Wintermute Warning: Four-year cycle ends, ETF barriers trap altcoins from rising

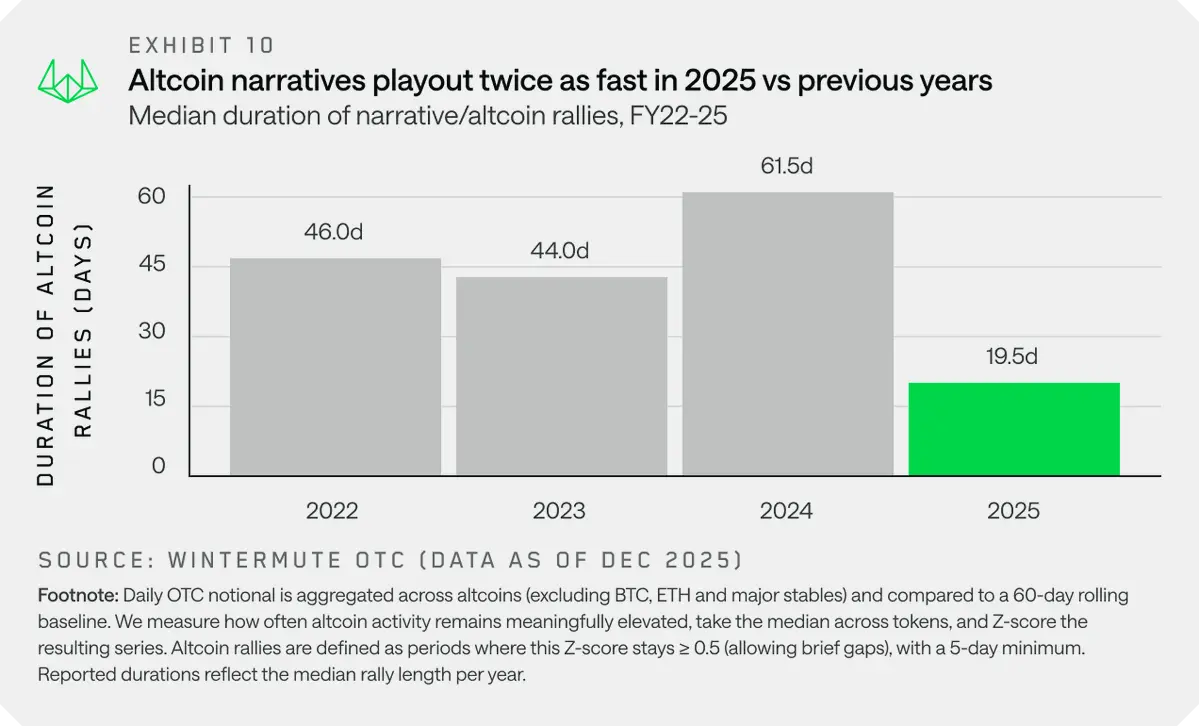

Wintermute data shows that the four-year cycle is becoming outdated, and the market is now driven by liquidity flows and investor attention. No significant upward movement is expected in 2025, marking a shift of cryptocurrencies toward mature assets. ETF has become a fortress garden, with funds trapped in Bitcoin and Ethereum, not rotating. Altcoins’ rally lasts only 20 days, less than the 60 days in 2024. In 2026, three paths emerge: ETF expansion, market-driven momentum, and retail investor re-entry.

Wintermute data shows that the four-year cycle is becoming outdated

The traditional four-year cycle is becoming obsolete. Market performance is no longer determined by self-fulfilling timing theories, but by liquidity flows and investor focus. Wintermute OTC flow data indicates this dissemination weakens in 2025. This is a significant signal of structural change in the cryptocurrency market.

The four-year cycle theory is based on Bitcoin halving events. Historically, Bitcoin halves every four years, reducing new coin issuance by 50%, which often triggers a bull market. Significant price increases occurred after halvings in 2012, 2016, and 2020, creating a consensus around the “four-year cycle.” Many investors allocate based on this theory, expecting a bull market peak within 12 to 18 months after halving.

However, after the April 2024 halving, market performance diverged from expectations. The anticipated rally in 2025 did not materialize, but it may mark the beginning of a transition from speculative assets to more mature asset classes. As one of the world’s largest crypto market makers, Wintermute’s OTC flow data is highly representative of the market. When Wintermute observes weakening capital rotation, it reflects a broader structural change, not just a single institution’s judgment.

The failure of the four-year cycle stems from changes in market participant structure. Previously, retail investors and native crypto institutions dominated, familiar with and trusting the four-year cycle theory, concentrating their allocations around halving periods. With the entry of ETFs and traditional financial institutions, these new participants are less concerned with halving cycles and base their decisions on macro liquidity, risk appetite, and asset allocation logic. As such capital share increases, the self-fulfilling mechanism of the four-year cycle breaks down.

Three main reasons for the failure of the four-year cycle

Institutional dominance: ETFs and DAT are indifferent to halving cycles, based on macro liquidity allocation

Rotation mechanism failure: Funds are trapped in Bitcoin and Ethereum, no longer naturally flowing into altcoins

Market maturity increase: Investors become more rational, no longer blindly trusting timing theories

What happened in 2025? The disappearance of capital rotation

(Source: Wintermute)

Historically, wealth in the crypto space acts as an interchangeable asset pool. Bitcoin flows into Ethereum, then blue-chip stocks, and finally other cryptocurrencies. Wintermute OTC flow data shows this rotation weakens in 2025. The breakdown of this rotation mechanism is one of the most significant structural changes in the market.

ETFs and DATs have evolved into “walled gardens.” They provide sustained demand for large-cap assets but do not naturally channel funds into broader markets. When investors profit from Bitcoin ETFs, these gains remain within traditional finance and do not flow back into crypto-native exchanges to allocate into altcoins. This “one-way flow” breaks the previous rotation cycle.

As retail interest shifts toward stocks, 2025 becomes a year of high concentration in the stock market. The average duration of altcoin rallies in 2025 is only 20 days, down from 60 days in 2024. This significant reduction indicates that even when altcoins rise, they struggle to form sustained trends. Investors quickly take profits and are unwilling to hold long-term, reflecting a severe lack of confidence in altcoins.

A few large companies absorb most of the new capital, yet the overall market remains sluggish. Bitcoin and Ethereum’s market share continues to rise, while the total market cap of altcoins declines. This “winner-takes-all” pattern is common in traditional markets but appears in the crypto space, which once championed “decentralization” and “equal opportunity,” making it particularly ironic.

From the retail investor perspective, in 2025, their focus shifts to emerging tech stocks like AI, rare earths, and quantum tech. As Nvidia, Tesla, and other tech stocks hit new highs, the narrative appeal of cryptocurrencies diminishes. The outflow of retail funds is a key reason for the weak performance of altcoins, which have historically relied on retail speculation.

Three development paths in 2026 will determine market direction

To expand beyond large institutions, at least one of the following must happen. The first path is ETF and DAT expansion. Most new liquidity remains within institutional channels; broader recovery requires expanding their investment scope. Early signs can be seen in the filing documents for SOL and XRP ETFs.

If more altcoins can obtain ETF products, it will break the current “walled garden” dilemma. The applications for Solana and XRP ETFs show asset managers are testing regulators’ acceptance of non-Bitcoin, non-Ethereum ETFs. If approved, this will open the floodgates for altcoin ETFs, bringing institutional funds into more tokens. However, this path faces regulatory uncertainty, as the SEC may impose stricter standards for altcoin ETFs.

The second path involves major market performance. Strong rallies in Bitcoin or Ethereum could generate wealth effects and spill over into broader markets, similar to 2024. How much capital will flow back into digital assets remains uncertain. This path depends on a breakout in the overall market. If Bitcoin can break above $120,000 and continue to set new highs, it will attract media attention and FOMO among retail investors, potentially reigniting crypto inflows.

Three development paths in 2026

ETF expansion: Solana, XRP, and other altcoin ETFs approved, institutional capital flows out

Market-driven momentum: Strong rallies in Bitcoin and Ethereum generate wealth effects, rotating into altcoins

Retail attention re-entry: From stocks to crypto, bringing new capital inflows and stablecoin issuance

The third path is the return of mental share. Retail investors’ attention may shift from stocks (AI, rare earths, quantum tech) back to cryptocurrencies, bringing new capital inflows and stablecoin issuance. Although the least likely, if it occurs, it will significantly expand market participation. Such a shift usually requires strong catalysts like regulatory breakthroughs, killer applications, or major technological innovations.

Liquidity concentration will determine the 2026 market landscape

The outcome depends on whether one of these catalysts can significantly expand liquidity, moving it beyond a few large-cap assets, or if this concentration persists. Understanding capital flow directions and necessary structural changes will determine which measures can succeed in 2026.

Wintermute’s analysis points to a core issue: current market liquidity is highly concentrated in Bitcoin and Ethereum. This concentration benefits large holders, who enjoy continuous institutional inflows and relatively stable prices. But for altcoin holders, it’s a tough environment, as capital no longer naturally rotates as before.

If this concentration persists, 2026 may continue the pattern of 2025: Bitcoin and Ethereum keep absorbing new funds, while altcoins languish without capital support. In this scenario, altcoin investors face a choice: switch to large-cap assets or accept prolonged stagnation.

Conversely, if any of the three paths succeed, the market landscape will change dramatically. ETF expansion will bring institutional funds into altcoins, market-driven momentum will rekindle retail speculation, and retail re-engagement will bring new inflows. These paths are not mutually exclusive; if multiple paths materialize simultaneously, the market could see a stronger rebound than expected.

From an investment strategy perspective, Wintermute’s analysis offers a clear framework. Focus on ETF approval progress for Solana, XRP, and others; monitor whether Bitcoin and Ethereum can break key resistance levels; observe retail sentiment and stablecoin issuance changes. These leading indicators will help investors determine which path the market is taking and adjust their allocations accordingly.

Related Articles

Bitcoin ETFs Attract $88M as Ethereum Flows Stall to Near Zero

Ethereum’s Great Decoupling – Analyzing the Growing Divergence Between ETH and Russell 2000