Aerodrome Finance (AERO) makes an impressive surge, is the upward momentum paving the way to the 0.73 USD mark?

During the overall recovery wave of the cryptocurrency market, Aerodrome Finance (AERO) stands out with an impressive breakout, nearly erasing all losses from December. This altcoin remains solid above the key support level of $0.40, then accelerates to a local peak of $0.59 before entering a slight correction.

At the time of reporting, AERO is trading around $0.558, representing an 18.75% increase in just 24 hours. The upward momentum is supported by a surge in trading volume of up to 70%, along with a 17% expansion in market capitalization, reflecting a clear return of capital flow and increasing on-chain activity.

Buying pressure drives Aerodrome Finance’s recovery

After AERO lost the important support level of $0.40 a few days ago, the Aerodrome Finance team quickly responded with token buybacks, thereby unlocking liquidity and strengthening market confidence. Specifically, the project bought and locked a maximum of 940,000 AERO through a flexible buyback model, adjusted closely with market developments.

This timely move acted as a “catalyst,” attracting investors to re-enter at discounted prices. The demand then spread across both spot and derivatives markets.

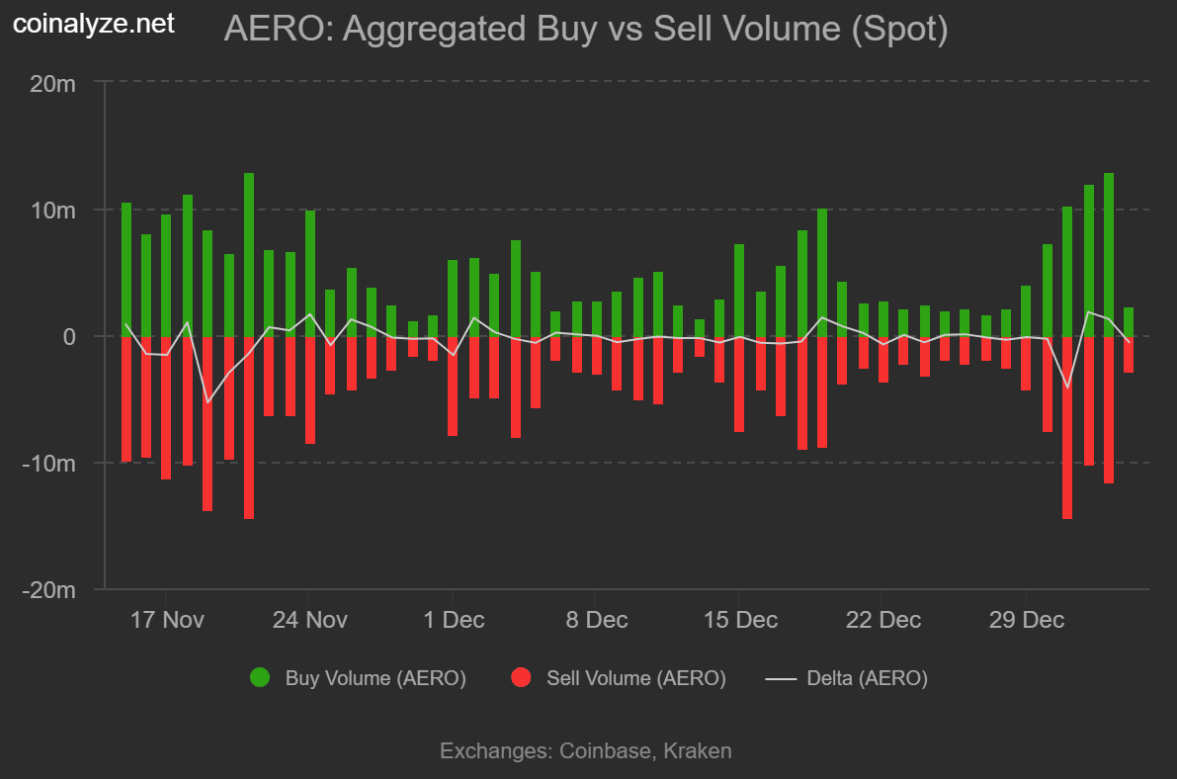

In the spot market, AERO recorded a trading volume of $27.1 million, significantly exceeding the $24.2 million in sell volume.

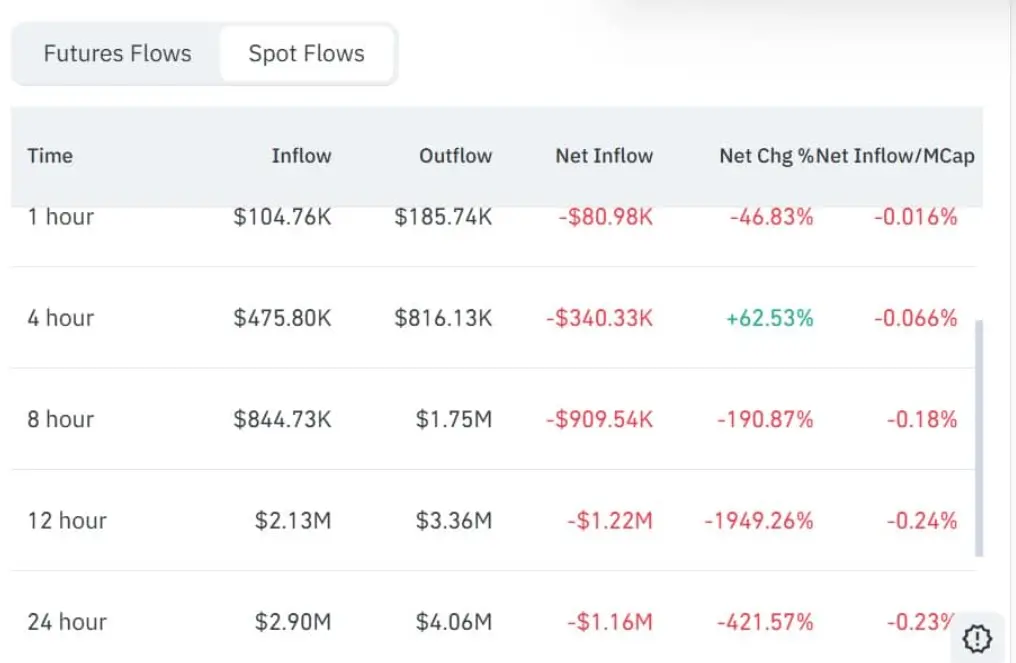

Moreover, data from CoinGlass shows that AERO outflows from exchanges surged to $4.06 million, while inflows decreased to $2.9 million.

Source: Coinglass Spot Netflow then plummeted 421% to -$1.16 million, reflecting increasingly strong holding sentiment. Amid rising spot buying activity, circulating supply is tightening — a factor often leading to faster and stronger price increases.

Source: Coinglass Spot Netflow then plummeted 421% to -$1.16 million, reflecting increasingly strong holding sentiment. Amid rising spot buying activity, circulating supply is tightening — a factor often leading to faster and stronger price increases.

Derivatives market sentiment turns positive

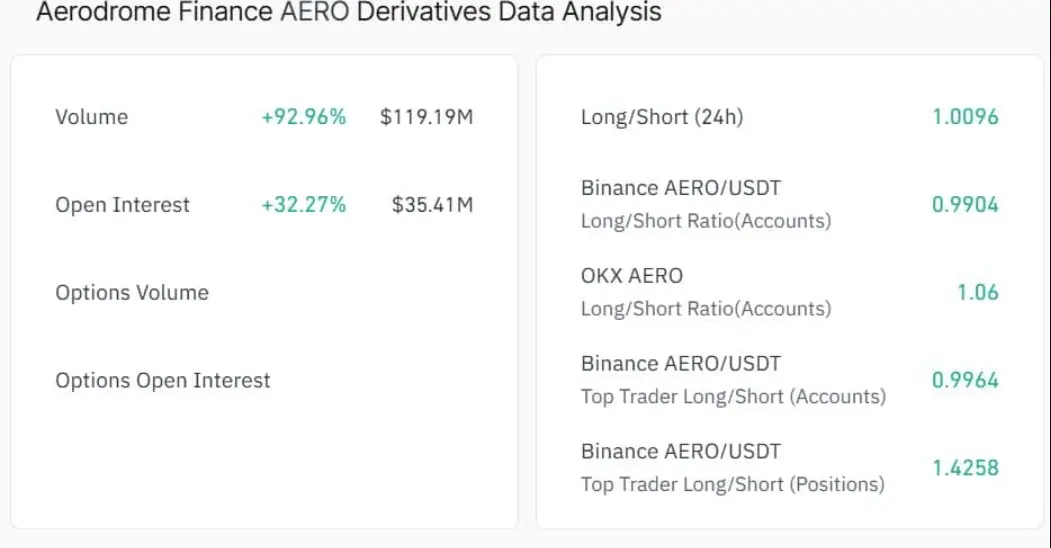

Open interest (OI) for AERO has surged by 32%, reaching $35.4 million, while derivatives trading volume exploded by 92%, according to data from CoinGlass.

The simultaneous increase in OI and volume indicates that futures market activity is picking up again, reflecting growing participation from investors, whether in long (Long) or short (Short) positions.

Source: Coinglass At the same time, the market recorded a net inflow of $37.6 million into derivatives contracts.

Source: Coinglass At the same time, the market recorded a net inflow of $37.6 million into derivatives contracts.

More notably, AERO’s Long/Short ratio has risen to 1.0, indicating that demand for opening Long positions is dominant. This development reflects widespread optimistic sentiment and expectations that AERO’s price could continue its upward trend in the near future.

Will AERO’s rally be sustained?

Aerodrome Finance has experienced an impressive breakout thanks to the return of bottom-fishing capital, successfully protecting the key support zone. The RSI indicator of this altcoin has risen to 54 before correcting back around 50, indicating that buying pressure remains fairly positive and shows no clear signs of weakening.

Source: TradingView Simultaneously, AERO has broken above the 20-day exponential moving average (EMA), an early signal that the recovery trend is gradually forming. Currently, the altcoin is testing the 50-day EMA around $0.61; if it successfully breaks through, the upward trend will be reinforced, opening room toward the short-term target of $0.73.

Source: TradingView Simultaneously, AERO has broken above the 20-day exponential moving average (EMA), an early signal that the recovery trend is gradually forming. Currently, the altcoin is testing the 50-day EMA around $0.61; if it successfully breaks through, the upward trend will be reinforced, opening room toward the short-term target of $0.73.

However, the positive scenario could be disrupted if profit-taking pressure increases, causing AERO to reverse and slide back below the psychological level of $0.50.

SN_Nour

Related Articles

10x Research: Circle receives multiple positive boosts, with fundamentals and institutional interest resonating to drive the stock price higher

VanEck Releases Bitcoin On-Chain Report: Long-term Holders Selling Slows Down, Hash Rate Contraction May Lay the Foundation for Future Stronger Returns

Hyperliquid (HYPE) emerges as a rare bright spot amid the cautious retail trader phase

Optimism Slides 22% as Base Moves Away from OP Stack, More Losses Ahead?

Robert Kiyosaki Buys Another Bitcoin at $67,000 as BTC Price Shows Recovery Signs