Bitmine Holds 4.17 Million ETH: Now Controls 3.45% of Ethereum Supply as World's Largest Ether Treasury

Bitmine (NYSE: BMNR) has solidified its position as the world’s largest corporate holder of Ethereum (ETH), with 4.17 million ETH in its treasury—representing approximately 3.45% of the total circulating supply (based on ~120.7 million ETH).

(Sources: X)

This aggressive accumulation, led by Chairman Thomas “Tom” Lee, mirrors MicroStrategy’s Bitcoin strategy but focuses exclusively on ETH, combining long-term holding with active staking for yield generation.

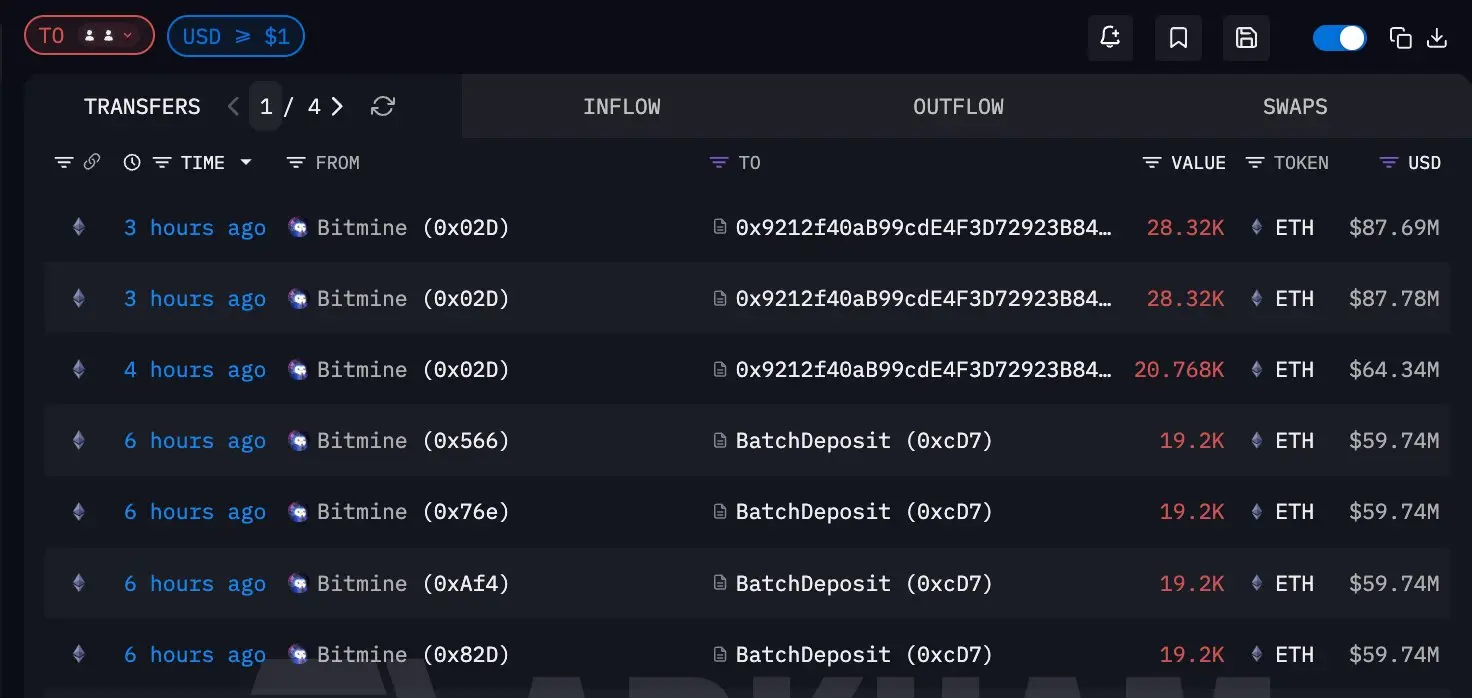

The latest update (January 12, 2026 press release) shows Bitmine’s total crypto + cash + “moonshots” holdings valued at $14.0 billion, making it the second-largest corporate digital asset holder globally (behind only MicroStrategy). Recent weekly additions included 24,266 ETH, pushing the treasury higher while maintaining strong cash reserves.

Breakdown of Bitmine’s Current Holdings

- 4,167,768 ETH — valued at ~$13 billion (priced at $3,119/ETH per Coinbase reference)

- 193 BTC

- $23 million stake in Eightco Holdings (NASDAQ: ORBS) as “moonshots”

- $988 million in cash reserves

Bitmine has staked 1,256,083 ETH (about 30% of its holdings, worth ~$3.9 billion), marking it as the entity staking the most ETH worldwide. Staking has ramped up dramatically, with 596,864 ETH added in the past week alone through partnerships with three providers.

MAVAN: Bitmine’s In-House Staking Network Launching Q1 2026

The company is on track to deploy its Made in America Validator Network (MAVAN) in early 2026 — an enterprise-grade, secure staking infrastructure designed specifically for its massive ETH position. Using the current Composite Ethereum Staking Rate (CESR) of 2.81% (via Quatrefoil), Bitmine projects annual staking revenue of $374 million (over $1 million per day) once the majority of its ETH is staked via MAVAN and partners.

This shift transforms Bitmine from a passive holder into a major network participant, contributing to Ethereum’s security while generating consistent yield for shareholders.

Strategic Push and Shareholder Vote

Bitmine aims to reach 5% of Ethereum’s total supply — a goal Chairman Tom Lee calls the “Alchemy of 5%.” The company has made rapid progress, owning nearly 70% of the way toward this target in just months.

A critical next step: shareholders must approve an increase in authorized shares (requiring 50.1% approval) at the upcoming annual meeting (January 15, 2026, at Wynn Las Vegas). Lee urged a “YES” vote on Proposal #2 to enable continued capital raises and ETH accumulation. Without approval, the pace of buying may slow.

BMNR stock has seen massive trading interest, averaging $1.3 billion in daily volume over the past five days — ranking it as the 67th most traded U.S.-listed stock.

Broader Context: Institutional Conviction in Ethereum

Bitmine’s strategy highlights growing institutional belief in ETH as a foundational asset — driven by its dominance in DeFi, stablecoins, real-world assets (RWAs), and staking economics. This aligns with Ethereum’s ongoing upgrades (e.g., Pectra/Fusaka) and Vitalik Buterin’s emphasis on long-term protocol resilience.

For investors, Bitmine offers leveraged exposure to ETH price appreciation plus future staking income, positioning it as a high-conviction play in the maturing crypto treasury space.

Track ETH and related assets securely with tools like Bitget Wallet for multi-asset monitoring, including tokenized holdings and broader portfolio oversight. As Bitmine continues its accumulation and MAVAN rollout, watch for updates around the January 15 shareholder vote — a key catalyst for further growth.

Related Articles

【Madman's Trend Talk】A Century of Change: Hold onto the Bullet, Deliver a Fatal Blow at the Critical Moment

Vitalik Buterin proposes building Ethereum with a "cypherpunk" approach

Technical Analysis for February 21: BTC, ETH, XRP, BNB, SOL, DOGE, BCH, ADA, HYPE, XMR

Wintermute Founder: The crypto industry has deviated from the cypherpunk original intention, with most of the Ethereum ecosystem's TVL being "deposited funds"

Tom Lee's Bitmine Purchases 17,722 ETH Worth $34.74 Million

Data: If ETH drops below $1,868, the total long liquidation strength on major CEXs will reach $832 million.