks increasing gold reserves

• Growing distrust in fiat currencies

• Rising geopolitical and economic uncertainty

Gold represents capital preservation in times of stress.

₿ Bitcoin: The Patience Asset

Bitcoin’s current consolidation is not weakness: • Long-term

As 2025 comes to a close, markets are witnessing a clear divide between Gold and Bitcoin — not as rivals, but as two different answers to uncertainty.

🥇 Gold: The Safe-Haven King

Gold pushing to new all-time highs reflects more than price action: • Central banks increasing gold reserves

• Growing distrust in fiat currencies

• Rising geopolitical and economic uncertainty

Gold represents capital preservation in times of stress.

₿ Bitcoin: The Patience Asset

Bitcoin’s current consolidation is not weakness: • Long-term

BTC-3,61%

- Reward

- 9

- 24

- Repost

- Share

MoonGirl :

:

1000x VIbes 🤑View More

#BitcoinGoldBattle

#BitcoinGoldBattle

Gold and Bitcoin exist in two completely different financial eras:

Gold is a traditional safe-haven asset. It is physical, scarce in nature, has been used for thousands of years, and is universally recognized across borders and cultures. Central banks still hold gold as a reserve asset.

Bitcoin is a digital, decentralized asset created for the modern financial world. It operates without central authority, runs on blockchain technology, and is often called “digital gold” because of its scarcity and resistance to manipulation.

The core question investors a

#BitcoinGoldBattle

Gold and Bitcoin exist in two completely different financial eras:

Gold is a traditional safe-haven asset. It is physical, scarce in nature, has been used for thousands of years, and is universally recognized across borders and cultures. Central banks still hold gold as a reserve asset.

Bitcoin is a digital, decentralized asset created for the modern financial world. It operates without central authority, runs on blockchain technology, and is often called “digital gold” because of its scarcity and resistance to manipulation.

The core question investors a

- Reward

- 33

- 26

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#BitcoinGoldBattle

The Bitcoin vs Gold debate is heating up once again as global markets enter a fresh phase of uncertainty, volatility, and shifting investor confidence. Both assets are being tested as stores of value in a rapidly evolving financial landscape.

Bitcoin continues to represent the digital frontier of wealth—borderless, decentralized, and powered by technological adoption. Its fixed supply narrative and growing institutional acceptance keep attracting long-term believers, even amid short-term price volatility.

Gold, meanwhile, remains the classic safe haven. Centuries of trust, p

The Bitcoin vs Gold debate is heating up once again as global markets enter a fresh phase of uncertainty, volatility, and shifting investor confidence. Both assets are being tested as stores of value in a rapidly evolving financial landscape.

Bitcoin continues to represent the digital frontier of wealth—borderless, decentralized, and powered by technological adoption. Its fixed supply narrative and growing institutional acceptance keep attracting long-term believers, even amid short-term price volatility.

Gold, meanwhile, remains the classic safe haven. Centuries of trust, p

BTC-3,61%

- Reward

- 9

- 13

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Nice Breakdown its rare to see this level of clarity in crypto related postView More

#BitcoinGoldBattle

Inflation Protection: Traditional Strength vs Digital Evolution

Inflation does not destroy wealth overnight. It slowly erodes purchasing power, forcing investors to seek assets that can preserve value across economic cycles. Gold, silver, and Bitcoin address this challenge in very different ways.

Precious Metals: Proven Financial Anchors

Gold and silver have functioned as stores of value long before modern financial systems existed.

Gold’s strength lies in its historical reliability. During periods of currency debasement or monetary uncertainty, it has consistently preserve

Inflation Protection: Traditional Strength vs Digital Evolution

Inflation does not destroy wealth overnight. It slowly erodes purchasing power, forcing investors to seek assets that can preserve value across economic cycles. Gold, silver, and Bitcoin address this challenge in very different ways.

Precious Metals: Proven Financial Anchors

Gold and silver have functioned as stores of value long before modern financial systems existed.

Gold’s strength lies in its historical reliability. During periods of currency debasement or monetary uncertainty, it has consistently preserve

BTC-3,61%

- Reward

- 8

- 10

- Repost

- Share

Crypto_Buzz_with_Alex :

:

⚡ “Energy here is contagious, loving the crypto charisma!”View More

#BitcoinGoldBattle

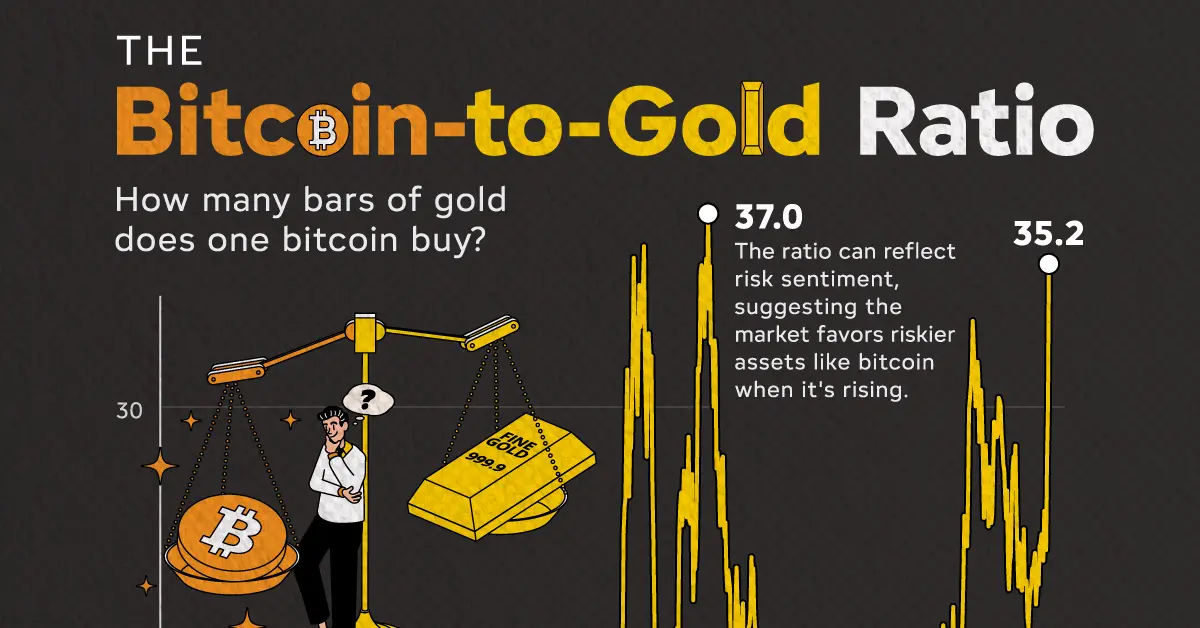

#BitcoinGoldBattle — Bitcoin vs. Gold 2026

Current Prices:

🔹 Bitcoin (BTC): 87,742

🔸 Gold (per ounce): 4,333

Let’s break down what the data, analysts, and models are saying — then explain who might win the battle in 2026 and how you can think about trading or investing..

📌 1. Market Position — Safe Haven vs. Growth Asset

🟡 Gold — Traditional Safe Haven

Gold has always been the classic hedge against economic uncertainty, inflation, and currency weakness. In 2025 it ran very strong and is still near record levels.

2026 outlook:

Goldman Sachs expects gold to reach around $

#BitcoinGoldBattle — Bitcoin vs. Gold 2026

Current Prices:

🔹 Bitcoin (BTC): 87,742

🔸 Gold (per ounce): 4,333

Let’s break down what the data, analysts, and models are saying — then explain who might win the battle in 2026 and how you can think about trading or investing..

📌 1. Market Position — Safe Haven vs. Growth Asset

🟡 Gold — Traditional Safe Haven

Gold has always been the classic hedge against economic uncertainty, inflation, and currency weakness. In 2025 it ran very strong and is still near record levels.

2026 outlook:

Goldman Sachs expects gold to reach around $

BTC-3,61%

- Reward

- 31

- 27

- Repost

- Share

BabaJi :

:

2026 GOGOGO 👊View More

#BitcoinGoldBattle

The debate between Bitcoin (BTC) and Gold (XAU) is one of the most discussed topics in the financial and crypto world. Both are considered stores of value, but they operate very differently and serve unique purposes in investors’ portfolios.

Current Market Snapshot (Dec 30, 2025):

Bitcoin (BTC): ~$90,000

Gold (XAU): ~$4,500/oz

Bitcoin has been highly volatile but continues to attract institutional interest, while Gold has reached historic highs, showing the market’s preference for stability amid global uncertainty.

1️⃣ Price Forecast & Outlook (2026)

Bitcoin (BTC):

Bullish

The debate between Bitcoin (BTC) and Gold (XAU) is one of the most discussed topics in the financial and crypto world. Both are considered stores of value, but they operate very differently and serve unique purposes in investors’ portfolios.

Current Market Snapshot (Dec 30, 2025):

Bitcoin (BTC): ~$90,000

Gold (XAU): ~$4,500/oz

Bitcoin has been highly volatile but continues to attract institutional interest, while Gold has reached historic highs, showing the market’s preference for stability amid global uncertainty.

1️⃣ Price Forecast & Outlook (2026)

Bitcoin (BTC):

Bullish

- Reward

- 21

- 16

- Repost

- Share

Discovery :

:

Nice sharing!View More

#BitcoinGoldBattle

🏆 #BitcoinGoldBattle — Why I’m Betting on Bitcoin Over Gold & Silver in 2026

The 2025 markets handed us one of the most dramatic inflation hedge battles in modern history. Gold and silver skyrocketed — smashing records and outperforming nearly every major asset class — while Bitcoin cooled off after heavy leverage liquidations and a sharp correction from all-time highs. So now the big question: precious metals or Bitcoin — where do you put your money in 2026? Here’s my take.

📈 Gold & Silver Have Been Massive Winners — But That’s Just the Beginning

There’s no denying it —

🏆 #BitcoinGoldBattle — Why I’m Betting on Bitcoin Over Gold & Silver in 2026

The 2025 markets handed us one of the most dramatic inflation hedge battles in modern history. Gold and silver skyrocketed — smashing records and outperforming nearly every major asset class — while Bitcoin cooled off after heavy leverage liquidations and a sharp correction from all-time highs. So now the big question: precious metals or Bitcoin — where do you put your money in 2026? Here’s my take.

📈 Gold & Silver Have Been Massive Winners — But That’s Just the Beginning

There’s no denying it —

BTC-3,61%

- Reward

- 18

- 18

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

Gold and silver have been soaring in recent months, breaking through key resistance levels as the U.S. dollar shows signs of weakening. These traditional safe-haven assets are benefiting from a combination of macroeconomic factors: rising inflation expectations, slowing economic growth in major economies, and persistent geopolitical uncertainty. Investors are turning to gold and silver as reliable stores of value, appreciating their centuries-long track record as hedges against currency debasement, market volatility, and systemic shocks. In this environment, tangible assets with intrinsic valu

BTC-3,61%

- Reward

- 10

- 18

- Repost

- Share

BabaJi :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

13.42K Popularity

40.1K Popularity

52.71K Popularity

14.39K Popularity

10.22K Popularity

338.97K Popularity

6.91K Popularity

9.15K Popularity

106.32K Popularity

16.78K Popularity

190.28K Popularity

14.39K Popularity

6.66K Popularity

9.26K Popularity

167.22K Popularity

News

View MoreThe three major US stock indices plummeted, Nvidia fell over 4%

1 h

The US Dollar Index fell 0.41%, closing at 98.642

1 h

Data: 1,928,900 TON transferred from wallet_v4r2, worth approximately $2,951,200.

2 h

Data: 492.18 BTC transferred from anonymous addresses, worth approximately $44.03 million

2 h

Data: In the past 24 hours, the entire network has been liquidated for a total of $709 million, with long positions liquidated for $649 million and short positions liquidated for $60.451 million.

2 h

Pin