Lighter (LIT) Hits New Lows Amid Cooling On-Chain Metrics and Airdrop Selling — Can This Key Support Spark a Bounce?

Key Highlights

-

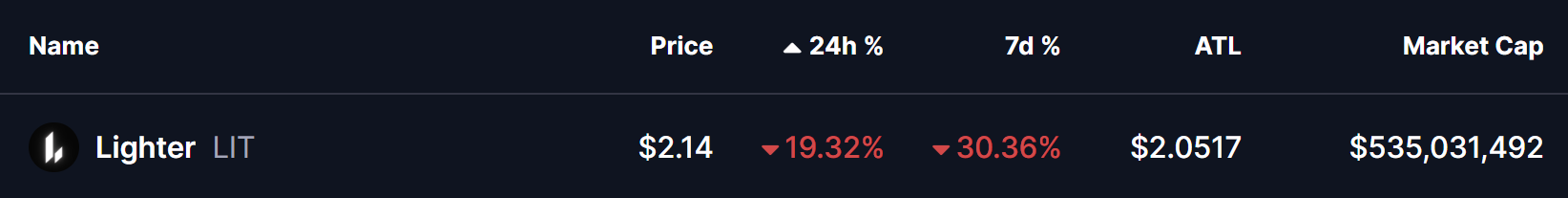

Lighter (LIT) has dropped to a new all-time low near $2.05, extending its weekly decline to nearly 30% after the post-airdrop sell-off.

-

On-chain activity on Lighter.xyz is cooling, with lower user registrations, declining trading volume, and fewer trades compared to launch-week peaks.

-

Airdrop data shows 49% of distributed LIT has been sold, though over 27% of that supply has already been bought back, hinting at dip-buying interest.

-

On the 4-hour chart, LIT is forming a potential falling wedge, a structure that can precede a short-term relief bounce if support holds.

Lighter, the decentralized perpetuals exchange built on Ethereum Layer-2, has had a rough start to 2026. The project officially launched on December 30, 2025, alongside its native token $LIT, distributing 25% of the supply via an airdrop to early users. While the launch initially sparked strong excitement — sending LIT above the $4 mark — the rally was short-lived.

Within days, heavy selling pressure dragged the token down by nearly 20% in a single session. The decline didn’t stop there. By January 13, LIT printed a fresh all-time low around $2.05, extending its weekly losses to nearly 30%. The sharp correction appears to be driven by a mix of cooling on-chain activity and aggressive airdrop-related selling.

Source: Coinmarketcap

Cooling On-Chain Metrics Signal Fading Early Momentum

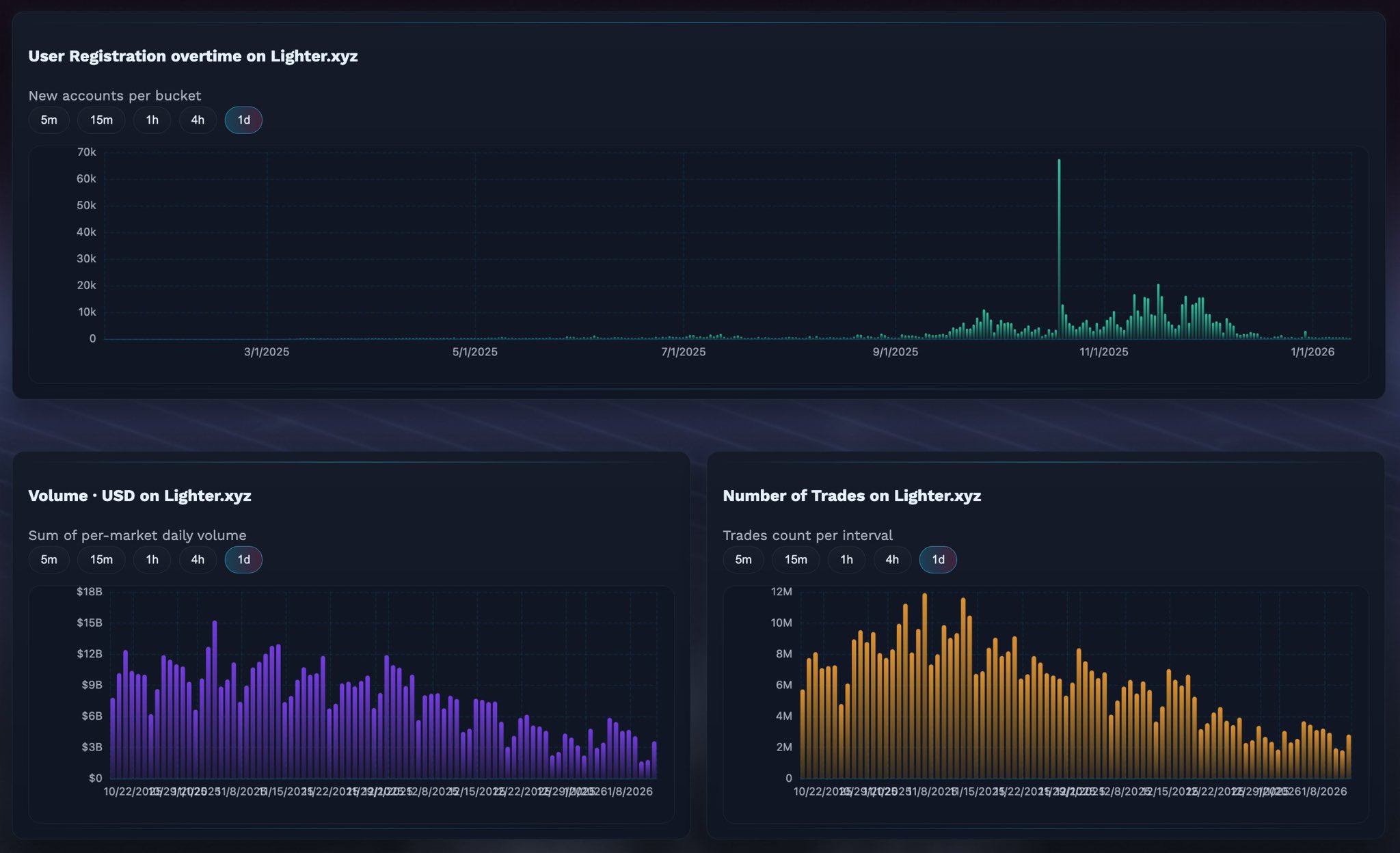

Recent on-chain data shared by crypto trader @KAIZ3NS shows a clear slowdown across Lighter’s core activity metrics. New user registrations, trading volume, and the total number of executed trades have all trended lower after peaking shortly following launch.

The user registration chart highlights a noticeable spike during the initial weeks, followed by a steady decline as January progressed. Similarly, both daily trading volume and trade count on Lighter.xyz have cooled significantly from their early highs. This slowdown likely reflects a familiar post-airdrop pattern, where short-term incentive seekers rotate capital to newer protocols offering fresh reward programs.

Lighter DEX Data/Source: @KAIZ3NS (X)

In simple terms, the early hype brought users in fast — but keeping them engaged has proven harder once the airdrop excitement faded.

Airdrop Selling Still Weighing on Price

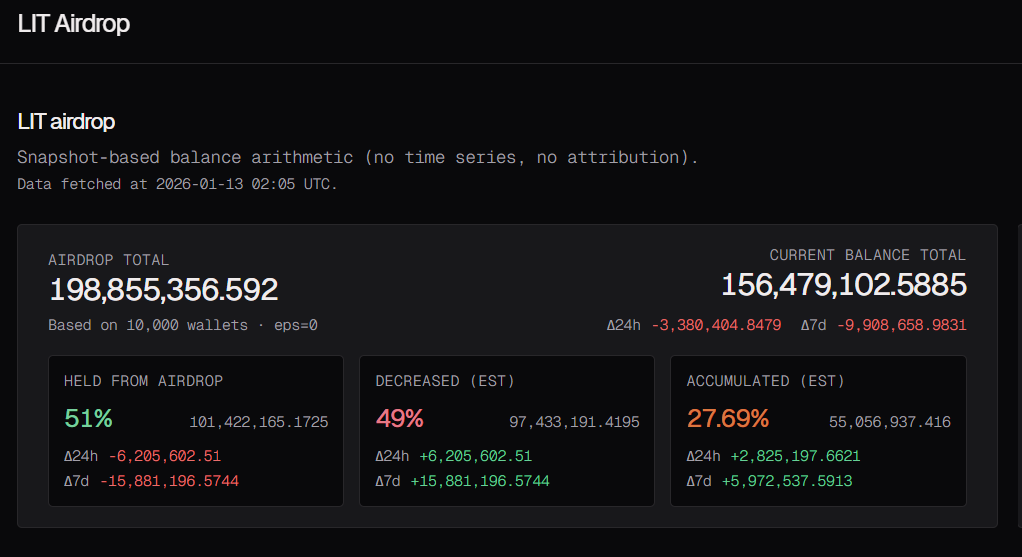

Adding further pressure to LIT’s price is continued selling from airdrop recipients. According to live data from Qwantify, only 51% of the airdropped LIT supply is currently being held. The remaining 49% has been partially or fully sold.

Interestingly, the data also shows that selling hasn’t been entirely one-directional. Of the 49% that was sold, roughly 27.69% has already been bought back, suggesting that some traders are attempting to re-enter at lower levels rather than abandoning the token completely. Still, the net effect remains bearish in the short term, as distribution continues to cap upside momentum.

Source: qwantify

Can This Support Area Trigger a Relief Bounce?

Despite the weak fundamentals in the short term, the technical picture is beginning to show early signs of potential stabilization.

On the 4-hour chart, LIT appears to be forming a falling wedge pattern, a structure often associated with trend exhaustion during downtrends. The latest sell-off pushed price down to the $2.05 zone, an area that aligns with the lower boundary of the wedge and has started acting as tentative support.

Lighter (LIT) 4H Chart/Coinsprobe (Source: Tradingview)

If buyers manage to defend this level, LIT could see a relief bounce toward the upper boundary of the wedge, which currently sits around $2.70–$2.75. Such a move would not imply a full trend reversal but could offer short-term recovery after weeks of sustained selling.

Momentum indicators are also hinting at a possible pause in downside pressure. The MACD on the 4-hour timeframe appears to be bottoming out, with bearish momentum gradually weakening. While this alone isn’t enough to confirm a reversal, it does support the idea that selling pressure may be losing steam near current levels.

Bottom Line

Lighter’s post-launch phase has been defined by a classic airdrop cycle: early hype, sharp distribution, and cooling on-chain activity. The drop to new all-time lows reflects real selling pressure rather than a single liquidation event. However, with a key support forming near $2.05 and technical momentum showing early signs of stabilization, LIT may be approaching a point where a short-term bounce becomes possible — provided broader market conditions don’t deteriorate further.

For now, LIT remains a high-risk, early-stage asset where sentiment can shift quickly. Whether this support holds or breaks will likely define the next major move.

Frequently Asked Questions (FAQ)

What is Lighter (LIT)?

Lighter is a decentralized perpetuals exchange built on Ethereum Layer-2, designed to offer low-cost and high-speed derivatives trading. LIT is its native utility token.

Why is the LIT price falling?

The decline is mainly driven by heavy airdrop-related selling and cooling on-chain activity, including fewer new users, lower trading volume, and a reduced number of trades.

How much of the LIT airdrop has been sold?

Roughly 49% of the airdropped LIT supply has been sold so far, although about 27.69% of that sold supply has already been repurchased.

Is LIT showing any bullish signs?

While the broader trend remains bearish, the MACD indicator is bottoming out, suggesting that downside momentum may be weakening near current prices.

Is this a good time to invest in LIT?

LIT remains a high-risk, early-stage asset. Traders and investors should wait for confirmation of support holding or a clear trend shift and always conduct their own research before making decisions.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

Rich Dad: Bought a Bitcoin at 67,000 because the Federal Reserve is printing money like crazy, and BTC is almost mined out.

The PI price loses momentum of recovery amid investor profit-taking.

Analysis: BTC breaks below the key on-chain valuation level and liquidity is tight. Support may be around $54,900.

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.