Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

Key Takeaways

-

Immutable (IMX) is gaining attention as the gaming crypto sector shows renewed strength in both market cap and volume.

-

The weekly chart points to a developing Power of 3 (PO3) structure, often seen near major market bottoms.

-

IMX has completed a long accumulation phase and appears to be stabilizing after a manipulation-driven breakdown.

-

Reclaiming the $0.35 level and the 50-week moving average near $0.53 is crucial to confirm bullish continuation.

-

A breakout above $0.815 could open the door for a larger upside move toward the $1.42 region in the coming months.

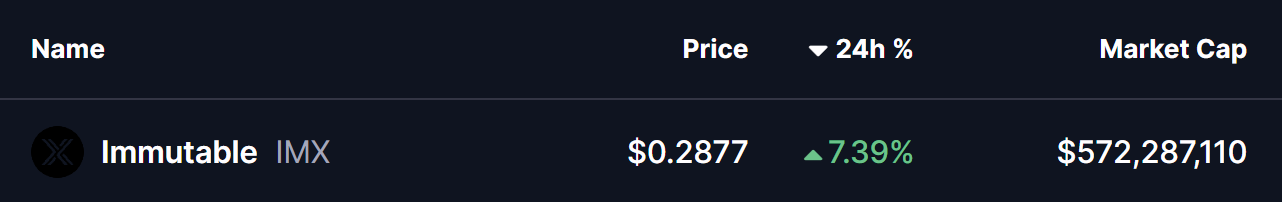

In the cryptocurrency market today, gaming tokens are back in the spotlight, with** Immutable (IMX) **drawing increased attention. The overall gaming narrative market cap has climbed by 2.99%, while trading volume has jumped a notable 9.57% over the past 24 hours.

Source: Coinmarketcap

Riding this momentum, IMX is up nearly 7% on the day. More importantly, the higher-timeframe chart is beginning to reveal a larger technical structure that could be setting the stage for a meaningful upside move in the weeks ahead.

Source: Coinmarketcap

Weekly Chart Signals a Bullish Move

From a technical perspective, the weekly **IMX **chart suggests the formation of a classic Power of 3 (PO3) structure — a pattern often seen near major market bottoms and trend transitions. This setup typically unfolds in three phases: accumulation, manipulation, and expansion, with the strongest price move usually emerging once the expansion phase begins.

Accumulation Phase

Between February and November 2025, IMX spent an extended period consolidating within a clearly defined range. Price action remained capped near the $0.815 resistance zone, while buyers consistently defended the $0.35 support area. This prolonged sideways movement reflects steady accumulation, where long-term participants quietly build positions while volatility remains compressed.

Manipulation Phase

During the broader market downturn in November 2025, IMX broke decisively below the $0.35 accumulation support, sliding toward a local low around $0.2031. This sharp breakdown, highlighted on the chart by the lower shaded zone, aligns well with the manipulation phase of the Power of 3 pattern.

Immutable (IMX) Weekly Chart/Coinsprobe (Source: Tradingview)

At this stage, stop losses are triggered, sentiment turns bearish, and weaker hands are forced out of the market. Notably, selling pressure has started to fade near this region, with IMX now trading around $0.2928 — an early sign that downside momentum may be losing steam.

What Comes Next for IMX?

Currently, IMX remains in the lower portion of the manipulation phase, trading just below the crucial $0.35 level. This zone is particularly important, as it previously acted as strong accumulation support and now serves as a key decision area.

For bullish momentum to gain credibility, IMX must first reclaim $0.35 and then push above the 50-week moving average, which sits near $0.5277. A sustained move above these levels would strongly suggest a transition into the expansion phase of the Power of 3 structure, where upside momentum typically accelerates.

If price manages to break and hold above the $0.815 resistance, the longer-term chart projection opens the door toward the $1.42 region in the coming months — a level that aligns with prior structural targets on the weekly timeframe.

That said, the setup remains conditional. As long as IMX trades below $0.35, downside risks cannot be completely ruled out, and price may continue to experience volatility. Holding current lows and reclaiming key resistance zones will be critical for bulls to confirm a broader trend reversal.

Bottom Line

While Immutable (IMX) has already posted a strong short-term bounce, the bigger story lies in its higher-timeframe structure. The ongoing stabilization near cycle lows, combined with a developing Power of 3 pattern, suggests that IMX could be preparing for a larger move — provided key levels are reclaimed. For now, patience is warranted, but the chart hints that the worst of the downside may already be behind.

Frequently Asked Questions (FAQ)

Is Immutable (IMX) bullish right now?

IMX is showing early signs of stabilization after a deep correction. While it is not fully bullish yet, reclaiming $0.35 and the 50-week moving average would significantly strengthen the bullish case.

What is the Power of 3 pattern in crypto trading?

The Power of 3 (PO3) is a market structure consisting of accumulation, manipulation, and expansion phases. It is often seen near major bottoms before strong trend reversals.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield the anticipated results. Investors are advised to exercise caution, conduct independent research, and make decisions aligned with their individual risk tolerance.

About Author: Nilesh Hembade is the Founder and Lead Author of Coinsprobe, with over 5 years of experience in the cryptocurrency and blockchain industry. Since launching Coinsprobe in 2023, he has been providing daily, research-driven insights through in-depth market analysis, on-chain data, and technical research.

Related Articles

UniCredit: BTC recovery requires market sentiment and ETF inflows to support; falling below $50,000 may face structural changes

Today, the Fear & Greed Index rose to 8, and the market is in a "Extreme Fear" state.

10x Research: Altcoin Market Is Fragile and Bitcoin Is Oversold, but Positioning Structure Is Quietly Changing

"Has the 'true bottom' not arrived yet? Experts warn: Bitcoin may face a 'surrender sell-off' in the final dip"

Cardano Faces Key Support Test at $0.244 Amid Market Uncertainty

Bottoming out and aiming for a rebound by the end of the year! Standard Chartered predicts: Bitcoin may drop to $50,000, and Ethereum could fall to $1,400