Tether frozen $182 million overnight! 5 Tron wallets blocked in cooperation with the FBI law enforcement

Tether froze a total of 5 wallets on the Tron blockchain on Sunday, amounting to $182 million USDT, in coordination with OFAC sanctions list. The total frozen assets exceed $3 billion, assisting over 310 law enforcement agencies across 62 jurisdictions. The frozen assets are 30 times more than Circle’s. USDT circulation is 187 billion, accounting for 64% of the market share, with stablecoins making up 84% of illegal transactions.

$182 Million Frozen: Law Enforcement Logic and OFAC Coordination

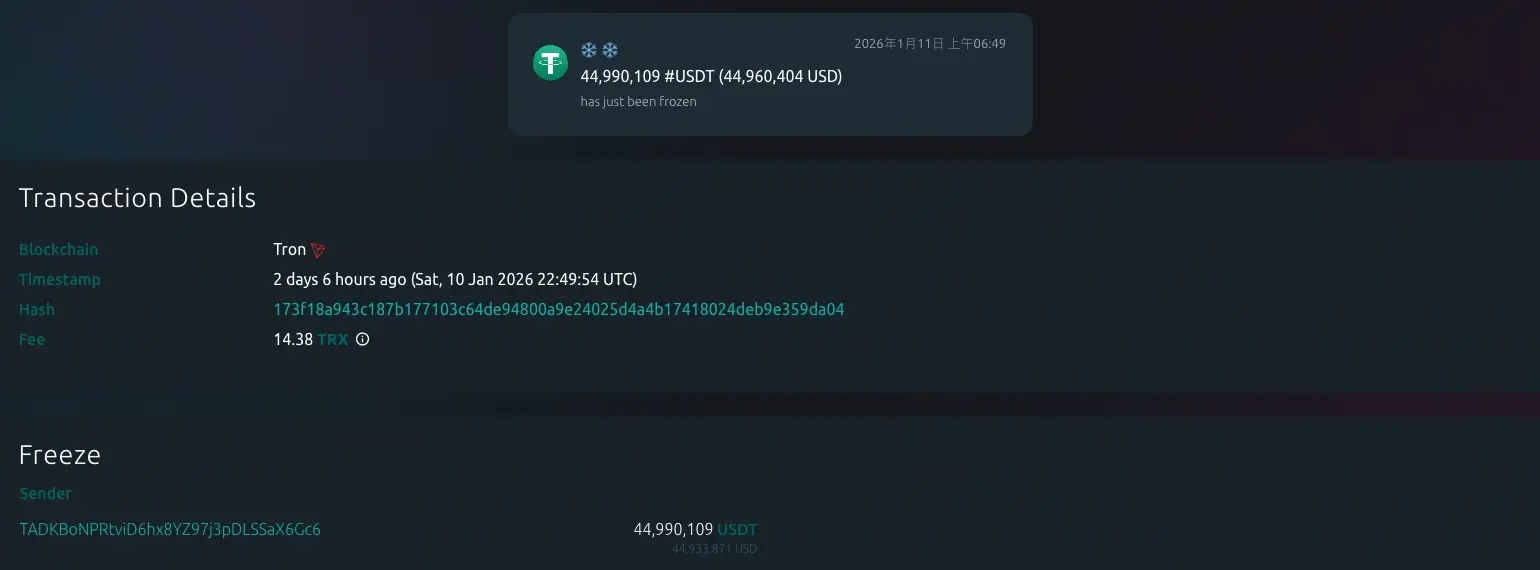

According to on-chain data monitoring tool Whale Alert, Tether on Sunday froze over $182 million USDT across 5 wallet addresses on the Tron blockchain, marking the largest on-chain freeze on Tron in recent months. On-chain data shows these 5 addresses hold between approximately $12 million and $50 million USDT each; Tether has not yet disclosed the specific reasons for freezing these assets.

The January 11 freeze aligns with Tether’s wallet freeze policy, officially launched in December 2023. The policy mainly aims to comply with the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) “Specially Designated Nationals (SDN)” sanctions list. Tether explicitly states in its terms of service that it reserves the right to freeze addresses or provide user information upon receiving court orders or when the company deems it “reasonable and necessary.”

How is this freeze mechanism technically implemented? USDT is a token issued based on smart contracts, with Tether as the issuer maintaining a “blacklist” feature within the contract. Once an address is blacklisted, USDT in that address cannot be transferred, traded, or used, effectively locking it permanently. This centralized control has been controversial within the decentralized crypto community, but Tether considers it a necessary measure to ensure compliance.

According to data disclosed on Tether’s official website, the company has assisted 62 jurisdictions and over 310 law enforcement agencies worldwide, freezing over $3 billion worth of USDT. As of July 2025, in cooperation with FBI and U.S. Secret Service, Tether has frozen over 2,380 wallets with assets totaling approximately $1.14 billion. This proactive law enforcement cooperation contrasts with long-standing regulatory skepticism toward Tether.

Three Main Types of Tether’s $3 Billion Freezing

OFAC Sanctions List: Coordinating with U.S. Treasury sanctions against addresses related to Iran, North Korea, Russia, etc.

Law Enforcement Requests: FBI, Secret Service, etc., targeting fraud, money laundering, ransomware cases.

Proactive Risk Control: Tether’s own judgment on high-risk addresses suspected of illegal activities.

Interestingly, Tether’s enforcement efforts significantly surpass those of its competitor Circle (issuer of USDC). According to a report by AMLBot published in December 2025, the total frozen assets by Tether since 2023 are 30 times that of Circle’s $109 million. This stark difference could be explained by two factors: first, USDT’s usage in illegal activities far exceeds USDC; second, Tether’s enforcement cooperation is markedly more aggressive than Circle’s.

USDT’s 64% Market Share: A Double-Edged Sword

Currently, USDT has a circulating supply exceeding $187 billion, dominating 64% of the stablecoin market. In contrast, USDC, which is more compliant and US-based, has a total supply around $75 billion. This market dominance makes USDT the de facto standard for global crypto trading but also the preferred tool for illicit fund flows.

According to Chainalysis’s latest report, stablecoins are now the primary medium for illegal crypto transactions. Data shows that in 2025, the global illicit crypto flows are conservatively estimated at $154 billion, with stablecoins contributing 84% of that. This astonishing proportion highlights the central role of stablecoins in illegal activities, with USDT, as the largest stablecoin, naturally being a major target.

USDT’s popularity in illegal activities is due to multiple reasons. First, liquidity: USDT is traded on nearly all exchanges with the best depth, making large transfers most convenient. Second, anonymity: while blockchain transactions are traceable, mixing services and multi-layer transfers can achieve a significant degree of privacy. Third, cross-border convenience: USDT can be transferred globally within minutes, far faster than traditional banking via SWIFT.

However, USDT’s market dominance also attracts regulatory pressure. When illegal activities predominantly use USDT, law enforcement and regulators naturally target Tether. If Tether does not actively cooperate, it risks sanctions or even shutdown. Therefore, Tether’s large-scale freezing actions are both a compliance obligation and a strategic self-protection measure.

Tron as a Hotspot: Technical and Regulatory Reasons

All these freezes occurred on the Tron chain, which is no coincidence. As the second-largest chain for USDT issuance (after Ethereum), Tron’s extremely low transfer fees and fast confirmation times make it the platform of choice for small, high-frequency transactions. However, these features also make Tron a significant conduit for illicit fund flows.

Tron’s transfer fees are usually below $1, far lower than Ethereum’s several dollars or tens of dollars. This cost advantage allows criminals to perform numerous small transfers to disperse tracking or use mixing services without worrying about fee erosion. Additionally, Tron’s fast confirmation time (~3 seconds) enables rapid fund transfers, increasing law enforcement’s tracking difficulty.

The user base structure of Tron also plays a role. Unlike Ethereum’s DeFi users and institutional investors, Tron’s users are more often retail traders and cross-border payment users from Asia. This group includes many participants involved in gray or black markets, such as gambling, money laundering, and scams, who prefer using Tron for fund transfers.

The targeted freeze on Tron by Tether may be based on intelligence provided by law enforcement. When multiple wallets are frozen simultaneously, it often indicates they are related, possibly belonging to the same criminal group or money laundering network. The total of 5 wallets with $182 million suggests a large organization rather than individual actors.

For ordinary users, this large-scale freeze is a warning: holding USDT is not entirely safe. Even if your funds are from legitimate sources, if you receive USDT from flagged addresses, your wallet could also be frozen. This “contamination risk” has led some security-conscious users to switch to USDC or other more compliant stablecoins.

Nevertheless, USDT’s market dominance remains strong. With a circulation of $187 billion versus USDC’s $75 billion, the advantage is clear. This gap stems from broader exchange support, deeper liquidity, and strong network effects in Asia and emerging markets. Despite regulatory concerns and freeze risks, USDT remains the preferred choice for most traders.

$3 Billion Frozen and the Future of Stablecoin Regulation

The $3 billion worth of USDT frozen by Tether demonstrates both its enforcement cooperation strength and the scale of USDT involved in illegal activities. While this accounts for about 1.6% of USDT’s total circulation, the actual scale of illegal USDT could be much higher, considering only confirmed illicit funds.

Whether Tether’s proactive enforcement can improve its regulatory standing remains to be seen. Long criticized for lack of reserve transparency, missing audit reports, and offshore registration, Tether has recently increased transparency by releasing periodic proof-of-reserve reports but has not undergone full audits. Active law enforcement cooperation may be part of Tether’s strategy to demonstrate responsibility and improve relations with regulators.

However, this centralized freeze authority also raises philosophical debates. The original vision of cryptocurrency is decentralization and censorship resistance, yet Tether’s freeze function effectively makes USDT a centralized asset controllable by a single entity. This contradiction leads some crypto purists to reject USDT and turn to decentralized stablecoins like DAI. But for most pragmatic users, liquidity and convenience still outweigh ideological concerns.

Related Articles

Tether ends support for the CNH₮ stablecoin due to limited market demand

Tether will cease the issuance and redemption of the offshore RMB stablecoin CNHT.

Tether CEO: XAUT, worth 94 tons of gold, has completed on-chain transfer with a total fee of only 0.0016%

Anchorage Digital launches stablecoin solution, offering cross-border USD settlement for international banks

Rumble announces integration of Tether US version stablecoin USAT into its wallet service

Elemental Royalty to Pay Dividends in Tether’s XAUT Gold Token