Gate Daily (January 13): Former New York City Mayor launches NYC Token; Thai Prime Minister orders tightening of digital asset regulations

Bitcoin (BTC) short-term rebound, currently around $91,400. The Federal Reserve survey and Trump’s tariffs boost risk aversion sentiment. Former New York City Mayor Eric Adams announced the launch of the “NYC Token” cryptocurrency project. Thailand’s Prime Minister has ordered tighter regulations on gold trading and digital assets to combat “gray funds.”

Macro Events & Crypto Hotspots

-

Former New York City Mayor Eric Adams announced a cryptocurrency project called “NYC Token,” aimed at raising funds to combat anti-Semitism, anti-American sentiments, and to educate children about blockchain technology. However, the specific details of the plan remain quite vague. During a brief presentation in Times Square, Adams did not specify how the token would specifically counter anti-Semitism, nor did he disclose partners, issuance timing, or fund allocation. Adams stated he will not take a salary from the project for now but may reassess in the future. Adams has previously supported the crypto industry vigorously but has also faced controversy over moral and conflict of interest issues. New Mayor Zohran Mamdani has stated he will not purchase the token. The NYC Token appears to have been launched on the Solana network, with its market cap briefly soaring to $700 million before quickly falling back, currently at $95.47 million.

-

Thai Prime Minister Anutin Charnvirakul has officially launched a comprehensive crackdown on “gray funds” and illegal capital flows, ordering tighter regulations on gold trading and digital assets. In the digital asset sector, the government will strictly enforce the “Travel Rule,” requiring identification of sender and receiver in all wallet-to-wallet transfers to eliminate anonymity. Additionally, Thailand will establish a national Data Bureau to centrally manage financial data, enabling regulators to track suspicious transactions in real-time.

News Highlights

-

Thai Prime Minister orders tighter regulations on gold trading and digital assets to combat “gray funds.”

-

Former New York City Mayor Eric Adams announces the launch of “NYC Token.”

-

US SEC Chair: Whether the US will confiscate Bitcoin seized from Venezuela remains to be seen.

-

US Senator Lummis proposes the “Blockchain Regulatory Certainty Act” to protect crypto developers.

-

WLFI officially sends 500 million WLFI tokens to Jump Trading, valued at approximately $83.12 million.

-

US CFTC is restructuring a new Innovation Committee, with several well-known crypto industry figures as initial members.

-

Bissent warns: Federal Reserve investigation causes market turbulence, possibly leading Powell to refuse to relinquish power.

-

Meta plans to cut back on Metaverse team investments, redirect funds to VR headset business.

-

Bitmine pledges over 150,000 ETH again, worth about $479 million.

Market Trends

-

Latest Bitcoin news: $BTC Short-term rebound, currently around $91,400. In the past 24 hours, liquidations reached $72.28 million, mainly long positions.

-

The four major US stock indices closed higher on January 12. The Dow, S&P 500, and Philadelphia Semiconductor Index hit new closing highs. Tech companies and retailer Walmart rose, with investors largely unaffected by the US Department of Justice’s criminal investigation into Fed Chair Powell. The Dow Jones Industrial Average closed up 86.13 points, up 0.17%, at 49,590.20; the S&P 500 rose 10.99 points, up 0.16%, at 6,977.27; the Nasdaq increased 62.56 points, up 0.26%, at 23,733.90. The Philadelphia Semiconductor Index gained 36.06 points, up 0.47%, at 7,674.84.

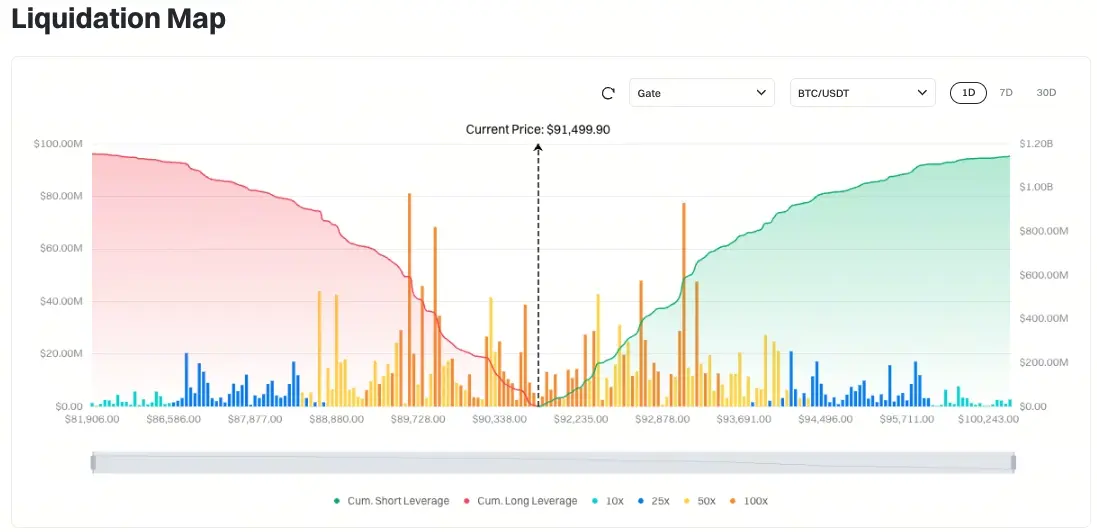

(Source: Gate)

- In the Gate BTC/USDT liquidation map, based on the current price of 91,499.90 USDT, if the price drops to around 89,692 USD, the total long liquidation exceeds $591 million; if it rises to around 93,032 USD, the total short liquidation exceeds $580 million. Short and long liquidations are roughly balanced.

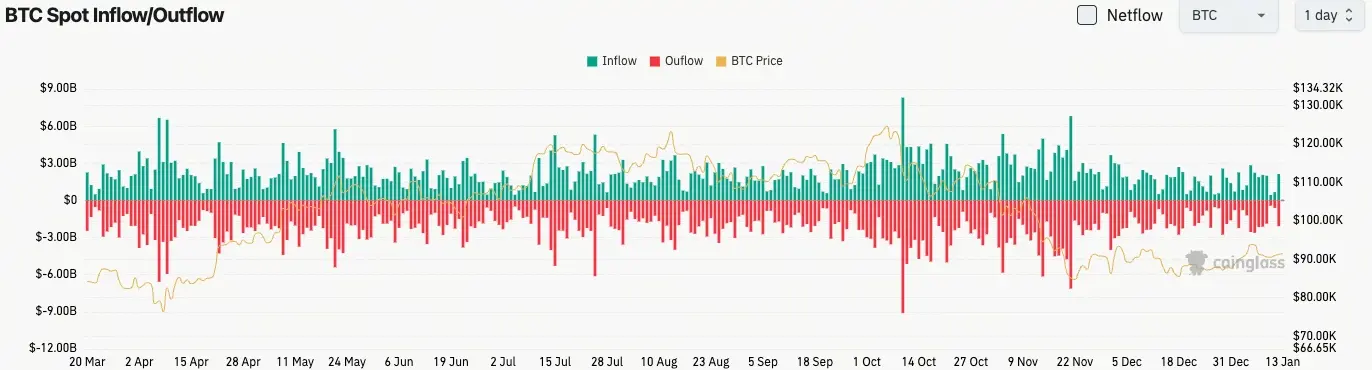

(Source: Coinglass)

- In the past 24 hours, spot inflow of BTC was $2.14 billion, outflow was $2.08 billion, net inflow was $0.6 billion.

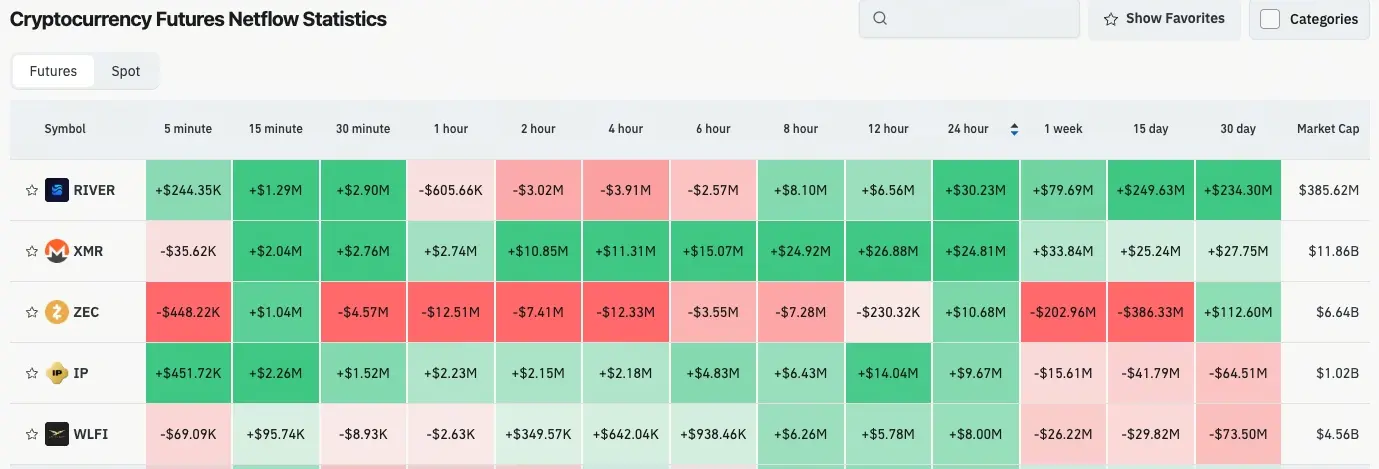

(Source: Coinglass)

- In the past 24 hours, contracts involving $RIVER, $XMR, $ZEC, $IP, $WLFI have led net outflows, presenting trading opportunities.

Top KOL Insights

Phyrex Ni (@Phyrex_Ni): “Monday’s trading was a complete mess. Iran and Venezuela issues are unresolved, and Trump is rushing to threaten Powell. Not sure how many still remember, but I posted a tweet two weeks ago about US government officials’ approval ratings, with Powell at the top and Trump at the bottom. Trump threatening Powell directly triggered market turbulence, worrying about the Fed’s independence.”

“Everyone knows Trump is just looking for trouble. Powell quickly resigned as Fed Chair, probably because Trump didn’t want Powell to continue as a director, trying to push him out. But this could backfire. The past three Fed Chairs and some overseas central bank heads have come out to support Powell, making Trump look even worse.”

“Meanwhile, US stocks have been volatile, swinging back and forth, only slightly rising at the close. The S&P 500 even hit a new all-time high before closing. Bitcoin’s price also fluctuated, but driven by the US stock rally, Bitcoin edged higher.”

“Looking at Bitcoin data, the turnover rate today isn’t high, and investor sentiment remains quite restrained. Not seeing large-scale trading amid macro and political turmoil is already good. The market now has two different views: one believes the US economy is resilient, and the Fed may not cut rates in 2026; some even think the Fed won’t cut rates in 2026 at all.”

“Another view is that inflation in November might have decreased due to stagnation, but December inflation could continue rising, possibly discouraging the Fed from cutting rates in 2026. Both views are not optimistic about rate cuts in 2026, and the key debate is whether Trump will interfere with the Fed’s independence after Powell’s departure.”

“So, will the market see this interference as good or bad? Only time will tell.”

Today’s Outlook

-

China’s M2 money supply at the end of December (annualized), previous value 8.0%.

-

US December Core Consumer Price Index (annualized), previous value 2.6%.

-

US December Consumer Price Index (annualized), previous value 2.7%.

-

US October New Home Sales (annualized monthly rate).

Related Articles

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

Macro Shift Alert: 5 Altcoins Quietly Eyeing 180% Gains as BTC Dominance Wavers

Alt-Season Is Starting Now: Top 5 Altcoins Positioned for 2x–4x Returns as Bitcoin Loses Dominance