Battle at $95K: Can Bitcoin Bulls Hold the Line?

With bitcoin priced at $95,101 on Sunday, its market cap holding strong at $1.89 trillion, and a 24-hour trading volume humming at $19.02 billion, traders are watching a tight intraday range between $94,869 and $95,543 like hawks. The mood? Restless. The charts are calling out indecision with the subtlety of a marching band.

Bitcoin Chart Outlook

Let’s start with the daily chart. Momentum built a lovely staircase up to $97,939, but since then, bitcoin has been lounging just below $96,000, as if waiting for someone to bring it coffee. The trend still shows higher highs and higher lows, confirming a broader uptrend, but don’t mistake a nap for a sprint.

Recent candles are shrinking, and volume is tapering off—classic signs of bullish fatigue. Support is lounging between $90,000 and $91,000, while resistance clinks glasses up near $97,939. If this range were a party, the host has stepped out, and everyone’s just mingling by the snack table.

BTC/USD 1-day chart via Bitstamp on Jan. 18, 2026.

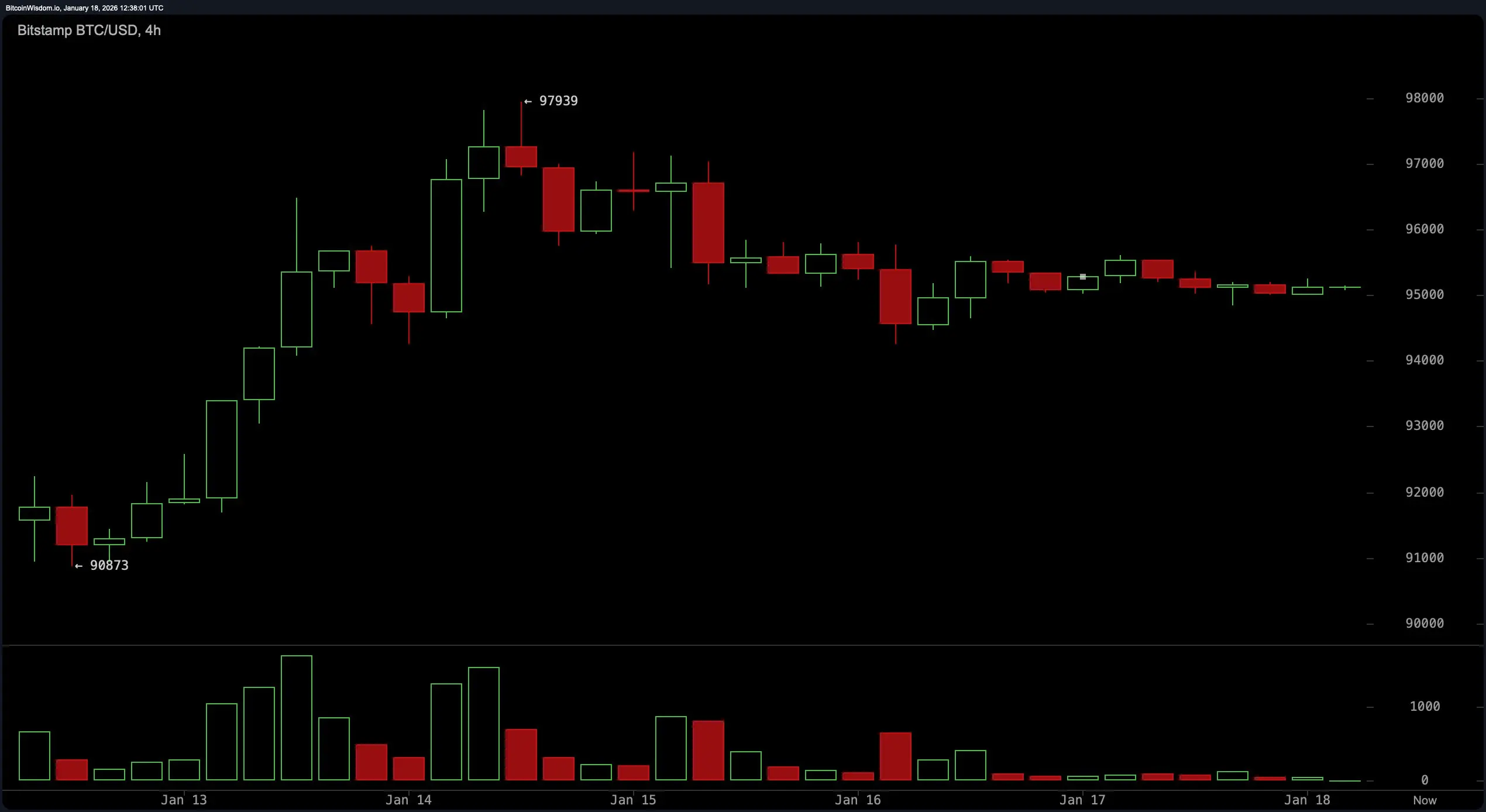

The four-hour chart reveals a tale of consolidation masquerading as strategy. Bitcoin is stuck between $94,500 and $96,000, tracing out a descending triangle that smells faintly of bearish intentions. Volume is drying up faster than a summer puddle, hinting that commitment is in short supply. Should the price break $96,500, the next dance would likely be toward $97,900. But a slip below $94,500, and we may be revisiting the $92,000 to $91,000 neighborhood—the crypto version of returning to your hometown after trying to make it in the big city.

BTC/USD 1-day chart via Bitstamp on Jan. 18, 2026.

The four-hour chart reveals a tale of consolidation masquerading as strategy. Bitcoin is stuck between $94,500 and $96,000, tracing out a descending triangle that smells faintly of bearish intentions. Volume is drying up faster than a summer puddle, hinting that commitment is in short supply. Should the price break $96,500, the next dance would likely be toward $97,900. But a slip below $94,500, and we may be revisiting the $92,000 to $91,000 neighborhood—the crypto version of returning to your hometown after trying to make it in the big city.

BTC/USD 4-hour chart via Bitstamp on Jan. 18, 2026.

On the one-hour chart, bitcoin looks like it’s in a bit of a sulk. A series of lower highs and lower lows paints a picture of a short-term downtrend, reinforced by its inability to claw back above $95,600. Support at $94,839 is trying to hold the line, but enthusiasm is lacking. Momentum is whispering instead of shouting, and without a volume resurgence, this pattern might continue limping along. A break below $94,600 could see intraday traders eyeing the exits faster than a conference room fire drill.

BTC/USD 4-hour chart via Bitstamp on Jan. 18, 2026.

On the one-hour chart, bitcoin looks like it’s in a bit of a sulk. A series of lower highs and lower lows paints a picture of a short-term downtrend, reinforced by its inability to claw back above $95,600. Support at $94,839 is trying to hold the line, but enthusiasm is lacking. Momentum is whispering instead of shouting, and without a volume resurgence, this pattern might continue limping along. A break below $94,600 could see intraday traders eyeing the exits faster than a conference room fire drill.

BTC/USD 1-hour chart via Bitstamp on Jan. 18, 2026.

Now to the indicators—those trusty tools with the bedside manner of a drill sergeant. The relative strength index ( RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and Awesome oscillator are all playing it cool at neutral, giving us the crypto equivalent of a shrug. The momentum indicator, however, is perking up at 4,065, and the moving average convergence divergence ( MACD) is showing its flirtatious side at 1,552—both leaning bullish.

BTC/USD 1-hour chart via Bitstamp on Jan. 18, 2026.

Now to the indicators—those trusty tools with the bedside manner of a drill sergeant. The relative strength index ( RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and Awesome oscillator are all playing it cool at neutral, giving us the crypto equivalent of a shrug. The momentum indicator, however, is perking up at 4,065, and the moving average convergence divergence ( MACD) is showing its flirtatious side at 1,552—both leaning bullish.

Meanwhile, short-term moving averages (MAs) such as the exponential moving average (EMA) and simple moving average (SMA) from 10 to 50 periods are all suggesting continued strength. The long-term crowd, however—the EMA 100, SMA 100, EMA 200, and SMA 200—aren’t convinced, with values above the current price. It’s a classic bull-vs-bear standoff: youth versus wisdom.

In sum, bitcoin may be flashing bullish undertones on the longer timeframe, but short-term action is giving wallflower energy. The oscillators are noncommittal, the candles are nonchalant, and the volume is non-existent. Until we see a convincing move out of this congestion zone, this chart is basically the crypto equivalent of “it’s complicated.”

Bull Verdict:

If bitcoin can muster the strength to break above $96,500 with conviction and volume, it could be game on for a retest of $97,900 and beyond. The short-term moving averages are already cheering from the sidelines, and momentum indicators are beginning to warm up. This bull just needs a little push to charge.

Bear Verdict:

But if bitcoin fumbles and breaks below $94,500—especially without the backing of decent volume—it risks sliding toward $92,000 or even $91,000. The descending triangle on the 4-hour chart and a sluggish one-hour trend aren’t exactly confidence-inspiring. For now, bears are circling, waiting for indecision to become a slip.

FAQ ❓

- What is bitcoin’s current price today? Bitcoin is trading at $95,101 as of January 18, 2026.

- **Is bitcoin in an uptrend right now?**The daily chart shows a confirmed uptrend, but momentum is cooling.

- **What price levels should traders watch near-term?**Key support is near $94,000, and resistance sits around $96,500.

- **Where is bitcoin likely headed next?**A breakout above $96,500 could push toward $97,900, while a drop below $94,500 may target $92,000.

Related Articles

The Next Few Days Will Decide Whether Bitcoin Price Explodes to $80K or Crashes to $40K

Bitcoin Sell Pressure Is Easing, But Whales Keep Dumping on Exchanges: CryptoQuant

Supreme Court Slams Trump Tariffs: Is Bitcoin and Crypto Surge Incoming?

Bitcoin Stuck Until Nasdaq Breaks Out, Expert Warns Amid Market Choppiness

XRP Trades Near $1.45 Support as Bitcoin Fractal Comparison Emerges