Decentraland (MANA) maintains its upward momentum, with the open contract soaring to a 3-month high

Decentraland (MANA) continues to maintain a positive breakout momentum, trading around the 0.173 USD level at the time of writing on Friday, after increasing more than 13% since the beginning of the week. This recovery trend is supported by positive signals from on-chain data and derivatives markets, as open interest (OI) rises to a three-month high, alongside an increase in daily active addresses and trading volume. Technically, the bulls are in control, laying a foundation for MANA’s price to continue moving toward higher levels in the short term.

Derivatives and on-chain data signal positive outlook

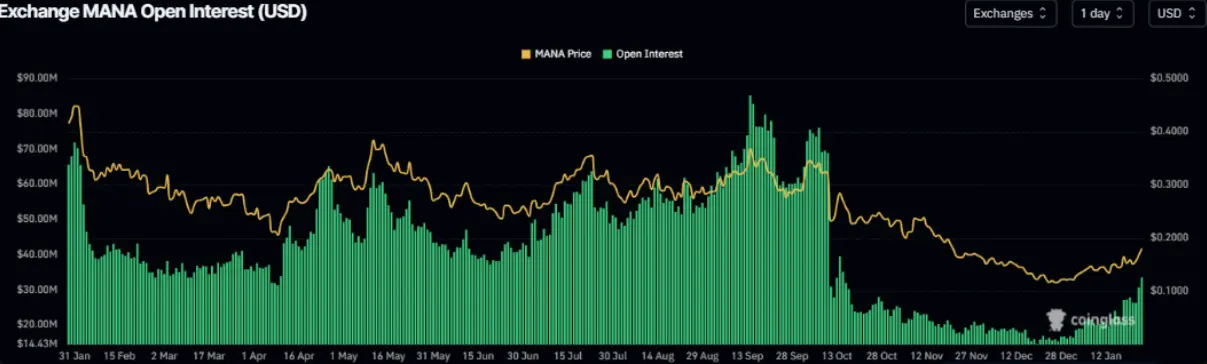

According to CoinGlass data, the open interest (OI) of MANA futures contracts on exchanges surged to 33.49 million USD on Friday, significantly higher than the 20.99 million USD recorded last Saturday. This is also the highest OI level since October 16, indicating new capital is flowing back into the market, reflecting increased buying pressure that could further support MANA’s current upward trend.

Decentraland Open Interest Volume Chart | Source: CoinglassIn addition, the Daily Active Addresses index from Santiment — a measure reflecting network activity over time — also signals a positive outlook for Decentraland. The increase in this index suggests improved blockchain usage, while a decline typically indicates weakening demand.

Decentraland Open Interest Volume Chart | Source: CoinglassIn addition, the Daily Active Addresses index from Santiment — a measure reflecting network activity over time — also signals a positive outlook for Decentraland. The increase in this index suggests improved blockchain usage, while a decline typically indicates weakening demand.

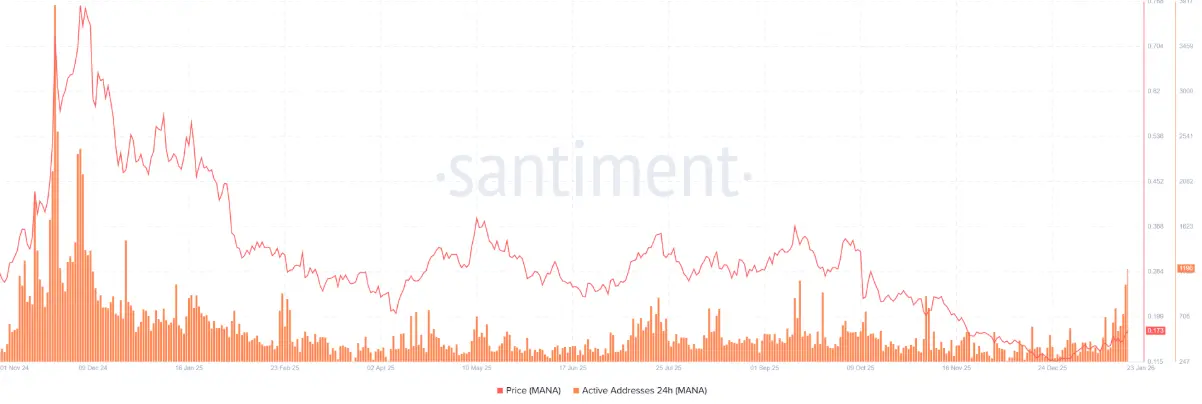

Specifically, the number of daily active MANA addresses rose to 1,196 on Friday, the highest since December 22, 2024, compared to just 562 addresses on Monday. This development indicates a clear recovery in demand for the Decentraland ecosystem, supporting short-term price prospects for MANA.

Daily Active Addresses Chart on Decentraland | Source: SantimentFurthermore, data from Santiment shows that the total transaction volume across the MANA ecosystem — including the total value of on-chain application transactions — reached 124.77 million USD on Sunday, the highest since October 11, before cooling down and stabilizing around 90.60 million USD on Friday. The significant increase in trading volume reflects growing investor interest and improved liquidity, further strengthening Decentraland’s bullish outlook.

Daily Active Addresses Chart on Decentraland | Source: SantimentFurthermore, data from Santiment shows that the total transaction volume across the MANA ecosystem — including the total value of on-chain application transactions — reached 124.77 million USD on Sunday, the highest since October 11, before cooling down and stabilizing around 90.60 million USD on Friday. The significant increase in trading volume reflects growing investor interest and improved liquidity, further strengthening Decentraland’s bullish outlook.

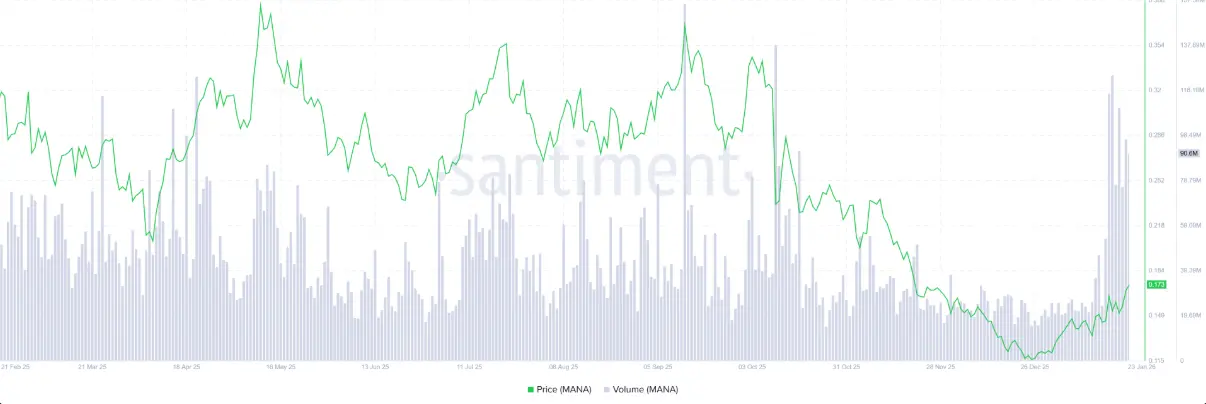

Decentraland Trading Volume Chart | Source: Santiment## Decentraland Price Forecast: Bulls in Control

Decentraland Trading Volume Chart | Source: Santiment## Decentraland Price Forecast: Bulls in Control

Decentraland (MANA) closed above the 50-day EMA at 0.152 USD on Saturday, but was immediately met with strong resistance at the 100-day EMA at 0.176 USD in the following session. Since then, MANA has mostly oscillated within a narrow range between these two key moving averages. As of Friday, the price is testing the 100-day EMA around 0.176 USD, indicating the market is at a critical juncture.

In a positive scenario, if MANA can close firmly above the 100-day EMA on the daily timeframe, the upward momentum is likely to be reinforced and extend to the 200-day EMA at 0.218 USD. Notably, this level also corresponds to the 50% Fibonacci retracement, established from the September 13 high at 0.391 USD down to the October 10 low at 0.046 USD, adding technical significance to this level.

Daily MANA/USDT Chart | Source: TradingViewRegarding indicators, the RSI on the daily chart is at 65, well above the neutral 50 level, reflecting bullish momentum. Meanwhile, the MACD has formed a bullish crossover since late December and remains sustained, with green histogram bars above the zero line, continuing to support a positive short-term outlook.

Daily MANA/USDT Chart | Source: TradingViewRegarding indicators, the RSI on the daily chart is at 65, well above the neutral 50 level, reflecting bullish momentum. Meanwhile, the MACD has formed a bullish crossover since late December and remains sustained, with green histogram bars above the zero line, continuing to support a positive short-term outlook.

However, if selling pressure emerges, MANA could retest the support zone around the 50-day EMA at approximately 0.152 USD.