Quant (QNT) Dips To Test Key Support — Could This Pattern Trigger an Rebound?

Date: Sun, Dec 21 2025 | 08:56 AM GMT

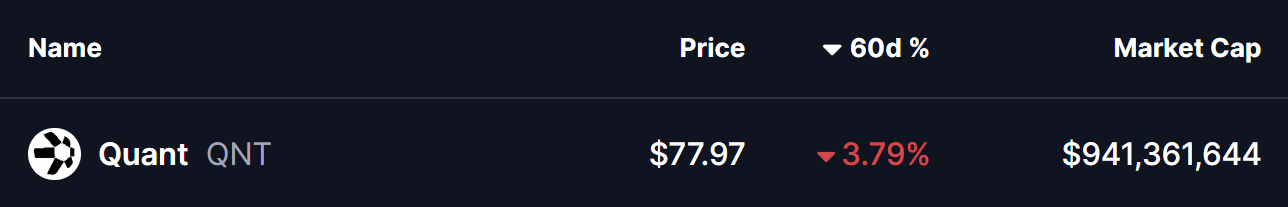

The broader cryptocurrency market has remained under pressure over the past several weeks, following the sharp sell-off that began on October 10. That corrective phase dragged Ethereum (ETH) down by nearly 23% over the last 60 days and weighed heavily on overall market sentiment. While many altcoins have struggled to stabilize, Quant (QNT) has shown relative resilience, posting only a modest decline and holding above a historically important support zone.

From a technical perspective, the daily chart suggests that QNT may be approaching a critical decision point, with price action forming a recognizable structure that could influence its next directional move.

Source: Coinmarketcap

Head and Shoulders Pattern Takes Shape

On the daily timeframe, QNT appears to be carving out a head and shoulders formation, a well-known pattern that often signals a potential trend shift once the neckline is tested. Earlier in the structure, QNT formed the left shoulder before rallying sharply to its head near the $100 region. From there, price reversed lower and slid back toward the neckline, located around the $70 support zone.

This $70 area has proven to be a strong demand zone in the past, repeatedly attracting buyers and preventing deeper declines. The recent move into this region was met with a noticeable reaction, as reflected by the long lower wick on the chart. That rejection from support pushed price back toward the $78 level, suggesting that buyers are actively defending the neckline and potentially forming the right shoulder of the pattern.

Quant (QNT) Daily Chart/Coinsprobe (Source: Tradingview)

The behavior around this zone is critical. A successful defense of the neckline often opens the door for a relief rally, especially if broader market conditions stabilize.

What’s Next for QNT?

For bullish momentum to build, QNT needs to reclaim the 50-day moving average, currently sitting near $83.73. This level now acts as a key short-term resistance, and a daily close above it would signal a shift in momentum back in favor of buyers.

If that recovery unfolds, the chart points toward a potential move into the $95.90 region. Such a move would represent a rebound of roughly 22% from current levels and align with the typical reaction seen during the right-shoulder phase of this pattern. A rally of this nature would not only ease recent selling pressure but also place QNT back into a more neutral technical posture.

That said, the setup remains delicate. If the $70 neckline support fails to hold on a sustained basis, the head and shoulders structure would remain bearish, opening the door to further downside and extending the corrective phase. For now, all eyes remain on how price behaves around this key support and whether buyers can regain control above the moving average.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

Related Articles

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"

Cardano Faces Key Support Test at $0.244 Amid Market Uncertainty

Bottoming out and aiming for a rebound by the end of the year! Standard Chartered predicts: Bitcoin may drop to $50,000, and Ethereum could fall to $1,400

Alt-Season Is Starting Now: Top 5 Altcoins Positioned for 2x–4x Returns as Bitcoin Loses Dominance