# TariffTensionsHitCryptoMarket

35.63K

Renewed tariff threats have lifted risk-off sentiment, with BTC seeing a sharp pullback after a brief surge. Is the market pricing in escalating trade tensions, or just reacting emotionally? What’s your outlook?

User_any

#TariffTensionsHitCryptoMarket

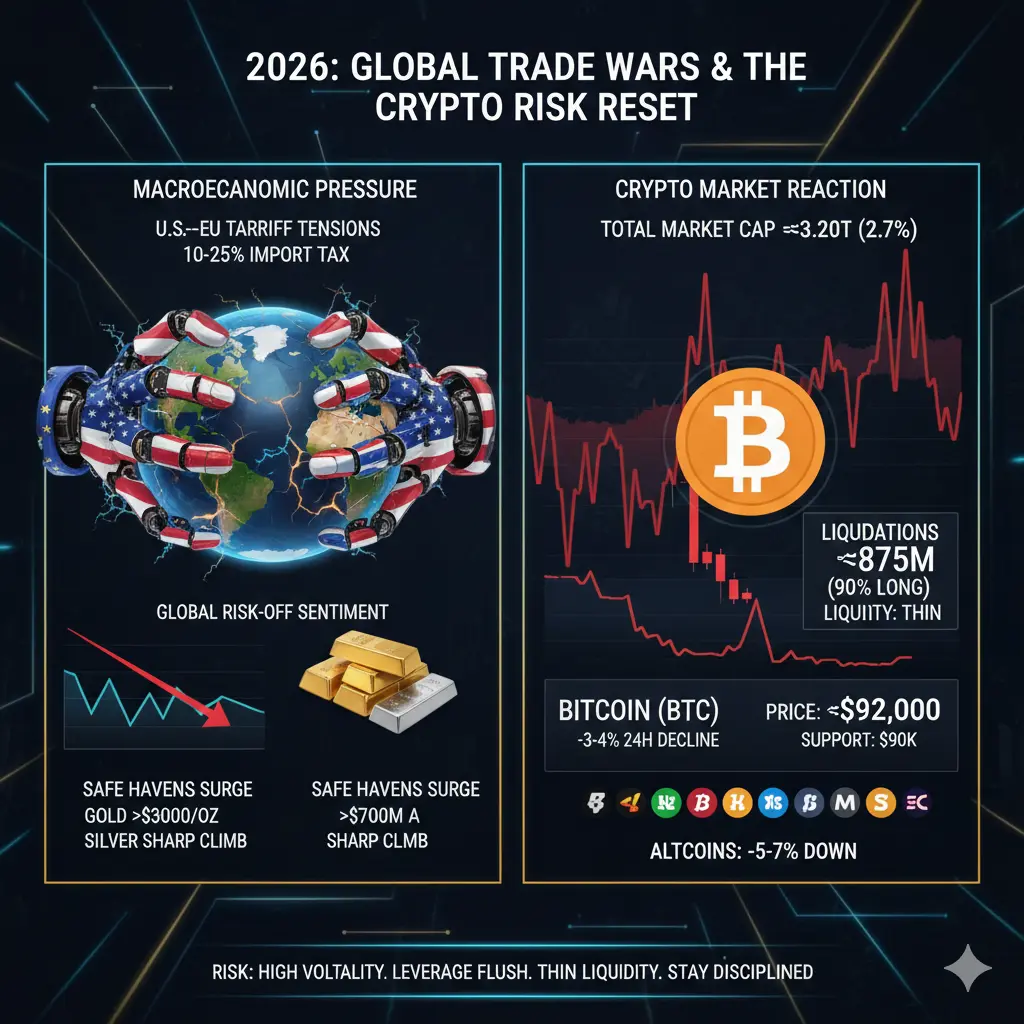

🔹The high tariffs that US President Donald Trump has implemented or threatened for 2025 and 2026, particularly the 100% threat against China, the 10-25% increases against European Union countries, and geopolitical tensions such as the Greenland dispute, created a significant risk-off wave in global financial markets. This situation affected the cryptocurrency market more severely than traditional stocks, leading to a rapid decline in Bitcoin from its all-time highs, deeper drops in Ethereum and other altcoins, the liquidation of billions of dollars in leveraged

🔹The high tariffs that US President Donald Trump has implemented or threatened for 2025 and 2026, particularly the 100% threat against China, the 10-25% increases against European Union countries, and geopolitical tensions such as the Greenland dispute, created a significant risk-off wave in global financial markets. This situation affected the cryptocurrency market more severely than traditional stocks, leading to a rapid decline in Bitcoin from its all-time highs, deeper drops in Ethereum and other altcoins, the liquidation of billions of dollars in leveraged

- Reward

- 23

- 22

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

The Chain Reaction Impact on Commodities, Forex, and Crypto Markets

The impact of the US-Europe tariff dispute will not be limited to the stock market but will spread through trade, exchange rates, and inflation expectations to commodities, foreign exchange, and even crypto assets.

First, commodities. An increase in tariffs often means:

* Supply chain restructuring

* Rising transportation and production costs

* Increased volatility in the prices of certain goods

Next is the foreign exchange market. When trade tensions escalate, safe-haven currencies and the US dollar tend to be more favored, w

View OriginalThe impact of the US-Europe tariff dispute will not be limited to the stock market but will spread through trade, exchange rates, and inflation expectations to commodities, foreign exchange, and even crypto assets.

First, commodities. An increase in tariffs often means:

* Supply chain restructuring

* Rising transportation and production costs

* Increased volatility in the prices of certain goods

Next is the foreign exchange market. When trade tensions escalate, safe-haven currencies and the US dollar tend to be more favored, w

- Reward

- 6

- 7

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket Hey everyone,

We've been seeing some serious turbulence in the crypto market again over the past few days.

Renewed tariff threats have triggered a clear risk-off mood, and Bitcoin pulled back sharply after a brief pump. Right now BTC is hovering in the $92,000–$93,000 range trying to find support, but the broader market is still under pressure. So the big question: Is the market actually pricing in escalating trade tensions, or is this just an emotional overreaction? Here's my take.

Let's start with what sparked this: Over the weekend, U.S. President Donald Trum

We've been seeing some serious turbulence in the crypto market again over the past few days.

Renewed tariff threats have triggered a clear risk-off mood, and Bitcoin pulled back sharply after a brief pump. Right now BTC is hovering in the $92,000–$93,000 range trying to find support, but the broader market is still under pressure. So the big question: Is the market actually pricing in escalating trade tensions, or is this just an emotional overreaction? Here's my take.

Let's start with what sparked this: Over the weekend, U.S. President Donald Trum

- Reward

- 55

- 141

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

The market is not afraid of conflicts; it fears uncertainty.

It is worth noting that after the outbreak of the US-Europe tariff dispute, the market's first reaction was not widespread panic but increased volatility and sector differentiation. This indicates that funds are not fleeing risk but are reassessing uncertainty.

What truly troubles the market is not the tariff figures themselves but:

* Whether policy paths are inconsistent

* Whether negotiations may reverse

* Whether companies can price in advance

When rules are unclear, funds instinctively choose to wait or shift to assets with highe

View OriginalIt is worth noting that after the outbreak of the US-Europe tariff dispute, the market's first reaction was not widespread panic but increased volatility and sector differentiation. This indicates that funds are not fleeing risk but are reassessing uncertainty.

What truly troubles the market is not the tariff figures themselves but:

* Whether policy paths are inconsistent

* Whether negotiations may reverse

* Whether companies can price in advance

When rules are unclear, funds instinctively choose to wait or shift to assets with highe

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#欧美关税风波冲击市场 The escalation of US-European trade frictions has triggered a significant pullback in the crypto market, with risk-averse sentiment intensifying. Currently, short-term volatility risks are prominent, but the market's long-term structure remains intact, emphasizing the importance of defensive positioning and rhythm control.

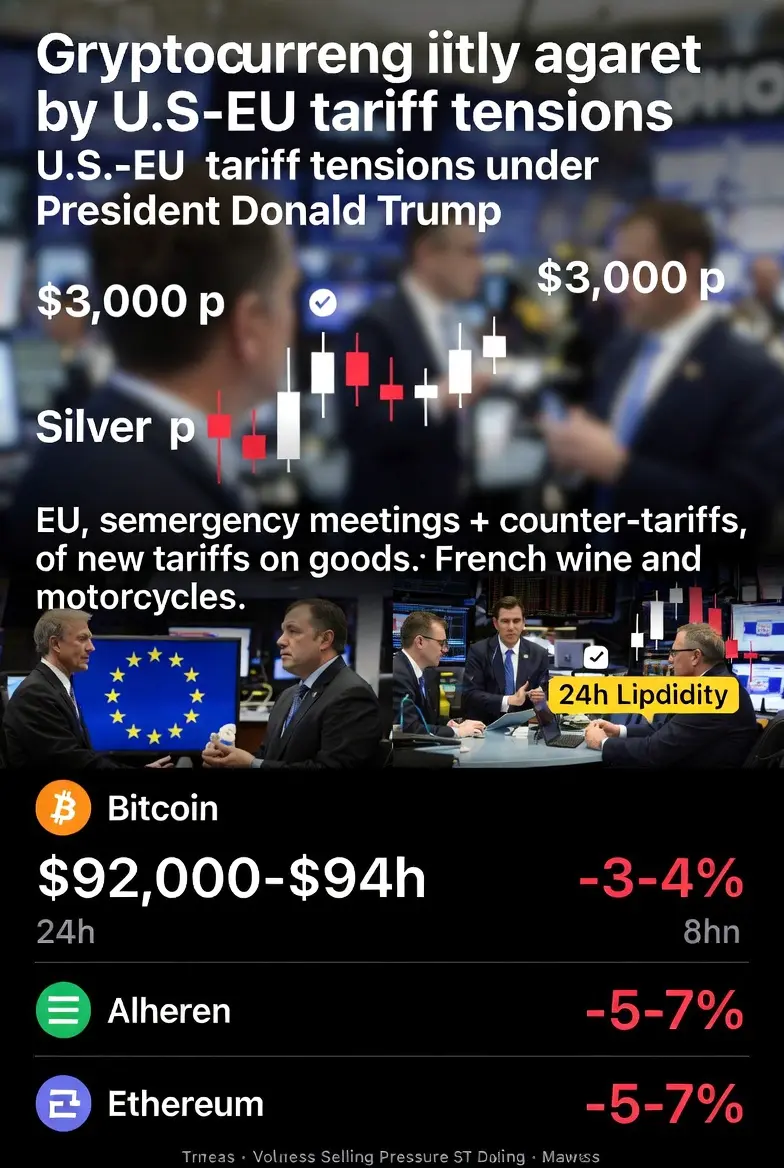

BTC and ETH technical indicators both broke below key support levels; on daily and hourly charts, RSI has entered oversold territory. A short-term rebound may occur, but the main trend remains uncertain.

Trading volume shows sell-offs without severe liquidity

View OriginalBTC and ETH technical indicators both broke below key support levels; on daily and hourly charts, RSI has entered oversold territory. A short-term rebound may occur, but the main trend remains uncertain.

Trading volume shows sell-offs without severe liquidity

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 20

- 32

- Repost

- Share

Long-ShortEquityStrategyMaster :

:

New Year Wealth Explosion 🤑View More

#TariffTensionsHitCryptoMarket

Tariff Tensions Hit Crypto Market In-Depth BTC & Altcoin Analysis, Macro Drivers, Market Psychology, Price Predictions, and Strategic Insights for Traders and Investors

The cryptocurrency market has recently entered a period of significant volatility, driven by renewed tariff threats, geopolitical tensions, and macroeconomic uncertainty. Bitcoin (BTC), the market’s bellwether, experienced a sharp pullback after a brief upward surge, prompting declines across high-beta altcoins and riskier tokens. This pullback has intensified risk-off sentiment, forcing investo

Tariff Tensions Hit Crypto Market In-Depth BTC & Altcoin Analysis, Macro Drivers, Market Psychology, Price Predictions, and Strategic Insights for Traders and Investors

The cryptocurrency market has recently entered a period of significant volatility, driven by renewed tariff threats, geopolitical tensions, and macroeconomic uncertainty. Bitcoin (BTC), the market’s bellwether, experienced a sharp pullback after a brief upward surge, prompting declines across high-beta altcoins and riskier tokens. This pullback has intensified risk-off sentiment, forcing investo

- Reward

- 7

- 5

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

#TariffTensionsHitCryptoMarket

In recent weeks, escalating tariff tensions, trade restrictions, and geopolitical economic pressure have become a major macro factor influencing global financial markets — and the crypto market is no exception. Below is a deep, point-by-point and expanded explanation of how current conditions are affecting cryptocurrencies and investor behavior.

1. Global Risk-Off Environment Intensifies

Whenever tariff tensions rise, markets enter a risk-off phase. Investors prioritize capital preservation over growth. As a result, high-volatility assets like cryptocurrencies f

In recent weeks, escalating tariff tensions, trade restrictions, and geopolitical economic pressure have become a major macro factor influencing global financial markets — and the crypto market is no exception. Below is a deep, point-by-point and expanded explanation of how current conditions are affecting cryptocurrencies and investor behavior.

1. Global Risk-Off Environment Intensifies

Whenever tariff tensions rise, markets enter a risk-off phase. Investors prioritize capital preservation over growth. As a result, high-volatility assets like cryptocurrencies f

- Reward

- 7

- 9

- Repost

- Share

Yanlin :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket

Global markets have entered a new phase of uncertainty as renewed U.S.–EU tariff tensions resurface under President Donald Trump—and the crypto market is reacting exactly as a high-risk asset class typically does during macro stress.

Over the weekend, President Trump announced plans to impose 10% tariffs starting February 1, with a potential escalation to 25% by June, on imports from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland, unless negotiations move forward on U.S. strategic interests related to Greenland.

This u

Global markets have entered a new phase of uncertainty as renewed U.S.–EU tariff tensions resurface under President Donald Trump—and the crypto market is reacting exactly as a high-risk asset class typically does during macro stress.

Over the weekend, President Trump announced plans to impose 10% tariffs starting February 1, with a potential escalation to 25% by June, on imports from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland, unless negotiations move forward on U.S. strategic interests related to Greenland.

This u

- Reward

- 14

- 29

- Repost

- Share

CryptoVortex :

:

2026 GOGOGO 👊View More

#TariffTensionsHitCryptoMarket

#TariffTensionsHitCryptoMarket

Tariff tensions are once again shaking global markets, and crypto is not staying quiet. When big economies start talking about higher import taxes, traders immediately think about risk, inflation, and slowing growth. This pressure moves fast into financial markets, including crypto.

At first, tariff news usually creates fear. Stocks turn weak, currencies become unstable, and investors move to safe assets. Crypto often reacts in two phases. The first phase is selling. Traders close risky positions, take profits, and reduce exposure.

#TariffTensionsHitCryptoMarket

Tariff tensions are once again shaking global markets, and crypto is not staying quiet. When big economies start talking about higher import taxes, traders immediately think about risk, inflation, and slowing growth. This pressure moves fast into financial markets, including crypto.

At first, tariff news usually creates fear. Stocks turn weak, currencies become unstable, and investors move to safe assets. Crypto often reacts in two phases. The first phase is selling. Traders close risky positions, take profits, and reduce exposure.

BTC-2,88%

- Reward

- 4

- 7

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

The tariff turmoil is not just news, but a signal of escalating game-playing

Recently, the US-Europe tariff dispute has heated up again. On the surface, the market sees "trade friction" and "negotiation disagreements," but essentially, this is more like a phased escalation in a long-term game. Tariffs are not the goal but a means to reshape the supply chain, compete for pricing power, and bargaining chips.

From a macro perspective, tariff escalation means:

* Increased global trade costs

* Compression of corporate profit margins

* Resurgence of inflation uncertainties

The impact on the market i

View OriginalRecently, the US-Europe tariff dispute has heated up again. On the surface, the market sees "trade friction" and "negotiation disagreements," but essentially, this is more like a phased escalation in a long-term game. Tariffs are not the goal but a means to reshape the supply chain, compete for pricing power, and bargaining chips.

From a macro perspective, tariff escalation means:

* Increased global trade costs

* Compression of corporate profit margins

* Resurgence of inflation uncertainties

The impact on the market i

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

7.05K Popularity

35.63K Popularity

49.69K Popularity

11.67K Popularity

8.91K Popularity

338.42K Popularity

5.83K Popularity

7.78K Popularity

107.28K Popularity

14.63K Popularity

182.2K Popularity

13.54K Popularity

6.6K Popularity

8.01K Popularity

166.86K Popularity

News

View MoreMask Network takes over Lens Protocol, aiming to create a "truly user-driven product"

11 m

Solana Labs Co-Founder: SKR at low prices benefits early builders; ecosystem maturity takes 10 years

23 m

The Dogecoin Foundation-supported House of Doge project launches DOGE payment app "Such"

25 m

After launching on NPM, Alpha increased by 4218.95%, current price 0.0024421 USDT

28 m

In the past 4 hours, the entire network has been liquidated for $236 million, mainly long positions.

32 m

Pin