XRP Funding Rates on Binance Flip Negative, Pointing to Potential Price Reversal

The XRP funding rates on Binance futures have become predominantly negative, pointing to bearish sentiments and a potential price rebound.

This comes as the XRP price continues to struggle below the $2 level, which it recently gave up again on Jan. 19. For context, after an impressive 30% increase to $2.41 on Jan. 6, which effectively recovered the losses from Q4 2025, XRP witnessed resistance and pulled back. Since then, it has struggled alongside the rest of the market.

As this struggle persists, data from the Binance futures market confirms that funding rates have become predominantly negative, as investor sentiment turns sour, leading to increased short positions. However, this trend, which has persisted since late 2025, could point to a potential price reversal.

Key Points

- XRP has struggled since dropping from the yearly peak of $2.41, currently changing hands at $1.94, below the $2 mark.

- The consistent price struggles have dampened investor sentiment, with this drop in sentiment reflected in the Binance futures market.

- Funding rates, representing periodic payments between traders in the futures market, have turned predominantly negative.

- Such negative funding rates indicate an increase in short positions, but this could translate to a potential price recovery.

XRP Funding Rates on Binance Flip Negative

However, the analyst called attention to what he described as a “bearish consensus,” pointing out that the timing of this consensus is particularly important. He noted that this bearish consensus, which comes after XRP’s 47% drop from the July 2025 peak, has led to investors increasingly opening bearish positions in the Binance futures market.

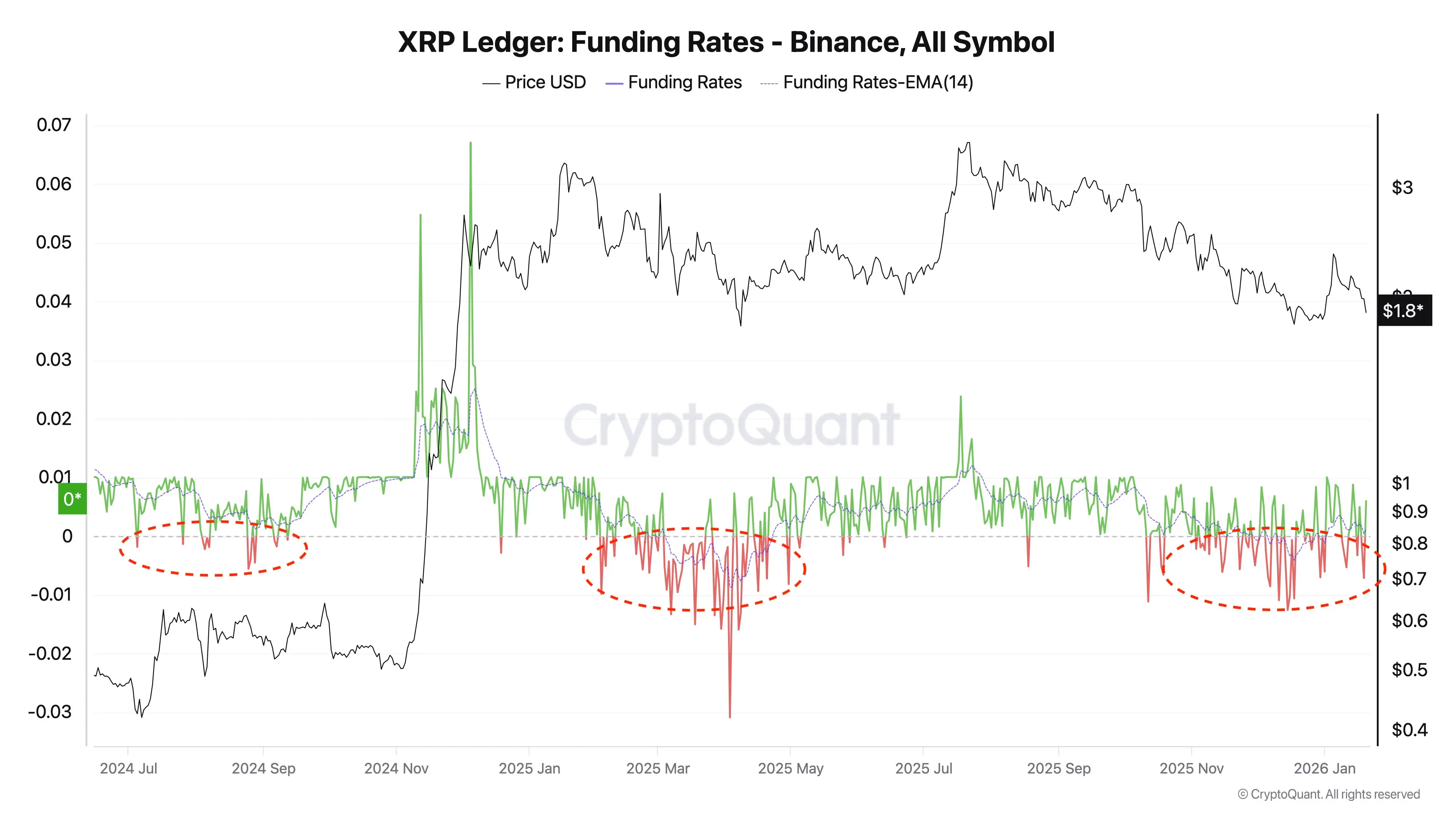

XRP Funding Rates on Binance | CryptoQuantThese increased short positions have resulted in the rise in negative XRP funding rates. Data from the XRP Funding Rates chart shows that these spikes in negative funding rates started playing out in December 2025 and have persisted until now, especially with the recent price declines.

XRP Funding Rates on Binance | CryptoQuantThese increased short positions have resulted in the rise in negative XRP funding rates. Data from the XRP Funding Rates chart shows that these spikes in negative funding rates started playing out in December 2025 and have persisted until now, especially with the recent price declines.

What Do Negative Funding Rates Signify?

Notably, spikes in negative funding rates during price downturns mean that more traders are opening short positions and paying to keep those trades open. This shows bearish sentiment, as many expect prices to keep falling, and it indicates growing confidence among short sellers.

However, deeply negative funding can signal that bearish positioning has become crowded. When too many traders lean short, even a small price bounce can force them to close positions, which may trigger short-term relief rallies despite the broader downtrend.

Could an XRP Reversal Emerge?

Citing this reality, Darkfost noted that the market often moves in the opposite direction when a consensus emerges among traders late

Specifically, short traders have now dominated the scene late in the ongoing bearish phase, and a sharp rise in XRP’s price could liquidate these bearish positions, bolstering the broader rebound.

Historical Context

Interestingly, this pattern has played out twice since mid-2024. Notably, between August and September 2024, XRP’s price struggled within a range of $0.43 and $0.66, leading to an increase in short positions.

These short positions naturally led to a rise in negative funding rates. However, when the XRP price started recovering in November 2024, these shorts faced liquidation, fueling the upsurge that pushed XRP to $3.4 by January 2025

The trend also emerged in April 2025, when the XRP correction led to a price drop to $1.61. During this downturn, funding rates witnessed negative spikes due to increased short positions. The rebound that emerged eventually took XRP to the $3.66 peak in July 2025.

Related Articles

The US SEC will decide this month whether to approve the T. Rowe Price Active Crypto ETF

'What Did I Do?': Ripple CTO Emeritus Reacts to XRP Community's Rage Against Wallet Fees - U.Today

Ju.com completes the third phase of the SOL 20% discount Launchpad event, and the fourth phase XRP is scheduled to launch on February 19.

Franklin Templeton's XRP ETF Holds Over 118 Million Tokens - U.Today