Vadeli

Kripto varlık vadeli işlemleri, kripto varlık türevlerinden biridir. BTC ve ETH tarafından temsil edilen kripto varlık vadeli işlem piyasası trilyonlarca dolarlık bir ölçeğe sahiptir. BTC veya ETH'nin yükselen veya düşen fiyatlarından alım veya satım yaparak kâr elde edebilirsiniz. Kripto varlık vadeli işlemleri nedir ve kripto varlık vadeli işlemleri nasıl yapılır? Vadeli işlemleri öğrenme kapısı bölümünde size açıklanacaktır.

Articles (57)

Beginner

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

Perpetual contract funding rate arbitrage refers to the simultaneous execution of two transactions in the spot and perpetual contract markets, with the same underlying asset, opposite directions, equal quantities, and offsetting profits and losses. The goal is to profit from the funding rates in perpetual contract trading. As of 2025, this strategy has evolved significantly, with average funding rates stabilizing at 0.015% per 8-hour period for popular trading pairs, representing a 50% increase from 2024 levels. Cross-platform opportunities have emerged as a new arbitrage vector, offering additional 3-5% annualized returns. Advanced AI algorithms now optimize entry and exit points, reducing slippage by approximately 40% compared to manual execution.

2024-03-19 07:47:46

Intermediate

understanding-logx-in-one-read

LogX is a perpetual contract trading aggregator, helping investors find the optimal trading platform from multiple underlying contract trading protocols.

2024-03-17 13:57:03

Intermediate

Data Withholding and Fraud Proofing: Why Plasma Doesn’t Support Smart Contracts

This article starts with the issue of DA and data withholding, and explores the reasons why Plasma has been buried for so long.

2024-01-06 06:41:03

Intermediate

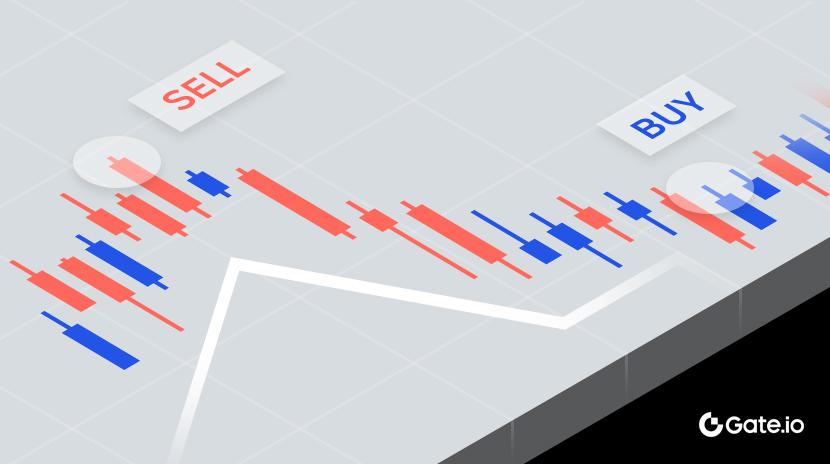

What is trend trading?

1.This “Gate Learn Futures” Intermediate course introduces concepts and the use of various technical indicators, including Candlestick charts, technical patterns, moving averages and trend lines.

2.Learn about trend-related concepts. We elaborate on the classification of short-term, medium-term, and long-term trends, and the relationship between trends and transactions.

2023-04-06 10:27:10

Intermediate

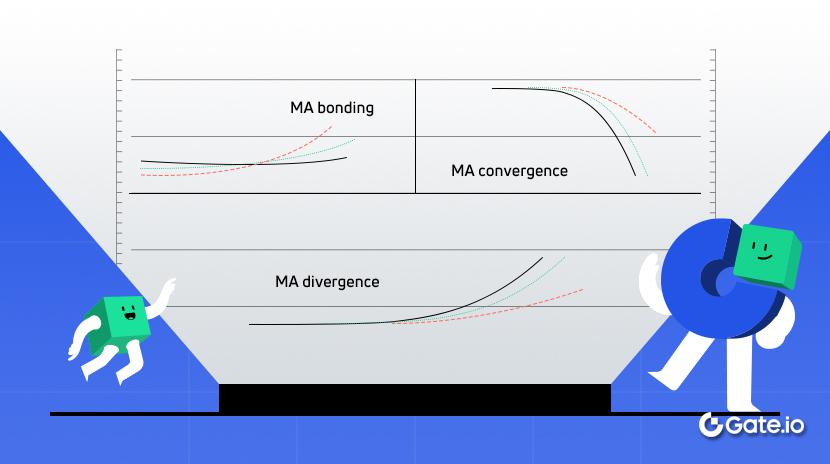

How to Use Moving Average Patterns - Moving Average Bonding, Convergence and Divergence

This “Gate Learn Futures” Intermediate course introduces concepts and the use of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

This article expands on the application skills of moving averages arranged in various patterns, including bonding, converging, and diverging. We will concentrate on definitions, pattern recognition, implications, and practical application of these three MA patterns.

2023-02-21 16:53:40

Intermediate

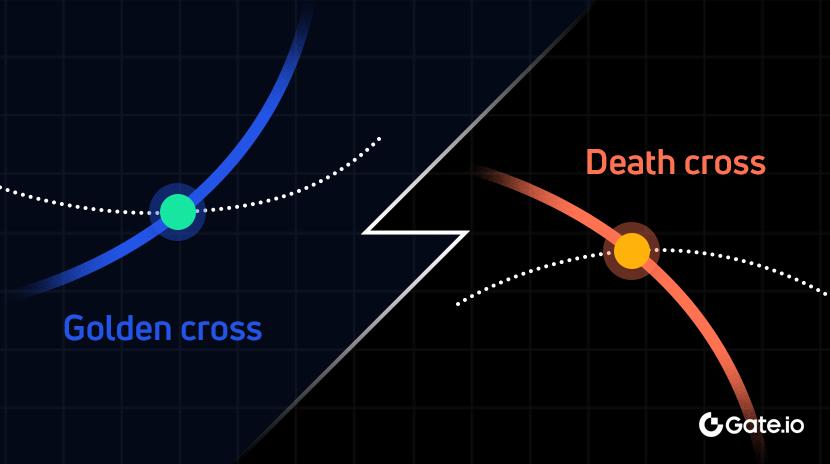

How to use Moving Average Patterns - Moving Average Cross

This “Gate Learn Futures” Intermediate course introduces concepts and the use of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

In this guide, we place a strong emphasis on the application of moving average crosses, mainly including the golden cross and death cross.

2023-02-21 16:44:07

Intermediate

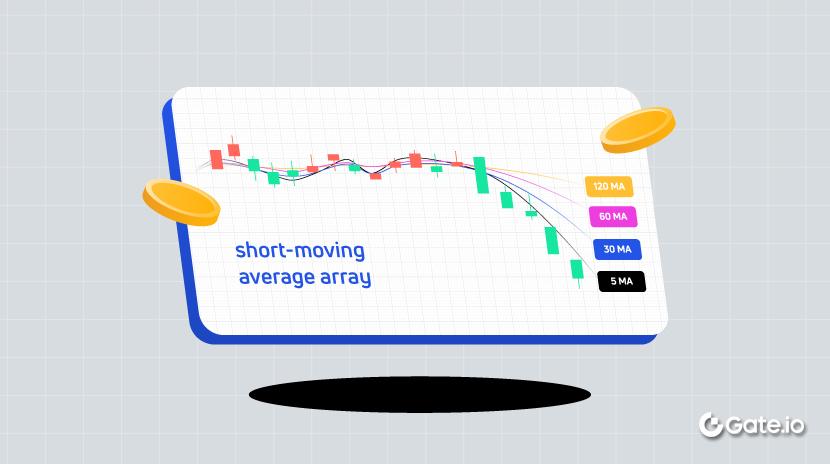

Application of Moving Average Array - Short Pattern

This Gate Learn Futures Intermediate course introduces concepts and uses of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

This section introduces the application skills of moving averages, especially how to use the short-moving average array with lines of short-term, medium-term, and long-term to predict the market trends in trading.

2023-02-21 16:32:07

Intermediate

Application of Moving Average Array - Long Pattern

This Gate Learn Futures Intermediate course introduces concepts and uses of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

This section introduces the application skills of moving averages, especially how to use the long moving average array with lines of short-term, medium-term, and long-term to predict the market trends in trading.

2023-02-21 16:20:59

Intermediate

Application of Double Moving Average

This Gate Learn Futures Intermediate course introduces concepts and uses of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

This article introduces the application skills of the double moving average, mainly including the practical application of short-term combination, medium-term combination, and long-term combination.

2023-02-21 16:02:56

Intermediate

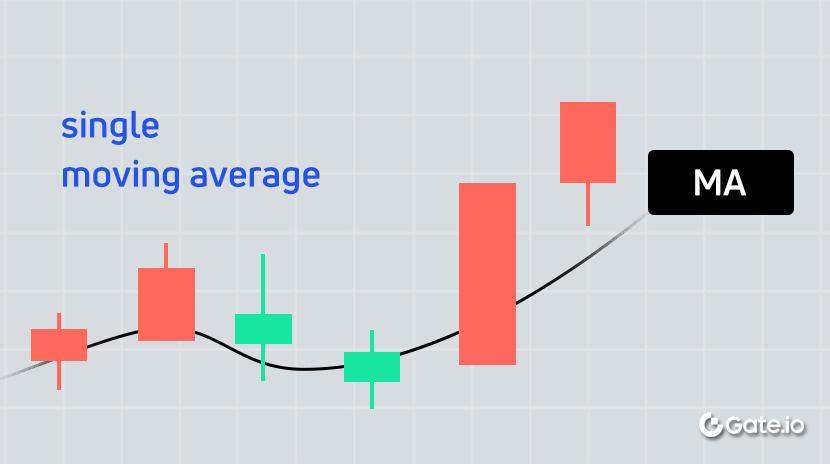

Application of single moving average

Gate Learn, Futures Intermediate Courses introduces concepts and uses of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

This article teaches you how to use four moving averages to analyze market trends, including MA5, MA30, MA60, and MA120.

2023-02-21 15:56:36

Intermediate

Detailed Explanation of Granville 8 Rules (Updated 2025)

This Gate Learn Futures Intermediate Course introduces concepts and usage of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines. 2. This article introduces the basics of Granville's 8 rules, a classic moving average-based market analysis theory, with 2025 updates showing improved success rates for cryptocurrency trading. The contents cover the concept, usage, application scenarios, and recent enhancements including AI integration, shortened timeframes for volatile markets, and effectiveness metrics showing 6-8% improvement in success rates since 2023.

2023-02-21 15:44:54

Intermediate

Understanding The Moving Average

1. This Gate Learn Futures Intermediate Courses introduces concepts and usage of various technical indicators, including Candlestick charts, technical patterns, moving averages, and trend lines.

2. In Section II, we will fully elaborate on the moving average from the following aspects: concept, characteristics, usage, and application.

2023-02-21 15:12:45

Intermediate

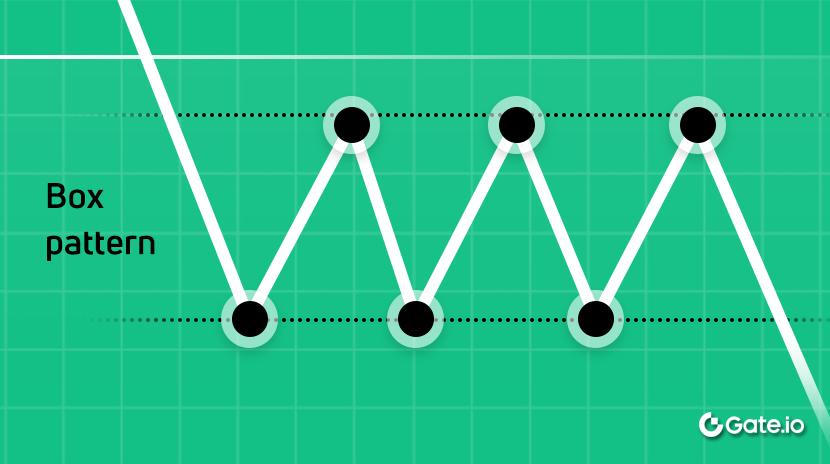

Continuation Technical Form - Rectangle (Box)

This Gate Learn Contract Intermediate Course introduces the basics of Candlestick charts, various technical patterns, moving averages, and trend lines, as well as how to use different technical indicators, aimed at helping users build a framework for technical analysis.

This article is an introduction to the rectangle. We will first explain its definition and characteristics, and then introduce how to use the pattern to predict price trends in BTC trading and what to pay attention to when using it.

2023-01-12 07:53:31

Intermediate

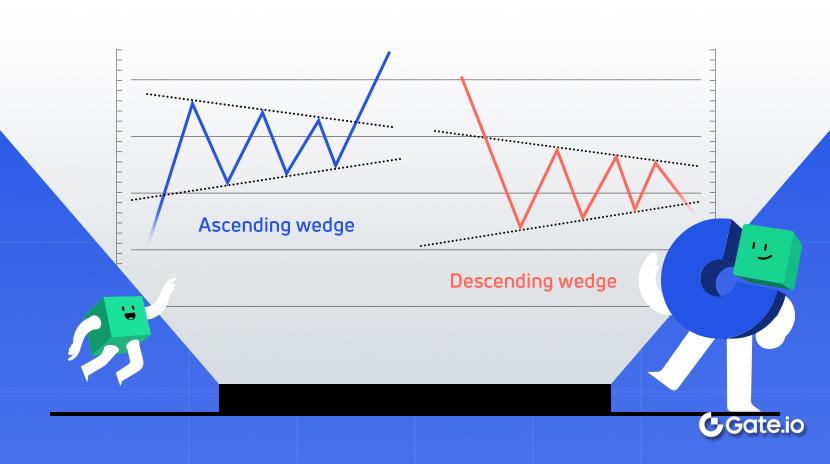

Continuation Technical Pattern - Wedge

This Gate Learn Contract Intermediate Course introduces the basics of Candlestick charts, various technical patterns, moving averages, and trend lines, as well as how to use different technical indicators, aimed at helping users build a framework for technical analysis.

This article is an introduction to the wedge pattern. We will first explain its definition and characteristics, and then introduce how to use it to predict price trends in BTC trading and what to pay attention to when using it.

2023-01-12 05:57:41

Intermediate

Continuation Technical pattern - Flag Pattern Highlights

The Gate Learn Contract Intermediate Courses introduce the basics of Candlestick charts, various technical patterns, moving averages, and trend lines, as well as how to use different technical indicators, aimed at helping users build a framework for technical analysis.

This article is an introduction to the flag pattern. We will first explain its definition and characteristics, and then introduce how to use the pattern to predict price trends in BTC trading and what matters to pay attention to about using it.

2023-01-12 04:01:16

Your Gateway to Crypto World, Subscribe to Gate for a New Perspective