Gate Daily (January 12): U.S. Department of Justice criminal investigation of Powell; BitMine staking ETH surpasses 1 million

Bitcoin (BTC) opened this week with a rebound, currently around $91,530 on January 12. BitMine’s staked ETH surpasses 1 million. Samson Mow predicts Elon Musk will “vigorously enter” the Bitcoin space by 2026. The Federal Reserve Chairman Powell is under investigation, with the focus on the Fed building renovation project, but he emphasizes that the criminal subpoena is a “political excuse,” vowing to withstand pressure from Trump.

Macro Events & Crypto Hotspots

-

Ethereum vault company BitMine has reached a milestone, with total staked ETH surpassing 1 million. According to Arkham Intelligence data, BitMine staked 86,400 ETH across four separate transactions, valued at approximately $268.7 million at press time. On-chain analysis platform Lookonchain states that the latest batch of staked ETH brings BitMine’s total staking to 1,080,512 ETH.

-

Jan3 founder Samson Mow predicts that billionaire investor and Tesla CEO Elon Musk will actively enter the Bitcoin field by 2026. This is one of Mow’s five bold predictions for Bitcoin in 2026. Last year, several well-known crypto executives failed to accurately forecast Bitcoin’s future. “Musk is heavily investing in Bitcoin,” Mow posted on X on Saturday.

-

The New York Times quoted informed officials revealing that the U.S. District Attorney’s Office in Washington, D.C., has launched a criminal investigation into Federal Reserve Chair Powell, involving the Fed headquarters renovation project and whether Powell made false statements to Congress about the project’s scale. The investigation includes analysis of Powell’s public statements and review of related expenditure records, approved last November. Powell stated that a grand jury subpoena was served last Friday. The new threat has nothing to do with his testimony or the renovation project, just an excuse. The broader issue is whether the Fed will continue to set interest rates based on evidence and economic data or be influenced by political pressure and intimidation. Powell emphasizes that he will perform his duties without fear of political pressure or bias and will continue to do so. He deeply respects the rule of law, but this unprecedented action should be viewed in the context of ongoing pressure from the current government on the Fed.

News Highlights

-

Spot silver hits a historic high

-

Stablecoin payment company PhotonPay completes a $10 million Series B funding round, led by IDG Capital

-

Powell responds to criminal investigation: the subpoena is a “political excuse,” vows to withstand Trump’s pressure

-

Spot gold first surpasses $4,600

-

Michael Saylor: The best-performing assets over the past decade are NVDA, MSTR, and BTC

-

A whale transfers 26,000 ETH to an exchange for liquidation, realizing a total profit of $269 million

-

US media: Powell under investigation, focus on Fed building renovation

-

Bloomberg analyst: The earliest possible date for SEC to process Morgan Stanley’s BTC ETF application is March 23

-

Michael Saylor posts again about Bitcoin Tracker, with potential disclosure of increased holdings next week

Market Trends

-

Latest Bitcoin news: $BTC opened this week with a rebound, currently around $91,530, with $18.37 million in liquidations in the past 24 hours, mainly short positions;

-

Investors ignore mixed economic data, and the U.S. Supreme Court has not ruled on the legality of Trump’s tariffs, leading to a positive close on Wall Street on January 9. The Dow Jones Industrial Average rose 237.96 points, or 0.48%, to close at 49,504.07. The S&P 500 increased 44.82 points, or 0.65%, to close at 6,966.28. The Nasdaq, mainly tech stocks, gained 191.33 points, or 0.81%, closing at 23,671.35. The Philadelphia Semiconductor Index rose 202.683 points, or 2.73%, to close at 7,638.78.

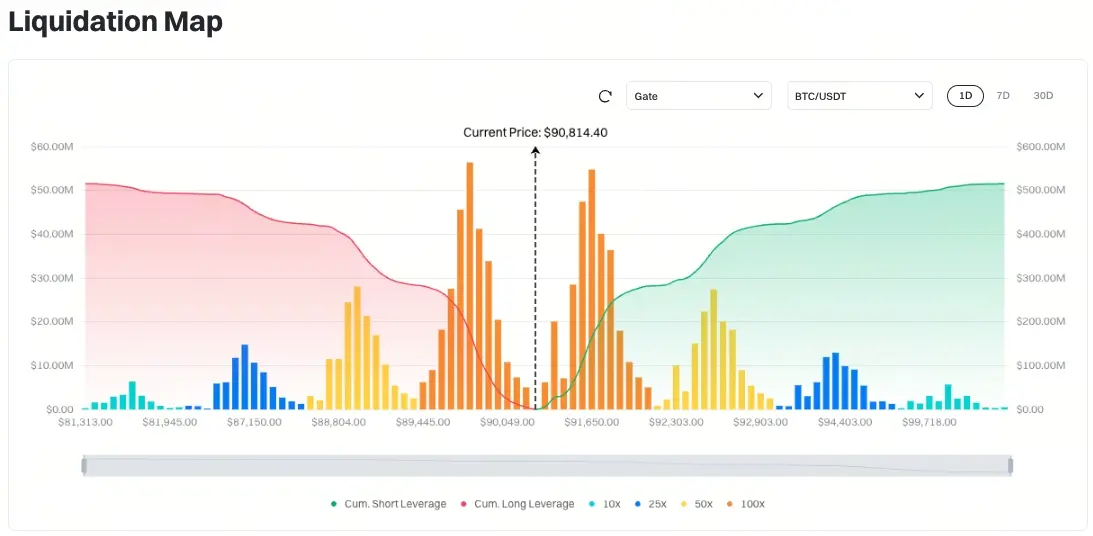

(Source: Gate)

(Source: Gate)

- According to Gate BTC/USDT liquidation map, with the current price at $90,814.40 USDT, if it drops near $89,790, total long liquidations exceed $175 million; if it rises near $91,650, total short liquidations exceed $164 million. Short liquidations are lower than longs; it is advisable to control leverage reasonably to avoid large-scale liquidations during market fluctuations.

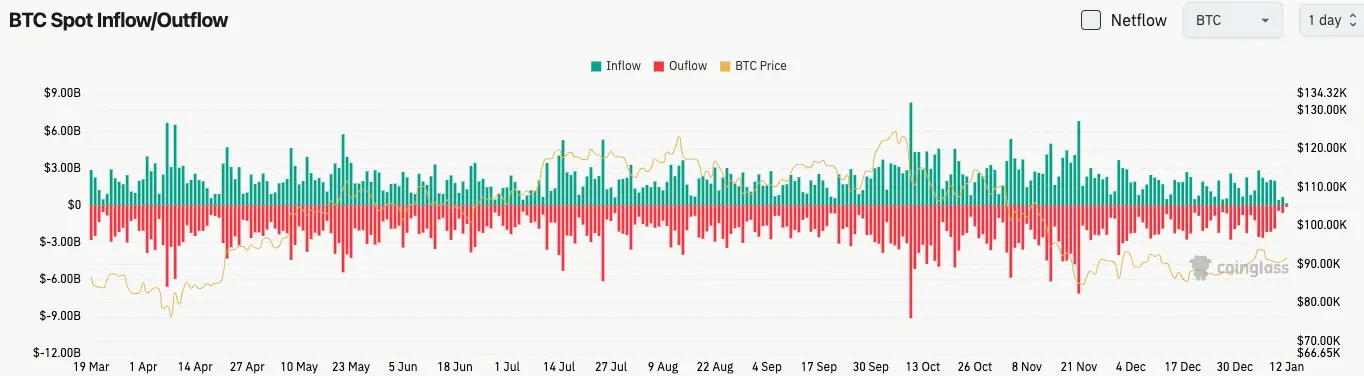

(Source: Coinglass)

- In the past 24 hours, BTC spot inflow was $672 million, outflow $602 million, net outflow $70 million.

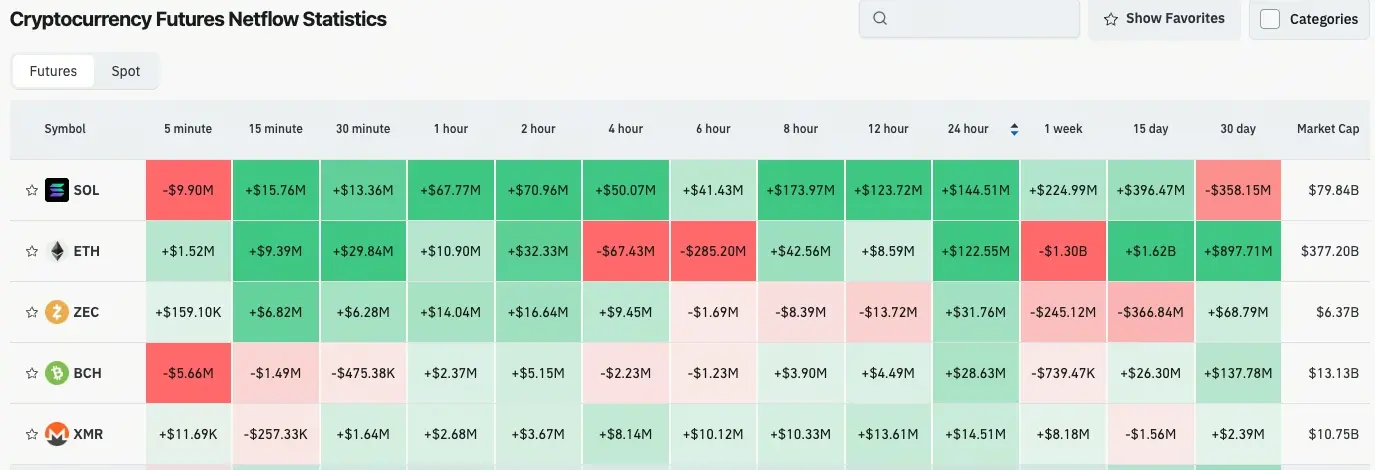

(Source: Coinglass)

- In the past 24 hours, net outflows led by contracts trading in $SOL, $ETH, $ZEC, $BCH, $XMR , indicating trading opportunities.

X KOL Selected Opinions

Phyrex Ni (@Phyrex_Ni): “Had a smooth Sunday, mostly spent learning from morning till late night, barely had time to type. It’s a fulfilling life. The biggest event this weekend remains Trump’s attitude towards Iran and Venezuela. The probability of Iran and Trump reconnecting is high, and Venezuela seems to have already negotiated US oil deals. But today, Venezuelans are leaving the US.”

“Also, Trump seems to have paused Venezuela’s oil shipments to Cuba. It looks like Venezuela’s oil is quite ‘controlled’ by the US. The market’s main concern is the impact of Trump’s series of actions. Looking at BTC’s current price trend, it’s quite similar to last week when Maduro was detained, especially with slight US market gains, and the market is in buy mode. Of course, it’s hard to be certain now; in a few hours, US stock futures will open, and Asian investors will give their initial answer, followed by Europe and US investors’ responses to confirm.”

“Back to Bitcoin data, the turnover rate on Sunday dropped significantly, reaching the lowest in recent months, indicating that without institutional and quantitative interference, genuine investor interest remains low. The weekend’s chip structure is also unremarkable. I’m just waiting to see if BTC will bottom again at $90,000 or if it will bottom at $83,000. However, higher-loss investors still hold very high positions, with no signs of panic.”

Today’s Outlook

-

China’s M2 money supply (annual rate) at the end of December, previous value 8.0%

-

G7 Finance Ministers Meeting

Related Articles

Bitcoin Bleeds 29% But Sellers Are Exhausted, VanEck Says - U.Today

The Next Few Days Will Decide Whether Bitcoin Price Explodes to $80K or Crashes to $40K

Bitcoin Sell Pressure Is Easing, But Whales Keep Dumping on Exchanges: CryptoQuant

Supreme Court Slams Trump Tariffs: Is Bitcoin and Crypto Surge Incoming?

Bitcoin Stuck Until Nasdaq Breaks Out, Expert Warns Amid Market Choppiness

XRP Trades Near $1.45 Support as Bitcoin Fractal Comparison Emerges