Is Quantum Computing Casting a Shadow Over Bitcoin’s Price?

Over roughly the past year, discussion has grown more pointed over whether the accelerating pace of quantum computing could eventually threaten the Bitcoin network. This week, prominent crypto advocate and Castle Island Ventures partner Nic Carter contended that bitcoin’s “underperformance,” which he links to quantum-related anxieties, is the only storyline that truly deserves attention this year.

Bitcoin’s Underwhelming Run Finds a New Villain: Quantum Computing

To some observers, bitcoin (BTC) has lagged in market performance for a considerable stretch. That has fueled debate over whether BTC’s long-discussed four-year cycle is broken, and when set beside precious metals like gold and silver, bitcoin’s price action appears, at best, unflattering. Of course, many observers offer their own explanations for why this has occurred.

One explanation, only recently tied to market performance in broader discussions, is growing unease over the possibility of Bitcoin facing attacks from quantum supercomputers. While most of the blame has centered on geopolitics, Trump’s statements, equity correlations, and macro and liquidity pressures, quantum risks are quietly shaping some portfolios.

A clear illustration of this dynamic is Christopher Wood, Jefferies’ global head of equity strategy. This month, Wood dropped a 10% bitcoin allocation from his influential “Greed & Fear” model portfolio, pointing to accelerating quantum computing risks that could threaten Bitcoin’s cryptography and erode its long-term appeal as a store of value. He redirected the capital into physical gold (5%) and gold-mining equities (5%).

Nic Carter Says Bitcoin’s Quantum Computing Risk ‘Is the Only Story That Matters This Year’

Castle Island Ventures partner Nic Carter has been among the most vocal figures on this issue. Bitcoin.com News reported on Carter last November when he raised concerns about potential quantum vulnerabilities. The following month, Carter explained that Bitcoin developers were “sleepwalking” toward a quantum reckoning. This week, Carter shared an X post from user @batsoupyum, who asked, “Wondering why BTC is so badly underperforming gold?”

“It’s because of this,” Batsoupyum said on X, pointing to the Jefferies executive’s move. “Financial Advisors read this kind of research and keep client allocations low or zero because quantum computing is an existential threat,” he added.

Carter echoed that view on X. “ Bitcoin’s ‘mysterious’ underperformance (due to quantum) is the only story that matters this year. The market is speaking— the devs aren’t listening,” he said. Setting market dynamics aside, Bitcoin developers have been hearing growing and louder feedback from the community for well over a year. Tensions between Bitcoin Core and Bitcoin Knots developers have widened existing divisions, and as quantum computing advances, the community has grown increasingly vocal about the risks and the need for meaningful quantum protections.

What makes the quantum debate especially fraught is how familiar it feels. The widening gap between community urgency and developer restraint echoes the debates from years past. Quantum fears may have reopened that old wound, reinforcing a long-standing tension over who ultimately decides Bitcoin’s future—and how responsive development should be when existential concerns collide with protocol conservatism. In the end, the quantum theory may be a plausible factor, particularly for risk-averse institutions shifting allocations toward gold.

Also read: Analyst Hints at Shadow Quantum Race Between China and US

Not Everyone’s Buying It: Critics Reject Quantum Blame for Bitcoin

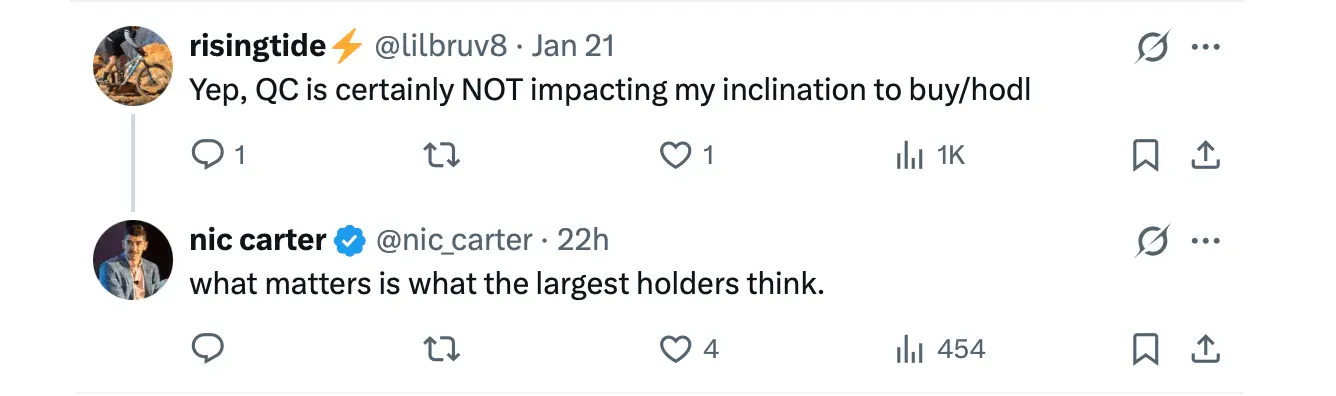

Still, Carter’s view on quantum computing (QC) is far from universally accepted. Prominent bitcoin advocate Vijay Boyapati replied to Carter, saying that the topic clearly warrants discussion and technical work—and on that point, he aligns with Carter—but he emphasized that he remains “highly skeptical the price action in BTC is explained by QC, notwithstanding there may be some investment notes that have picked up that narrative.”

James Check, also known as Checkmate, the co-founder of Checkonchain, has echoed Boyapati’s view, expressing similar skepticism that quantum computing concerns meaningfully explain bitcoin’s recent price action. “QC keeps some capital away, but this argument that gold is up and bitcoin is down because of it just isn’t it,” Checkmate wrote on X. “ Gold has a bid because sovereigns are buying it in place of treasuries. The trend has been in place since 2008, and [has accelerated] after Feb-22. Bitcoin saw sell-side from HODLers in 2025, which would have killed every prior bull thrice over, and then once more.”

Checkmate concluded:

“Yes, we should have QC plans in place. But attributing price being down to it as a primary factor, is akin to blaming market manipulation for red candles, and declining exchange balances for green ones.”

FAQ ⚛️

- Why are some investors linking bitcoin’s performance to quantum computing?

Some analysts argue accelerating quantum research could eventually threaten Bitcoin’s cryptography, influencing cautious allocation decisions, especially in the U.S.

- Who has raised concerns about quantum risks to Bitcoin?

Nic Carter and several market observers have pointed to quantum computing as a potential long-term issue, though the view remains contested.

- Are Wall Street firms adjusting bitcoin exposure because of quantum fears?

Yes, some institutional strategies, including those highlighted by U.S.-based banks, have reduced bitcoin exposure while favoring gold.

- Do all bitcoin analysts agree quantum risk explains BTC’s price action?

No, critics like Vijay Boyapati and James Check argue macro conditions, not quantum computing, better explain recent market behavior.

Related Articles

Satoshi's 2010 Post Sheds Light on Bitcoin-Gold Comparison - U.Today

Metaplanet Inc. Posts Blockbuster FY2025 but Sits on a Huge Unrealized Bitcoin Loss

Data: In the past 24 hours, the entire network has liquidated $222 million, with long positions liquidated at $143 million and short positions at $78.9452 million.

Metaplanet Posts Record FY2025 Growth on Bitcoin Strategy

XRP Uses Almost No Power Compared to Bitcoin: The Electricity Numbers Are Shocking